Listen up. The crypto market is wild, but even the biggest exchanges swing the axe. Binance Token Delistings are a reality every serious trader needs to understand. This isn’t just about a token disappearing; it’s about price volatility, liquidity crises, and strict deadlines that can wipe out your assets if you’re not prepared. This guide gives you the hard facts, the process, and your action plan to protect your money.

🔒 Why Binance Delists Tokens: The Iron Fist of Quality Control

Binance, like any major exchange, has a responsibility to maintain a robust, stable, and compliant trading environment. This means they regularly review and, if necessary, remove cryptocurrencies from their platform. These decisions are not arbitrary; they follow a set of criteria designed to protect users and the integrity of the market.

Project and Team Commitment.

A token is only as good as the team and project behind it. Binance scrutinises whether a project shows ongoing development, maintains transparent communication with its community, and delivers on its roadmap. A lack of commitment, signs of project abandonment, or significant inactivity are major red flags that can lead to delisting. If the builders aren’t building, the token is dead weight.

Market Performance.

This is a straightforward one. Assets with consistently low trading volume or insufficient liquidity are prime candidates for removal. Low volume means a token isn’t actively traded, making it difficult for users to buy or sell without causing massive price swings. It creates a poor trading experience and ties up exchange resources. Binance wants a market that moves, a market where money flows.

Regulatory Risks.

The crypto world is under increasing scrutiny from regulators globally. Tokens facing legal complications, operating without necessary approvals in key jurisdictions, or engaging in activities that might attract regulatory action are likely to be delisted. Exchanges like Binance must avoid legal entanglements and maintain compliance to operate in regulated markets. This is a critical factor, especially concerning global Policies impacting digital assets.

Security Risks.

Security is non-negotiable. Recurrent security vulnerabilities, major hacking incidents related to the token’s protocol, or consistent noncompliance with security protocols can lead to delisting. Binance prioritises user asset safety. If a token poses a consistent security threat, it’s out.

Ethical Risks.

Projects involved in deceptive practices, fraudulent activities (like misleading whitepapers or fake partnerships), or those deemed harmful to the crypto ecosystem are at severe risk of removal. Exchanges want to distance themselves from anything that undermines user trust or the industry’s reputation.

Utility Issues.

A token needs a purpose. Tokens lacking real-world application, clear utility within their ecosystem, or failing to deliver substantial value to the broader crypto space are candidates for delisting. If a token doesn’t do anything, if it’s just a speculative chip with no function, it’s not serving the market.

🗓️ The Delisting Process: What Happens When the Axe Falls

When Binance decides to delist a token, it follows a structured process to ensure users have time to react, though the speed of reaction is up to you.

User Notification: Early Warnings.

Binance typically provides multiple notifications to users. These usually come through official announcements on their website, email notifications, and sometimes in-app alerts. The announcement usually details the token, the reason for delisting, and the critical deadlines. It’s your job to stay informed and check these announcements frequently.

Trading Suspension: Orders Canceled.

A specific date and time are announced for the suspension of trading. Typically, this happens 1–2 weeks after the initial announcement. At this point, all existing open orders (buy or sell) for the delisted token’s trading pairs are automatically cancelled by the exchange. You can no longer place new orders.

Deposit Suspension: No More Inflows.

Simultaneously, deposits for the delisted tokens are usually no longer credited to user accounts. Attempting to deposit delisted tokens after this point means they might be lost or become inaccessible.

The Withdrawal Window: Your Critical Deadline.

This is the most important period for tokenholders. Binance provides a withdrawal window, typically ranging from 30 to 90 days from the date of the delisting announcement. During this time, you can withdraw your delisted tokens to an external, self-custodied wallet or to another exchange that still supports the token. Missing this deadline is a serious mistake.

Payment Restriction: All Transactions Cease.

After the withdrawal deadline passes, all transactions for the delisted tokens cease. This means you can no longer withdraw, deposit, or trade the token on Binance. Your assets become frozen on the platform.

📉 Impact on Tokenholders: What Happens to Your Assets

A delisting can cause immediate shock, but understanding the precise impact helps you take the right steps.

During the Withdrawal Period: Action is Key.

If you hold a token being delisted, the period between the announcement and the withdrawal deadline is your crucial action window. During this time, you can still move your tokens. Your primary goal should be to secure your assets by transferring them out.

After Withdrawal Period: Ownership Retained (But Access Lost).

If you miss the withdrawal deadline, you still technically own the tokens, but you lose access to them on Binance. The tokens remain on Binance’s books, but you cannot move them or trade them. Relisting is rare, so consider these funds inaccessible unless a very specific solution is provided.

Stablecoin Conversion: Binance’s Rare Option.

In some, very rare cases, Binance may convert unwithdrawn tokens into stablecoins (e.g., USDT) and credit the equivalent value to user accounts. This is usually done with prior notice and is a discretionary action by the exchange, not a guarantee. Don’t count on it.

Exchange Offers: Rare Swaps.

Even rarer are instances where Binance might offer a limited swap or conversion program for delisted tokens, typically for tokens that are migrating to a new blockchain or undergoing a significant protocol change. Again, this is not standard procedure.

🏃♂️ What Users Must Do: Your Action Plan

This is not a time for hesitation. Your prompt, decisive action can save your capital.

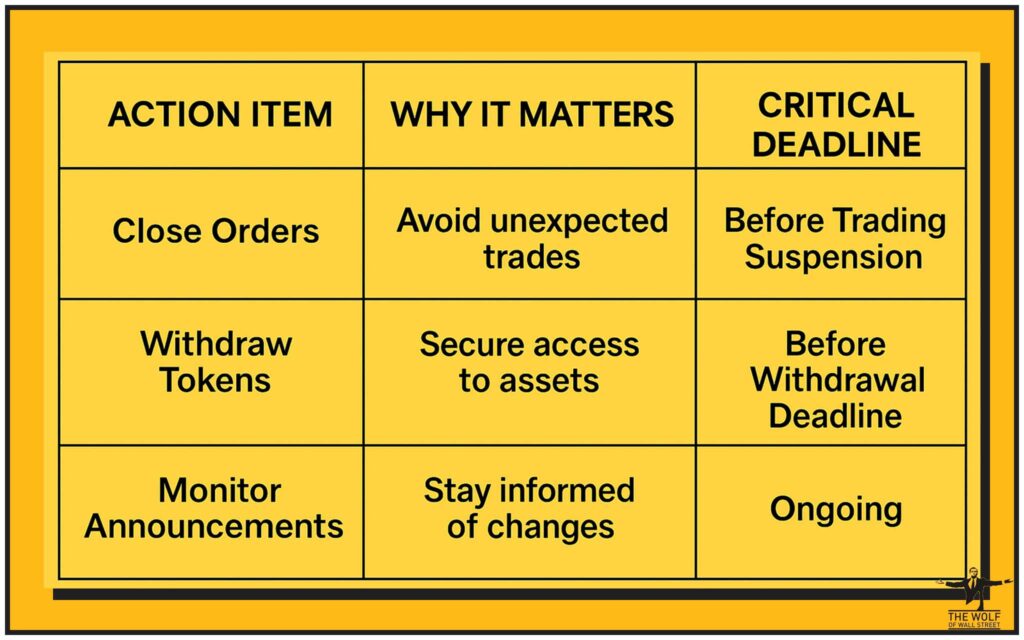

Close Open Orders: Before Trading Suspends.

As soon as a delisting announcement hits, immediately close any active buy or sell orders involving that token. These orders will be cancelled automatically when trading suspends, but cancelling them yourself ensures clarity and prevents any unexpected issues.

Withdraw Tokens: Before the Deadline.

This is the most critical step. Move your delisted tokens to an external, self-custodied wallet (like a hardware wallet) or to another exchange that still lists the token, before the announced withdrawal cutoff time. Do not delay. Missing this deadline means your funds are locked on Binance.

Stay Informed: Monitor Official Binance Announcements.

This cannot be stressed enough. Delisting details can change, or new options might arise. Regularly check Binance’s official announcement page and your registered email for updates and additional instructions. Rely only on official sources.

🤔 Delisting vs. Removing Trading Pairs: A Critical Distinction

These two terms are often confused, but their impact on your holdings is entirely different.

Full Token Delisting: Gone from All Services.

When a token is fully delisted, it means Binance is removing it from all its services. This includes all trading pairs (spot, futures, margin), as well as any staking, lending, or other products offered on the platform for that token. The token effectively disappears from Binance’s ecosystem.

Removing a Trading Pair: Only Specific Market Affected.

If Binance only removes a specific trading pair (e.g., BTC/USDT), it means the underlying token (Bitcoin, in this example) is still available for trading against other pairs (e.g., BTC/BUSD, BTC/ETH) on the exchange. Only that one specific market is closed. This is a far less severe event than a full token delisting.

🔄 Strategic Implications: Beyond the Immediate Shock

While a delisting is an immediate negative event, it also carries broader implications and can, surprisingly, present new opportunities for smarter investors.

Diversification as a Defence Against Delistings.

A key lesson from delistings is the absolute need for diversification. If a large portion of your capital is in one token that gets delisted, the impact is severe. Spreading your investments across multiple assets, different sectors, and even different exchanges reduces the risk of any single delisting wiping out a significant part of your portfolio. This ties into broader Portfolio Management Tips for investors.

Opportunity to Explore Other Assets.

A delisting can force you to re-evaluate your investment choices. If a token is delisted due to lack of utility or poor performance, it’s an opportunity to reallocate that capital to assets with stronger fundamentals, better prospects, or those aligned with current market trends. It’s about moving from dead weight to productive assets.

Impact on Long-Term Token Value and Market Perception.

A delisting from a major exchange like Binance often severely damages a token’s credibility, liquidity, and future price potential. It sends a strong negative signal to the market, making it harder for the token to attract new investors or maintain its value elsewhere.

💡 Real-World Case Studies: Delistings in Action

Learning from actual events is how you get smart in this market.

XMR (Monero) Delisting: Why it happened.

(Describe: In early 2024, Binance delisted several privacy-focused coins, including Monero (XMR). The primary reason cited was the increasing regulatory pressure globally concerning anti-money laundering (AML) and know-your-customer (KYC) compliance. Despite Monero’s technical merits, its features designed for privacy made it difficult for exchanges to comply with new regulations. Impact: The delisting led to a significant short-term price drop for XMR and a shift in its liquidity to other, often smaller, exchanges that still supported it.) This highlights the impact of evolving Policies on crypto.

REN (Ren Protocol) Delisting: Project-specific issues.

(Describe: Ren Protocol’s token (REN) was delisted following the collapse of Alameda Research and FTX, its primary backer and largest liquidity provider. The project faced significant uncertainty about its future development and funding. Impact: The delisting led to a dramatic fall in REN’s price and liquidity, as investors lost confidence in the project’s ability to continue without its main support.)

Other Notable Delistings: Illustrating the ongoing nature.

Binance has delisted numerous tokens over time, including IDRT, KP3R, OOKI, UNFI, ANT, MULTI, and VAI. These delistings often stem from combinations of low volume, project inactivity, non-compliance, or security concerns. They serve as constant reminders for traders to assess projects thoroughly, akin to due diligence in a Crypto Token Listing Process Guide or by regularly asking When to Sell Crypto.

⚖️ Regulatory and Security Trends: The Shifting Landscape

The forces of regulation and security are increasingly dictating delisting decisions.

Increased Regulatory Pressure on Exchanges.

Authorities worldwide are demanding stricter compliance from exchanges, particularly regarding KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. Exchanges are pressured to delist tokens that don’t meet these heightened standards or are used in illicit activities.

Exchange Security Standards and Vulnerabilities.

Exchanges must constantly maintain world-class security. Delistings can occur if a token’s smart contract is found to have critical vulnerabilities, or if repeated security incidents make it a liability to the exchange’s overall security posture.

Compliance-Driven Delistings.

Binance, like other major exchanges, is becoming increasingly proactive in delisting tokens that pose significant regulatory risks or fall out of favour with evolving global regulations. They prioritize staying compliant in key markets, which means shedding tokens that could jeopardise their licenses.

📈 Portfolio Management Tips: Prepare for Anything

Don’t wait for a delisting announcement to hit. Be proactive.

The Need for Diversification.

Never put all your capital into one token. Diversify across different Cryptocurrencies, blockchain sectors, and platforms to minimise the impact of any single delisting.

Monitoring Project Health.

Regularly review the fundamental health of the projects you hold. Is their development active? Is their community engaged? Are there any looming regulatory threats? Look for signs of trouble before the exchange makes the decision for you. This involves consistently conducting Research Crypto Opportunities Guide.

Using Decentralized Alternatives.

For tokens that might face delisting risk on centralised exchanges due to regulatory or utility issues, consider using decentralised exchanges (DEXs) or self-custody as alternative ways to manage your assets. While DEXs have their own risks (like impermanent loss in yield farming, relevant to Earn Crypto Without Selling), they offer permissionless trading.

Glossary of Key Delisting Terms:

To help clarify the jargon related to this process, here are some essential terms:

- Liquidity: The ease with which an asset can be bought or sold without affecting its price significantly.

- Wash Trading: The practice of artificially inflating trading volume by repeatedly buying and selling the same asset to create a false impression of activity.

- Regulatory Compliance: Adhering to legal and governmental rules and regulations.

- Counterparty Risk: The risk that the other party to a financial transaction will not fulfil their obligations.

- KYC (Know Your Customer): A process where businesses verify the identity of their clients to prevent illegal activities.

- AML (Anti-Money Laundering): Procedures to prevent the generation of income from illegal activities.

Frequently Asked Questions (FAQs)

- Why does Binance delist cryptocurrencies?

Binance delists tokens for reasons including low trading volume, lack of project commitment, regulatory risks, security vulnerabilities, ethical concerns, and insufficient utility within the crypto ecosystem. - What is the “withdrawal window” during a delisting?

The withdrawal window is a specific period (typically 30 to 90 days) after trading suspension during which users can still withdraw their delisted tokens from Binance to an external wallet or another exchange. - What happens to my tokens if I miss the withdrawal deadline?

After the withdrawal deadline, Binance typically disables withdrawals for the delisted token. While you retain ownership, accessing the tokens directly through Binance becomes very difficult, unless Binance decides to relist the token (which is rare). - How is “delisting” different from “removing a trading pair”?

Delisting means the token is completely removed from all Binance services. Removing a trading pair means only a specific trading market (e.g., BTC/USDT) is removed, but the underlying token may still be traded against other pairs on the exchange. - What should be my immediate action if a token I hold is delisted on Binance?

Your immediate action should be to cancel all open orders for that token and, most importantly, withdraw your tokens to an external wallet or another exchange that supports the token before the withdrawal deadline.

There you have it – Binance Token Delistings. A swift, unavoidable process. Act fast, stay informed, and you’ll survive the axe.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:/n* Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””