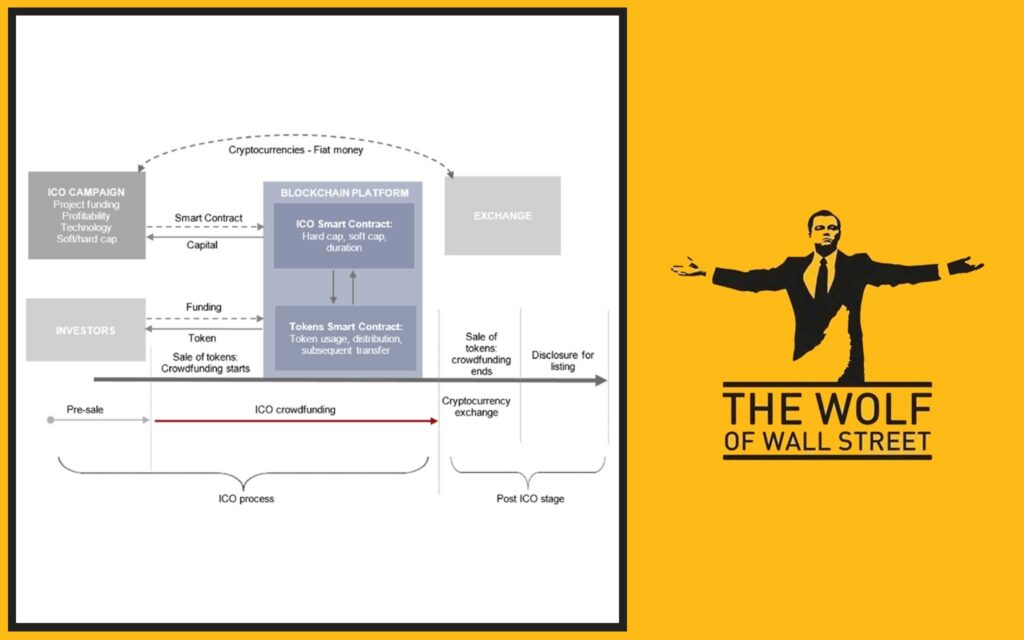

Forget what you think you know about getting a token listed. This isn’t just about good tech; it’s a high-stakes, high-wire act where fundamentals meet fees, and connections can trump code. The Crypto Token Listing Process is the ultimate gatekeeper to liquidity, credibility, and true market value for any crypto project. This guide pulls back the curtain, giving you the unvarnished truth, direct from the source.

💎 The Holy Grail: Why a Listing Matters

For any cryptocurrency project, a successful listing on a major exchange is the ultimate goal. It’s the moment your project goes from a promising idea to a tangible asset traded by millions. The impact is immediate and profound:

- Massive liquidity increase: Suddenly, your token becomes easily tradable. This means buyers and sellers can transact quickly, without moving the price too much. Liquidity attracts more traders, creating a virtuous cycle.

- Enhanced credibility: Being listed on a reputable exchange signals legitimacy to the broader market. It’s an endorsement that the project has passed some level of vetting, however superficial.

- Significant market value boost: The increased demand, liquidity, and credibility often translate directly into a surge in market capitalisation. For many projects, this is the ‘exit’ they’ve been building for.

- The dream: Reaching millions of potential investors overnight. A listing on a top-tier platform puts your token directly in front of an enormous, active trading audience.

🔒 Centralised Exchanges (CEXs): The Gatekeepers

These are the titans of the crypto world: Binance, Coinbase, Kraken, Bybit. They are the primary goals for most projects aiming for widespread adoption and liquidity. But getting in? That’s where the reality hits.

Official Listing Criteria: What they say they want.

Every major CEX publishes a list of criteria they look for. These are the table stakes, the minimum entry requirements. They typically include:

- Strong use case and technological innovation: Does your project solve a real problem? Is the tech sound and unique?

- Credible and transparent team: Who is behind the project? Are they doxxed, experienced, and trustworthy?

- Active community engagement: Do you have a vibrant, organic community supporting your token? Exchanges value active users.

- Robust security audits: Has your code been audited by reputable firms to ensure it’s secure and free of vulnerabilities?

- Regulatory compliance: Is your project legally compliant in relevant jurisdictions? This is increasingly critical.

- Sufficient liquidity and trading volume: Even before listing, exchanges want to see signs of real demand and trading activity, often on DEXs.

These are the ‘on paper’ rules. They are necessary, but far from sufficient.

The Unwritten Rules: Fees, Marketing, and Supply Demands: The harsh realities.

This is where the real game begins. What most projects don’t publicly discuss is the cost.

- Substantial listing fees: While many exchanges officially deny charging listing fees, industry reports and expert insiders indicate that top-tier exchanges often demand millions of dollars – sometimes in fiat, sometimes in tokens – for a primary listing. These fees are usually undisclosed, making the process opaque.

- Required marketing allocations: Beyond fees, exchanges often require significant budgets for marketing and promotion once listed. This ensures trading volume and visibility on the platform.

- Demands for a percentage of total token supply: Some top exchanges, like Binance in past reports, have allegedly demanded up to 7% of a project’s total token supply. Alternatively, they might seek discounted investment terms, effectively getting a cheap stake in the project in exchange for the listing. This is a massive hidden cost that can dilute existing token holders.

The Insider Edge: Connections and Relationships: Why who you know matters.

In this industry, connections are currency. Having strong relationships with exchange executives, venture capitalists, or influential listing agencies can significantly accelerate the listing process. A cold application might sit in a queue for months or never even be reviewed in depth. An introduction from a trusted insider can open doors and fast-track due diligence. This isn’t unique to crypto; it’s how big business runs.

Binance’s Process: Direct applications, rigorous due diligence, and community governance.

Binance maintains a public listing application portal. Their process involves initial screening, rigorous due diligence on the project’s technology, financials, team, and legal structure. They also famously incorporated a community co-governance mechanism in the past, where BNB holders could vote on listings. While the voting mechanism has evolved, community sentiment and active participation remain key factors in their decision-making. Reports from projects that successfully listed often mention multiple rounds of technical and business deep-dives by Binance teams.

Coinbase’s Approach: Compliance-First, No Fees (but strict vetting).

Coinbase has positioned itself as the most compliant US-based exchange, heavily prioritising regulatory adherence. They famously state they do not charge listing fees. However, their vetting process is arguably the most stringent in the industry. Projects must demonstrate ironclad legal standing, strong decentralisation (if applicable), and clear alignment with US securities laws. This compliance-first approach means their listing process is often longer and more challenging, accessible primarily to well-established projects that can meet their high legal and technical bars.

🚪 Decentralised Exchanges (DEXs): The Open Door

Not every project targets a CEX immediately, or ever. Decentralised Exchanges like Uniswap, PancakeSwap, and SushiSwap offer a fundamentally different path.

Permissionless Listings: Lower Barriers, Different Requirements.

DEXs operate on a permissionless model. This means anyone can list a token without needing approval from a central authority. You don’t pay a listing fee to the exchange itself. The barriers to entry are significantly lower, making DEXs the starting point for most new crypto projects. This accessibility has fueled innovation.

Project Responsibilities: Providing Liquidity.

While there are no listing fees to the DEX, projects have a critical responsibility: providing liquidity. For a token to be tradable on a DEX, there must be a liquidity pool created, typically consisting of your token and a base currency (like ETH or stablecoins). The project team, or its community, must deposit these assets into the pool. Without sufficient liquidity, trading becomes difficult due to high slippage, and your token effectively remains untradable.

The Community Factor: Fostering Volume.

On a DEX, trading volume isn’t generated by a centralised exchange’s marketing push. It’s driven purely by organic interest and activity. Projects must foster a strong, active community that engages in trading and generates real volume. DEX listings are a true test of a project’s organic traction.

🤝 Listing Agencies: Friend or Foe?

Navigating the listing landscape, especially for CEXs, is incredibly complex. This has given rise to ‘listing agencies’ – third-party firms that claim to help projects secure listings.

How Agencies Help: Guiding the Process, Negotiations.

Reputable listing agencies can offer value. They might have established relationships with exchanges, understand the unspoken requirements, help prepare application materials, and even assist in negotiating listing terms. They can streamline a process that would otherwise be overwhelming for a small project team.

The Scam Risk: Identifying Unreliable Partners.

The listing agency industry is rife with scams. Many fraudulent actors promise guaranteed listings on top exchanges for hefty upfront fees, only to disappear with the money or deliver nothing. Projects must exercise extreme caution. Warning signs include:

- Guaranteed listings on top exchanges (no legitimate exchange guarantees a listing).

- Demanding 100% upfront payment.

- Lack of transparency regarding their processes or previous successes.

- Unprofessional communication or lack of clear contracts.

Non-Refundable Security Deposits: A Common Pitfall.

Even with seemingly legitimate agencies or direct exchange applications, projects can lose substantial sums. Some exchanges or agencies may require a non-refundable security deposit or an ‘initial assessment fee’ that is lost if the project fails due diligence or decides not to proceed. These can range from tens of thousands to hundreds of thousands of dollars.

⚠️ Major Risks and Delistings: What Can Go Wrong

Getting listed is a huge win, but it’s not the end of the road. There are significant risks, even after a successful listing.

Fraudulent Agencies and Their Traps: Case studies of scams.

Consider a scenario where a new memecoin project, eager for exposure, pays a ‘listing agency’ $500,000 for a guaranteed spot on a top-tier exchange. The agency disappears after receiving payment, and the project is left with no listing and a half-million dollar hole in its treasury. This is a common tale of desperation meeting deception in the crypto space.

The Threat of Delisting: Reasons and Impact on Token Value.

Exchanges retain the right to delist tokens for various reasons, and delisting can devastate a token’s value and its community. Common reasons for delisting include:

- Failure to meet liquidity/volume requirements: Exchanges remove tokens that don’t generate enough trading volume or liquidity.

- Regulatory non-compliance: Changes in regulations or a project failing to comply with existing rules can trigger delisting.

- Security breaches or project abandonment: Hacks, major protocol flaws, or a project simply going dark will lead to delisting.

- Sudden delistings: These can occur with little notice, often plunging a token’s value, wiping out liquidity, and shattering community trust.

Market Realities: Liquidity traps and fake volume.

Some projects resort to ‘wash trading’ or ‘market making’ services to artificially inflate their trading volume to meet listing requirements. This creates fake liquidity. While it might help secure an initial listing, it’s unsustainable and eventually leads to a liquidity trap where real traders cannot exit or enter positions without causing massive price swings. This is a dangerous game.

🗺️ Strategic Recommendations: A Roadmap for Success

Given the complexity and risks, a strategic approach is essential for any project looking to get listed.

Start Small: Building Credibility on Mid-Tier Exchanges.

Instead of aiming for Binance from day one, many projects find success by starting on smaller, reputable exchanges (e.g., MEXC, Gate.io). This allows them to:

- Build initial liquidity and trading volume.

- Gain experience with exchange relationships.

- Prove their community traction and security.

- Establish a track record that makes them more attractive to top-tier exchanges later.

Build Real Liquidity and Community First: Organic growth before paying for listings.

Focus efforts on developing a valuable product, attracting real users, and fostering an organic, engaged community. Exchanges, even top-tier ones, are increasingly looking for projects with genuine utility and organic trading interest. This creates sustainable growth that is far more valuable than paid volume.

Focus on Fundamentals: Beyond the Listing.

A listing is a tool, not a destination. The project’s long-term success depends on its underlying technology, use case, team, and ability to deliver on its roadmap. Don’t sacrifice project development or community building for the sake of a quick listing.

Due Diligence is Non-Negotiable: On Exchanges and Agencies.

Before engaging with any exchange or listing agency, perform rigorous due diligence.

- Research their reputation.

- Talk to other projects that have used their services.

- Get everything in writing.

- Understand all fees and potential hidden costs.

- For agencies, ask for proof of past successes (and verify them independently).

(Imagine a checklist for project due diligence before engaging with exchanges or listing agencies, covering legal, financial, and operational aspects.)

⚖️ Regulatory Environment: The Shifting Sands

The crypto landscape is constantly shifting, especially concerning regulations. This has a direct impact on listing processes.

Impact of Evolving Crypto Regulations on Listings: Exchanges becoming more cautious.

Governments worldwide are increasing their scrutiny of cryptocurrencies. This means exchanges are under pressure to be more selective and compliant. New regulations around securities, money laundering, and consumer protection directly influence which tokens exchanges are willing to list. Projects must stay informed about relevant Policies in their target markets.

Compliance as a Key Factor for Major Exchanges: Prioritising regulatory clarity.

Top-tier exchanges, particularly those operating in regulated jurisdictions like the US or Europe, prioritise regulatory clarity. They avoid listing tokens that might be deemed unregistered securities or that pose significant compliance risks. This has led to a much more cautious approach than in earlier years of crypto.

Global Regulatory Divergence: Different rules in different jurisdictions.

Regulatory frameworks vary significantly from country to country. What’s legal in one jurisdiction might not be in another. Projects often face the challenge of navigating these divergent rules, which can complicate multi-jurisdictional listings. Understanding the regulatory landscape is key for any project aiming for widespread adoption. The broader Cryptocurrencies market faces these challenges.

🚀 Beyond the Listing: The Real Work Begins

A listing, especially on a major CEX, feels like the ultimate victory. But it’s really just the starting gun.

Listing as a Beginning, Not an End: Continued development, marketing, and community building are crucial.

The liquidity and exposure gained from a listing are tools, not a passive stream of endless growth. Projects must continue to build, innovate, market their product, and actively engage their community. The competition is fiercer post-listing.

Post-Listing Support and Development: Maintaining liquidity, active communication.

Projects need to actively maintain liquidity on listed exchanges, often through market-making agreements. Continuous communication with the exchange and your community is vital. Any issues with volume, security, or regulatory concerns can lead to swift delisting.

Perseverance and Realism: The long game in the crypto market.

The Crypto Token Listing Process is a marathon, not a sprint. It demands realism about costs, risks, and the effort required. Success in the crypto exchange landscape ultimately comes down to a combination of a strong product, a dedicated team, persistent effort, and a keen understanding of both the public and unspoken rules of the game. Get this right, and you’re set for the long haul.

Frequently Asked Questions (FAQs)

- What is the primary difference between a CEX and a DEX listing?

A CEX listing requires approval from a central authority (the exchange) and often involves fees and strict criteria, while a DEX listing is permissionless, requiring the project to provide liquidity. - Do major centralised exchanges always charge listing fees?

While some exchanges publicly state they don’t, industry reports and expert insiders suggest that top-tier exchanges often have undisclosed listing fees or demand a percentage of token supply. - What is the biggest risk when using a listing agency?

The biggest risk is engaging with fraudulent agencies that promise guaranteed listings for upfront fees but then disappear or fail to deliver. - Why do crypto tokens get delisted from exchanges?

Tokens can be delisted for failing to meet liquidity/volume requirements, regulatory non-compliance, security breaches, or project abandonment. - What is the most important thing for a project to focus on before seeking a listing?

Projects should focus on building a strong, valuable product with a clear use case, fostering a genuine, engaged community, and ensuring robust security and regulatory compliance.

There you have it – the real story behind the Crypto Token Listing Process. It’s tough, but if you play it smart, the rewards are immense.

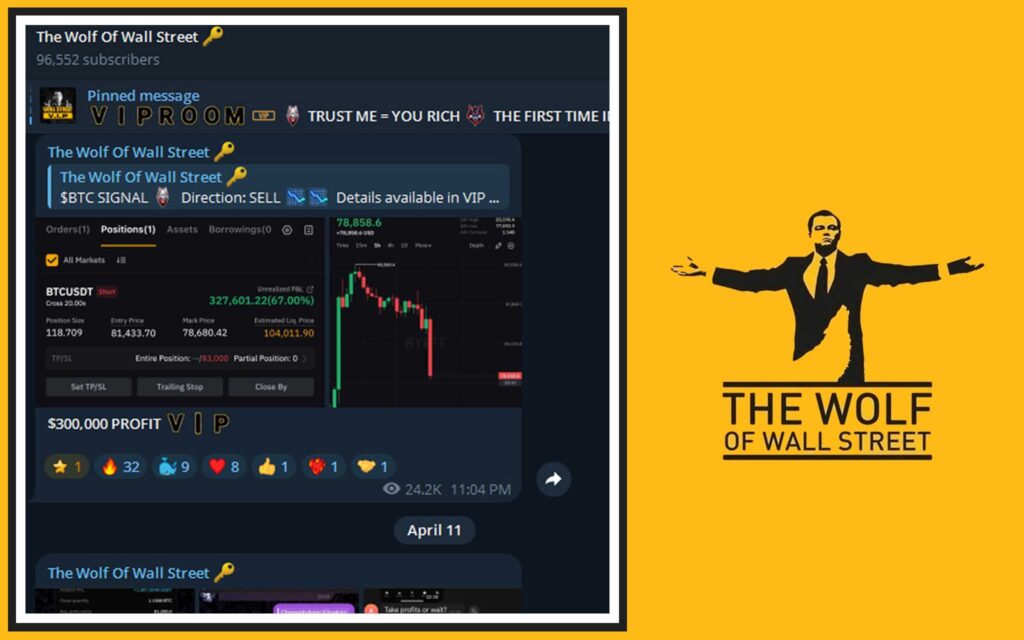

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””