Introduction:

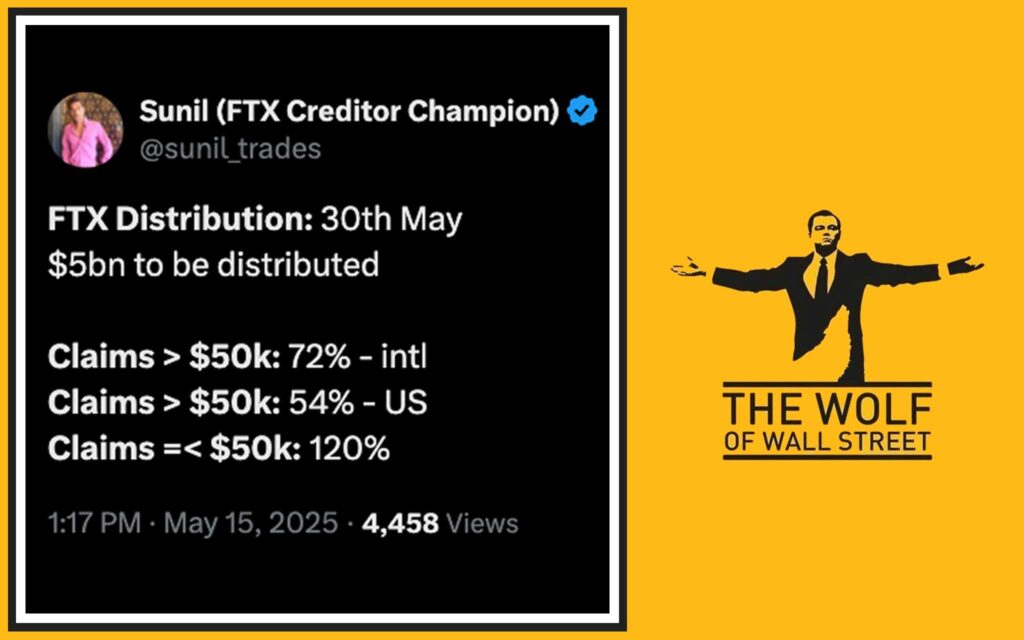

FTX is back in the headlines, but this time it’s not about another scandal – it’s about paying back creditors. The fallen crypto giant is set to initiate its second round of repayments to creditors on May 30, distributing over $5 billion through BitGo and Kraken. This follows a previous payout of $1.2 billion in February, with a total of $16 billion in claims expected to be resolved under the reorganization plan.

For creditors, this round of repayments is crucial, as the cryptocurrency market has experienced a significant resurgence, with Bitcoin surging over 400% since FTX’s collapse. But what does this repayment really mean for creditors, especially those holding crypto-denominated claims? Let’s break it down.

💰 What Is FTX’s Repayment Plan?

FTX’s repayment plan is a meticulously structured process aimed at distributing recovered assets among creditors. The plan categorizes creditors into five distinct classes, known as “convenience classes.” Each class receives a different percentage based on the amount and type of claim filed.

- Class A: Institutional creditors – Expected repayment: 54% – 80%

- Class B: Large individual claimants – Expected repayment: 60% – 90%

- Class C: Crypto-denominated claims – Expected repayment: 70% – 100%

- Class D: Retail investors – Expected repayment: 85% – 118%

- Class E: Insider claims – Expected repayment: 100% – 120%

The percentages vary, reflecting the complexity and volatility of FTX’s asset pool, which includes cash, crypto, and equity stakes in various entities.

📅 Key Dates for the Second Repayment Round

The second repayment round kicks off on May 30. Creditors can expect to receive their payments within 1 to 3 business days once the distribution begins. BitGo and Kraken, the custodians of the assets, will facilitate the disbursements.

For those still waiting for their claims to be processed, the timeline remains somewhat uncertain. However, subsequent repayment rounds are projected to occur every three to four months, depending on the asset recovery process and legal proceedings.

For the latest updates on FTX repayments, visit Trading Insights.

💸 How Much Is Being Repaid in This Round?

This round will see over $5 billion distributed among creditors. This amount is significantly higher than the $1.2 billion disbursed in the first repayment round, indicating that FTX’s asset recovery efforts have been more successful than initially anticipated.

In total, FTX aims to resolve up to $16 billion in claims, making it one of the most substantial creditor repayment plans in cryptocurrency history. With over $11 billion still pending, creditors are eager to know how future asset recoveries will affect their claims.

For more on how other crypto platforms are managing creditor repayments, check out Cryptocurrencies.

✅ Understanding the Convenience Classes Structure

FTX’s repayment structure is not a one-size-fits-all approach. Each of the five classes of creditors receives a different payout percentage based on their claims:

- Class A (Institutional Creditors): Major institutions like hedge funds and venture capitalists fall under this category. With expected repayments ranging from 54% to 80%, these creditors are positioned to recover a significant portion of their claims.

- Class B (Large Individual Claimants): Individuals with claims exceeding $1 million. Expected repayment ranges from 60% to 90%.

- Class C (Crypto Claims): Claims denominated in cryptocurrencies like Bitcoin and Ethereum. These creditors may receive 70% to 100%, a range influenced by recent crypto price surges.

- Class D (Retail Investors): The largest class, consisting of smaller, individual claimants. Expected repayment: 85% to 118%.

- Class E (Insider Claims): Claims filed by former FTX executives and insiders. Expected repayment: 100% to 120%, as these claims are largely contested.

For a deeper dive into how these classes are structured, explore DeFi.

🚀 How Bitcoin’s Surge Impacts Repayment Values

Since FTX’s collapse, Bitcoin has surged over 400%, causing significant fluctuations in the value of crypto-denominated claims. Creditors who held Bitcoin or Ethereum claims may now receive more than initially projected, depending on the exchange rate used during repayment calculations.

For instance, creditors who had 100 BTC in claims could see a considerable increase in their payout due to Bitcoin’s rising value. However, this volatility also introduces risk, as market conditions could shift before the repayment is completed.

For insights on how the Bitcoin surge impacts broader crypto markets, visit Bitcoin.

🛠️ Tools and Resources for Creditors

Navigating the repayment process can be complex, especially for those holding crypto-denominated claims. Here are some essential tools and resources:

- BitGo: Secure digital asset storage for cryptocurrency claims.

- Kraken: Facilitates fiat and crypto conversions.

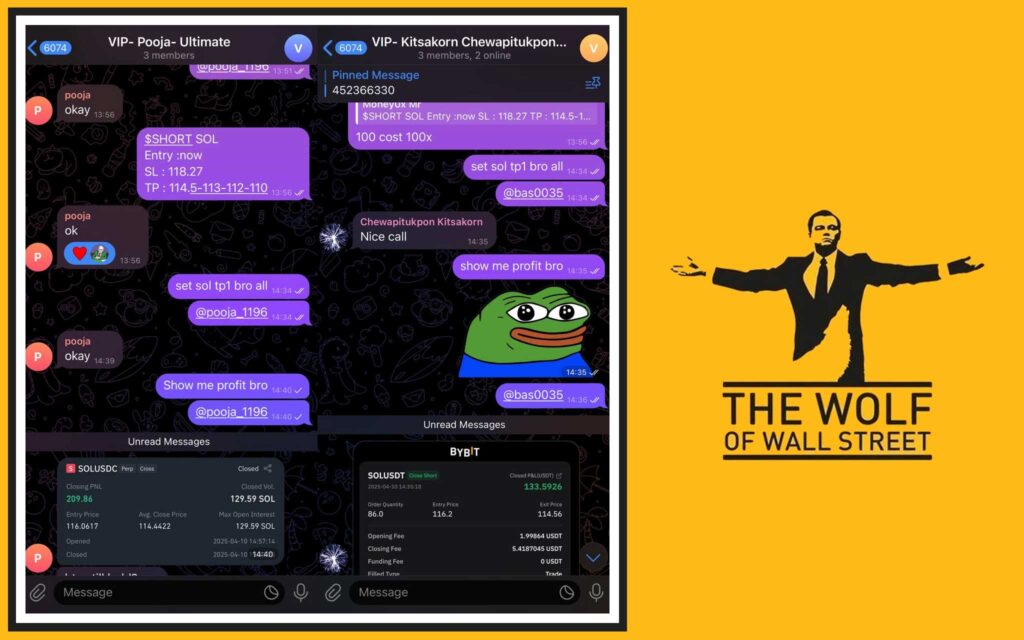

- The Wolf Of Wall Street Crypto Trading Community: Offers expert analysis, VIP trading signals, and a private network of 100,000+ traders. Access the The Wolf Of Wall Street community to stay informed and capitalize on market movements.

👉 Join The Wolf Of Wall Street on Telegram: https://t.me/tthewolfofwallstreet

⚖️ Legal Fallout: What Happened to FTX’s Key Figures?

While creditors await their repayments, the legal battles surrounding FTX’s collapse are nearing resolution. Sam Bankman-Fried, the company’s disgraced founder, was sentenced to 25 years in prison for his role in the misuse of funds. Other key executives, including Caroline Ellison and Ryan Salame, have also faced significant legal penalties.

The financial penalties imposed on these executives are being directed toward the creditor repayment pool, further boosting the available assets for distribution.

For ongoing legal updates, check out Policies.

📈 Future Repayment Rounds and What to Expect Next

As the second repayment round begins, creditors are eager to know what’s next. The next scheduled distribution is tentatively set for August 2025, with projected repayments of $3 billion. Future rounds are expected to continue until the full $16 billion in claims is resolved.

For more on FTX’s recovery strategy, explore Newbie.

🌐 The Wolf Of Wall Street: Empowering Crypto Traders Amid Market Uncertainty

For those looking to maximise gains amid the FTX fallout, the The Wolf Of Wall Street crypto trading community offers:

- Exclusive VIP Signals: Maximise trading profits with insider strategies.

- Expert Analysis: Insights from seasoned traders to navigate the volatile market.

- 24/7 Support: Real-time assistance from a dedicated support team.

Unlock your trading potential:

- Visit the The Wolf Of Wall Street website: https://tthewolfofwallstreet.com/

- Join the Telegram community: https://t.me/tthewolfofwallstreet

Conclusion:

FTX’s second repayment round is a pivotal moment for creditors seeking to recoup their losses. With over $5 billion set to be distributed and Bitcoin’s surge reshaping the value of crypto-denominated claims, the stakes couldn’t be higher. While the legal battles surrounding former executives continue, the focus for creditors now shifts to maximizing recovery and preparing for the next repayment round.

For ongoing updates and in-depth analysis, leverage resources like the The Wolf Of Wall Street community and stay informed on the latest crypto market movements.

FAQs:

- How can creditors track their FTX repayments?

Creditors can track repayments through BitGo and Kraken’s platforms. - What percentage of claims will be repaid in the second round?

Expected repayment percentages range from 54% to 120%, depending on the creditor class. - How has Bitcoin’s price surge affected creditor claims?

Crypto-denominated claims have increased in value due to Bitcoin’s 400% rise since FTX’s collapse. - What are the legal outcomes for FTX’s executives?

Sam Bankman-Fried received a 25-year prison sentence, while other executives faced significant fines. - How can The Wolf Of Wall Street help traders navigate the crypto market post-FTX?

The Wolf Of Wall Street provides exclusive VIP signals, expert analysis, and 24/7 support, making it a vital resource for navigating volatile markets.