You want to trade like a wolf, not a sheep? Good. Because the Stochastic Indicator isn’t just another squiggly line on your chart—it’s a powerful momentum tool that gives you an edge. It screams opportunity before the herd even knows what’s happening. And when you combine that with a strategy, a system, and the right mindset, you become un-freakin-stoppable.

Let’s dive in. Buckle up.

🚀 What Is the Stochastic Indicator? Why It’s a Game-Changer

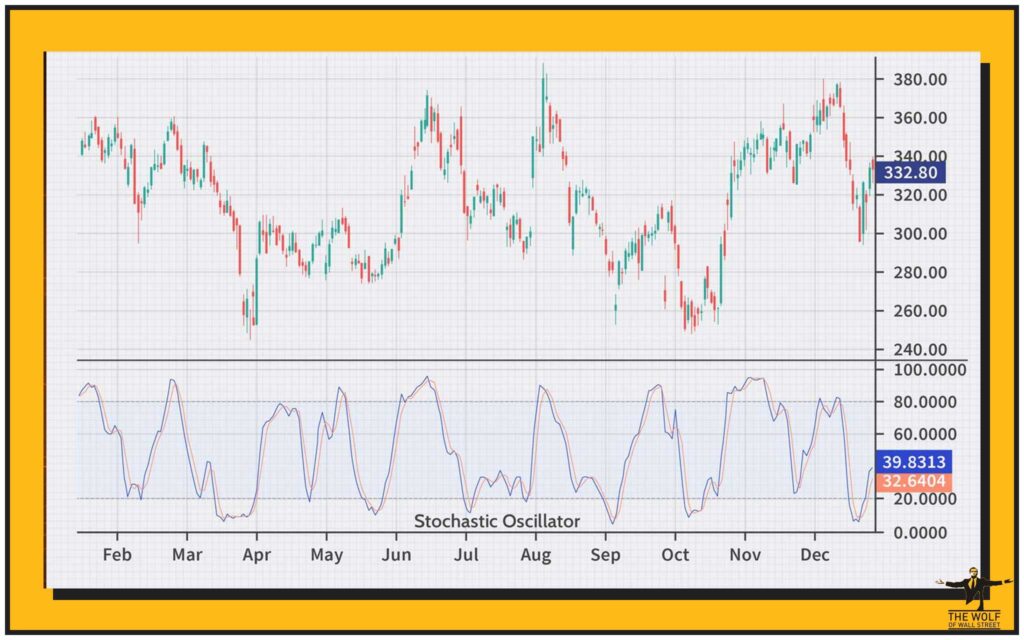

The Stochastic Oscillator was cooked up by George C. Lane in the 1950s—not to lag behind, but to lead. It’s a momentum indicator that compares a closing price to its price range over a set period. That’s how you measure buying and selling pressure.

It tells you one thing: is the market overbought or oversold? That’s it. And when used right, this little tool can pinpoint reversal zones like a sniper.

- Above 80 = overbought → price might drop

- Below 20 = oversold → price might bounce

When the indicator is “overbought,” it is above 80, and when it is “oversold,” it is below 20. Keep in mind that the price may reverse in these situations!

📊 The Simple Formula Behind Big Money

Now, this ain’t some rocket science.

Here’s the formula:

- %K = [(Close – Low) / (High – Low)] x 100

- %D = SMA of %K (usually 3 periods)

Let’s say the highest high in 14 periods is 50, lowest low is 30, and the current close is 40.

- %K = [(40-30)/(50-30)] x 100 = 50

Boom. You’re in the middle. Not overbought, not oversold. Chill zone.

There are 3 types of Stochastic:

- Fast – reacts quickly, but noisy

- Slow – smoother signals, fewer fakeouts

- Full – adjustable settings for the pros

Choose your weapon based on your strategy.

🔥 Why Smart Traders Rely on Stochastic

Because it gives you the drop on the market. While lagging indicators wait for confirmation, Stochastic screams early signals. It’s a leading indicator, and that means early moves = early profits.

But listen closely: context is king. Stochastic works best when the market is ranging or lightly trending. Don’t try to use it during breakouts or parabolic runs. That’s how amateurs get slaughtered.

💡 How to Read Stochastic Like a Wall Street Killer

Here’s the deal:

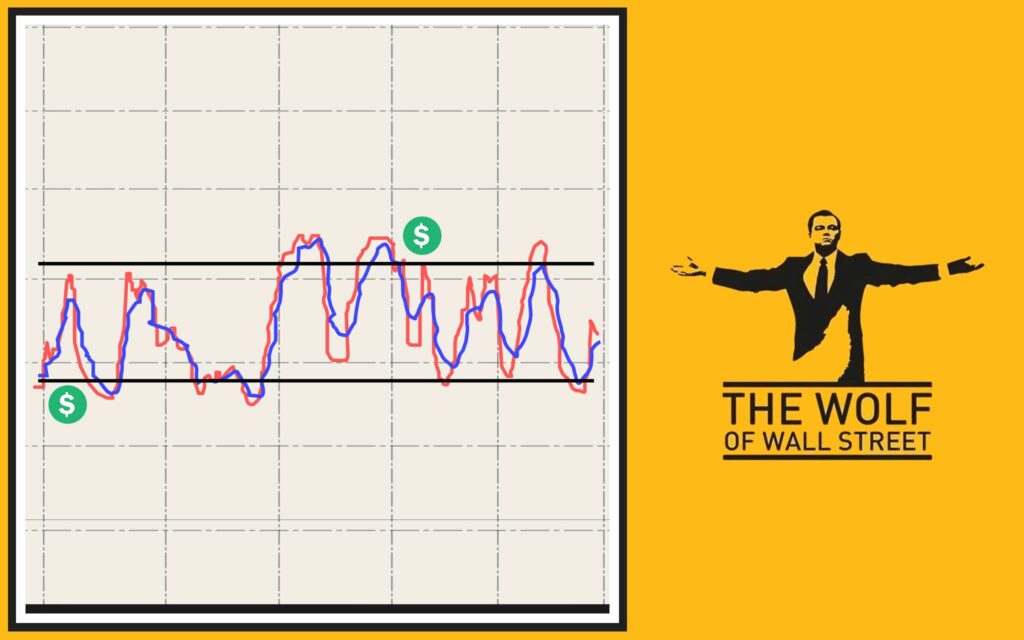

- When %K crosses above %D below 20 → BUY

- When %K crosses below %D above 80 → SELL

That’s your bread and butter.

But don’t just trade every crossover like a blind monkey. Watch for confirmation:

- Candlestick patterns

- Volume shifts

- Support/resistance zones

Want pro-level clarity? Use Slow Stochastic with 14,3,3 settings. That’s what elite traders do.

🎯 Entry & Exit Strategies That Actually Work

Here’s where the money is made:

✅ Strategy: Oversold Crossover + Bullish Candle

- %K crosses above %D below 20

- Enter on next bullish candle

- Stop-loss below swing low

- Take profit at nearest resistance

✅ Strategy: Overbought Breakdown + Bearish Rejection

- %K crosses below %D above 80

- Enter on bearish engulfing candle

- Stop-loss above the high

- Target recent support

This is not gambling. This is precision.

📎 Recommended Read: Crypto Trading Insights

📎 For Starters: Newbie Crypto Traders

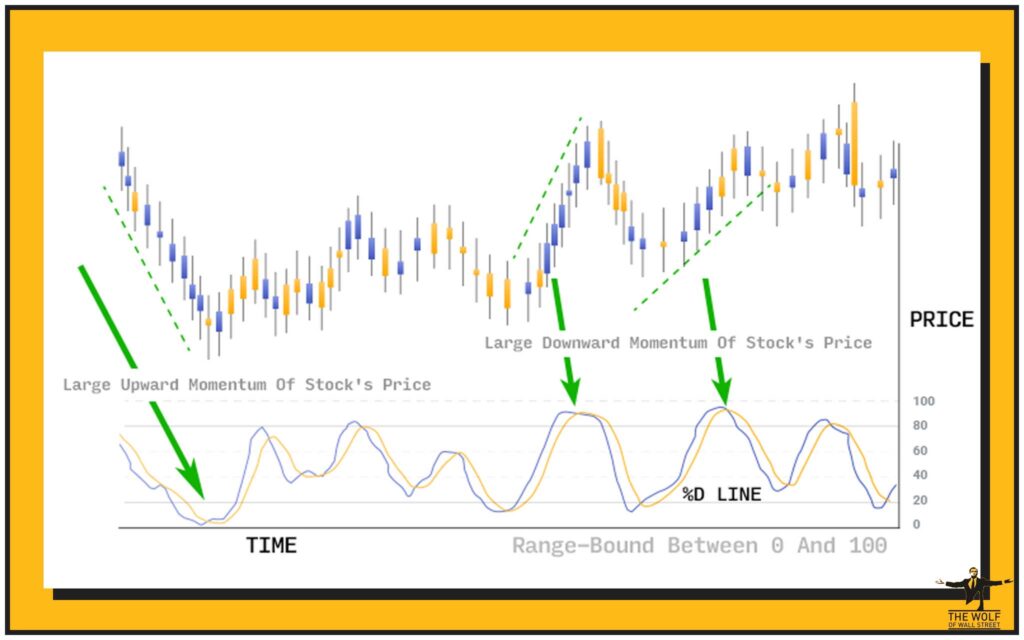

🔍 Divergence: The Stochastic Secret Nobody’s Telling You

Now we’re talking pro-level.

- Bullish Divergence: Price makes lower lows, but Stochastic makes higher lows → price may rise

- Bearish Divergence: Price makes higher highs, Stochastic makes lower highs → price may fall

This right here? It’s the cheat code. Combine it with candle patterns, and you’re golden.

Example: BTC makes a lower low, but Stochastic is climbing? Load up. That’s the market tipping its hand.

🧠 Stochastic vs RSI: Which One’s Your Weapon?

Both are good. But they serve different masters.

- Stochastic = Speed + Precision

- RSI = Strength of move

RSI is smoother, better in trending markets. But when you need those tight reversal entries, Stochastic is your guy.

Savvy traders? They use both. RSI to confirm strength, Stochastic to time the entry. Like a two-punch combo.

⚙️ Combine Stochastic with These Indicators for Insane Accuracy

Let’s stack your edge:

- MACD: Confirms momentum + trend

- Moving Averages: Show overall direction

- Volume: Validates breakouts

- Candlestick Patterns: Final confirmation

Stochastic + MACD Crossover = monster combo.

When both say “BUY”, it’s not a guess—it’s a calculated strike.

💀 When Stochastic Can Burn You (and How to Avoid It)

Let’s be real. It’s not always sunshine and Lambos.

🔥 Avoid:

- Strong trends: Stochastic gives false overbought/oversold signals

- Low volume zones: Choppy mess

- News events: Everything breaks down when headlines hit

Always use Stochastic with a trend filter. Never alone.

🧪 Real Trade Example: Stochastic in Action

Asset: ETH/USD

Timeframe: 1H

Setup:

- Price drops to support

- Stochastic dips under 20

- %K crosses %D

- Bullish engulfing candle forms

Action:

- Entry at \$1,870

- SL at \$1,850

- TP at \$1,940

✅ Profit: 3.5R. That’s how you build a bankroll.

📎 Explore This Too: Altcoins to Watch

📎 Hot Trading Trends

📈 Best Timeframes and Settings for Crypto vs Forex

For Crypto:

- Use 1H or 4H for swing trades

- 14,3,3 Slow Stochastic = cleaner signals

- Avoid using on meme coins with no liquidity

For Forex:

- 15M + 1H combo is golden for scalping

- Match entries to London or New York session

- Filter with fundamentals

You don’t need to overthink it—just master one setup per market.

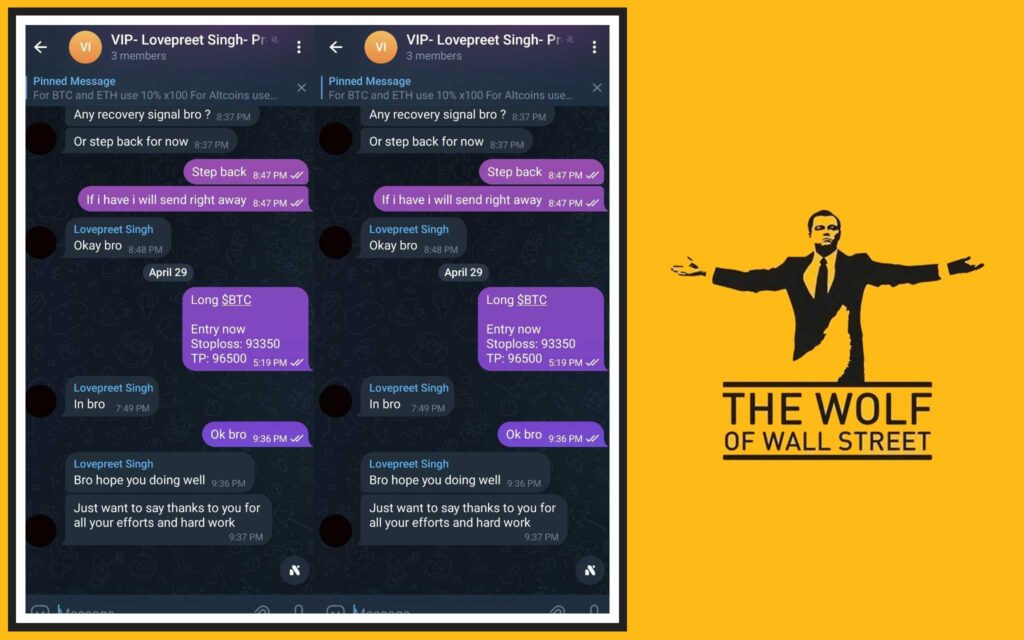

⚡ The Wolf Of Wall Street Method: Trading Like an Absolute Savage

This is where the real winners hang out.

The Wolf Of Wall Street Crypto Trading Community is the ultimate shortcut to mastering the game. You get:

- 🚨 VIP Signals – insider-level alerts

- 📉 Market Analysis – no BS, just raw data

- 🧠 100,000+ traders – all focused, all hungry

- ⚙️ Volume tools, calculators, resources

- 🛠️ 24/7 Support – because the market never sleeps

Want to trade like a savage?

👉 Visit: https://tthewolfofwallstreet.com

👉 Join the real-time community: Telegram

💬 Stochastic: No-nonsense Breakdown

Hey everyone, here’s a concise summary:

- When the Stochastic indicator is below 20, the market is considered oversold.

- When it is above 80, the market is deemed overbought.

- Divergence serves as a strong signal for potential reversals.

- Always use additional candlestick patterns to confirm the signals.

- Don’t rely solely on indicators; always combine them with other analyses!

Got it? It’s that simple. Happy trading!

📚 Glossary of Must-Know Terms

- %K – Raw stochastic value

- %D – Smoothed %K (moving average)

- SMA – Simple moving average

- Overbought/Oversold – Market conditions

- Divergence – Mismatch between price and indicator

✅ Pros & Cons Recap – Is Stochastic Right for You?

✔️ Pros:

- Early signals

- Easy to use

- Great for ranging markets

- Killer for reversals

❌ Cons:

- False signals in strong trends

- Needs confirmation

- Can mislead newbies

Use it smart. Combine it. Dominate.

💥 Final Verdict: Trade Like a Wolf, Not a Sheep

If you’re just blindly buying breakouts or following Twitter hype, stop. That’s how you get wrecked.

Stochastic is your edge.

Use it right, and you’ll enter before the crowd, exit before the crash, and stack gains like a savage.

Combine it with the The Wolf Of Wall Street system, and you’ll have the signals, the tools, and the community to back you up every step of the way.

The game is on. You ready to win?

❓ FAQs

1. What’s the best timeframe for Stochastic?

1H and 4H for crypto swings, 15M–1H combo for forex.

2. Can I use it alone?

No. Always confirm with price action or other tools.

3. What’s divergence and how does it help?

It shows price weakness—often before reversals. Learn it, use it.

4. Is Stochastic better than RSI?

Depends on your strategy. Stochastic is faster; RSI is smoother.

5. How does The Wolf Of Wall Street help my trading?

VIP signals, tools, pro analysis, and a massive trader community—no guesswork, just results.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

You gain:

– VIP Signals for profits

– Expert Analysis

– 100,000+ traders

– Tools + 24/7 Support

👉 The Wolf Of Wall Street Website

👉 Join Telegram