Listen up, you crypto maniacs! This isn’t kindergarten; this is the cryptocurrency market. It’s wild, it’s brutal, and it’s where fortunes are made and lost in the blink of an eye. You want a slice of that pie? You want to swim with the sharks and come out rich? Then you better understand the damn game. We’re talking about P2P versus Centralized Exchanges – the two titans battling for your trading volume. This isn’t just theory; this is about strategic advantage, pure and simple.

💰 The Crypto Wild West: Understanding Your Battlefield

You think you can just blindly jump into crypto and make a killing? Get real! This market is a jungle, and if you don’t know your way around, you’ll be eaten alive. Understanding the fundamental platforms where you buy, sell, and trade digital assets isn’t optional; it’s mandatory. It’s the difference between a high-roller and a broke fool.

Why You Need to Know This NOW

The crypto landscape is shifting faster than a politician’s promise. What worked yesterday might get you wiped out tomorrow. The distinction between a peer-to-peer setup and a centralised behemoth isn’t just technical jargon; it’s about control, security, and ultimately, your profit margins. Ignoring this is like bringing a knife to a gunfight. Don’t be that guy. This knowledge gives you the edge, the foresight to pick the right weapon for the right battle. You need to know when to go rogue and when to play by the rules. For more foundational knowledge, check out our guide on getting started in crypto.

The Stakes: What’s on the Line in Every Trade

Every single trade you make carries risk and reward. But the platform you choose fundamentally alters that equation. On a P2P exchange, you’re your own bank, your own security. On a CEX, you’re trusting a third party with your hard-earned capital. Are you comfortable with that? Do you know the pros and cons of each gamble? Because every decision impacts your bottom line. We’re talking about your financial freedom here, not some chump change. This is about building an empire, and empires aren’t built on ignorance.

🔥 Token Dynamics: Swaps, Migrations, and Making Your Capital Work

Before we dive into the exchanges, let’s get a handle on how tokens themselves move and evolve. This isn’t just about trading; it’s about understanding the underlying mechanics that can make or break your portfolio.

Token Swaps: Quick Gains or Strategic Re-positioning?

Token swaps are straightforward: you exchange one cryptocurrency for another. Think of it like trading a stock for a bond – a direct exchange, often facilitated by decentralised protocols or within an exchange. The goal? To capitalise on market movements, rebalance your portfolio, or simply get into a more promising asset. This is about agility, about making quick decisions to pivot and profit. You see an opportunity, you execute the swap. For a deeper dive into these processes, read our article on token swap and migration for crypto dominance.

Token Migrations: Riding the Wave of Innovation

Now, token migrations are a different beast entirely. This isn’t a simple swap; it’s usually when a project moves its entire token from one blockchain to another. Maybe they’re upgrading their tech, moving to a more scalable network, or rebranding. For you, the trader, this means paying attention. If you hold tokens undergoing migration, you need to follow the process to ensure your assets aren’t left behind. Miss this, and your holdings could become worthless. This is about staying ahead of the curve, understanding the evolution of the crypto world, and ensuring your investments transition seamlessly into the future. It’s about adapting, not getting stuck in the past. To understand how new tokens are listed, check out our crypto token listing process guide.

Don’t Get Left Behind: The The Wolf Of Wall Street Advantage

This market moves at light speed. You can’t afford to be guessing. You need an edge, a real advantage. That’s where a community like The Wolf Of Wall Street comes into play. They’re not just talking shop; they’re giving you exclusive VIP signals designed to maximise your trading profits. Think about it: proprietary information, market analysis from seasoned crypto traders, and a private community of over 100,000 like-minded individuals. This isn’t just a group; it’s an army, sharing insights and support, ensuring you’re always in the loop. Why would you go it alone when you could be part of a winning team?

🚀 Peer-to-Peer (P2P) Exchanges: The Maverick’s Playground

Alright, let’s talk about P2P. This is where the old-school hustlers thrive, the ones who like to be in absolute control. Forget the big institutions for a moment; this is about direct, raw trading between individuals.

Direct Deals, No Middleman: The P2P Power Play

P2P exchanges are online platforms that cut out the fat, enabling you to trade cryptocurrencies directly with another person. No brokerage firms, no banks, no bureaucratic red tape. You post your offer, someone else matches it, and you get the deal done. It’s efficient, transparent, and built on the very essence of blockchain: decentralisation. Transactions are verified by the network, not by some suit in a fancy office. This gives you full autonomy, full control over your transaction. It’s exhilarating, frankly. It’s pure, unadulterated freedom.

Privacy, Control, and the Underground Edge

One of the biggest draws of P2P? Privacy. You’re dealing with individuals, and while some platforms might have basic verification, it’s a far cry from the stringent KYC requirements of centralised exchanges. This means more anonymity, which for some, is worth its weight in gold. You maintain full control over your assets until the deal is sealed. Many P2P platforms use escrow services to safeguard funds, meaning your crypto is locked up until both parties fulfil their side of the bargain. It’s a trust mechanism built into the system, protecting both the buyer and the seller. It’s about taking responsibility for your own financial destiny, not handing it over to a faceless entity.

Global Reach, Local Rules: Navigating P2P’s Flexibility

P2P exchanges often offer a mind-boggling array of payment options. Bank transfers, cash in hand, PayPal, whatever gets the job done. This flexibility is massive, especially for traders in regions where traditional financial systems are restrictive or where access to centralised exchanges is limited. It breaks down geographical barriers and opens up a global marketplace where you can find exactly the deal you’re looking for, regardless of where your counterparty is located. This is true financial inclusion, on your terms. If you’re looking to understand broader market movements and trends, our trading insights can give you an edge.

The P2P Hustle: Downsides and How to Dodge Them

Now, don’t get me wrong, it’s not all sunshine and Lamborghinis. P2P has its drawbacks. Liquidity can be lower than on centralised exchanges, meaning it might take longer to find a buyer or seller for the exact price you want. You might not always have as many trading options. Dispute resolution can be a nightmare because there’s no big daddy exchange stepping in. It’s often community-based arbitration, which can be slower and less definitive. And let’s be honest, counterparty risk is a real thing. You’re dealing with another human being, and while escrow helps, human error or malicious intent can still be a factor. The speed of execution can be slower, and there’s no guarantee on reclaiming your original fiat value. It’s a trade-off, a risk-reward calculation you need to make for yourself.

🏦 Centralized Cryptocurrency Exchanges (CEXs): The Big Leagues

Alright, let’s pivot to the gorillas in the room: Centralised Exchanges, or CEXs. These are the household names, the ones that dominate headlines and move billions daily.

The Gatekeepers of Liquidity: Why CEXs Rule Volume

Centralised exchanges are run by a single company, acting as the intermediary for every single trade. Think of them as the stock market for crypto. They manage vast pools of user assets in custodial wallets, which means they hold your crypto for you. This simplifies transactions, making them lightning-fast and incredibly efficient. The trade-off? You’re trusting them with your funds. But the upside is immense liquidity. Want to buy or sell a massive amount of Bitcoin or Ethereum instantly? CEXs are where it happens. They have order book matching technology that ensures trades are executed with incredible speed and efficiency, giving you the best possible price. For insights on specific cryptocurrencies, explore our cryptocurrencies category section.

Speed, Selection, and Services: The CEX Profit Machine

If speed is your game, CEXs are your arena. Transactions are nearly instant. And the sheer volume of cryptocurrencies available on these platforms? Astronomical. Bitcoin, Ethereum, every altcoin imaginable – you name it, they’ve probably got it. But it’s not just about buying and selling. CEXs are evolving into full-service financial hubs. We’re talking about staking, margin trading, derivatives, even crypto loans. They offer a comprehensive suite of services that goes far beyond basic spot trading, allowing you to diversify your strategies and chase profits from multiple angles. This is where the sophisticated players find their leverage. For those interested in advanced trading, consider exploring how to master crypto order types for trading.

Regulation and Security: Playing by the Big Boys’ Rules

Most CEXs operate under strict regulatory oversight. They require you to jump through the hoops of Know Your Customer (KYC) verification, which means providing personal identification. This is a double-edged sword: it reduces privacy, but it also attracts institutional investors and brings a layer of legitimacy that some traders crave. For many, this regulatory compliance translates to enhanced trust and a perceived higher level of security. They pour resources into cybersecurity, employing top-tier encryption and security protocols to protect your funds. It’s a more traditional, regulated environment, which can be appealing to those coming from conventional finance. Keep up with regulatory changes in our policies category section.

The CEX Trap: Risks You Can’t Ignore

But don’t be fooled into thinking CEXs are bulletproof. The biggest downside? You relinquish control over your assets. Your crypto isn’t in your wallet; it’s held by the exchange. If they get hacked – and history is littered with examples of massive CEX hacks – your funds are at risk. If the exchange goes bankrupt, your assets could be tied up or even lost forever. Remember FTX? Yeah. That. Regulatory restrictions can also limit access to certain tokens or even entire regions. And let’s not forget, these are businesses. Their profit-driven motives can sometimes lead to conflicts of interest or even unethical practices. You’re trusting a central entity, and that trust carries inherent risk.

⚡ The Showdown: P2P vs. CEX – Where Do YOU Make Your Millions?

Alright, let’s lay it all out. This isn’t about choosing a favourite; it’s about making an informed, strategic decision that puts more money in your pocket.

The Hard Numbers: A Feature-by-Feature Breakdown

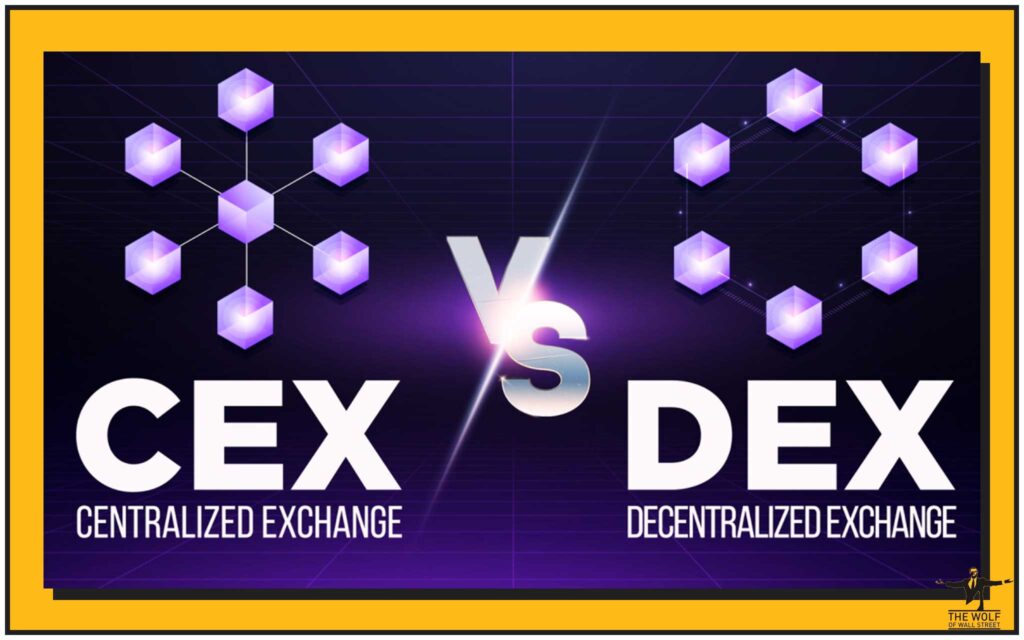

| Feature | P2P Exchanges | Centralized Exchanges (CEXs) |

|---|---|---|

| Authority | Decentralized | Centralized |

| Intermediary | None | Exchange acts as intermediary |

| Asset Control | Users retain control | Exchange holds assets |

| Privacy | Higher (anonymity) | Lower (KYC required) |

| Liquidity | Generally lower | High |

| Speed | Can be slower | Fast, near-instant |

| Payment Methods | Flexible, user-defined | Standardized |

| Security Risks | Counterparty risk, scam potential | Exchange hacking risk, regulatory risk |

| Regulatory Oversight | Minimal | High |

| Dispute Resolution | Community/arbitration | Exchange-mediated |

Who Wins? Matching Your Strategy to the Platform

So, who wins? It’s not a simple answer.

- If you’re a privacy fanatic, a decentralisation maximalist, or you need extreme payment flexibility, P2P is your playground. It empowers you with direct control, but you better be savvy and vigilant.

- If you crave high liquidity, lightning-fast trades, a massive selection of assets, and a wide array of financial services, CEXs are where you belong. Just remember the golden rule: not your keys, not your crypto. You’re trading a degree of control for convenience and advanced features.

The smartest traders, the ones who truly rake in the cash, use both. They understand the nuances, they exploit the advantages of each, and they mitigate the risks. It’s not about tribalism; it’s about maximizing your leverage.

The The Wolf Of Wall Street Playbook: Maximizing Your Gains on Any Exchange

No matter which exchange you favour, the game remains the same: profit. And that’s where the The Wolf Of Wall Street crypto trading community comes into its own. This isn’t about hoping for the best; it’s about having the tools and the network to win. They provide exclusive VIP signals that can guide your trades, whether you’re navigating the complexities of a P2P deal or executing high-volume trades on a CEX. Their expert market analysis gives you the insights you need to make informed decisions, cutting through the noise and focusing on what truly matters. This knowledge is your power, letting you apply the best strategies for both direct peer-to-peer interactions and the centralised order books. For those always seeking the next big thing, check out our trending crypto news and hot crypto topics categories.

💡Mastering the Market: Essential Tools and Support

You don’t go to war without your weapons, and you don’t trade crypto without the right arsenal.

Arm Yourself: Tools for Informed Decisions

Forget intuition; we deal in data. You need tools that give you an edge. Volume calculators are crucial. They tell you exactly how much you can trade without impacting the market, ensuring you’re not caught out by slippage. These aren’t luxuries; they’re necessities for anyone serious about making money. Understanding market depth, order books, and real-time data is paramount. The more information you have, the better your decisions. For specific trading strategies, consider our guides on Bollinger Bands trading strategy and RSI crypto trading strategies. You might also benefit from understanding market makers and takers in crypto.

Expert Analysis: Don’t Trade Blind

This market is too complex, too volatile, to rely on gut feelings or social media hype. You need in-depth analysis from seasoned crypto traders. These are the pros who spend their lives in the trenches, dissecting market trends, identifying opportunities, and spotting danger zones before the masses even know what hit them. Their insights are invaluable. Don’t be a sheep; get the expert perspective that can transform your trading from a gamble into a calculated conquest. To further refine your approach, explore how to research crypto opportunities.

The Inner Circle: Community is Your Currency

You think you can conquer this market alone? You’re wrong. You need a network, a private community of over 100,000 like-minded individuals. These aren’t just strangers; they’re fellow warriors, sharing insights, strategies, and support. When you’re part of a community, you get real-time updates, warnings, and opportunities that you’d never find on your own. It’s a collective brain, a shared intelligence that gives you an unbeatable advantage. The smart money always sticks together.

24/7 Backup: Because Opportunity Doesn’t Sleep

The crypto market never sleeps. Opportunities can arise at 3 AM or 3 PM, and when they do, you need support. 24/7 assistance from a dedicated support team isn’t a perk; it’s a lifeline. Technical issues, trading queries, market insights – you need answers, and you need them fast. Don’t let a minor hiccup cost you a major profit. This continuous assistance ensures you’re always ready to strike.

🎯 The Future of Crypto Trading: Adapt or Die

The crypto world is a constant evolution. What’s cutting edge today is obsolete tomorrow.

Innovation Unleashed: What’s Next for Exchanges

Both P2P and centralised exchanges are in a relentless race to innovate. P2P platforms are exploring more robust dispute resolution mechanisms and better escrow services, while CEXs are diving deeper into decentralised finance (DeFi) integration, offering hybrid models that try to capture the best of both worlds. We’re seeing advancements in cross-chain compatibility, enhanced AI-driven trading tools, and seamless fiat-to-crypto gateways. The smart money stays ahead by understanding these developments. For more on the future of automation in trading, check out trading bots vs AI agents in 2025.

Regulation’s Grip: Shaping Tomorrow’s Opportunities

Regulation is coming, whether you like it or not. Governments globally are trying to get their hands around crypto, and this will profoundly impact how exchanges operate. While some see it as a threat, savvy traders see it as an opportunity. Clear regulations can bring more institutional money into the market, driving up liquidity and potentially prices. It will also force exchanges to mature, improving security and consumer protection. Understanding these policies will be critical for navigating the future and identifying the next wave of profitable ventures. Stay informed on regulatory shifts affecting Bitcoin and Ethereum ETFs. You can also keep up with broader crypto news.

Your Edge in a Volatile Market: How The Wolf Of Wall Street Keeps You Ahead

In a market this volatile, this dynamic, you need more than just a sharp mind; you need a system. The Wolf Of Wall Street isn’t just a community; it’s a platform designed to empower your crypto trading journey. They’re giving you the essential trading tools like volume calculators, ensuring every decision is informed. They’re providing the 24/7 support, so you’re never left in the dark. And with their exclusive VIP signals and expert market analysis, you’re not just reacting to the market; you’re anticipating it. They’re giving you the blueprint to unlock your potential to profit in the crypto market.

You want to know more? You want to stop leaving money on the table? You want to actually profit?

🧠 Unlock Your Potential: Join the Winning Team

This isn’t some sales pitch; this is the truth. The market is ripe for the taking, but only if you’re armed with the right knowledge, the right tools, and the right network.

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information. See for yourself what a real advantage looks like.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions. This is where the action is, where insights are shared, and where opportunities are seized.

Stop playing small. Stop hoping. Start dominating. Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

📊 Frequently Asked Questions (FAQs)

What’s the biggest risk in P2P trading?

The biggest risk in P2P trading is counterparty risk. You are directly dealing with another individual, and while escrow services mitigate some of this, there’s always a risk of fraud or a counterparty failing to uphold their end of the agreement. Thorough verification and platform-provided dispute resolution mechanisms are crucial for reducing this risk. For more on managing risks, consider learning about when to sell crypto strategies.

Are centralized exchanges truly secure?

Centralized exchanges invest heavily in security, but no system is entirely risk-free. They are susceptible to cyberattacks and internal mismanagement. The primary security concern for users is that they do not hold their own private keys, meaning their assets are in the custody of the exchange. If the exchange is compromised or fails, user funds can be lost. Always enable two-factor authentication (2FA) and use strong, unique passwords.

How can I get expert market analysis?

You can get expert market analysis by joining reputable crypto trading communities, subscribing to professional analysis platforms, or following seasoned traders and analysts on platforms like the The Wolf Of Wall Street crypto trading community. They offer in-depth insights, trend predictions, and strategic advice from experienced traders.

Why is community important in crypto trading?

A strong community in crypto trading provides invaluable benefits such as shared insights, real-time updates, emotional support, and collective intelligence. In a volatile market, having a network of over 100,000 like-minded individuals, as offered by The Wolf Of Wall Street, can help you identify opportunities, avoid pitfalls, and stay informed about market movements.

What are “exclusive VIP signals”?

Exclusive VIP signals are proprietary trading alerts or recommendations provided by expert traders within a community like The Wolf Of Wall Street. These signals are based on advanced market analysis, technical indicators, and in-depth research, designed to help members identify potentially profitable trading opportunities and maximise their gains.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”