📜Introduction: The Day Crypto Stopped Playing Small

Listen—if you still think crypto is some wild, unregulated jungle, you’re living in the past. The rules have changed, the stakes are higher, and Ripple just put its foot on the gas by applying for a US national banking licence.

This isn’t another headline for the trading geeks—it’s the defining moment where the crypto world stops disrupting from the sidelines and starts playing the big leagues. The game? It’s legitimacy, integration, and real money.

Let’s break down what Ripple’s move means, why you should care, and how to get ahead before the market leaves you behind.

🚀 Ripple’s Big Swing: From Outlaw to Insider

Ripple has always been the high-voltage brand in the crypto space—a disruptor, a risk-taker, and, let’s face it, a little bit of an outlaw. But the landscape’s changed. If you want to win in today’s game, you need more than hype. You need trust, compliance, and the kind of access only the big banks ever had.

Ripple’s application for a national banking licence isn’t about following the rules. It’s about rewriting them. They’re turning from mavericks to market-makers—insiders with all the tools, regulation, and investor confidence that used to be exclusive to Wall Street. This move isn’t about survival. It’s about domination.

🏁 Circle, Ripple, and the Race for Legitimacy

Let’s talk competition. Circle saw the writing on the wall and made their move first, applying for a similar licence. But Ripple’s entry ups the ante. Why? Because when the big players start chasing legitimacy, you know the days of “cowboy crypto” are numbered.

Ripple vs. Circle: Who’s Playing It Smarter?

| Criteria | Ripple | Circle |

|---|---|---|

| Licence Applied | National Bank Charter (OCC) | National Bank Charter (OCC) |

| Main Stablecoin | RLUSD | USDC |

| Regulation | NYDFS, Now Federal (proposed) | NYDFS, Now Federal (proposed) |

| Fed Master Account | Applied | Applied |

| First-Mover Edge | Late Entry | Early Mover |

| Market Reaction | +3.2% XRP spike | Moderate USDC attention |

The bottom line? Ripple’s going for scale and access, not just compliance. They’re after the master account, the gold standard of credibility.

Want to trade smarter as these seismic shifts happen? Get in early with crypto trading services or stay up to speed with the latest crypto news and trending analysis.

🧑⚖️ The GENIUS Act and the Regulators’ Gameplan

If you’re trading in 2025 and don’t know about the GENIUS Act, you’re missing the plot. The US Senate just passed this heavyweight piece of legislation, setting strict new standards for stablecoin issuers. Translation: no more half-measures. If you’re not federally approved, you’re not in the game.

For Ripple (and every big-name stablecoin), compliance isn’t just a checkbox—it’s the ticket to play on the global stage. The Office of the Comptroller of the Currency (OCC) and the Federal Reserve are the gatekeepers now. And the GENIUS Act is their rulebook.

💼 OCC, Federal Reserve, and Master Account: The Real Power Moves

So, what’s this all about? The OCC is the federal agency that hands out the golden tickets—a national banking licence. With that, you can operate across all US states, not just one.

But the true kingmaker here is the Federal Reserve master account. Having one means direct access to the US central bank. It’s what separates the power players from the amateurs.

Ripple isn’t just asking for a seat at the table—they’re demanding the full buffet. But here’s the twist: no crypto firm besides Anchorage Digital has pulled this off before. The regulators are sceptical. The process? Gruelling. The payoff? Monumental.

💵 Stablecoins and RLUSD: The Future of Digital Money

Let’s talk product. Ripple isn’t betting its future on hype coins. They’re pushing RLUSD, a stablecoin regulated by New York State (NYDFS) and now gunning for federal status.

Why’s this important? Because once it’s under federal oversight, RLUSD becomes a benchmark for trust, transparency, and mass adoption.

More regulation? Sure. But with it comes the potential for institutional investment, mainstream integration, and a safer playground for retail traders. That’s not just a win for Ripple—it’s a win for every serious market participant.

📈 XRP Price Impact: Proof the Market’s Hungry for Change

Markets don’t lie. The minute Ripple’s banking ambitions hit the news, XRP jumped 3.2%. That’s not speculation—that’s raw market appetite for legitimacy.

Imagine the domino effect as other tokens and coins scramble to catch up.

XRP Market Impact Table

| Asset | Price Before News | Price After News | % Change |

|---|---|---|---|

| XRP | $0.55 | $0.57 | +3.2% |

| USDC | $1.00 | $1.00 | 0% |

| BTC | $62,000 | $62,500 | +0.8% |

The lesson? The market rewards confidence and credibility. Are you positioned to profit as this trend accelerates? Find out with real-time insights from trading analysis and hot crypto topics.

💰Expert Commentary: Not Just Hype – Real Reactions from the Frontlines

Brad Garlinghouse, Ripple’s CEO, called this “the biggest step for trust in stablecoins since the sector’s birth.”

Legal analysts say, “It’s the logical next phase—crypto is joining, not fighting, the system.”

Top traders? They’re not just watching. They’re reallocating capital, eyeing new entry points, and preparing for a regulated crypto bull run.

Want more than headlines? The The Wolf Of Wall Street crypto trading community gives you exclusive VIP signals, expert market analysis, and private community support—so you’re never trading alone.

⚠️ Risks, Hurdles, and the Bear Traps Ahead

Let’s get real—this isn’t a risk-free play. Ripple faces intense regulatory scrutiny, operational obstacles, and a long, uncertain approval process. Not every crypto outfit will make it through the gauntlet.

- Regulatory minefields: The OCC and Fed will dig deep.

- Operational headaches: Compliance is expensive and time-consuming.

- Market risks: A denied application could hit XRP hard.

Survival means being smart, prepared, and plugged into the right support. If you want to thrive—not just survive—align with industry leaders and real-time community insights.

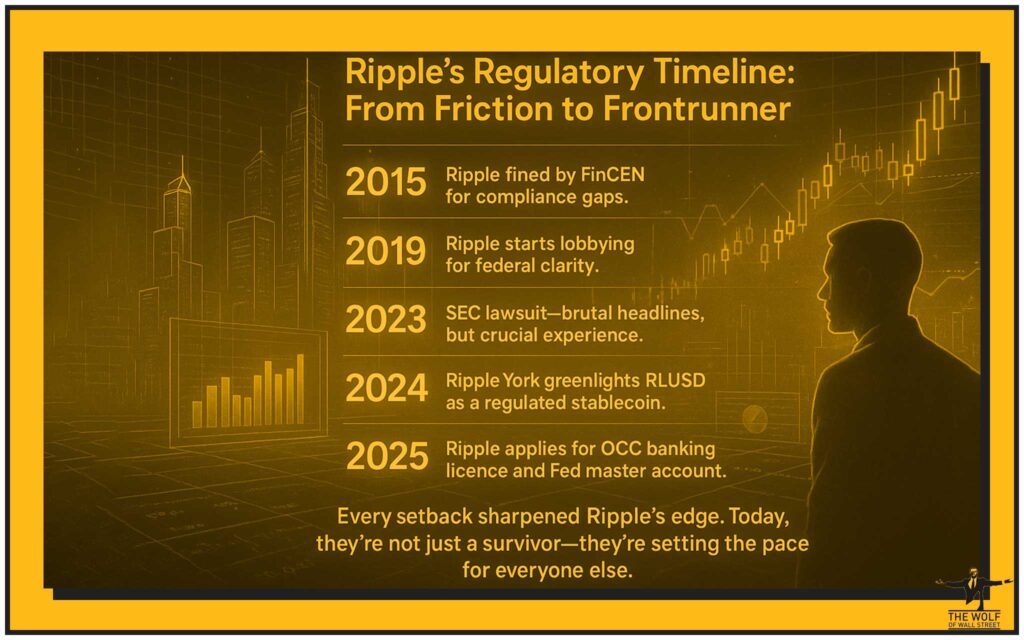

🚀Ripple’s Regulatory Timeline: From Friction to Frontrunner

2015: Ripple fined by FinCEN for compliance gaps.

2019: Ripple starts lobbying for federal clarity.

2023: SEC lawsuit—brutal headlines, but crucial experience.

2024: New York greenlights RLUSD as a regulated stablecoin.

2025: Ripple applies for OCC banking licence and Fed master account.

Every setback sharpened Ripple’s edge. Today, they’re not just a survivor—they’re setting the pace for everyone else.

💼 Crypto Firms: From Disruptors to Establishment Players

This is the meta-shift. For years, crypto prided itself on being the anti-bank. Now? The smartest players are fighting for a seat at the banking table. Why? Because scale, access, and mass adoption don’t happen without regulation.

Circle, Ripple, and a handful of others are showing the way. Expect more copycats, mergers, and Wall Street partnerships—because nobody wants to be left holding the bag as the market matures.

For those still playing with meme coins and chaos? This is your warning shot.

Time to graduate—explore the ecosystems and serious defi plays before the old rules are gone for good.

💥 Consumer Impact: Why This Matters for the Average Trader

Think you’re just a spectator? Think again.

- More trust: Regulated coins = less rug-pull risk.

- More access: Banks and institutions bring deep liquidity.

- Bigger opportunities: Regulation unlocks new products, trading pairs, and yield options.

The line between “crypto trader” and “financial insider” is about to blur. Will you be ready?

Stay informed with newbie guides or level up with altcoin strategies.

🤝 The Wolf Of Wall Street: Where Ambitious Traders Stay Ahead of the Curve

Let’s cut to the chase—navigating the new crypto world takes brains and community.

The The Wolf Of Wall Street crypto trading community gives you everything you need to profit:

- Exclusive VIP Signals: Proprietary intel that moves the needle.

- Expert Market Analysis: Insights from the pros, not amateurs.

- 100,000+ Private Members: Collaborate, share, and win together.

- Essential Trading Tools: From volume calculators to market scanners—no guesswork, just precision.

- 24/7 Support: Real traders, real help, anytime.

Ready to turn market chaos into clarity? Join our service, tap into our Telegram community, and start trading like you mean it.

🛣️ What’s Next? The Roadmap for Crypto’s New Era

Ripple’s banking ambitions aren’t just a one-off. They’re the opening shot in the race to merge crypto and finance—forever.

- More big names will chase licences.

- Expect tighter rules, but deeper rewards.

- The winners? Those who adapt fast, learn nonstop, and connect with winning communities.

Stay sharp with the latest from policies, bitcoin, NFTs & gaming, and layer-1/layer-2 solutions.

🎤 Conclusion: Get in or Get Left Behind

Here’s the bottom line—Ripple’s move is your signal.

This isn’t the time for hesitation. The money, the tech, the credibility—it’s all converging.

If you want to win, you need to play the new game: compliance, community, and relentless learning.

Don’t sit on the sidelines.

Get informed, get plugged in, and make the moves that matter.

Because when the dust settles, only the smart, connected, and ambitious will be left standing.

🔚 FAQs: The Burning Questions Everyone’s Asking

Q: What is a national banking licence and why does Ripple want one?

A: It’s federal approval to operate as a bank in the US, opening doors to direct payment rails and mainstream trust.

Q: What is the GENIUS Act?

A: New US law mandating strict oversight and standards for stablecoin issuers—only the compliant survive.

Q: What’s the impact for traders?

A: Greater trust, security, and new trading/investment opportunities as crypto gets institutional legitimacy.

Q: How can I stay ahead?

A: Follow trading insights, join communities like The Wolf Of Wall Street, and never stop learning.

🌍 Further Reading and Resources

- Dive into defi

- Explore ecosystems

- Stay on top of policies

- Learn about bitcoin and altcoins

- Start strong with newbie guides

- Master trading insights

- Catch the latest trends and hot topics

- Level up in NFTs & gaming and layer-1/layer-2 solutions

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

Ready to make your next move?

Welcome to the future—don’t just watch it, profit from it.