👨💻 When Trust Gets Hacked, Opportunity Strikes

Listen up. May 22, 2025 wasn’t just another date in the DeFi calendar – it was a seismic jolt that rattled the entire Sui ecosystem. $220 million. Gone. Just like that. And while most investors were scrambling for answers, the smart money was already moving.

Cetus, the top DEX on the Sui blockchain, got hit with a brutal exploit. But here’s the kicker – what looked like a deathblow turned into a masterclass in comeback strategy. If you’re in the crypto game to win, buckle up. We’re diving deep into how it happened, why it matters, and how YOU can leverage the chaos.

💥 The $220 Million Mistake That Woke Up DeFi

This wasn’t a rug pull. It was surgical. A flaw buried in Cetus’ math library let an attacker manipulate liquidity calculations. The attacker used spoof tokens like BULLA and MOJO to distort price curves and reserve ratios, draining real assets like SUI and USDC from 46 liquidity pairs. It was a calculated, methodical blitz executed with flash loans and capped off by crosschain laundering.

Boom. $223 million evaporated. You either watched in horror or took notes.

🚨 Exploiting the Exploit: What Actually Happened?

Let’s decode the play-by-play:

- Attack Vector: Overflow bug in the liquidity math function

- Tools Used: Spoof tokens, flash loans, fake liquidity ratios

- Outcome: Smart contracts fooled, pools drained

The attacker launched the blitz with a flash loan, hit the system with large values to cause arithmetic overflow, and spun spoof tokens into the mix to inflate valuations. Then they siphoned the good stuff and vanished.

🔗 Related: Explore more DeFi risks

✋ Cetus Hits Pause: Instant Response That Saved Billions

Most protocols freeze when attacked. Cetus froze the money instead.

- $162 million was frozen in hours.

- Core smart contracts were shut down within minutes.

- A white-hat bounty of $6M was offered. Crickets from the attacker.

Rapid coordination with Sui Foundation and network validators made this possible. Centralised moves? Maybe. Effective? Absolutely.

🔗 See more: Hot takes on market reactions

⛓️💥 Sui Ecosystem: Ripple Effects Across the Chain

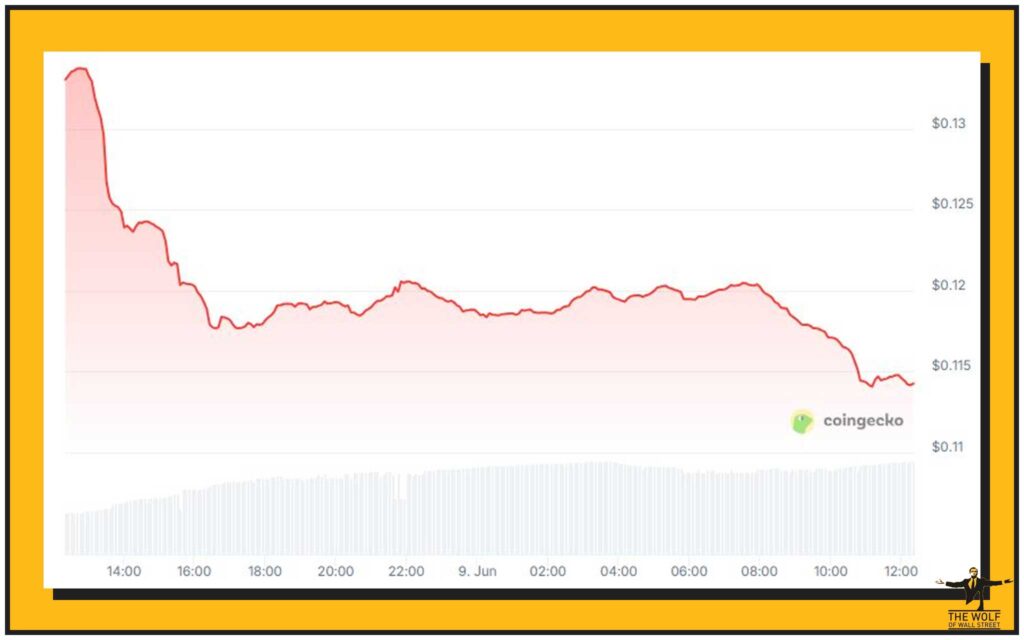

The attack torched CETUS’ value by 40% in a day. Chaos spread. Other tokens followed suit. Volume spiked to $2.9B on May 22 alone.

Confidence shaken. Traders on edge. But those who understood volatility made moves.

⛑️ Recovery Mode: Cash, Crypto, and Compensation

Cetus didn’t whine. They reloaded:

- $7M in reserves

- $30M loan from Sui Foundation

- Recovered funds redeployed

User compensation?

- 15% of CETUS token supply

- 5% released instantly

- 10% drip-fed monthly for 12 months

🔗 Discover: What altcoins are bouncing back

🎯 Relaunch Strategy: Audit. Patch. Repeat.

Security audits. Patching protocols. Rewriting liquidity logic. Everything was on the table. Cetus came back on June 8 stronger, faster, smarter.

The new mantra: paranoid coding or perish.

🕹️ Open-Source Pivot: The Transparency Power Play

In an industry screaming for transparency, Cetus delivered. Open-sourcing their codebase isn’t just a goodwill gesture – it’s a strategic edge.

Now, anyone can audit. Anyone can hunt bugs. And with a white bounty program in place, ethical hackers finally get paid like criminals.

⚔️ Legal Battles and Blockchain Justice

Courtrooms now smell like crypto. Multi-jurisdictional lawsuits are underway. Law enforcement is hunting. Cetus isn’t just rebuilding its platform – it’s gunning for the perp.

Blockchain’s Wild West is getting sheriffs.

🌀 Bigger Than Cetus: The DeFi Audit Illusion

Multiple audits didn’t catch this bug. That’s the red pill for DeFi.

Lesson: Audits are snapshots, not safeguards. Security must be layered, ongoing, and community-driven.

🧠 Lessons for the DeFi Hustler

- Don’t trust. Verify. Then verify again.

- Audit reports are marketing tools unless combined with active monitoring.

- Protocols need bug bounties, not just whitepapers.

You’re either ahead of the curve or crushed by it.

💱 What The Wolf Of Wall Street Traders Know That Most Don’t

The Wolf Of Wall Street crypto trading community isn’t just riding waves. We’re making them.

- VIP Signals that catch moves before the market sniffs them

- Expert Analysis from crypto veterans

- Volume Calculators that give you edge over normies

- 24/7 Support so you’re never flying blind

🔗 Sharpen your edge: Level up your trading insights

💰 How You Profit While Everyone Else Panics

Cetus proved one thing: volatility equals opportunity for those ready to pounce. When others fear, you move.

That’s what The Wolf Of Wall Street trains you to do: read the market like a wolf in a blood-scented ocean.

🚀 Join the Elite: The Wolf Of Wall Street Community Edge

This isn’t a chat group. It’s an army.

- 100K+ traders on Telegram

- Insider tools at your fingertips

- Real-time signals, zero lag

Empower your trading journey:

- Visit: tthewolfofwallstreet.com

- Join: t.me/tthewolfofwallstreet

⚠️ Conclusion: DeFi’s Reality Check — Adapt or Be Exploited

The Cetus exploit isn’t just a story. It’s a signal. An alert. If you’re in this game, your playbook just changed. Fast.

In chaos lies cash. In code lies risk. In community lies edge.

So adapt. Or be exploited.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street