💰 The Crypto Game: Are You Playing to Win?

Let’s face it. You’re here because you want to make serious money in crypto. You’ve heard the stories, seen the headlines, and felt that itch – the hunger to seize control of your financial destiny. But here’s the dirty little secret many won’t tell you: the crypto market is a jungle, and if you don’t know how to read the terrain, you’re going to get eaten alive. You need an edge, a strategic advantage that separates the winners from the wannabes. That edge? It’s understanding volume. Not just surface-level fluff, but the real volume that tells you where the smart money is moving.

Don’t Get Fooled: Why Volume is Your Secret Weapon

Forget the noise, the endless tweets, the celebrity endorsements. Those are distractions. The true heartbeat of any market, especially one as volatile and revolutionary as crypto, is volume. Volume reveals demand, supply, and conviction. It tells you whether a price move is legitimate or just a fleeting pump-and-dump. It’s the lifeblood of liquidity, and without understanding it, you’re flying blind, leaving your hard-earned capital to chance. You wouldn’t invest in a company without looking at their financials, would you? So why would you trade crypto without understanding its core metrics? Volume is your financial statement for the blockchain.

The Cold, Hard Truth About Market Data

The crypto market is awash with data, but most of it is either misleading, manipulated, or simply misunderstood. There’s ‘trading volume’ reported by exchanges, and then there’s ‘onchain volume’ – the verifiable, immutable truth written on the blockchain itself. You need to know the difference, because one can make you rich, and the other can send you straight to the poor house. We’re going to expose the myths and lay bare the facts, giving you the clarity to make moves that matter. This isn’t about guesswork; it’s about precision.

⛓️ Onchain Volume: The Unfiltered Reality of Crypto

Imagine a ledger, transparent and incorruptible, where every single transaction, every single movement of value, is recorded for all eternity. That’s the blockchain. And onchain volume? That’s the sum total of all those genuine, verifiable movements. This isn’t speculation; it’s the raw, unadulterated truth of a network’s activity.

What Exactly Is Onchain Volume? No Bullshit, Just Facts.

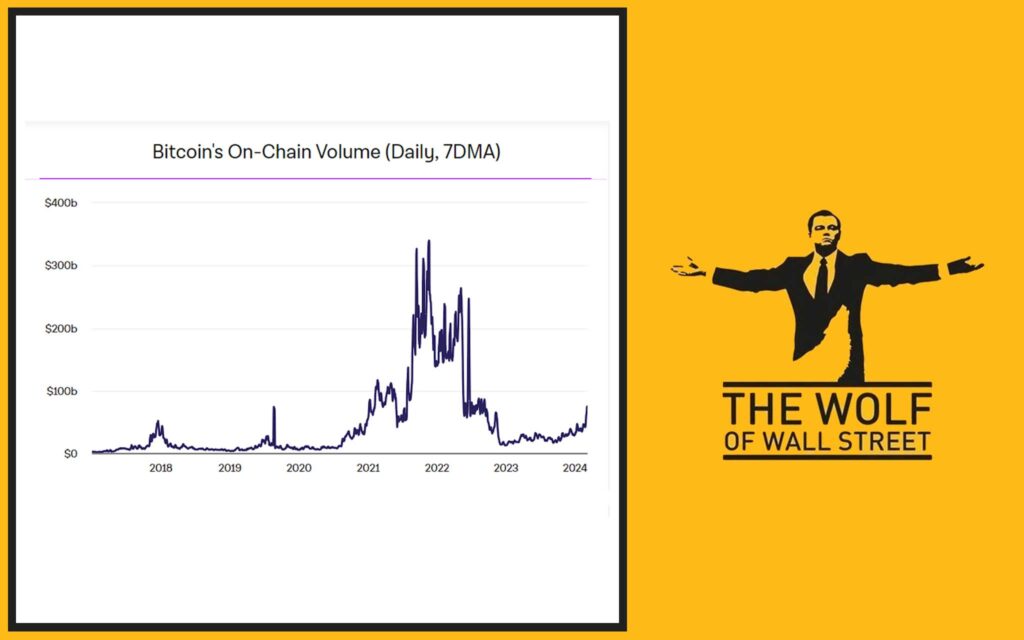

Onchain volume measures the total amount of cryptocurrency moved between wallets directly on a blockchain over a specific period. This isn’t about buying and selling on some centralized platform; it’s about the fundamental utility of the blockchain itself. Think of it: every time someone sends Bitcoin from one wallet to another, every time a DeFi protocol executes a swap, every payment, every smart contract interaction – that’s onchain volume. It’s the actual, tangible usage of the network. It’s the “pulse” of the blockchain, pulsating with real economic activity. Because these transactions are recorded on public, distributed ledgers, the data is completely transparent and verifiable. No fudging the numbers, no hidden agendas. It’s what it is.

Why Onchain Data Doesn’t Lie

The beauty of onchain data lies in its inherent transparency. Every transaction is timestamped, publicly recorded, and cryptographically secured. You can trace it. You can verify it. It’s a mathematical certainty. This means that when you look at onchain volume, you’re seeing genuine economic activity, not some fabricated numbers designed to lure in unsuspecting traders. Centralized exchanges can, and often do, manipulate their reported trading volumes to appear more liquid or active than they truly are. But onchain? That’s a different beast entirely. It’s the closest thing you’ll get to the absolute, unvarnished truth in this market.

Real-World Power: How Onchain Volume Reveals the Market’s Pulse

Onchain volume isn’t just a technical curiosity; it’s a powerful indicator for serious players. It gives you direct insight into:

- Network Health and Usage: A high onchain volume indicates a healthy, active network with genuine utility. People are actually using the cryptocurrency, not just trading it speculatively.

- True Liquidity Movement: You can see where large amounts of crypto are moving – are whales accumulating? Are institutions shifting assets? This gives you a critical heads-up on potential market shifts.

- Adoption Trends: Sustained increases in onchain volume can signal growing adoption and real-world integration of a cryptocurrency, which is a fundamental driver for long-term value.

- Congestion and Fees: High onchain volume can lead to network congestion and increased transaction fees, which can impact profitability and strategy for certain assets.

This data is crucial for understanding the underlying health and genuine demand for a digital asset. It’s about separating the wheat from the chaff, the real projects from the pretenders.

Beyond the Hype: Spotting True Adoption

Anyone can spin a narrative, but onchain volume cuts through the noise. When you see a project consistently generating significant onchain activity – a steady flow of transactions, smart contract interactions, and wallet-to-wallet transfers – that’s a powerful signal of real adoption. It means people are using the technology for its intended purpose, whether it’s for payments, decentralised finance (DeFi), or gaming. This is the kind of organic growth that fuels sustainable value, not just speculative bubbles. Don’t listen to what they say; watch what they do onchain.

Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”! Ready to elevate your game? You need the best strategies. Learn more about how to buy crypto with absolute precision, or dive into the future with trading bots vs. AI agents for 2025 to sharpen your edge and automate your profits.

📈 Trading Volume: The Exchange Game, With All Its Tricks

Now, let’s talk about the other side of the coin: trading volume. This is what most newcomers fixate on, because it’s splashed across every exchange and crypto data site. But don’t let its prominence fool you. While it’s important, it’s also the metric most susceptible to manipulation and deception.

What Trading Volume Really Shows You

Trading volume represents the total amount of cryptocurrency traded on exchanges – both centralized (CEXs) and decentralized (DEXs) – during a given time frame. It’s what you see when you look at a candlestick chart: the vertical bars indicating how many units of a specific crypto were bought and sold within that period. This metric is primarily a technical indicator used to gauge market activity, liquidity, and the strength of price trends. High trading volume often accompanies significant price movements, suggesting strong conviction behind the trend.

The Illusion of Activity: How Exchanges Play Games

Here’s where it gets dangerous for the uninitiated. While trading volume should reflect genuine buying and selling interest, it can be, and often is, manipulated. Many centralized exchanges are notorious for inflating their reported volumes through practices like “wash trading” – where an entity simultaneously buys and sells the same asset to create artificial activity. Why do they do it? To appear more active, attract more users, and climb higher in rankings.

Forbes, for example, exposed that much of Bitcoin’s reported trading volume is likely fake, with a significant portion of the total volume coming from platforms with questionable reporting standards. If you’re basing your trading decisions solely on these inflated numbers, you’re essentially betting your money on a phantom. You’re trading against an illusion. And in this game, illusions cost you everything.

Centralised vs. Decentralised: Where Does the Real Action Happen?

When we talk about trading volume, it’s crucial to distinguish between Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs).

- Centralized Exchanges (CEXs): These are platforms like Binance, Coinbase, Kraken. They act as intermediaries, holding your crypto and managing orders off-chain. This is where the majority of reported trading volume traditionally resides, but also where manipulation is most prevalent. Their off-chain order books mean that while the deposit and withdrawal of funds are onchain, the actual trades between users happen within their internal systems, making them less transparent.

- Decentralized Exchanges (DEXs): These are platforms like Uniswap, PancakeSwap. They operate directly on the blockchain, using smart contracts to facilitate peer-to-peer trading. Because every trade on a DEX is an onchain transaction, their reported trading volumes are inherently more transparent and less susceptible to the kind of manipulation seen on CEXs. If you want to dive deeper into the differences and how to profit, check out our guide on P2P vs. Centralized Crypto Exchanges: A Profit Guide.

Understanding this distinction is vital. A high trading volume on a DEX, backed by onchain data, often signals more genuine market interest than an equally high volume reported by a CEX.

Don’t Fall for the Smoke and Mirrors: Recognizing Manipulation

How do you spot the fakes? It’s not always easy, but here are some red flags:

- Discrepancies: Massive differences in reported volume for the same asset across different exchanges.

- Illiquid Books: High reported volume with thin order books, meaning there aren’t many real bids and asks close to the market price.

- Unusual Trading Patterns: Spikes in volume with no corresponding price movement, or consistent, smooth volume graphs that look too perfect.

These are the signs that someone’s playing games. And when someone’s playing games, you’re the one who pays the price.

⚖️ The Showdown: Onchain vs. Trading – The Metrics That Matter

This isn’t a popularity contest; it’s about effectiveness. While both metrics are crucial, they serve different purposes and possess different levels of reliability. Understanding their distinctions is your first step toward true market mastery.

| Feature | Onchain Volume | Trading Volume |

|---|---|---|

| What it measures | All blockchain-recorded transactions | Trades on exchanges (CEXs & DEXs) |

| Transparency | Highly transparent and verifiable | Can be manipulated by exchanges |

| Scope | Wallet-to-wallet, payments, smart contracts | Only trading-related transactions |

| Use case | Network health, adoption, liquidity | Market activity, liquidity, trends |

Transparency: The Unshakeable Truth of Onchain

Onchain volume is your direct window into the blockchain’s soul. It’s an open book. Every transaction is a record. This unparalleled transparency makes it a far more reliable indicator of genuine activity. You can verify it yourself, eliminating the guesswork and the fear of hidden agendas. There are no secrets, no backdoor deals being made to pump numbers. It’s pure, unadulterated data.

Accuracy: Why One Stands Above the Other

When it comes to accuracy, onchain volume wins hands down. Why? Because it’s a direct reflection of confirmed, irreversible transactions on a decentralized ledger. There’s no third party to distort or inflate the numbers. Trading volume, especially from centralized exchanges, is often a house of cards. Its accuracy is contingent on the integrity of the exchange, and let’s be honest, integrity isn’t always the strongest suit in this wild west. While DEX trading volume offers better accuracy than CEX, onchain volume still provides the most fundamental layer of truth.

Scope: What Each Metric Truly Captures

- Onchain Volume: Captures the full spectrum of blockchain activity. This includes not just speculative trades but also payments, transfers, DeFi interactions, NFT mints, and governance actions. It tells you about the utility of the cryptocurrency.

- Trading Volume: Focuses primarily on the speculative aspect – buying and selling on exchanges. While it gives you a snapshot of market sentiment and liquidity for trading, it doesn’t necessarily reflect the underlying health or adoption of the network.

The Ultimate Goal: Informed Decisions, Maximum Profit

You’re not here to dabble; you’re here to dominate. And to dominate, you need informed decisions. Relying solely on one metric is like trying to drive a car with one eye closed. You might get somewhere, but it’s risky, and you’ll miss crucial opportunities. The goal is to combine these insights to form a holistic, unbeatable strategy that puts you ahead of the curve.

🚀 Why Both Metrics Are Non-Negotiable for Serious Traders

Look, if you want to make serious money, you need to be serious about your analysis. You can’t just pick one metric and call it a day. The market is complex, and to truly understand its dynamics, you need both perspectives. They complement each other, painting a complete picture that allows you to anticipate trends, confirm conviction, and execute trades with precision.

Onchain Volume: Your Compass for Network Health and Adoption

Think of onchain volume as your compass. It points you towards the true north of a cryptocurrency’s health and utility.

- Market Sentiment: Spikes in onchain volume can signal increased interest, potentially preceding price rallies as more people actually start using the asset. Conversely, declining onchain volume might indicate waning interest or fundamental issues.

- Network Congestion: High onchain volume can lead to network congestion and higher transaction fees. If you’re a trader, this impacts your speed and cost of execution.

- Validation of Other Metrics: Onchain data can validate or invalidate what trading volume is telling you. If trading volume is soaring but onchain activity is flat, it’s a red flag. If both are rising, you’ve got a powerful signal.

Trading Volume: Your Barometer for Liquidity and Market Sentiment

Trading volume, despite its potential for manipulation, is still your barometer for immediate market sentiment and liquidity.

- Confirming Trends: A strong price trend, whether up or down, is more reliable when accompanied by high trading volume. Low volume trends are often weak and prone to reversal.

- Liquidity: High trading volume means there are plenty of buyers and sellers, making it easier to enter or exit positions without significantly impacting the price. Low volume markets can lead to slippage and difficulty executing large orders.

- Volatility: Surges in trading volume often precede or accompany periods of high volatility, presenting opportunities for rapid gains (or losses).

- Developing Strategies: Technical indicators like the Money Flow Index (MFI) or the Accumulation/Distribution Line, rely heavily on trading volume to provide signals.

The Synergy Effect: Combining Data for Unstoppable Strategies

This is where the magic happens. Combining onchain and trading volume data provides a powerful, synergistic view of the market.

- Confirming Breakouts: If a cryptocurrency breaks out of a resistance level with high trading volume and an accompanying surge in onchain transactions, that’s a much stronger signal of a sustained rally.

- Spotting Fake Pumps: If a coin’s price surges on a CEX with massive reported trading volume, but its onchain volume remains flat, it could be a warning sign of a manipulative pump-and-dump scheme. Don’t get caught holding the bag!

- Identifying Accumulation/Distribution: Large, consistent onchain transfers to exchange wallets might indicate selling pressure, while transfers from exchanges to private wallets could signal accumulation by long-term holders. Overlay this with trading volume, and you have a clearer picture of smart money movements.

- Validating Exchange Health: By comparing an exchange’s reported trading volume with its onchain deposit/withdrawal activity, you can get a better sense of its genuine user base and liquidity, rather than just trusting their self-reported figures.

You need to master more than just volume to truly command the crypto market. Sharpen your trading game with insights on mastering crypto order types or get savvy with understanding market makers and takers in crypto for optimal execution. And remember, for even more cutting-edge market analysis and expert insights, check out our trading insights to stay ahead of every single move.

💪 Cutting Through the Noise: Reliability & Real-World Use Cases

The market is full of noise, whispers, and outright lies. To succeed, you need to filter out the garbage and focus on what’s real. This is about precision and trust, and knowing which data source you can bet your fortune on.

The Gold Standard: Why Onchain Volume is Your Trustworthy Ally

When it comes to reliability, onchain volume is the gold standard. Every transaction on a public blockchain is verifiable. You can independently confirm the data. This transparency means it’s incredibly difficult to fake or manipulate onchain volume at scale. While it doesn’t capture off-chain trades that happen internally on centralized exchanges, it gives you an undeniable view of the fundamental activity and usage of a network. If you’re serious about fundamental analysis and long-term investment, onchain volume is your bedrock. It reveals adoption, network health, and genuine interest, not just speculative fervor.

The Wild West: Navigating the Perils of Unverified Trading Data

The trading volume reported by many centralized exchanges is, quite frankly, a mess. As mentioned, wash trading and inflated numbers are rampant. This makes it incredibly risky to rely solely on these figures for your trading decisions. Imagine basing your entire strategy on data that’s 70% fabricated! You’d be setting yourself up for failure. This isn’t to say trading volume is useless; it’s a powerful indicator of market sentiment and immediate liquidity. But it must be approached with extreme caution and, ideally, validated by onchain data. Don’t just look at the numbers; question their source and their veracity.

Strategic Plays: How to Use Both Metrics to Your Advantage

Now, how do you actually use this information to make real money?

- Confirming Trends: See a big price pump on a CEX? Don’t just ape in! Check the onchain volume. If Bitcoin’s price is soaring but onchain transfers are stagnant, it could be a short-term speculative rally. If both are surging, that’s a more robust, sustainable trend. This applies to individual tokens too – if you’re looking at an Altcoin, check its onchain activity.

- Spotting Accumulation/Distribution: Are large amounts of a token moving from exchange wallets to private, cold storage wallets (onchain)? That often signals smart money accumulating for the long haul. Conversely, large movements to exchanges could signal an impending sell-off. Cross-reference this with trading volume spikes to time your entries and exits.

- Liquidity Assessment: Trading volume gives you a real-time sense of an asset’s liquidity on exchanges. If you’re planning a large trade, high trading volume means you can execute without significant price impact. But combine this with onchain analysis – if a token has decent exchange volume but very little onchain activity, its real-world utility might be questionable.

- Identifying True Project Health: For long-term investors, onchain volume is paramount. It tells you if a blockchain is being used, if its dApps are gaining traction, and if its ecosystem is truly thriving. High trading volume alone can be misleading if the underlying network is a ghost town.

This isn’t about guesswork; it’s about making calculated, informed decisions based on the most reliable data available.

🏆 The “The Wolf Of Wall Street” Edge: How to Leverage Exclusive Insights for Massive Gains

Listen, in this market, knowledge is power, but exclusive knowledge is unstoppable power. You can spend years trying to piece together this puzzle yourself, or you can join a community that gives you the edge you need to truly profit. This isn’t just about understanding metrics; it’s about getting the real-time, actionable insights that turn information into cold, hard cash.

The “The Wolf Of Wall Street” crypto trading community offers a comprehensive platform designed to cut through the noise and navigate the volatile cryptocurrency market. This is where serious players come to get ahead, to gain that undeniable advantage.

Exclusive VIP Signals: Your Shortcut to Maximized Profits

Forget chasing rumors. “The Wolf Of Wall Street” provides Exclusive VIP Signals designed to maximize your trading profits. These aren’t random guesses; these are proprietary signals, meticulously crafted from deep market analysis, combining both onchain and trading volume insights, along with a multitude of other factors. It’s like having a financial oracle whispering the right moves into your ear, giving you the jump on everyone else. You get the insights before the market moves, not after.

Expert Market Analysis: Cutting-Edge Intelligence from Seasoned Pros

You want to learn from the best? You need to hear from those who live and breathe this market. With “The Wolf Of Wall Street”, you benefit from Expert Market Analysis from seasoned crypto traders. These are individuals who understand the nuances of onchain data, the tricks of trading volume, and how to combine them for maximum impact. They don’t just give you signals; they give you the why, empowering you to understand the market on a deeper level and refine your own strategies.

Private Community: Over 100,000 Minds, One Goal – Success

You’re not alone in this game. Imagine a network of over 100,000 like-minded individuals, all focused on one thing: profit. This isn’t just a group; it’s a powerful, collaborative ecosystem where you can share insights, get support, and learn from the collective wisdom of thousands of dedicated traders. This Private Community is an unparalleled resource, a place where you can ask questions, discuss strategies, and stay ahead of emerging trends. Two heads are better than one, and 100,000 heads focused on success? That’s an exponential advantage.

Essential Trading Tools: Your Arsenal for Informed Decisions

You can’t go to war without the right weapons. “The Wolf Of Wall Street” equips you with Essential Trading Tools, like volume calculators and other critical resources, all designed to help you make informed decisions. These tools help you process the data, calculate risk, and execute your strategies with precision. We give you the instruments to translate knowledge into actionable trades.

24/7 Support: We’ve Got Your Back, Always

The crypto market never sleeps, and neither do we when it comes to supporting our community. You get 24/7 Support from a dedicated team ready to assist you. Have a question about a market move? Need clarification on a signal? Facing a technical challenge? Our team is there, around the clock, ensuring you’re never left in the dark. Your success is our mission.

Empower your crypto trading journey and unlock your potential to profit in this market with “The Wolf Of Wall Street”. Visit our website at https://tthewolfofwallstreet.com/ for detailed information, or join our active Telegram community at https://t.me/tthewolfofwallstreet for real-time updates and direct discussions. This is your chance to step up, to stop guessing, and start dominating.

🧠 Smart Money Moves: FAQs for the Aspiring Crypto Mogul

You’ve got questions, and I’ve got answers. No fluff, just what you need to know.

How do I tell if a trading volume is fake?

Look for inconsistencies. If a token shows massive trading volume on one or two lesser-known exchanges but very little on major, reputable ones, it’s a red flag. Also, check for high volume with minimal price movement or very thin order books. If the bids and asks are far apart, despite high reported volume, it’s likely wash trading. Always cross-reference with onchain activity – if trading volume is through the roof but onchain transfers are flat, it’s probably fake.

Can Onchain Volume predict market crashes?

While onchain volume doesn’t directly predict crashes with 100% accuracy, it can provide strong warning signs. A significant and sustained decrease in onchain transactions, especially transfers to exchanges, can indicate that large holders (whales) are moving assets to sell. Conversely, if onchain activity is booming but the price is stagnant or falling, it might indicate distribution. It’s a powerful indicator of underlying network health and potential shifts in sentiment.

What tools do I need to track both metrics effectively?

You’ll need a combination of tools. For onchain data, look at platforms like Glassnode, CryptoQuant, Nansen, or Dune Analytics. These provide detailed onchain metrics, including transaction counts, active addresses, and exchange flows. For trading volume, major data aggregators like CoinMarketCap or CoinGecko provide reported volumes, but always take those with a grain of salt and cross-reference. Many charting platforms will also display trading volume alongside price data. And of course, being part of a community like “The Wolf Of Wall Street” gives you access to curated insights and essential tools.

Why should I trust onchain data over exchange data?

Simple: transparency and verifiability. Onchain data is recorded directly on a public blockchain, meaning every transaction is visible and auditable by anyone. There’s no intermediary to manipulate the numbers. Exchange data, particularly from centralized exchanges, is self-reported and can be easily inflated through wash trading or other dubious practices to appear more active or liquid. While exchange trading volume is crucial for understanding market sentiment and immediate liquidity, onchain data provides the fundamental truth about a cryptocurrency’s actual usage and network health.

🏁 The Bottom Line: Your Path to Financial Freedom in Crypto

So, there you have it. The real deal on onchain volume versus trading volume. This isn’t just theory; this is the actionable intelligence you need to stop losing money and start making it. You can’t afford to be ignorant in this market. The days of blind speculation are over. The future of crypto trading belongs to those who understand the data, those who can see through the illusions, and those who dare to play the game on a higher level.

Don’t Just Trade, Dominate.

This isn’t about being good; it’s about being the best. It’s about taking control, making calculated risks, and stacking gains while others are still scratching their heads. You now know that onchain volume provides the fundamental, verifiable truth about network utility and adoption. You also understand that trading volume, while essential for gauging market sentiment and liquidity, must be scrutinized for manipulation. The power lies in combining these two forces, creating a comprehensive analytical framework that empowers you to make strategic decisions.

The Future Belongs to Those Who Understand the Data.

The crypto market is evolving at lightning speed. Opportunities appear and disappear in the blink of an eye. If you want to not just survive but thrive, you need to arm yourself with the right knowledge, the right tools, and the right community. This guide is your first step. Now it’s up to you to apply it. The market is waiting. Are you ready to seize your fortune?

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”