Listen up. You hear terms like “ETFs” and “ETPs” thrown around, right? And you probably think they’re all the same. WRONG. This market isn’t about guessing; it’s about knowing exactly what you’re buying. Understanding the difference between ETPs vs. ETFs and their many forms is absolutely critical. This isn’t just theory; it’s about picking the right tool for your money, managing risk, and spotting the real opportunities, whether it’s in traditional markets or crypto. Get this breakdown, and you’re ahead of the game.

🗺️ What Are Exchange-Traded Products (ETPs)? The Big Picture

An Exchange-Traded Product (ETP) is a broad category of investment vehicles that are designed to track the performance of an underlying asset, index, or benchmark. The key defining characteristic of all ETPs is that they trade on stock exchanges, just like ordinary company shares. This means you can buy and sell them throughout the trading day at market prices, offering high liquidity.

An Umbrella Term for Trackers.

Think of ETPs as an umbrella term. Under this umbrella, you’ll find various types of products, each with its own structure and characteristics. The most well-known ETP is the Exchange-Traded Fund (ETF), but the category also includes Exchange-Traded Notes (ETNs) and Exchange-Traded Commodities (ETCs), among others. It’s important to understand that while all ETFs are ETPs, not all ETPs are ETFs. This distinction is crucial for understanding risk and reward.

Traded Like Stocks, Valued Like Funds.

ETPs marry the liquidity of stocks with the diversification potential of investment funds. Because they trade on exchanges, their price can fluctuate throughout the day based on supply and demand, just like a stock. However, their value is ultimately derived from the value of the assets or index they track, similar to how an investment fund’s Net Asset Value (NAV) is calculated. This blend offers flexibility and transparency.

📈 Exchange-Traded Funds (ETFs): The Diversification Workhorse

ETFs are the rockstars of the ETP family, and for good reason. They are essentially investment funds that hold a basket of underlying assets, but their shares are traded on exchanges like stocks.

Holding Actual Assets.

When you buy a share of an ETF, you’re not directly owning the underlying assets (like individual stocks, bonds, or Bitcoin). Instead, you own a share of the fund, which in turn holds those actual assets.

- They can hold stocks: Giving you exposure to broad markets (like the S&P 500) or specific sectors (e.g., technology, healthcare).

- They can hold bonds: Providing diversified exposure to government or corporate debt.

- They can hold commodities: Such as physically-backed Gold ETFs.

- Increasingly, they hold cryptocurrencies: Like the recently approved spot Bitcoin ETFs in the US, which directly hold Bitcoin.

How ETFs Provide Diversification and Lower Fees.

ETFs are fantastic for diversification. Instead of buying dozens of individual stocks or bonds, a single ETF share gives you instant exposure to a diversified portfolio. This spreads your risk across many assets. On top of that, ETFs generally come with much lower expense ratios (management fees) compared to traditional actively managed mutual funds, as most are passively managed, tracking an index. This means more of your money stays invested.

Creating and Redeeming Shares.

The unique ‘creation/redemption’ mechanism helps keep an ETF’s market price in line with its Net Asset Value (NAV) – the total value of its underlying assets. Large institutional investors (authorised participants) can create new ETF shares by depositing a basket of underlying assets with the ETF issuer. Conversely, they can redeem ETF shares for the underlying assets. This arbitrage process ensures that if an ETF’s price deviates too far from its NAV, these participants will step in to profit from the difference, pushing the price back towards its fair value. This dynamic helps maintain liquidity and fair pricing.

Key Advantages: Transparency, Liquidity, Tax Efficiency.

- Transparency: Most ETFs disclose their holdings daily, so you always know what you own.

- Liquidity: Traded on exchanges, you can buy and sell ETF shares throughout the day at market prices, not just once a day like mutual funds.

- Tax Efficiency: In many jurisdictions, ETFs are more tax-efficient than mutual funds, particularly in how they manage capital gains distributions.

Risks of ETFs: Market Risk.

While ETFs offer diversification, they are still subject to market risk. If the overall market or the sector/asset class the ETF tracks goes down, the value of your ETF shares will also go down. Other risks can include tracking error (the ETF not perfectly matching its index) and liquidity risk for very thinly traded ETFs.

Real-World Examples of Popular ETFs:

- S&P 500 ETF (e.g., SPDR S&P 500 ETF Trust, ticker SPY): Provides exposure to the 500 largest US companies.

- Gold ETF (e.g., SPDR Gold Shares, ticker GLD): Tracks the price of physical gold.

- Crypto Spot ETFs (e.g., BlackRock iShares Bitcoin Trust, ticker IBIT): Recently approved, these ETFs directly hold Bitcoin, offering institutional and retail investors regulated access to crypto without direct ownership of the coins.

📝 Exchange-Traded Notes (ETNs): Unsecured Debt with a Twist

ETNs are a different animal entirely. While they are also ETPs that trade on exchanges, their structure is fundamentally different from ETFs, and this brings unique risks.

What Are ETNs? Unsecured Debt Securities.

An ETN is an unsecured debt security issued by a financial institution (typically a bank). When you buy an ETN, you’re not buying a fund that holds assets. Instead, you’re lending money to the issuing bank, and in return, the bank promises to pay you a return based on the performance of a specific underlying index or asset, minus fees. It’s essentially a promise to pay.

Tracking Asset Prices Without Holding Assets.

ETNs track various benchmarks, including commodities, currencies, or market volatility indices. The issuer uses the money raised to invest in ways that mimic the performance of the underlying asset. You get the exposure without direct ownership or the complexities of managing futures contracts yourself.

Key Advantage: Access to Niche or Illiquid Markets.

ETNs often provide access to markets or strategies that are difficult for individual investors to access directly, or where creating a traditional ETF would be too complex or expensive (e.g., very specific commodity baskets, or strategies that involve futures that are hard to manage). They can offer efficient exposure to niche markets.

Unique Risk: Issuer Credit Risk.

This is the big one. Since an ETN is an unsecured debt obligation, if the issuing bank goes bankrupt or defaults, you could lose some or all of your investment, regardless of how the underlying asset performs. This ‘issuer credit risk’ is a major difference from ETFs, where your investment is protected from the fund issuer’s insolvency because the fund holds actual assets.

Tax Implications of ETNs: Often taxed as ordinary income.

Gains from ETNs are often taxed differently than ETFs. In many jurisdictions, ETN gains might be treated as ordinary income, which can be taxed at a higher rate than capital gains (which ETFs often qualify for). This can significantly impact your net return.

⛏️ Exchange-Traded Commodities (ETCs): Direct Exposure to Goods

ETCs are a subset of ETPs designed specifically to provide exposure to commodities.

What Are ETCs? Focus on Commodities.

ETCs allow investors to gain exposure to raw materials like gold, silver, oil, natural gas, or baskets of commodities. They can also include digital commodities like Bitcoin (many European Bitcoin ETPs are technically ETCs or ETNs).

Backed by Physical Assets or Digital Assets.

Some ETCs are physically backed, meaning they hold the actual commodity (e.g., physical gold bars in a vault). Others might track the commodity’s price through futures contracts. For digital assets, some ETCs directly hold the underlying cryptocurrency.

Risks of ETCs: Commodity Volatility.

Commodity prices can be extremely volatile due to supply and demand dynamics, geopolitical events, and economic factors. ETCs will reflect this volatility directly. They can also carry roll-over risk if they track futures contracts (the cost of rolling over expiring contracts).

🚀 Leveraged and Inverse ETPs: High-Risk, Short-Term Plays

These are the high-octane versions of ETPs, designed for short-term, aggressive traders, not long-term investors.

Amplifying Gains and Losses (Leveraged ETPs).

A leveraged ETP aims to return a multiple (e.g., 2x, 3x) of the daily performance of an underlying index or asset. If the underlying asset goes up 1% in a day, a 2x leveraged ETP aims to go up 2%.

Profiting from Declines (Inverse ETPs).

An inverse ETP aims to return the opposite performance (e.g., -1x, -2x) of an underlying asset. If the underlying asset goes down 1% in a day, a -1x inverse ETP aims to go up 1%.

Why These are NOT for Long-Term Holding.

The key word here is daily. Leveraged and inverse ETPs are designed to reset their leverage daily. This means that over periods longer than a day, the compounding effect can cause their returns to diverge significantly from (and often be worse than) the stated multiple of the underlying asset’s performance. Even if the underlying asset moves exactly as you expect over a week, a leveraged ETP might lose value due to volatility.

Risks of Leveraged/Inverse ETPs: Rapid value erosion, complex mechanics.

These products are incredibly risky due to their volatility and the compounding effect. They are suitable only for experienced traders with a clear understanding of their mechanics and a very short-term trading horizon. Misunderstanding them can lead to rapid and substantial capital loss.

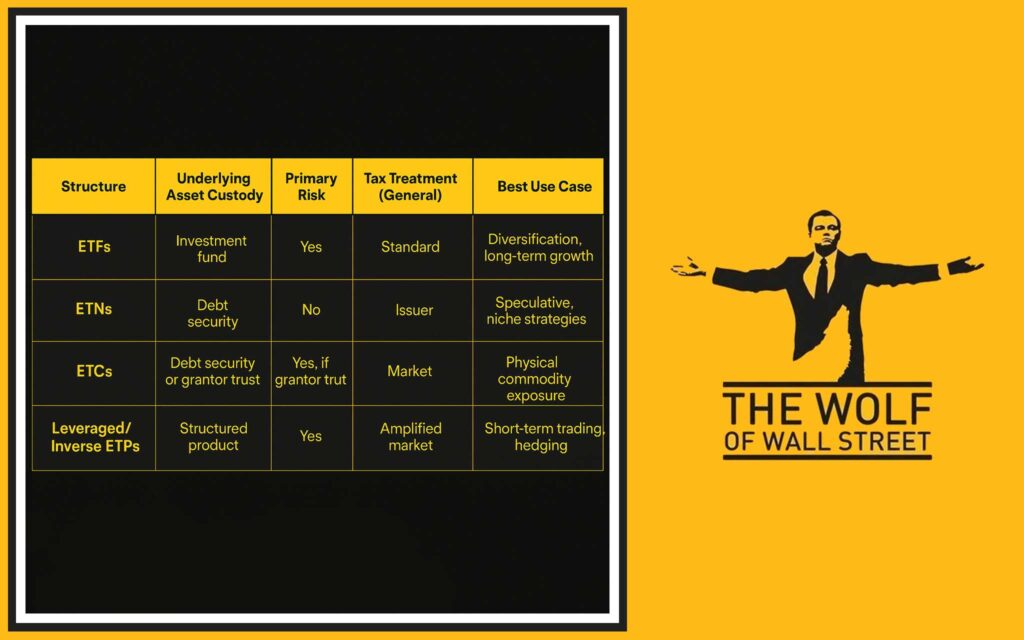

⚔️ ETPs vs. ETFs: A Comparison Overview

To cut through the complexity, here’s a side-by-side look at the key differences between these product types.

- Structure and Ownership:

- ETFs: A fund holding actual underlying assets. You own a share of the fund.

- ETNs: An unsecured debt obligation. You own a promise from the issuer.

- ETCs: Primarily track or hold commodities (physical or digital).

- Leveraged/Inverse ETPs: Complex derivative structures designed for daily amplified returns.

- Risk Profiles:

- ETFs: Primarily market risk.

- ETNs: Market risk + significant issuer credit risk.

- ETCs: Market risk + commodity price volatility risk.

- Leveraged/Inverse: Amplified market risk, compounding risk, tracking error, counterparty risk.

- Tax Treatment Variations: Tax implications vary significantly by jurisdiction and product type. ETFs are often more tax-efficient for capital gains than ETNs (which might be ordinary income) or some ETCs.

- Use Cases and Investment Goals:

- ETFs: Long-term diversification, core portfolio holdings, passive investing.

- ETNs: Niche market access, specific strategies, potential for higher risk/reward due to issuer risk.

- ETCs: Direct commodity exposure, hedging.

- Leveraged/Inverse: Short-term directional bets, aggressive speculation, hedging.

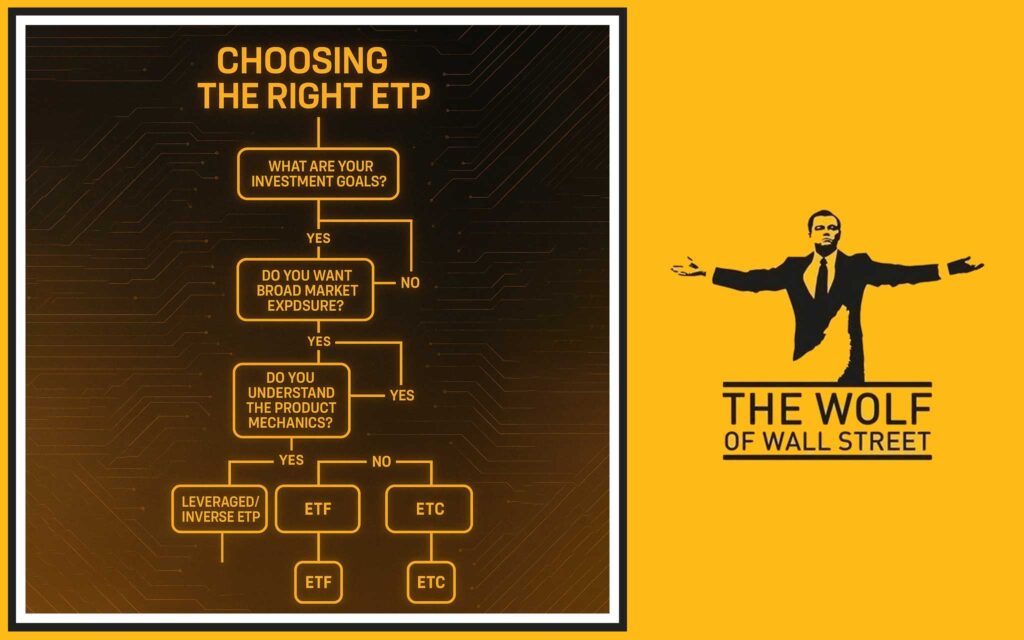

🎯 Choosing the Right Product: Aligning with Your Goals

This is about matching the investment tool to your personal objectives, knowledge, and willingness to take on risk. Don’t pick a product just because it’s popular or promises high returns.

Assess Your Investment Goals:

- Long-term growth and broad diversification? ETFs are often the ideal choice.

- Short-term speculation on market downturns or amplified moves? Leveraged/Inverse ETPs, but with extreme caution and deep understanding.

- Niche market access or specific commodity exposure without direct ownership of volatile futures contracts? ETNs or ETCs might be suitable.

Evaluate Your Risk Tolerance.

Be brutally honest with yourself. Can you stomach significant short-term price swings? Are you comfortable with issuer credit risk? Understanding your true risk tolerance is paramount. If a potential 20% loss would cause panic, avoid leveraged products.

Due Diligence on Issuer and Structure.

Always research the issuing institution’s creditworthiness (especially for ETNs). Understand the product’s exact mechanics, how it tracks its underlying, and all associated fees.

⚖️ Security, Regulation, and Suitability

These factors are non-negotiable for any investment product, and they are especially complex for crypto-related ETPs.

Importance of Platform Security.

When buying ETPs/ETFs on exchanges, the security of your brokerage platform is critical. Use strong, unique passwords, 2FA, and be aware of phishing scams. Your money is only as safe as the platform holding it. (For more on protecting your assets, review Research Crypto Opportunities Guide which covers exchange security.)

Regulatory Landscape for ETPs/ETFs: Especially Crypto-Specific.

Regulations for crypto ETPs vary significantly globally. For instance, while spot Bitcoin ETFs are now approved in the US, other regions like Europe have had Bitcoin ETCs for years, but with different regulatory frameworks. Some countries place restrictions on what products retail investors can access due to risk. Always check the regulations in your jurisdiction. The evolving global Policies impact these products.

Suitability for Different Investors.

Financial advisors often have ‘suitability’ requirements. Not all products are appropriate for all investors. Complex, high-risk products like leveraged ETNs are typically only suitable for experienced investors with a high risk tolerance.

Risk Disclaimers and Warnings.

Always read the prospectus (the official legal document) for any ETP/ETF. These documents contain all the fine print, risks, fees, and operational details. Never invest in something you haven’t fully researched and understood.

💡 Real-World Scenarios & Expert Views

Let’s look at how these products play out in real-world scenarios.

Successful Diversification with an ETF:

(Describe a generic example): “An investor, bullish on the overall cryptocurrency market but wanting broad exposure without picking individual coins, decides to allocate a portion of their portfolio to a diversified Cryptocurrencies](/category/cryptocurrencies/) market ETF. This allows them to benefit from the growth of the overall digital asset market, spreading their risk across many coins, with the simplicity of trading a single instrument on a traditional exchange.” This illustrates the diversification benefit.

The Dangers of Misusing Leveraged ETPs:

(Describe a generic cautionary example): “A new trader, convinced Bitcoin is going up, invests in a 3x leveraged Bitcoin ETP. Bitcoin rises for a few days, but then experiences a sharp, volatile correction. Even though Bitcoin eventually recovers its original price, the leveraged ETP’s value has significantly eroded due to the daily compounding during the volatile period. The trader loses a substantial portion of their capital, highlighting that these products are not for long-term holding or high-volatility environments.” This stresses the compounding risk.

Glossary of Key ETP/ETF Terms:

To help clarify the jargon in this market, here are some essential terms:

- Arbitrage Mechanism: The process by which authorised participants keep an ETP’s market price aligned with its underlying value (NAV) by creating or redeeming shares.

- Net Asset Value (NAV): The total value of an ETF’s underlying assets minus its liabilities, divided by the number of shares outstanding.

- Tracking Error: The difference between an ETP’s returns and the returns of its underlying index or asset.

- Rebalancing: The process by which leveraged and inverse ETPs adjust their portfolios daily to maintain their stated leverage ratio.

- Expense Ratio: The annual fee charged by the fund to cover management and operational costs.

- Spread: The difference between the bid (buy) and ask (sell) price of an ETP, a transaction cost.

- Issuer Credit Risk: The risk, primarily in ETNs, that the financial institution issuing the product may default on its obligation.

Frequently Asked Questions (FAQs)

- What is the main difference between an ETP and an ETF?

An ETP is a broad category that includes ETFs, ETNs, and ETCs, while an ETF is a specific type of ETP that holds actual assets. - What is the unique risk of an ETN compared to an ETF?

ETNs carry issuer credit risk, meaning if the issuing bank defaults, you could lose your investment, a risk not present in ETFs which hold actual assets. - Why are leveraged and inverse ETPs generally not suitable for long-term investing?

They are designed for daily returns, and the compounding effect of daily rebalancing can significantly erode their value over periods longer than a single day, even if the underlying asset performs as expected. - How do ETFs provide diversification?

ETFs hold a basket of multiple underlying assets (e.g., many stocks, bonds, or different cryptocurrencies), allowing investors to gain exposure to a diversified portfolio with a single purchase. - What should an investor do before investing in any ETP or ETF?

Investors should assess their investment goals and risk tolerance, conduct thorough due diligence on the product’s structure, issuer, and underlying assets, and always read the product’s prospectus.

There you have it – ETPs vs. ETFs, demystified. This isn’t just about labels; it’s about understanding the engine, the risks, and the true potential of every product you put your money into.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””