Donald Trump’s fingerprints are all over the crypto game now—and Washington is losing its mind. When you mix political power, billion-dollar stablecoins, and a fresh regulatory bill that reshapes the digital asset landscape, you get a volatile cocktail of controversy. Strap in, because this isn’t just about coins—this is about control.

From high-stakes hearings in Congress to secret dinners with memecoin holders, Trump’s crypto rise is no side hustle. It’s a full-scale financial takeover—and the fallout could change everything.

🧨 The Setup – A Billion-Dollar Shockwave Hits Crypto and Congress

Picture this: a Trump-linked company launches a dollar-backed stablecoin. A UAE investment firm uses it to buy a $2 billion stake in Binance—the world’s biggest crypto exchange. It’s not fiction. It’s not hype. It happened.

USD1, the stablecoin in question, was developed by World Liberty Financial, a firm tied directly to the Trump family. At the recent TOKEN2049 event in Dubai, Zach Witkoff, WL Financial’s co-founder, confirmed the game plan: USD1 would be the official medium for a multibillion-dollar injection into Binance, backed by Abu Dhabi’s MGX Digital.

Translation? Trump’s crypto coin just got the global green light—and Washington, D.C. is furious.

This explosive development is already shifting the narrative across the crypto news space, and it’s only the beginning.

🦾 The Trump Crypto Playbook – Memecoins, Power Moves, and Pure Controversy

Let’s not pretend Trump fell into crypto by accident. His first major move? A memecoin tied to his persona, sold with exclusive perks—dinners, autographs, access. Classic Trump branding.

That memecoin? It reportedly generated over $2 billion in trading volume, according to critics, with accusations that Trump and his family cashed out while retail investors got burned.

Next came USD1—a dollar-pegged stablecoin, supposedly backed by U.S. Treasuries. It’s sleek. It’s legit-looking. It’s got billions in circulation. And now, with MGX and Binance on board, it’s international.

This pattern reflects a broader trend in memecoins where celebrity or political involvement fuels speculative hype—often at the public’s expense.

📜 The Draft Bill – Republicans Shake the Foundations of U.S. Crypto Law

Now here’s the kicker. Just one day before the MGX-Binance deal went public, House Republicans dropped a draft bill designed to overhaul how the U.S. regulates crypto.

The bill calls for:

- Shared oversight of crypto by the SEC and CFTC

- A redefinition of digital assets that limits SEC authority

- Protections for “digital commodities” like Bitcoin and, potentially, stablecoins

This new approach could impact the regulatory framework across multiple cryptocurrencies and even the broader DeFi ecosystem.

Critics say it’s tailor-made to benefit USD1, and insiders aren’t even hiding it.

🔥 Maxine Waters’ Rebellion – Ethics, Power, and Crypto Collide

Democratic Rep. Maxine Waters isn’t letting this slide. She blocked a House hearing on the bill, citing Trump’s personal stake in the crypto space.

“This bill is a Trojan horse for self-enrichment,” she told reporters.

“We’re watching the presidency become a crypto cash machine.”

Waters accused Trump of:

- Profiting from USD1’s rollout

- Hosting exclusive crypto dinners in exchange for memecoin buys

- Pushing legislation to sidestep oversight

Some have drawn comparisons to past attempts to deregulate financial assets, raising alarms that similar policy shifts in crypto regulations could backfire.

🕵️♂️ Political Conflict or Crypto Coup?

Let’s call it what it is: a power play. Trump isn’t just riding the crypto wave—he’s trying to control the tide. And the GOP’s new bill could be the vehicle to do it.

Even some Republican insiders are spooked. Reports surfaced that Trump hosted a private dinner for top memecoin holders, many of whom later donated heavily to Super PACs supporting his campaign.

One insider told Axios: “This isn’t crypto policy—it’s loyalty testing through tokenomics.”

Whether this is political genius or an ethical disaster depends on which side of the aisle you sit.

🌍 USD1 vs the U.S. Dollar – A New Global Contender?

This is where it gets geopolitical. USD1, though pegged to the U.S. dollar, isn’t issued by the Treasury. It’s private. And it’s now being used in multi-billion-dollar foreign deals.

MGX’s use of USD1 to buy into Binance sets a global precedent.

Some lawmakers worry it could erode the dollar’s dominance, opening doors for crypto-led monetary systems to bypass U.S. banking altogether.

The implications extend into Layer-1 and Layer-2 ecosystems that increasingly rely on stablecoin integration to support cross-chain liquidity and global access.

⚖️ Legal Grey Zones – Where Does the Line Get Crossed?

Here’s what’s murky—and dangerous.

- Conflict of interest laws may not clearly apply to crypto investments, especially if held by family members.

- Campaign finance regulations are decades behind in dealing with stablecoin contributions.

- Foreign interference loopholes could allow crypto holders abroad to influence U.S. elections through token buys.

Several watchdog groups are now calling for an investigation into:

- Trump’s memecoin fundraising mechanics

- The Binance deal’s political implications

- Whether any aspect of USD1 constitutes a pay-to-play scheme

This entire situation is becoming a key discussion point for crypto policy analysts and ethics watchdogs across the U.S.

📈 How Traders Should Navigate This Chaos

Here’s the big question: What does this mean for traders?

- Regulatory volatility: Expect increased scrutiny and wild swings in stablecoin valuation.

- Risk of overreach: If the bill passes, it could embolden other political figures to launch their own coins.

- Opportunity window: Projects aligned with Republican messaging may see short-term surges, but beware the crash.

This is not the time for blind speculation. You need sharp analysis, tight execution, and real-time signals.

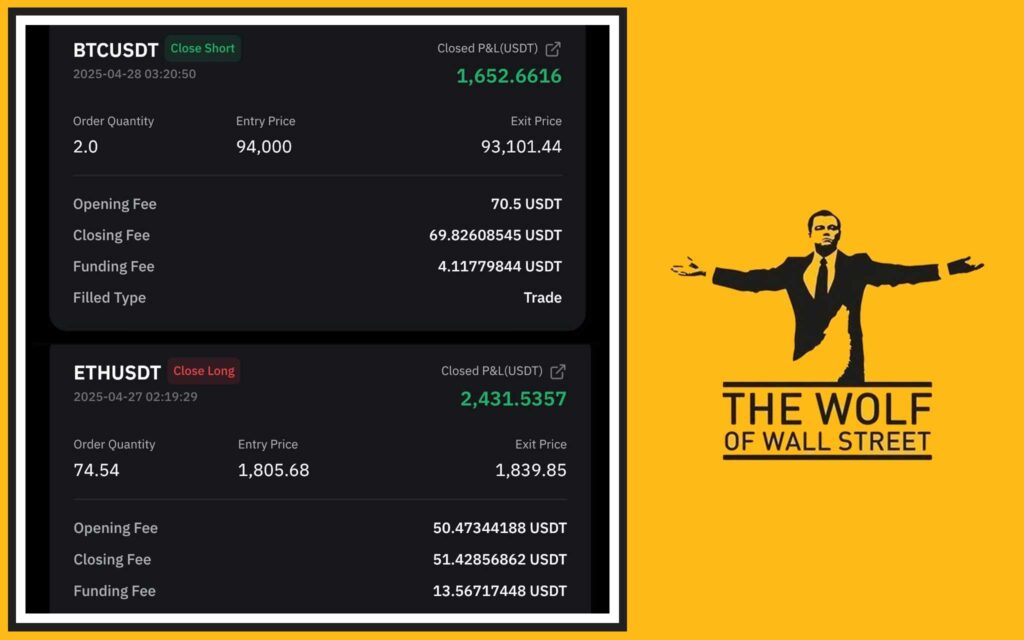

That’s where communities like The Wolf Of Wall Street come in.

💡 Real Talk – The Role of The Wolf Of Wall Street in a Turbulent Crypto Market

In this chaos, clarity is currency. The Wolf Of Wall Street delivers exactly that.

Here’s what you get:

- 🔥 Exclusive VIP Signals – Custom market moves before they hit the mainstream

- 📊 Expert Analysis – From battle-tested traders who know volatility

- 🧠 Essential Tools – Position size calculators, market scanners, and more

- 🫂 100,000+ Private Community – No trolls, just sharp minds and shared wins

- 💬 24/7 Support – Because crypto never sleeps

🔗 Check it out: tthewolfofwallstreet.com

📢 Join the Telegram: t.me/tthewolfofwallstreet

Whether Trump wins or the market melts, you’ll trade like a wolf—not a sheep.

🔚 Final Word – Is This the Beginning of a New Crypto Order?

Trump’s not just dipping his toes into the crypto waters—he’s cannonballing into the deep end. The blend of policy power, private tokens, and partisan chaos is no accident. It’s a blueprint.

We’re witnessing the weaponisation of Web3, where coins aren’t just assets—they’re influence.

So, is this the new world order for crypto? Or a bubble built on borrowed trust?

Time will tell. But if you’re not paying attention—you’re already late.

🙋♂️ FAQs

1. What is USD1 and why is it controversial?

USD1 is a stablecoin launched by Trump-linked World Liberty Financial, pegged to the U.S. dollar. It’s at the centre of a $2B deal with Binance and accused of being used for political gain.

2. What’s the Trump crypto regulation bill?

House Republicans proposed a draft that limits SEC oversight and favours digital commodities. Critics say it’s designed to benefit Trump’s holdings.

3. Why are Democrats opposing the bill?

They claim it’s a conflict of interest, accusing Trump of legislating for personal gain through stablecoin and memecoin ventures.

4. Could Trump be impeached over this?

Some Democrats believe the crypto connections may constitute ethical violations, potentially justifying impeachment—though it’s a long shot without a Senate majority.

5. How can traders protect themselves in this environment?

By using real-time signals, market analysis, and trusted communities like The Wolf Of Wall Street to make informed, fast decisions in a politically volatile market.