🚀 Introduction: The Wolf’s Wake-Up Call to Crypto Traders

Listen up—because what I’m about to reveal separates the hungry wolves from the clueless sheep in the crypto jungle. You can talk all day about bull markets, leverage, or flipping memecoins—but if your execution sucks, you’ll never be a consistent winner. The truth? It’s not just what you buy or sell, but how you enter and exit that makes the real difference.

Crypto is a 24/7 market—volatile, ruthless, and packed with whales ready to eat you alive. If you want to avoid getting fleeced on every big trade, you need an edge. Enter: TWAP and VWAP. These aren’t just fancy acronyms—they’re the silent engines behind every smart, profit-driven move made by the real pros. And today, I’m pulling back the curtain so you can play the same game.

🧐 The Big Picture: Why Execution Strategies Are Non-Negotiable

Ever been front-run by a bot? Watched your big order nuke your own entry price? Welcome to the club—every rookie gets burned. But the wolves, the winners, don’t settle for sloppy entries. They leverage algorithms that slice, dice, and disguise their intentions, letting them move size without leaving a trail.

Slippage? Not in your playbook. Market impact? You minimise it or you’re out of the game. Smart execution is your edge, and without it, you’re just another lunch menu item. As Jordan Belfort says: “If you’re not optimising, you’re losing.” Don’t be the patsy.

🔍 Meet the Titans: TWAP and VWAP Defined

Let’s cut through the noise.

- TWAP (Time-Weighted Average Price):

This is your silent assassin. It takes a big order, splits it into bite-sized chunks, and executes each part at fixed intervals—completely ignoring the market’s volume. You’re in stealth mode, never tipping off the crowd.

- VWAP (Volume-Weighted Average Price):

Now we’re riding the wave. VWAP isn’t about time; it’s about where the action is. Your trades hit hardest when the market is buzzing, tracking the average price where most volume trades hands. You’re moving with the crowd, benchmarking yourself against the real market pulse.

Institutional vs Retail:

Institutions use these algorithms to push through multi-million-dollar buys and sells without spiking prices. But here’s the kicker—you don’t need to be a hedge fund to use them. They’re available for every trader with the right platform and mindset. And if you’re in the The Wolf Of Wall Street crypto trading community, you’re already running with the best.

🧠 The Wolf’s Breakdown: How Each Method Works, Step-by-Step

Let’s get surgical. No jargon, just results.

TWAP:

- Decide your total order size.

- Split that order into equal parts—could be every minute, every hour, you choose.

- The algorithm executes each part at those regular intervals—no care for volume, just relentless, predictable entries.

Use-case?

Perfect for low-liquidity tokens where you want to avoid shaking the tree and waking up market makers.

VWAP:

- Watch the market’s trading volume at each price.

- The algo fires off bigger trades when volume surges, smaller ones when it’s quiet.

- The average price you get is weighted by volume—so your execution mirrors the heart of market activity.

Use-case?

Killer in high-volume environments, when you want to trade like a shark, not a minnow.

Formulas (no-nonsense):

- TWAP: Add up all prices at regular intervals. Divide by the number of intervals.

- VWAP: Multiply each price by traded volume at that price, sum up, then divide by total volume.

🏆 Real-World Power Plays: Legendary Use Cases & Case Studies

Let’s put skin in the game.

- TWAP:

Remember when MicroStrategy snapped up $250 million in Bitcoin? They didn’t go all-in at once—they TWAP’d that order over days, slipping in quietly so they didn’t light the price on fire. That’s how real money moves. - VWAP:

On Kraken Pro’s platform, you can trade with VWAP execution—mirroring the big players, ensuring you’re not getting picked off by market makers. It’s like having a GPS for the best average price in a liquid market.

For traders who want in-depth breakdowns, check out trading insights. If you’re still cutting your teeth, start at the newbie section. And for real stories of how the wolves take profit, visit the crypto-profit-taking wolf’s guide.

🤜🤛 TWAP vs VWAP: The Battle Royale—Key Differences Table

Let’s compare, side by side, so you never pick the wrong tool:

| Feature | TWAP | VWAP |

|---|---|---|

| Weighting | Time (equal intervals) | Volume (trades more when action is hottest) |

| Market Type | Low liquidity, stealth moves | High liquidity, active markets |

| Complexity | Simple, predictable | More complex, volume-aware |

| Market Impact | Lower, less detectable | Can be higher if volume dries up |

| Best Use | Avoiding big footprints, thin markets | Benchmarks, trend trading, large liquid tokens |

| Example | MicroStrategy’s stealth BTC buy | VWAP indicator on Kraken Pro |

👔 Who Should Use What? Trader Profiles & Decision Triggers

Not all wolves hunt the same way.

- Retail traders with smaller positions can use either, but if you’re moving size, the right execution is everything.

- Institutions love TWAP for discretion—think stealth Bitcoin buys.

- Day traders thrive on VWAP to trade with the flow and not against it.

- Whales? If you’re shifting millions, use TWAP when liquidity is thin; VWAP when you want to ride volume spikes.

What should drive your choice?

- Market conditions: Thin order books? Go TWAP. Raging market? VWAP.

- Order size: The bigger your bite, the smarter you need to be.

- Timing: Fast moves? VWAP. Slow and steady? TWAP.

Avoid rookie mistakes—never force VWAP in illiquid markets or you’ll end up moving the price against yourself.

🧑💻 The The Wolf Of Wall Street Edge: Level Up with Community, Tools, and VIP Signals

Let’s talk about real edge.

If you’re trading alone, you’re playing checkers. The wolves? They play chess, together, leveraging every weapon possible.

That’s where the The Wolf Of Wall Street crypto trading community slays:

- Exclusive VIP Signals:

Proprietary signals engineered to maximise your profits. Forget guesswork—act on alpha. - Expert Market Analysis:

You want institutional-grade breakdowns from seasoned traders? Done. - Private Community:

Join 100,000+ traders sharpening each other’s skills—iron sharpens iron. - Essential Tools:

From volume calculators to advanced analytics, your decisions are no longer blind. - 24/7 Support:

Crypto doesn’t sleep, and neither does The Wolf Of Wall Street support. Get answers, fast.

Want to get in? Visit the The Wolf Of Wall Street service page for details, or jump into the action on their Telegram community.

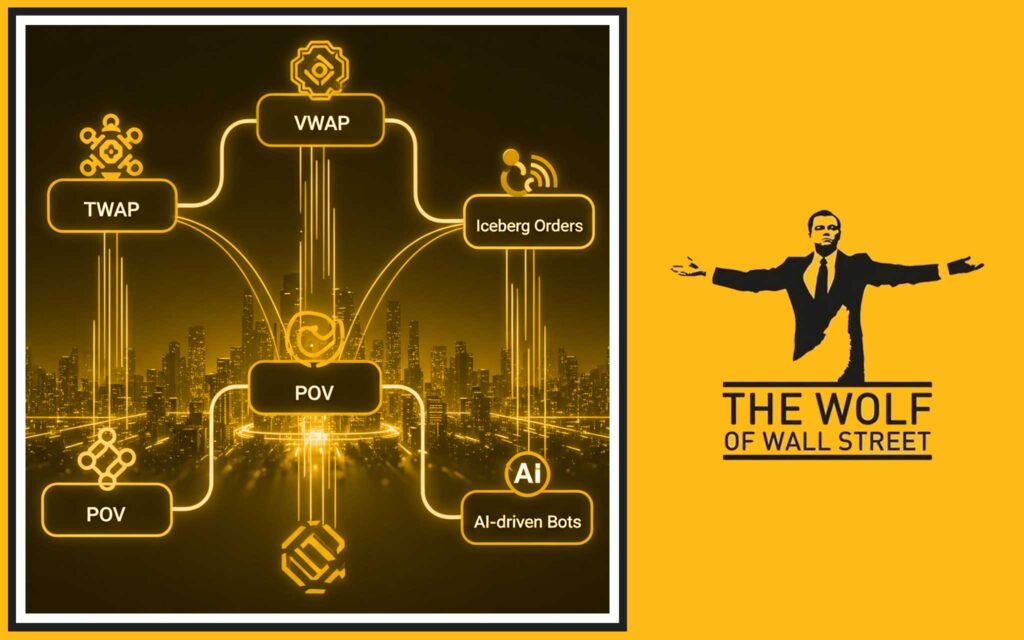

⚡ Advanced Execution: Beyond the Basics (POV, Iceberg Orders & More)

Don’t stop at the basics if you want alpha.

- POV (Percentage of Volume):

Matches your orders as a fixed % of the market’s actual volume. Great for keeping your moves invisible. - Iceberg Orders:

Hide your true size—show a little, execute a lot. Perfect for whales dodging front-runners. - AI-Driven Execution:

The future is now: some platforms let machine learning adapt your algo execution in real time.

Smart traders in the layer-1 and layer-2 solutions space are mixing and matching strategies, keeping their playbook sharp.

🛠️ Practical Walkthroughs: Setting Up TWAP & VWAP on Major Platforms

You want to use these like a pro? Here’s how:

Binance:

- Use their advanced order options. Look for TWAP/VWAP when placing big trades.

Kraken Pro:

- Select “VWAP” in the trading interface. Use their charts for real-time guidance.

TradingView:

- Add VWAP or TWAP as indicators. Use for benchmarking and backtesting.

Pro tip: Run a backtest before you go live. Know your numbers.

For more on setting up strategies, check master crypto order types and moving averages market trends.

🔥 Risks, Limitations & How to Avoid Getting Burned

Don’t kid yourself—every tool has a downside.

- Slippage still happens if you’re not watching liquidity.

- Latency & algo lag: Algorithms aren’t magic—network delays can cost you.

- Spoofing & manipulation: In small markets, bad actors love to mess with VWAP.

- Regulatory risks: Don’t get cute—know your local laws before running bots.

Mitigate your risk by using proven tools and community-vetted strategies from crypto-hedge-funds market shift and crypto-aml-guide-compliance-security-2025/.

🧩 Wolf Wisdom: Proven Tips to Optimise Your Trade Execution

- Don’t chase the market—let the algos do the heavy lifting.

- Always backtest: Use historical data before putting real money at risk.

- Keep an eye on fees: Execution doesn’t matter if your profits get eaten up.

- Combine with indicators: Use RSI strategies or MACD signals for confirmation.

- Stay connected: Community intel = edge. Don’t miss real-time updates in the The Wolf Of Wall Street Telegram.

💼 TWAP & VWAP in Your Daily Playbook: Real-Life Scenarios

- Day trading Bitcoin: Use VWAP to avoid overpaying on big swings.

- Accumulating DeFi tokens: Stealth-accumulate via TWAP so you don’t pump the price.

- Trading memecoins: Liquidity’s a joke—only TWAP keeps you from nuking your own entry.

See more in the defi category and stay sharp on crypto token listing process guides.

📊 Quick Reference: Summary Table of TWAP vs VWAP

| Aspect | TWAP | VWAP |

|---|---|---|

| Best For | Thin/quiet markets | Busy/liquid markets |

| Executes on | Fixed time intervals | Volume surges |

| Goal | Minimise detection | Benchmark price |

| Risk | Misses volume spikes | Impact in low volume |

| Platform | Algo bots, APIs | Pro trading platforms |

🐺 The Call to Action: Don’t Trade Like a Cub—Join the Wolf Pack Today!

You’ve got the knowledge. Now get the edge. Join the The Wolf Of Wall Street trading community and trade with the hunger—and precision—of a true Wolf.

- Get instant access to proprietary signals

- Tap into expert support and tools

- Upgrade your execution with real-time analysis

Don’t wait until your next order gets chewed up—level up now with the The Wolf Of Wall Street service page, see the latest trending strategies, or dive into deep-dive Bitcoin analysis.

❓ Frequently Asked Questions (FAQs)

Q1: Can I use TWAP and VWAP as a retail trader, or are they only for institutions?

Absolutely—you can use both with most advanced platforms and bots. Size doesn’t matter, execution does.

Q2: When is VWAP better than TWAP?

VWAP shines in high-liquidity, high-volume situations where you want your price to reflect the true market average.

Q3: What’s the biggest risk with these strategies?

Getting front-run or using them in the wrong market conditions—always know your liquidity.

Q4: Do they guarantee better profits?

No strategy guarantees profit. But executed right, they minimise slippage and help you keep more of your gains.

Q5: What tools can help automate TWAP and VWAP trading?

Join the The Wolf Of Wall Street community to access proprietary tools, volume calculators, and automated signals.

💰 Conclusion: The Wolf’s Last Word on Winning Execution

Here’s the bottom line: You want to trade like a pro? Then act like one. The difference between a sheep and a wolf in crypto is execution. Master TWAP and VWAP and you won’t just keep up—you’ll leave the herd behind.

You’ve seen the playbook, now it’s your move. Be relentless, be strategic, be the Wolf.

📚 Appendix: Glossary, References & Source Context

Glossary:

- TWAP: Time-Weighted Average Price, for steady, stealth order execution.

- VWAP: Volume-Weighted Average Price, for volume-matched, market-reflective trades.

- POV: Percentage of Volume, advanced algorithmic execution.

References:

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Want more? Explore crypto-profit-taking wolf’s guide, trading insights, and trending strategies in the hot category.