Brace yourself. This is the real deal, no sugar-coating, no fence-sitting. Ripple Labs has just pulled the ultimate power move—announcing they’re dropping their cross-appeal against the US Securities and Exchange Commission (SEC). The result? XRP surged. Traders rejoiced. And the crypto world felt the tremor. I’m breaking down the facts, slashing through the noise, and giving you the actionable insight you crave. Let’s dive in.

🎯 What Happened? Ripple Drops SEC Appeal

Brad Garlinghouse, Ripple’s magnetic CEO, dropped a Friday bombshell: Ripple is dropping its cross-appeal against the SEC. The anticipation? The SEC will follow suit. Immediately, XRP price popped—shooting up more than 3% in hours to hit $2.18. Market cap? $126.2 billion. The message to traders was clear: big money moves when uncertainty fades.

This is not just a press release. This is Ripple saying, “We’re done with distractions, let’s build.” The legal fog is clearing. Now, let’s see why this matters for your wallet and for the entire crypto market.

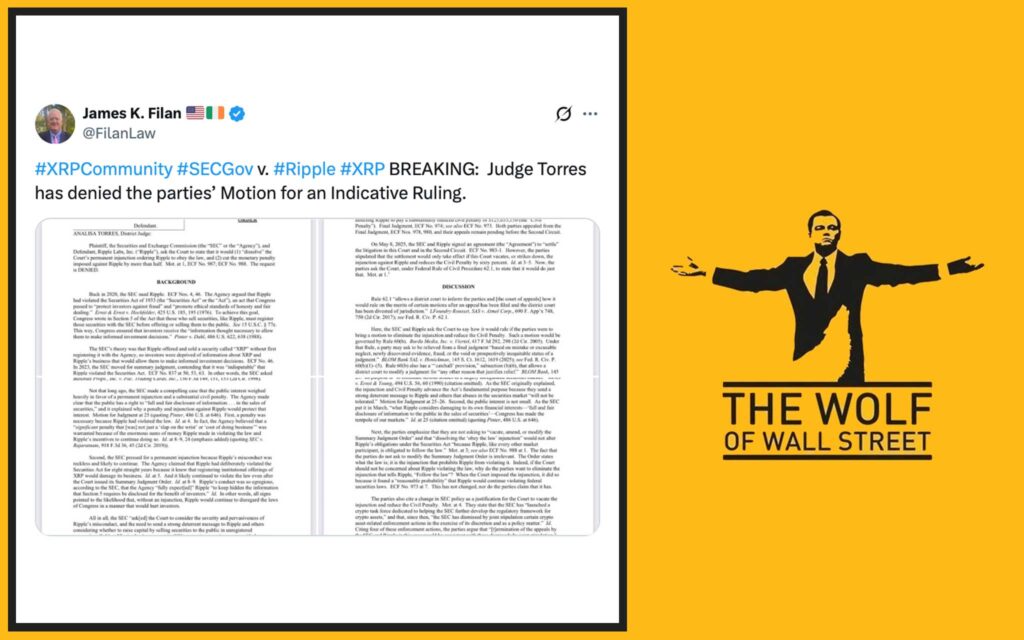

⚖️ Legal Background: A 4-Year Crypto Clash

To appreciate the scale, rewind to December 2020. The SEC slammed Ripple with a lawsuit, claiming they raised $1.3 billion by selling XRP as an unregistered security. The regulators went for the jugular—a $2 billion penalty. But Ripple didn’t flinch. Through relentless negotiation and sharp legal strategy, Ripple crushed that penalty down to $125 million. That’s not just a win; it’s a lesson in outmaneuvering the system.

A crucial ruling remained: primary sales of XRP to institutional investors count as securities transactions. But here’s the kicker—Ripple’s legal team never budged on one key message: XRP itself is not a security. That position shapes the game for every other crypto under regulatory fire.

Want to see more legal and regulatory breakdowns? Check out our Policies and Cryptocurrencies insights.

📈 Immediate Market Impact

Let’s talk numbers. XRP leaped 3% within hours, marking a 4.01% 24-hour gain. Its market cap ballooned to $126.2 billion. This wasn’t some speculative blip—this was real capital chasing real news.

Why? Uncertainty kills market enthusiasm, and Ripple just handed the market clarity on a silver platter. Investors know the rules of the game, and money hates waiting.

This instant reaction tells us that crypto traders, big and small, were desperate for an end to the SEC standoff. Now they’ve got it.

For more real-time trade ideas, get plugged into our Trading Insights hub.

🥊 Ripple’s Legal Strategy: Why Drop the Appeal?

So why did Ripple blink first? Because it’s all about leverage. Brad Garlinghouse and his team know when to walk away—when the risk of endless litigation outweighs the reward. Ripple is betting on clarity, operational focus, and future growth.

Now, instead of burning cash on lawyers, they’re back to building the “internet of Value.” You want to scale? You need focus. Ripple knows this better than anyone.

Ripple CEO Brad Garlinghouse Speaks Out

Garlinghouse wasn’t subtle: “It’s time to get back to business.” He stressed Ripple’s mission to revolutionise global finance. No more legal distractions, no more regulatory fog. Ripple wants to be the infrastructure—the rails—of the new global value network. And now, they can.

⚡ SEC’s Response: Anticipated Next Move

The ball is now in the SEC’s court. Expectations are sky-high that the regulator will drop its own appeal, effectively slamming the door shut on this multi-year legal saga. If (when) that happens, Ripple’s legal limbo ends for good.

Timeline? Days, maybe weeks. But the psychological impact is instant: a giant weight off XRP’s back.

🌐 Broader Implications for Crypto Regulation

This is more than Ripple’s win; it’s a precedent. The SEC’s heavy-handed approach just lost some teeth. Crypto projects across the board are watching, learning, and preparing to leverage this outcome in their own battles. If XRP isn’t a security, what about Ethereum, Solana, or your favourite DeFi token?

A new regulatory chapter could be opening, and Ripple just wrote the first page.

For deep dives into the evolving regulatory landscape, visit our Policies section.

🚦 Ripple’s Path Ahead: Opportunities and Challenges

Ripple can now focus on what it does best—expanding its network, locking in new partnerships, and rolling out products that move the market.

But let’s keep it real: just because one court battle ends, it doesn’t mean the war is over. Ripple still needs to navigate evolving global regulations, fierce competition, and ever-changing market sentiment.

Investor Insights and Market Predictions

Here’s where it gets interesting. Experts see this as a green light for institutional players who’ve been sitting on the sidelines. Expect to see new money entering the XRP market, more corporate partnerships, and possibly a faster route to broader crypto ETF approval.

Institutional investors aren’t emotional—they’re waiting for regulatory clarity. This news is their signal.

🗣️ Community Reactions: XRP Holders Weigh In

The XRP Army is out in force on Twitter, Telegram, and every corner of the crypto web. Sentiment? Ecstatic. Years of FUD (fear, uncertainty, doubt) are melting away. Crypto influencers are calling it a “watershed moment,” and grassroots traders see it as validation for holding through the storm.

Want to tap into the real-time community pulse? Join the discussion in our active Telegram community.

🔍 Ripple vs Other Crypto Cases: A Comparative Analysis

Look at the scoreboard. Ripple’s journey was tougher than most—Binance, Ethereum, you name it. But here’s the secret sauce: Ripple fought back, didn’t settle for scraps, and walked away with clarity that most projects still lack.

Now, projects like Ethereum and Solana can point to Ripple as precedent if the SEC comes knocking. The playing field just tilted.

🔮 Future Scenarios for XRP and Crypto Market

Let’s map the battlefield. If the SEC drops its appeal, expect:

- More US-based exchanges relisting XRP

- Major institutional entry

- Potential fast-tracking of crypto ETFs

- Boosted confidence for new crypto startups

But nothing is guaranteed. If the SEC hesitates, there’s room for more volatility. Stay sharp, stay flexible.

XRP’s Market Outlook: Bullish or Bearish?

Short-term? Bullish, no question. Volatility is your friend if you know how to play it. Long-term? If Ripple delivers on their business promises, we could see new all-time highs. If they stumble or face fresh regulatory headwinds, expect turbulence.

Don’t just watch. Get informed, get strategic, and use every tool at your disposal.

🛠️ Essential Tools for Crypto Traders

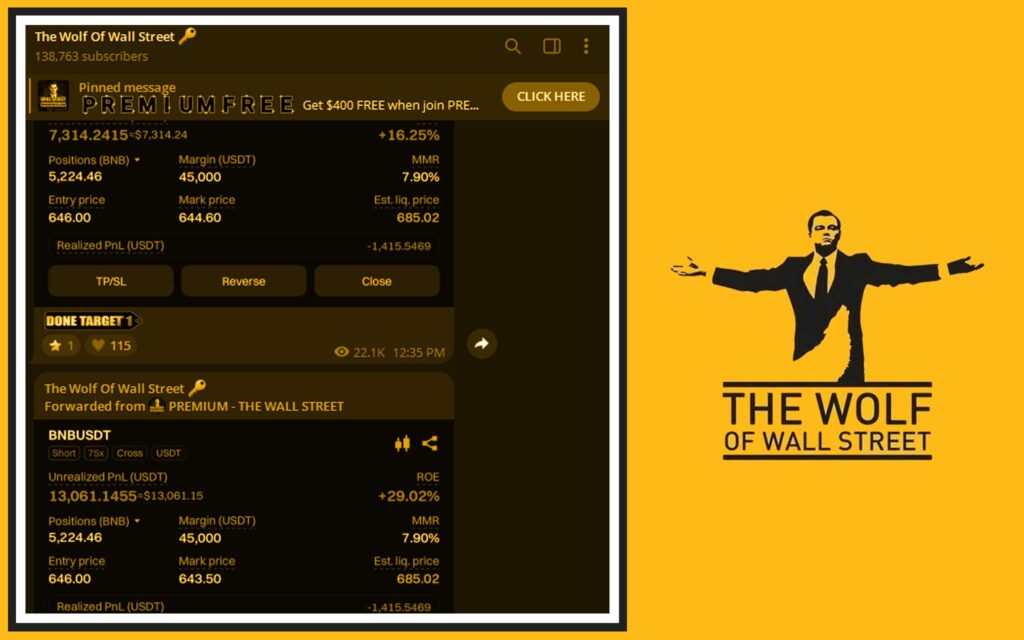

Want to crush it in the new XRP era? You need more than news—you need signals, analytics, and a tribe. That’s where the The Wolf Of Wall Street crypto trading community comes in.

Here’s your edge:

- Exclusive VIP Signals: Tap into proprietary signals built to maximise your profits.

- Expert Market Analysis: Leverage the insight of seasoned pros who know how to read the market’s next move.

- Private Community: Trade ideas with over 100,000 serious players—no amateurs.

- Essential Trading Tools: Use volume calculators and resources to optimise your strategy.

- 24/7 Support: Hit a wall? Get help from a team that never sleeps.

Unlock your potential now:

- Explore our service page for details.

- Plug into our Telegram community for live updates, signals, and community support.

📌 FAQs About Ripple, SEC, and XRP

Q1: Is XRP finally not a security?

A: According to Ripple’s legal team and recent court rulings, XRP in secondary markets is not a security. Only certain institutional sales were flagged.

Q2: What happens if the SEC drops its appeal?

A: This would mark the official end of the four-year legal war. Ripple can operate freely, and XRP could see broader adoption.

Q3: How does this impact my XRP holdings?

A: Regulatory clarity typically boosts confidence and liquidity. But, as always, volatility remains—trade wisely.

Q4: What does Ripple mean by the “internet of Value”?

A: It’s Ripple’s vision for seamless, global value transfer—like the internet did for information.

Q5: Where can I stay updated and get trading support?

A: Join the The Wolf Of Wall Street community and bookmark our service page.

Conclusion

Ripple’s decision to drop its cross-appeal against the SEC is not just another crypto headline—it’s a power move with market-shaking consequences. XRP’s price surge is only the beginning. With legal clouds parting, Ripple can finally chase its vision without shackles. This is your wake-up call: stay sharp, stay informed, and be ready to capitalise.

Want to win in this market? Use every edge—signals, analysis, community. The next bull run favours the bold.

Related Internal Links:

- Service

- News

- Cryptocurrencies

- DeFi

- Ecosystems

- Trading Insights

- Trending

- Hot

- Layer-1 and Layer-2 Solutions

- Newbie

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.