Introduction: The Ultimate Crypto Power Play

Imagine dropping nearly half a billion dollars on Bitcoin in a single move. That’s exactly what Tether just did – a $459 million bet that puts Twenty One Capital on the map as a serious Bitcoin treasury player. With a SPAC merger lined up with Cantor Equity Partners and heavy backing from SoftBank and Bitfinex, this acquisition is more than just another Bitcoin grab – it’s a strategic power play designed to position Twenty One Capital as a pure Bitcoin investment vehicle. But what does this mean for the broader crypto market? Let’s break it down.

🚀 Why Tether Is Betting Big on Bitcoin

Why would Tether, a stablecoin giant, throw down $459 million on Bitcoin? Simple – Bitcoin is digital gold.

1. Strategic Positioning:

Tether’s bet on Bitcoin isn’t just about holding assets. It’s about controlling influence in the market, and Twenty One Capital is the perfect vehicle to do that.

2. Market Impact:

By acquiring a significant chunk of Bitcoin, Tether strengthens its asset reserves, potentially reducing market volatility tied to USDT.

3. Competitor Watch:

This move signals to competitors like MicroStrategy and MARA Holdings that there’s a new player in town, and they’re not here to play small.

👉 Looking to learn more about institutional investors diving into crypto? Read more in our Crypto Trading Insights.

💡 Who is Twenty One Capital?

Twenty One Capital – remember the name. This Bitcoin-focused investment firm is poised to shake up the crypto world.

1. Backed by Titans:

With Tether, SoftBank, and Bitfinex in its corner, Twenty One Capital has access to deep pockets and strategic expertise.

2. Bitcoin-Centric Strategy:

Forget traditional earnings metrics. Twenty One Capital is all about Bitcoin per share, a bold move that mirrors MicroStrategy’s strategy but with a more aggressive focus.

3. SPAC Merger:

The merger with Cantor Equity Partners positions the firm to go public under the ticker symbol XXI, setting the stage for massive capital influx and market visibility.

🔍 Curious about how other major players are approaching Bitcoin? Check out the latest in Cryptocurrencies.

🛠️ Inside the SPAC Merger – What’s the Game Plan?

This isn’t just another SPAC merger – it’s a tactical chess move.

1. Timeline of the Merger:

- Expected closure: Q3 2025

- Funding: $585 million from Cantor Equity Partners

2. Funding Sources:

- Tether: $459 million in Bitcoin

- SoftBank: $900 million in capital backing

- Bitfinex: 42,000 BTC pledged as collateral

Looking for more insights on how SPACs are reshaping the financial landscape? Dive into our DeFi Category for deeper analysis.

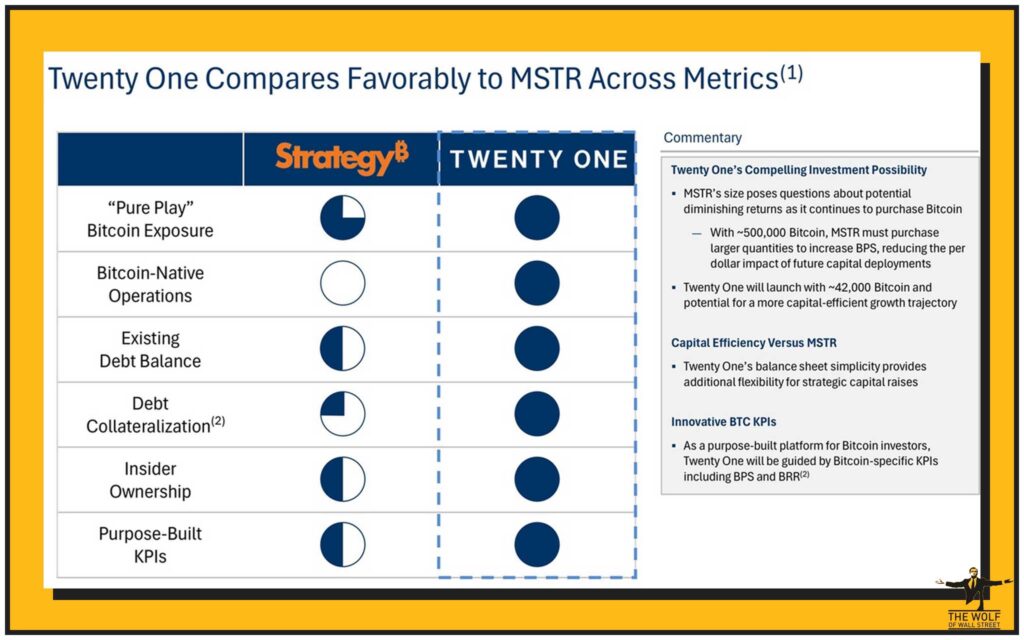

📈 How Does Twenty One Capital Compare to MicroStrategy?

When it comes to Bitcoin-centric firms, MicroStrategy has been the undisputed heavyweight. But Twenty One Capital is gunning for that title.

| Firm | Bitcoin Holdings | Strategy | Ticker |

|---|---|---|---|

| Twenty One Capital | 36,312 BTC | Bitcoin per share | XXI |

| MicroStrategy | 158,245 BTC | Bitcoin per share | MSTR |

| MARA Holdings | 13,600 BTC | Bitcoin mining and holding | MARA |

🔗 How does this acquisition affect Bitcoin’s market dynamics? Learn more in our Bitcoin Analysis.

🔍 The Bitcoin Acquisition Breakdown – By the Numbers

Tether’s $459 million Bitcoin purchase wasn’t just a hasty move – it was a calculated strike.

1. Purchase Price:

- Acquisition made at $95,319 per BTC, a 10% premium over the market price.

2. Total BTC Acquired:

- 36,312 BTC now held by Twenty One Capital.

3. Market Impact:

- This acquisition positions the firm as the third-largest corporate Bitcoin holder, right behind MicroStrategy and MARA Holdings.

Stay updated on the latest market moves in our Bitcoin Category.

💼 Key Players in the Acquisition – SoftBank and Bitfinex

It’s not just Tether pulling the strings. SoftBank and Bitfinex are the silent powerhouses behind this deal.

1. SoftBank’s Influence:

- $900 million investment, solidifying its position in the Bitcoin investment space.

2. Bitfinex’s Collateral Play:

- Pledged 42,000 BTC as collateral to secure funding.

Explore more about institutional investments in our News Category.

🧠 Strategic Implications for Tether – Beyond Bitcoin

Tether’s massive Bitcoin acquisition isn’t just about asset reserves – it’s about market influence.

1. Market Stability:

- By holding a substantial BTC reserve, Tether can mitigate market fluctuations, stabilising USDT.

2. Regulatory Focus:

- Increased scrutiny from regulatory bodies like the SEC.

3. Future Plans:

- Potential for BTC-backed investment products, setting the stage for crypto ETFs or structured investment vehicles.

Stay ahead of regulatory updates in our Policies Section.

🚨 Potential Risks and Challenges

- Volatility: Bitcoin’s price can swing dramatically, impacting Twenty One Capital’s valuation.

- Regulatory Scrutiny: SEC’s focus on Bitcoin-centric firms could tighten.

- Liquidity Risks: If BTC prices crash, Tether’s reserves could be forced to liquidate at a loss.

Learn more about risk management in our Trading Insights.

🛡️ The Wolf Of Wall Street Crypto Trading Community – Navigate the Crypto Market Like a Pro

Want to profit from crypto moves like Tether’s? The The Wolf Of Wall Street Crypto Trading Community is where you need to be:

- VIP Signals: Get proprietary trade signals from expert traders.

- Market Analysis: Access in-depth crypto market insights.

- Private Network: Join 100,000+ traders for insider tips and strategies.

👉 Visit The Wolf Of Wall Street.com or join the Telegram Community now!

🔥 Key Takeaways and Final Thoughts

Tether’s $459 million Bitcoin acquisition for Twenty One Capital isn’t just a play for market share – it’s a calculated move to dominate the Bitcoin treasury game. With backing from SoftBank and Bitfinex, the firm is positioning itself as a Bitcoin-centric powerhouse, set to challenge the likes of MicroStrategy.

For more insights, visit our Bitcoin Category and stay updated on the latest trends in the Cryptocurrencies Section.