🔥 Introduction

Welcome, traders! Ready to dive into one of the most powerful tools in the market? If you’re serious about mastering technical analysis, you’ve got to know about the Commodity Channel Index (CCI). It’s been around for decades and, let me tell you, it’s still packing a punch in 2025! Whether you’re trading stocks, forex, or cryptocurrency, the CCI can help you spot trends, identify reversals, and make smarter decisions. Keep reading, because I’m about to show you how to dominate the markets with CCI.

🧐 What is the Commodity Channel Index (CCI)?

Definition of CCI

The Commodity Channel Index (CCI) is a technical indicator that helps traders identify trends, overbought/oversold conditions, and potential reversals. It’s an oscillator that fluctuates above and below zero, telling you whether the market is hot or cold. CCI isn’t just for commodities – it’s now used across stocks, cryptocurrencies, and forex to make trading decisions quicker and smarter.

The Origin of CCI (Developed by Donald Lambert)

CCI was developed in 1980 by Donald Lambert, a genius in the world of technical analysis. Initially, it was designed for commodity markets, but its versatility allowed it to spread like wildfire across all financial instruments. Now, it’s indispensable in every trader’s toolkit.

How CCI Works

CCI works by comparing the current price to an average price over a set period. If the price is significantly higher than the average, CCI spikes, signaling a potential buy. If it’s lower, it’s time to sell. Simple, yet incredibly effective!

🧮 The CCI Calculation Formula

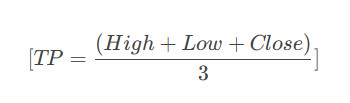

The Typical Price (TP) Formula

Before you can unleash the power of CCI, you’ve got to understand how it’s calculated. Here’s the formula for Typical Price (TP): TP = (High + Low + Close) / 3

Simple Moving Average (SMA)

The next step is calculating the Simple Moving Average (SMA) of the Typical Price. This is just the average of the TP values over a set period (usually 14 days).

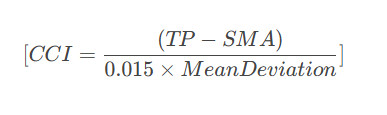

Mean Deviation and CCI Formula

Once you’ve got your SMA, it’s time for the Mean Deviation (average of absolute differences between each TP and SMA). And then, you apply the formula for CCI: CCI = (TP – SMA) \ (0.015 x Mean Deviation)

It’s a lot of math, but trust me, it works wonders when you want to spot market opportunities!

📈 How CCI Helps Traders

The CCI is like a superpower for traders. It helps you with:

- Trend identification: Buy when the market is hot, sell when it’s cold.

- Overbought/oversold conditions: Know when the market is too hot to handle or too cold to ignore.

- Divergence analysis: Predict reversals with bullish and bearish divergence signals.

⚖️ Interpreting CCI Values

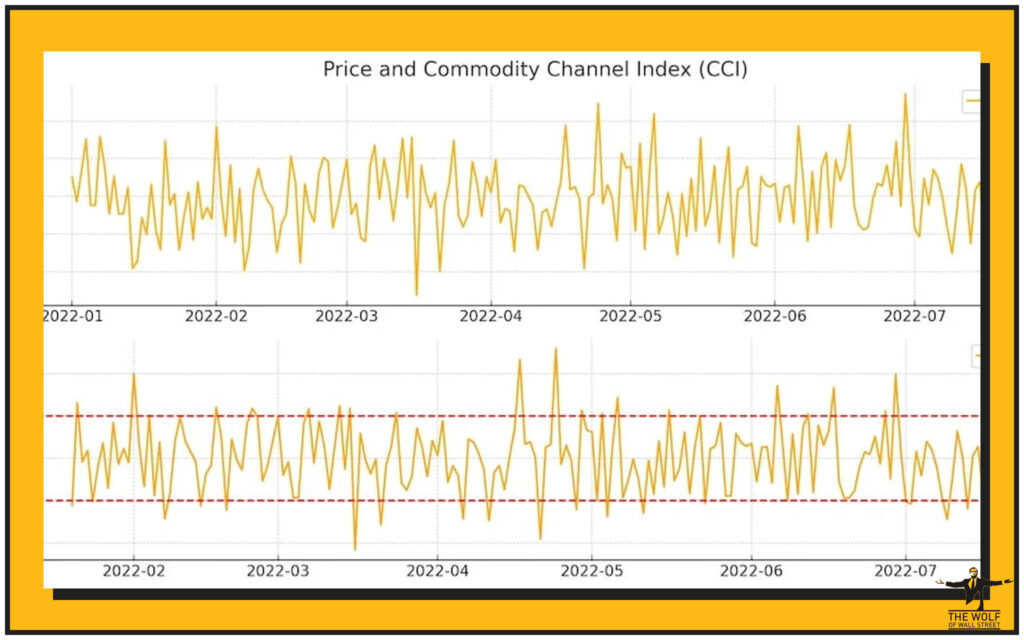

Positive CCI Values (Above +100)

When CCI breaks above +100, it’s a sign that the market is in full-on uptrend mode. This is your buy signal! But be cautious if it goes over +200, as that could mean the market is too hot and about to cool off.

Negative CCI Values (Below -100)

On the flip side, CCI below -100 signals a downtrend. Time to sell? Probably. But if it dips below -200, you might want to buy—the market is oversold and could bounce back.

Extreme CCI Values and Their Significance

- Overbought: CCI above +200 = time to sell or prepare for a pullback.

- Oversold: CCI below -200 = time to buy before the market corrects itself.

🧑💻 How to Use CCI for Trend Identification

How CCI Indicates Buy and Sell Opportunities

- Buy: When CCI crosses +100, you’ve got a strong uptrend. Time to buy and ride the wave.

- Sell: When it crosses -100, the downtrend is probably just beginning. Sell now, or risk getting stuck.

The Role of CCI in Spotting Market Reversals

The CCI is also fantastic for spotting market reversals. If the CCI spikes to +200 or -200, the market may be about to reverse. It’s like a warning light for traders. Use it!

🚨 Overbought and Oversold Conditions

Recognizing Overbought Conditions with CCI

CCI above +200? That’s a red flag for overbought conditions. The market is likely too hot and about to cool off. Get ready to sell!

Recognizing Oversold Conditions with CCI

CCI below -200? The market is oversold! Time to buy before the bounce. If you wait too long, you could miss the reversal.

🤔 CCI Divergence and What It Means for Traders

Understanding Bullish Divergence with CCI

When the price makes lower lows but the CCI makes higher lows, that’s bullish divergence. It’s a signal that the market could be about to reverse upwards. Time to buy!

Understanding Bearish Divergence with CCI

When the price makes higher highs but the CCI makes lower highs, that’s bearish divergence. This signals a downtrend. Sell now, or you might get stuck.

⚙️ The Best CCI Settings for Different Market Conditions in 2025

Optimal CCI Settings for Volatile Markets

In volatile markets, like crypto or forex, use a shorter period (e.g., 10-12 days) to capture quick movements. The faster you react, the more profit you make!

Adjusting CCI for Forex, Cryptocurrency, and Stocks

- For Forex: Use a medium period (14 days) to catch solid trends.

- For Crypto: Go with shorter settings to handle crypto’s wild swings.

- For Stocks: A longer setting (20+ days) will help you catch steady moves in the stock market.

📚 How to Combine CCI with Other Technical Indicators

Pairing CCI with Moving Averages

When the CCI and moving averages align, you’ve got a powerful combo. For example, if the CCI is rising and the price is above the 50-day MA, it’s a buy signal!

Using CCI with RSI and MACD

Combine CCI with RSI and MACD to confirm trends. These tools filter out the noise and give you the perfect setup for a trade.

💥 The Role of CCI in Crypto Trading

Why CCI is Essential for Crypto Traders in 2025

Crypto markets are volatile—and the CCI is your compass in this storm. It helps you spot the overbought/oversold extremes and predict market reversals.

CCI’s Influence on Trading Strategies for Cryptocurrencies

With the right settings, CCI can give you the edge you need to navigate the wild crypto markets and make profits like never before.

🌍 Using CCI in Forex Markets

CCI and Forex: A Powerful Pairing

Forex traders can use the CCI to spot trends and confirm reversals, ensuring that they’re always trading in the right direction.

How to Leverage CCI for Better Forex Trading Decisions

Use the CCI alongside moving averages and RSI to create a robust forex strategy. With the right tools, your trades will be more predictable and profitable.

🤖 Analyzing CCI’s Effectiveness in Today’s Algorithmic Trading Landscape

CCI in Algorithmic Trading

Algorithmic trading uses CCI to make decisions faster than any human can. If you’re using algorithms, CCI is a must-have tool for making data-driven decisions in the blink of an eye.

The Shifting Effectiveness of CCI in the Modern Market

As AI and algorithms change the game, CCI remains a trusted indicator. It’s just as effective today as it was in 1980, but now, traders use it in conjunction with advanced algorithms for better results.

📈 Recent Trends in CCI Usage

How CCI is Adapted to Modern Trading Practices

Traders have adapted CCI to fit modern strategies, adjusting it to different timeframes and combining it with other cutting-edge tools.

The Evolution of CCI in 2025

In 2025, CCI continues to evolve, helping traders adapt to new market conditions. It’s still the ultimate tool for spotting reversals, trends, and extreme market conditions.

🏁 Conclusion

The Commodity Channel Index (CCI) is a game-changing tool for traders in 2025. Whether you’re trading stocks, cryptos, or forex, understanding how to use CCI can help you maximize profits and minimize risks. Master this tool, and you’ll be well on your way to trading success in today’s fast-paced markets. Let’s make 2025 your most profitable year yet!

💬 FAQs

- How does CCI differ from other technical indicators like RSI?

- CCI is more dynamic and versatile, providing both trend identification and overbought/oversold signals, while RSI is primarily focused on momentum.

- Can CCI be used effectively for long-term investments?

- CCI is best suited for short-term trading. For long-term investing, consider combining it with fundamental analysis or other trend-following tools.

- How can I improve my accuracy using CCI in crypto trading?

- Adjust your CCI settings for the high volatility of crypto markets and use it alongside other indicators to confirm signals.

- What are the risks of relying solely on CCI for trading decisions?

- CCI can give false signals, especially in sideways markets. Combine it with other indicators to filter out noise and improve your accuracy.

- How frequently should I adjust my CCI settings for optimal results?

- In volatile markets, use shorter periods. For more stable markets, longer periods work better to filter out fluctuations.

For a professional edge in trading, platforms like “The Wolf Of Wall Street” provide exclusive access to VIP signals, expert market analysis, and a private community of over 64,000 traders. Their 24/7 support and trading tools can amplify your use of indicators like CCI to stay ahead of the curve. Don’t miss out—join their Telegram community for real-time updates and get the insights you need to make profitable trades in 2025!