🚀 Robinhood Goes Global: The $200M Crypto Gambit

Robinhood just pulled off a move that screams bold, brilliant, and downright aggressive. They dropped a clean $200 million—in straight cash, mind you—to acquire Bitstamp, one of the most trusted and battle-tested crypto exchanges on the planet. This isn’t just another acquisition; it’s a strategic assault on the global crypto market. Let’s break it down like a boardroom pitch with billions on the line.

The Robinhood Bitstamp acquisition isn’t just about market share. It’s about planting a flag on new digital territory: Europe, Asia, and beyond. It’s the kind of move that shifts power in the crypto chessboard. Robinhood didn’t tiptoe in. They kicked the door open.

🌍 Why Bitstamp? Why Now?

Timing is everything. The crypto market is still volatile, still maturing, but ripe for consolidation. Bitstamp has been around since 2011. That’s ancient by crypto standards. They survived every winter and thrived in every bull run.

So, why now? Simple. Robinhood needed credibility, reach, and a way to service both retail and institutional clients. Bitstamp delivers all three.

💰 The Deal Breakdown: $200M in Pure Cash

This wasn’t a stock swap. No funny money. Robinhood wired $200 million in cold, hard cash. That’s confidence.

The deal was first announced in June 2024 and wrapped up by early June 2025. No delays. No revisions. Just execution.

🛡️ Compliance Goldmine: 50+ Global Licenses Acquired

This is where it gets surgical. With Bitstamp, Robinhood instantly snags over 50 active regulatory licenses across Europe, the UK, Asia, and the US. That’s an international launchpad on a silver platter.

Compare that to most exchanges trying to play regulatory hopscotch. Robinhood now has clearance to operate legally in the world’s most important financial corridors.

Check our deep dive into crypto policy shifts and see why this matters more than ever.

🧠 Enter the Institutions: 5,000 High-Net Clients on Deck

Bitstamp isn’t just another retail playground. Their client roster includes over 5,000 institutional players. We’re talking hedge funds, fintech firms, asset managers—big money.

For Robinhood, which was largely retail-centric, this is an entirely new class of clientele. It’s like going from selling penny stocks to managing elite portfolios.

📊 Financial Firepower: Revenue, Margins & Expansion

Let’s talk numbers.

- Bitstamp: $95 million revenue in the last 12 months.

- Robinhood: $252 million in crypto income just in Q1 2025.

Combined, you’re looking at a revenue monster. This isn’t about cost-cutting. It’s about scale, synergy, and raw growth.

🔗 Platform Integration: The Smart Routing Advantage

Robinhood is already rolling Bitstamp into its infrastructure: Smart Exchange Routing and Robinhood Legend. That means faster trades, tighter spreads, and a seamless experience for both rookies and whales.

Want more insights into layer-2 advantages? That’s where execution efficiency is born.

🌐 Global Domination Blueprint

This isn’t a one-off. In May 2025, Robinhood also snapped up WonderFi in Canada for $179 million.

Let’s connect the dots:

- US dominance? Check.

- Canada? Secured.

- Europe and Asia? Bitstamp unlocks.

Robinhood is now a global force. Coinbase and Binance should be sweating.

Explore more about evolving crypto ecosystems and how Robinhood’s positioning is no accident.

🧬 Tokenisation – Robinhood’s Secret Weapon

Here’s the next-level play: tokenisation of real-world assets (RWAs). CEO Vladimir Tenev is betting big on it.

Imagine buying tokenised shares of SpaceX or OpenAI in seconds. No middlemen. Just blockchain.

Robinhood is developing a tokenisation platform, possibly with Solana or Arbitrum. They’ve already pitched the SEC to make tokenised RWAs as legit as traditional stocks.

This isn’t just future talk. It’s being built right now.

🏗️ Risk, Regulation, and Realities

No move is without risk. Robinhood expects to burn through about $65 million in Bitstamp integration and ops costs through 2025.

There’s also the regulatory risk. Different markets, different rules. But with Bitstamp’s compliance armoury, they’re better equipped than most.

Need to brush up on decentralised finance dynamics? Dive into our DeFi library.

📈 Market Moves: Shareholder Reaction & Industry Vibes

Investors loved it. Robinhood stock jumped 2.77% on the news, climbing further in after-hours trading.

Why? Because this wasn’t a gamble. It was a calculated, global expansion move with short-term payoff and long-term upside.

📚 Bitstamp’s Legacy vs Robinhood’s Hustle

Bitstamp is steady. Reliable. Institutional-grade.

Robinhood? Flashy. Fast. Disruptive.

Can they blend? That’s the real question. If they do, you’re looking at one of the most potent combos in crypto history.

⚖️ What It Means for Crypto Traders

More assets. Better liquidity. Global access. Whether you’re a seasoned trader or a newbie, this opens the door to smarter plays and better profits.

New to trading? Hit our newbie section and get levelled up.

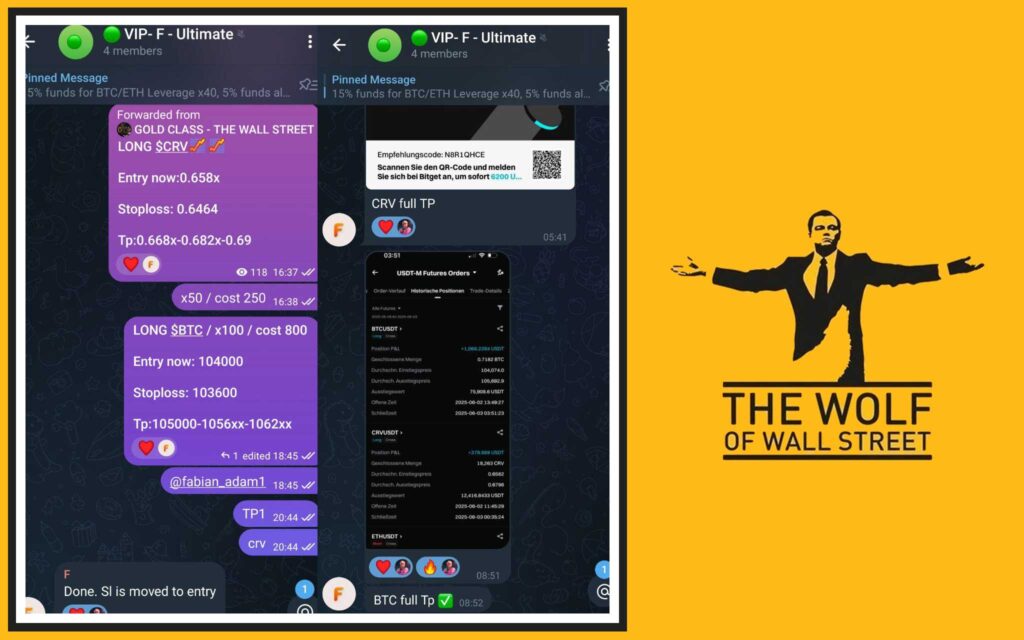

🧐 The Wolf Of Wall Street Trading Edge: Leverage the Shift

At The Wolf Of Wall Street, we don’t just react. We capitalise.

Here’s how our members are preparing:

- Using VIP Signals to identify Bitstamp-arbitrage opportunities.

- Tapping into real-time insights from a community of 100,000+ traders.

- Maximising positions with our volume calculators and tools.

- Getting 24/7 access to support and strategy.

Visit The Wolf Of Wall Street.com and join the Telegram alpha stream.

❓ FAQs

Q: What is the Robinhood Bitstamp acquisition?

A: A $200 million cash deal that gives Robinhood global access and 5,000+ institutional clients.

Q: How does this affect crypto in Europe and Asia?

A: It accelerates adoption and opens new markets via Bitstamp’s licences.

Q: Is this good for retail traders?

A: Yes. Expect more assets, better liquidity, and smarter tools.

Q: What’s the big deal with tokenisation?

A: It unlocks global investment in previously private assets using blockchain.

📏 The Wolf’s Verdict

Let’s not sugarcoat it. The Robinhood Bitstamp acquisition is a power move. It’s bold. It’s strategic. And it puts Robinhood on a collision course with every major player in the global crypto arena.

If you’re a trader, an investor, or just crypto-curious, this changes the game. Big time.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals to maximise profits.

- Expert Market Analysis from seasoned traders.

- Private Network of 100,000+ traders.

- Essential Tools like volume calculators.

- 24/7 Support and continuous insights.

Empower your trading journey: