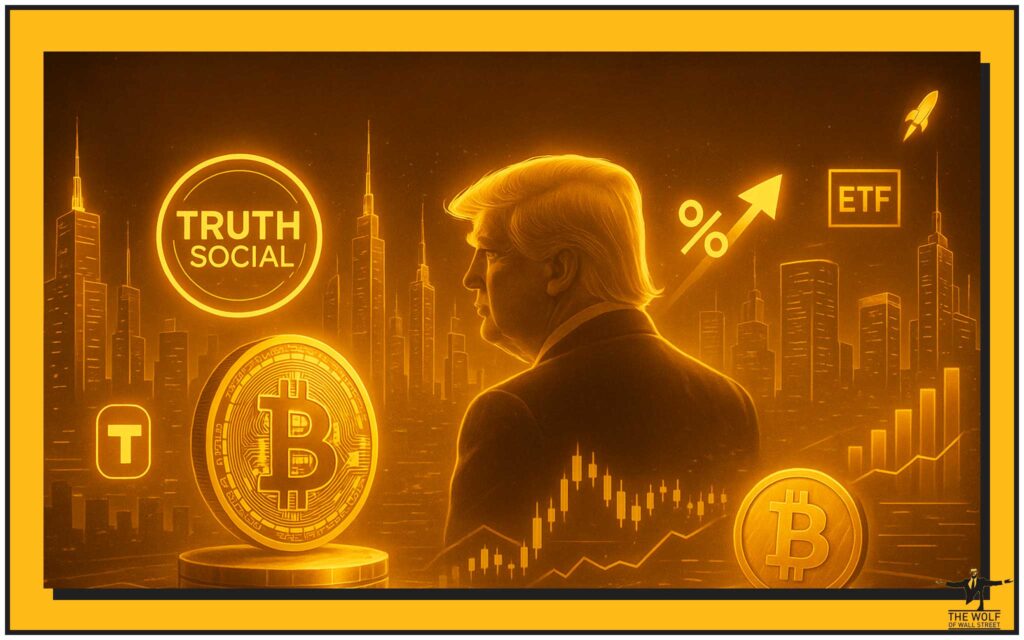

Buckle up. Trump Media just dropped a financial bombshell: a $400 million stock buyback and a $2.5 billion Bitcoin treasury — two bold moves that say, “We play to win.” I’m about to break it all down — no fluff, just straight-up value.

💣 Introduction: The Money Play No One Saw Coming

Picture this: Trump Media (the parent of Truth Social) comes out swinging with a $400 million stock buyback. But wait for it — behind the scenes, they’ve quietly raised $2.5 billion to build a Bitcoin treasury.

That’s not just a power play. It’s a declaration of war on the old-guard financial system. Today, I’m going to walk you through the seismic implications of bold stock resets, Bitcoin bankrolls, regulatory victories, ETF strategies, and what it all really means for you— the sharp trader, the next crypto victim turned winner.

💰 Trump Media’s Double-Barrelled Strategy: Buybacks & Bitcoin

First up: the $400M stock buyback. Why does that matter? Simple. Companies flex buybacks to pump up their share price, reward shareholders, and neutralise dilution. It’s smart fiscal housekeeping.

But here’s the kicker: Trump Media says this doesn’t touch that massive Bitcoin war chest. They pull the buyback lever, boost investor confidence, and still channel billions into Bitcoin. Two birds, one stone.

👉 Key takeaway: This is no scattergun tactic—it’s calculated precision. They’re locking in shareholder love while doubling down on crypto exposure.

🚀 Bitcoin Treasury: Billion-Dollar Bull Move

Let’s get real: $2.5 billion isn’t chump change. And $2.3 billion of that comes from share sales and convertible notes. They’re not raiding the coffers, tossing out the old ticker—they’re raising capital specifically for crypto dominance.

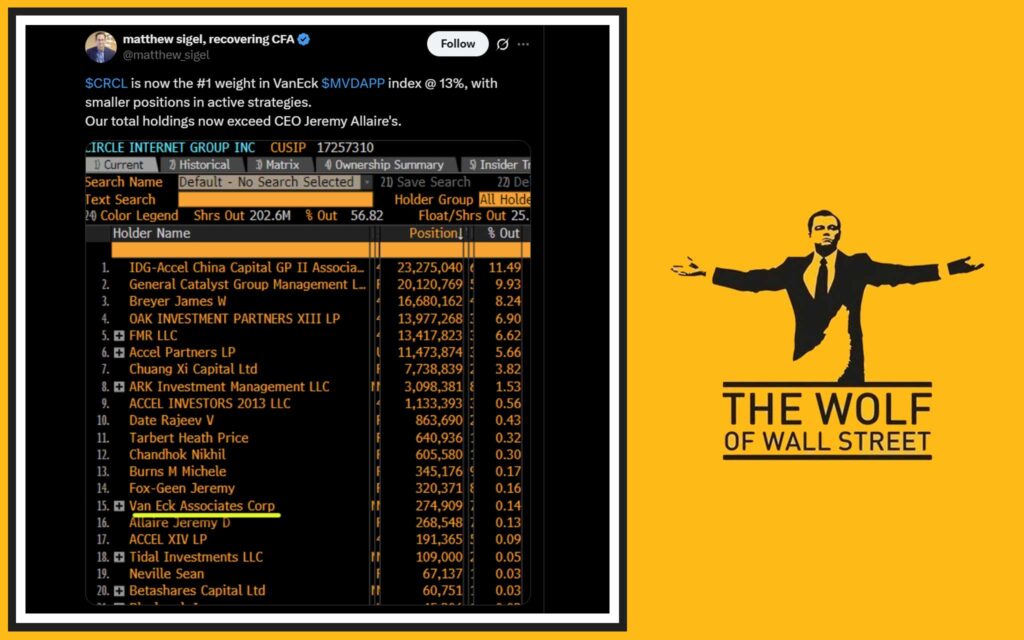

And here’s the confirmation: the U.S. SEC has approved the Bitcoin treasury structure. That’s not just regulatory window dressing — it’s a stamp of legitimacy and trust. When the SEC nods its head, insurance policies, institutional buyers, and big-money funds take note.

👉 Bottom line: This isn’t hilarious chance or hype—it’s legally backed and investor-approved.

🧠 Why the Spot Bitcoin ETF Is a Masterstroke

Now, hold onto your hats. Trump Media is filing for a spot Bitcoin ETF — one that holds real Bitcoin. That’s game-changing. Compare this to futures-based or synthetic ETFs: this is the real deal.

And they’re not stopping there. Truth Social is going for a dual ETF tied to Bitcoin and Ethereum. Two of the biggest digital assets under one roof? That’s target-rich territory for institutional capital.

Why it matters:

- Liquidity Surge: Retail and institutional investors get direct access—no crypto wallet, no hassle.

- Price Impact: Demand naturally inflates with easier access.

- Competitive Edge: If they win approval, others will scramble to keep up—or be left in the dust.

🧩 Internal Links:

- Dive deeper into trading insights

- Learn about Bitcoin strategies

🗺️ Trump’s National Crypto Vision: Strategic Bitcoin Reserve

Plot twist: Trump isn’t just thinking company-level; he’s got national plans. He’s proposed a Strategic Bitcoin Reserve and Digital Asset Stockpile—national piggy banks for seized digital assets.

Could this rip markets open? You bet. But it also ignites legal controversies: conflicts of interest, insider trading shadows, and potential misuse of power. The ignition clause? Senator Schiff’s upcoming bill, which clamps down on public officials endorsing digital assets. If passed, it’ll make these moves legally dicey.

👉 Final thought: Potential monopoly of crypto assets under one national brand—genius if executed clean. Regulatory nightmare if they don’t.

⚖️ Conflict or Control? The Political Flashpoint

Let’s be crystal clear: the mix of power, politics, and profit is a high-voltage cocktail.

- Risk 1: Schiff’s bill could throw a wrench into their entire plan.

- Risk 2: SEC scrutiny could escalate if insider trading accusations arise.

- Risk 3: Public perception—one bad headline, one tweet—could blow it up.

Every stone’s being overturned, every angle monitored. This isn’t a solo sprint—it’s a high-stakes chess match.

🔍 Why It Matters to You—Retail and Institutional Players

Here’s why you should care:

- ETF Accessibility: A spot Bitcoin ETF from a media powerhouse means easier on-ramps. No joke.

- Institutional Credibility: SEC approval + spot ETF filings = legitimacy for the entire crypto asset class.

- Market Psychology: Again, Trump’s influence moves markets. This is not just crypto — it’s geopolitical sentiment capital.

- Strategic Alignment: Big money tracks bold moves. If Trump Media succeeds, others follow—and that drives volume and price.

What to do? Position yourself now. Study the filings. Watch the regulations. And if you want leverage, tools and elite insight are your best ally.

🧠 Master Your Crypto Game with The Wolf Of Wall Street 🔥

You can ride this wave yourself—but why go it alone?

The Wolf Of Wall Street is the community for traders ready to dominate. Here’s what you get:

- Exclusive VIP Signals—no public bullsh*t. Just sharp, proprietary indicators designed to maximise profits.

- Expert Market Analysis from battle-hardened crypto veterans.

- Private Community of 100K+ traders sharing insights and strategies.

- Essential Trading Tools—volume calculators, charting resources, risk tools.

- 24/7 Support—real people, real answers, real fast.

You want real-time intel? They’ve got a buzzing Telegram channel. 🔗 Visit the service here or jump into the Telegram crew. It’s a fast track to trading dominance.

Internal links:

- Cruise through DeFi opportunities

- Catch hot market trends

- Get started with newbie crypto basics

📉 Risks You Must Acknowledge

Alright, this is real smoke and mirrors. We’re talking:

- Regulatory Risk: Laws can change overnight.

- Market Volatility: Crypto still swings harder than a pendulum.

- Political Backlash: One poorly worded tweet from a congressperson, and the narrative flips.

- Reputation Risk: Conflict-of-interest allegations can tank market sentiment.

Be smart. Set risk stops. Know your exit strategies. This is Wall Street-energy — control your assets or it controls you.

📊 The Future Forecast: Crypto Mainstream or Meltdown?

Here’s the future map:

- If Trump’s ETF launches: Expect institutions to swarm in. Liquidity floods in. Volatility rockets—and so does adoption.

- If legal roadblocks pop: We get turbulence—and potentially, a market-wide shakeout.

- Broader effect: Big media, big finance, big politics — they all lean in or break away.

This isn’t crypto fever. This is the tidal shift.

✅ Conclusion: Your Wake-Up Call

Listen up: Trump Media’s power move is seismic. It’s bold. It’s calculated. And it’s catching regulation and public opinion in the crosshairs.

The twin-track strategy of buybacks and Bitcoin treasuries—with ETF filings on top—signals one thing: crypto is going mainstream, and fast.

If you’re waiting on the sidelines, you’re handing opportunity to someone else.

Time to position. Time to strategise. And yes — time to take a big leap forward.

⚡ Frequently Asked Questions

Q1: What’s a spot Bitcoin ETF and why does it matter?

A spot ETF holds real Bitcoin—not derivatives. That means direct exposure, better liquidity—and makes it big‑league friendly for banks and advisors.

Q2: How does Trump’s Strategic Bitcoin Reserve impact global crypto?

It’s like adding a national-level buyer to the ecosystem. If funded legally, it’s institutional demand on steroids—but the political headwinds are intense.

Q3: Is it legal—or a grey-zone tactic?

Right now, with SEC approval and official filings, the structure looks clean. But once public office, asset endorsement, and potential insider benefit collide, things get muddy—and Congress may step in.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like‑minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real‑time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street.”