🚀 Why This ETF Filing Is a Big, Fat Deal

If you’re not paying attention, you’re already behind.

Nasdaq just filed with the SEC to list the 21Shares Sui ETF, and this isn’t some “maybe, we’ll see” filing. This is a shot fired at the heart of traditional finance—an aggressive move signalling that altcoins are no longer on the fringe. They’re coming for the big stage.

Let’s call it what it is: the next Bitcoin moment, only this time, it’s SUI—the native token of one of the fastest-growing Layer 1 blockchains on Earth.

The ETF will offer direct exposure to spot SUI tokens, with zero leverage, zero derivatives, and zero fluff. You want real market exposure? This is it.

📅 SEC’s Clock Is Ticking – And We’re Watching

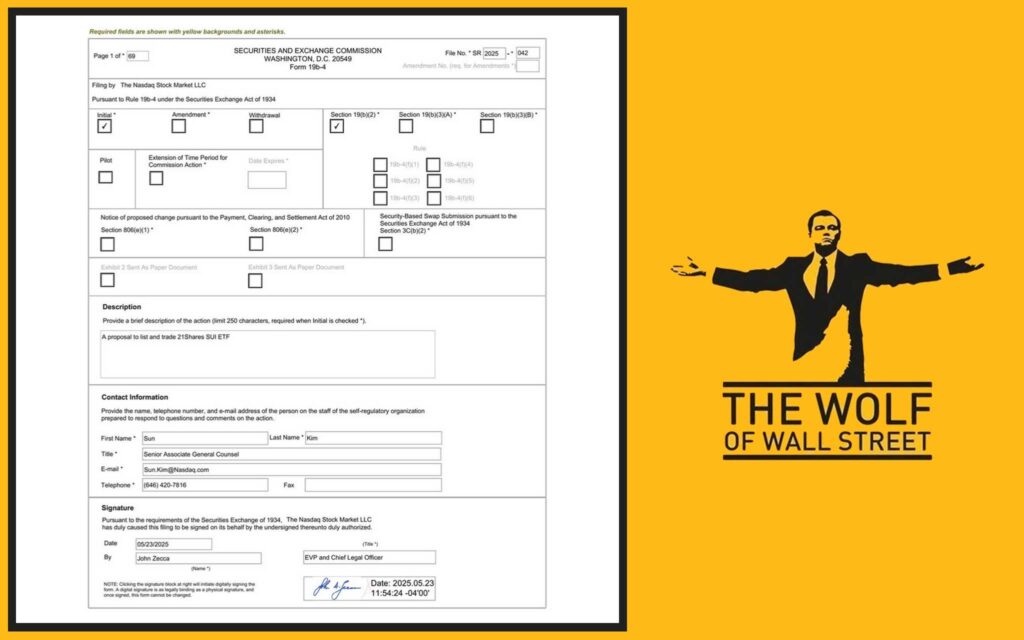

On May 23, 2025, Nasdaq hit ‘send’ on the infamous 19b-4 form, which triggers the SEC’s review. Tick-tock, the countdown begins. They’ve got 45 days to respond, but here’s the game—they can delay. Again. And again. Up to 240 days max.

Circle your calendar: January 18, 2026. That’s judgment day.

But while the bureaucrats drag their feet, smart money is already moving. Institutions are betting on the outcome before the bell rings.

🧱 The Sui Blockchain: Born for Speed, Built for the Future

Forget clunky chains. Sui is a Formula 1 car in a field of tractors.

What makes it so lethal?

- Object-centric data model: radically different from account-based chains

- Parallel transaction execution: say goodbye to congestion

- Sub-second finality: you blink, it’s done

This isn’t future tech. This is now. It’s built by ex-Meta engineers from the Diem project who weren’t just dreaming of innovation—they shipped it.

💰 SUI Token: The Swiss Army Knife of Web3 Finance

If you’re holding SUI, you’re not just holding a coin—you’re holding a multi-purpose asset.

- Staking rewards

- Gas payments

- Governance rights

- In-app liquidity

It’s lean, it’s mean, and it’s sitting on a $12.3B market cap, already outpacing competitors in ecosystem growth.

No gimmicks. Just raw functionality powering a blockchain that’s already eating into Solana’s lunch.

➡️ Learn more in our Altcoins section

🕹️ Inside the Ecosystem: DeFi, NFTs, and Gaming Galore

Sui’s not a “maybe” network. It’s hosting real projects with real value.

- $2.1 billion in Total Value Locked (TVL) as of May 2025

- Higher year-to-date institutional inflows than Solana

- DeFi protocols, NFT marketplaces, high-speed gaming dApps—it’s all here

Sui’s infrastructure is so damn fast and cheap that developers are fleeing Ethereum’s high gas fees like it’s a burning building.

➡️ Get deep into DeFi and NFTs + Gaming

⚔️ What Makes Sui a Real Threat to Solana?

Let’s break this down:

| Metric | Sui | Solana |

|---|---|---|

| Institutional Inflows (YTD) | $84M | $76M |

| TVL (May 2025) | $2.1B | Higher (but slowing) |

| Innovation? | ✔️ Parallel processing | ✔️ Proven speed |

| Scalability | ✔️ Horizontal validator scaling | ✔️ |

Solana may have been the golden child, but Sui is the beast investors weren’t ready for.

🛡️ What’s the Catch? Let’s Talk Risk and Reward

Alright, let’s not sugar-coat it.

Sui recently faced a $223M exploit on Cetus, a DeFi protocol on the network. Bad news? Absolutely. But here’s the twist—the Sui team froze most of the stolen funds and spun up a $10M security fund overnight.

The bug? In Cetus. Not in the Sui blockchain.

So the takeaway? Resilience. When Sui gets hit, it gets back up—faster and smarter.

🌍 Europe Is Already In – So Why Is the U.S. Late to the Party?

You want proof of demand?

21Shares already launched a Sui ETP in Europe—on Euronext Paris and Amsterdam. No hype, just hard numbers:

- $317 million AUM

- Continuous capital inflows

- Institutional appetite building at full steam

The only thing stopping U.S. investors from jumping in? That three-letter wall: SEC.

➡️ Check out our News section for global market updates.

🧠 Why 21Shares Is Betting Big on Sui

21Shares isn’t rolling dice here. They’re making calculated plays.

- BitGo and Coinbase Custody will handle the assets—this isn’t back-alley storage

- No derivatives, no leverage, no staking—just pure spot SUI tokens

The message? Simplicity scales. Institutions don’t want complications—they want clean, compliant exposure.

📊 Battle of the ETFs: How Sui Measures Up

Let’s throw Sui into the ring:

| Feature | 21Shares Sui ETF | Solana ETFs (proposed) | Bitcoin/Ethereum ETFs |

|---|---|---|---|

| Status | Filed 19b-4, S-1 | Pending | Approved |

| Underlying Asset | Spot SUI | Spot SOL | Spot BTC/ETH |

| Custodians | BitGo, Coinbase | TBD | Varies |

| Derivatives? | No | TBD | No |

| Europe ETP? | Yes | Yes | Yes |

| SEC Deadline | Jan 18, 2026 | TBD | N/A |

This isn’t just about Sui—it’s about whether altcoins can level up to regulated exposure in the U.S.

🔍 The Timeline That Could Change the Crypto ETF Game

- May 23, 2025: Form 19b-4 filed

- July 2025: Initial SEC deadline

- Sept-Nov 2025: Expected extensions

- Jan 18, 2026: Final SEC decision

You’ve got 240 days to position yourself. After that, the door either blows wide open—or slams shut (for now).

➡️ Need deeper insight? Visit Trading Insights

🎯 What This Means for You (Yes, YOU, the Trader)

If the ETF gets approved, expect a flood of institutional capital into SUI. This won’t be retail hype—it’ll be BlackRock-level money flowing into the market.

That means:

- Price action on steroids

- Volume like you’ve never seen

- Massive arbitrage opportunities for smart traders

But why wait?

🔐 Want to Trade SUI Like a Pro? The Wolf Of Wall Street Is the Move

Don’t gamble. Trade with an edge.

The Wolf Of Wall Street is the crypto community that gives you:

- Exclusive VIP Signals with sniper-like accuracy

- Expert Market Analysis—no fluff, just facts

- A private network of 100,000+ traders

- Volume calculators and pro-level tools

- 24/7 support—because volatility never sleeps

Ready to go pro in the SUI markets?

🔗 Join the The Wolf Of Wall Street Community

🔗 Visit the Website

🧠 Final Word: This Isn’t Just an ETF – It’s a Movement

The 21Shares Sui ETF is a line in the sand.

If it gets the green light, it opens the floodgates for every promising altcoin to follow suit. If it doesn’t? That wave is still coming. It’s just waiting offshore.

The future’s not being built in boardrooms—it’s being built on chains like Sui, by communities who refuse to wait for permission.

❓ FAQs: What People Want to Know About the 21Shares Sui ETF

1. What makes the Sui ETF different from Bitcoin or Ethereum ETFs?

It offers spot exposure to an emerging altcoin with real-world use cases, not just store-of-value assets.

2. What are the chances the SEC approves this ETF?

Low to medium in 2025—but growing. Market maturity and pressure from Europe could tip the scales.

3. How can I gain SUI exposure if the ETF is delayed?

Join platforms like The Wolf Of Wall Street for real-time signals and leverage on-chain opportunities.

4. Is Sui safe after the Cetus exploit?

Yes. The exploit was on a third-party protocol. Sui’s core remains uncompromised.

5. Why is institutional demand growing for altcoins like SUI?

Because the next wave of crypto isn’t about store-of-value—it’s about utility, scalability, and real-world apps.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

✔️ Exclusive VIP Signals

✔️ Expert Market Analysis

✔️ Private Community of 100,000+ Traders

✔️ Essential Trading Tools

✔️ 24/7 Support

Empower your crypto trading journey:

🔗 Visit The Wolf Of Wall Street

🔗 Join the Telegram