🚀 Introduction

Listen up, because what’s happening in crypto right now isn’t just another “news cycle”—it’s a seismic shift. The rise of spot Bitcoin ETFs since 2024 isn’t just bringing new money to the market. It’s flipping the script on what it means to truly “own” your coins. And if you’re still thinking the ETF train is just a fad, you’re missing the kind of once-in-a-lifetime opportunity that makes or breaks fortunes.

This is about more than profits. It’s about control, access, and the soul of Bitcoin itself. Are you ready to take a side—or build a smarter strategy and win, no matter which direction the market tilts? Because the only thing riskier than action in crypto is sitting on your hands while the world evolves around you.

🔑 The Crypto Paradigm Shift: Not Your Keys, Not Your Coins

Before the ETF era, crypto had one golden rule: “Not your keys, not your coins.” It wasn’t just a slogan. It was the firewall between financial independence and the same old institutional control we came to crypto to escape. If you held your private keys, you held power. If not, you were just another customer.

This philosophy fuelled the original crypto revolution. It turned everyday investors into their own banks, immune to middlemen, bank holidays, and government meddling. Self-custody wallets boomed. Cold storage was king. And for a while, it looked like individual sovereignty would stay at the heart of this industry forever.

💥 The Spark: Approval of Spot Bitcoin ETFs in 2024

Then came January 2024. With regulators green-lighting spot Bitcoin ETFs—first BlackRock, then Fidelity, Grayscale, and others—the game changed overnight. Suddenly, Bitcoin was open for business on Wall Street’s terms.

The money didn’t just trickle in. It flooded. Compliance walls that had locked out trillions were bulldozed. Retirement funds, pension managers, and public companies—all wanted in, and all wanted it the easy, regulated way.

No more worrying about lost seed phrases or hacked laptops. Just a ticker symbol, an app, and you’re in. Simple? Sure. Safe? That’s the billion-dollar question.

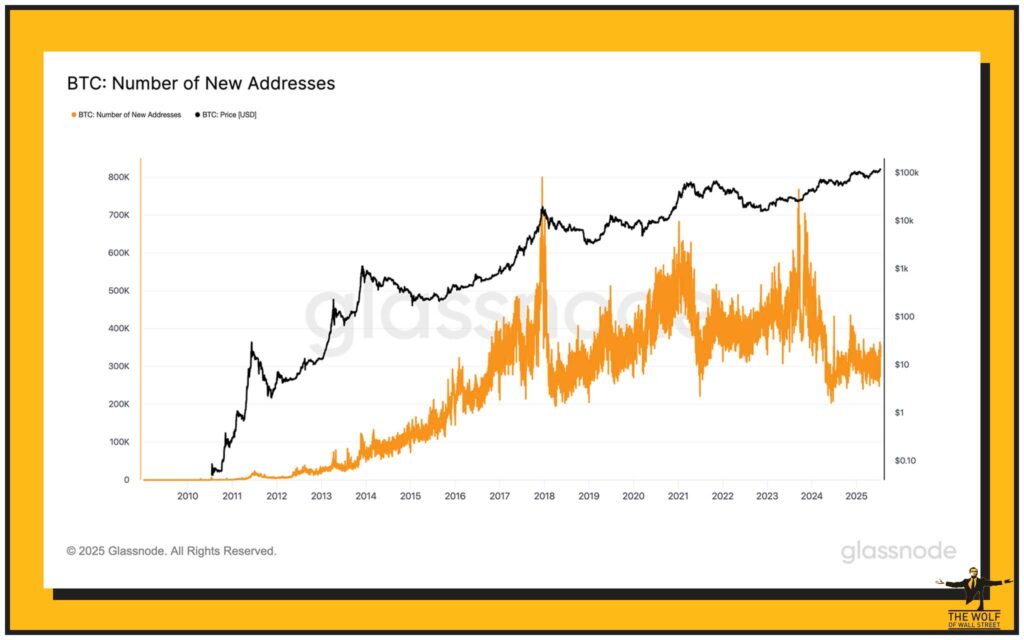

📉 The Data Doesn’t Lie: Self-Custody in Decline

Let’s get real—numbers don’t lie. In the first 18 months after ETF approvals, Bitcoin’s active address count went from nearly 1 million to around 650,000. That’s the lowest since 2019. New BTC address creation slowed dramatically. This isn’t just a blip; it’s a trend.

Why? Because investors—especially newcomers and institutions—are choosing custodial, ETF-style solutions over managing their own wallets. Why juggle private keys when you can buy a regulated product and sleep easy?

But here’s the kicker: what you gain in convenience, you might lose in control. And if you think ETF providers aren’t watching how much Bitcoin you own, think again.

💸 Institutional Money Floods In: $50 Billion and Counting

When you see $50 billion in net inflows hit spot Bitcoin ETFs in under 18 months, you know you’re watching history. BlackRock’s IBIT alone controls more than 700,000 BTC and $83 billion in assets under management—outpacing even the wildest Wall Street projections. This isn’t your buddy’s Telegram group; this is serious capital from the world’s biggest players.

Pension funds, corporate treasuries, hedge funds—they’re all in. Why? Because ETFs offer legitimacy, scale, and regulatory clarity that cold storage can’t match. Compliance teams love it. CFOs love it. The market? It’s loving it so much that Bitcoin’s institutionalisation is now a full-blown trend.

Want the inside edge on these moves? Check out the latest news and insights in our news category and see who’s making waves.

🛡️ ETF Benefits: Security, Simplicity, and Scale

Let’s cut through the noise. ETFs make owning Bitcoin as easy as buying Apple stock. You get:

- Security (sort of): Funds are insured, held with trusted custodians.

- Simplicity: No private keys, no cold wallets, no heart attacks if you lose your phone.

- Scale: Big money, instant exposure, no technical hurdles.

That’s a recipe that brings millions of new investors to the table. And for the average Joe or institutional whale who doesn’t want to be a tech whiz, ETFs are the answer.

But remember, with scale comes a new kind of risk: your Bitcoin is only as safe as the institution holding it. And if you think the regulators are always on your side, you haven’t been paying attention.

🧬 Self-Custody: Core to Crypto’s DNA, or Obsolete Relic?

Now, let’s hear from the hardliners. For Bitcoin’s OGs and self-custody evangelists, handing over your private keys is blasphemy. They’ll tell you self-custody is the only way to truly “own” your coins. They’re not wrong—but they might be fighting a battle that’s already lost.

Satoshi Nakamoto’s original whitepaper didn’t dream of ETFs. It was about financial independence—peer-to-peer, no middlemen, no banks. That ethos still has die-hard fans: privacy hawks, cypherpunks, and those living in regions where trust in institutions is zero.

Some are doubling down on hardware wallets, multisig solutions, and cold storage, refusing to let the ETF wave wash away their sovereignty. The reality? They’re becoming the minority.

🔥 Critics Fire Back: Centralisation, Risk, and “Paper Bitcoin”

Here’s where things get spicy. Critics of the ETF trend see danger around every corner:

- Centralisation: Just a handful of giants (BlackRock, Fidelity, Grayscale) now own massive chunks of Bitcoin.

- “Paper Bitcoin”: If custodians start issuing claims on more Bitcoin than they actually hold—Houston, we have a problem.

- Regulatory Risk: All your eggs are in one institutional basket. If regulators or courts freeze assets, you’re on thin ice.

And let’s not forget, custodians can be hacked. They can fail. You could wake up one morning and discover your “Bitcoin” is just an IOU. For deep dives into the risks, hit up our Bitcoin hub.

🍰 ETFs Don’t Kill Self-Custody – They Expand the Pie

Time for some straight talk: ETFs haven’t “stolen” self-custody users. They’ve expanded the market. Analysts like Willy Woo say most ETF buyers are new blood—people who never would’ve touched self-custody in the first place.

The result? The pie gets bigger. Bitcoin gets more legit. The asset class matures, and mainstream adoption takes a quantum leap forward.

ETF growth brings more capital, more liquidity, and more eyes on Bitcoin. And that means more opportunities for those bold enough to ride the wave instead of fighting it.

💼 Real Talk: What This Means for Retail Investors

Here’s the money shot. If you’re a retail investor, you need to answer one question: What matters more to you—convenience, or control?

- ETFs: Zero learning curve, regulated, easy for retirement accounts.

- Self-Custody: Full control, higher responsibility, off-the-grid sovereignty.

The truth? There’s no one-size-fits-all answer. Some smart investors use a hybrid approach: keep a portion in ETFs for easy access, but store a significant stack in cold storage as their “sovereignty fund.”

Want to level up? Study the game, follow real trading insights, and join communities that keep you informed and ahead of the curve.

🌍 Global Snapshot: How the World’s Adopting (or Resisting) ETFs

The ETF tsunami isn’t hitting every shore equally. In North America and parts of Europe, ETFs are the new gold rush. But in countries with strict capital controls or weak financial systems, self-custody is still king.

- Hot ETF Markets: US, Canada, UK, Germany

- Self-Custody Strongholds: Latin America, parts of Asia, Africa

Regulation is shaping the battleground. In places where ETFs aren’t approved or are tightly restricted, local investors stick to cold wallets. Dive deeper into crypto adoption by region to see how local laws impact your options.

📝 Practical Playbook: Navigating the New Crypto Custody Game

So how do you win? Here’s your blueprint:

- Know your goals: Are you an investor, a trader, a true believer?

- Evaluate your risk: Can you handle losing access to your wallet—or do you trust institutions?

- Diversify custody: Consider a mix of ETFs, cold wallets, and trusted platforms.

- Leverage community knowledge: Don’t trade alone. Communities like The Wolf Of Wall Street arm you with expert signals, real-time analysis, and 24/7 support.

Bottom line: Don’t fly blind. Whether you’re a newbie or a veteran, plug into networks that make you smarter and keep you in the profit lane.

📈 The Wolf Of Wall Street: Level Up Your Trading in the ETF Era

Let’s talk edge—because in this new market, information is everything. The The Wolf Of Wall Street crypto trading community isn’t just another chatroom. It’s a powerhouse platform offering:

- Exclusive VIP Signals: Get proprietary insights to supercharge your profits.

- Expert Market Analysis: Benefit from seasoned traders who’ve seen every market cycle.

- Private Community: Join 100,000+ serious traders for collective brainpower.

- Essential Tools: Volume calculators, alerts, and real-time updates.

- 24/7 Support: Dedicated help whenever you need it.

Why fly solo when you can tap into the collective intelligence of the sharpest minds in the game? Your next big win might just come from a signal you didn’t even know existed. Dive into more trading insights and see why the smart money never stops learning.

🔮 The Future of Financial Sovereignty: What’s Next?

Is there a “best of both worlds” coming? The future could be all about hybrid solutions: think decentralised custodians, smart contract wallets, or ETFs with built-in user sovereignty features.

DeFi (decentralised finance) is already pushing the envelope. Imagine earning yield, managing risk, and accessing global liquidity—all without giving up your private keys. For the next chapter in this saga, keep an eye on our DeFi coverage.

🏁 Conclusion: Time to Choose Sides – Or Build a Smarter Strategy?

Here’s where you put your cards on the table. Bitcoin’s ETF era is here, and it’s not going anywhere. You can double down on self-custody, embrace the ease of ETFs, or play both sides like a true pro.

The only mistake? Doing nothing. The winners in this market are the ones who adapt, learn, and seize opportunity wherever it appears. So—where do you stand? How will you profit? And who’s in your corner when the next big move happens?

Your next step: Decide. Act. And join a community that helps you crush it in any market condition.

💡 FAQs: Your Burning Questions Answered

1. Are Bitcoin ETFs safe for long-term holding?

ETFs offer institutional-level security and regulatory protection, but your assets are only as safe as the custodian and regulatory landscape. For maximum safety, combine with self-custody.

2. Can ETFs ever truly replace self-custody?

Not for everyone. ETFs offer access and simplicity, but self-custody remains essential for those who value independence above all.

3. What are the risks of relying on custodial products?

Counterparty risk, regulatory intervention, and potential hacks. Always know who holds your keys.

4. How do I move from ETF to self-custody (or vice versa)?

Most platforms allow conversion, but it requires careful planning and understanding of tax/regulatory implications.

5. Will regulatory changes impact ETF holders in the future?

Almost certainly. Stay updated and agile to adapt as new rules emerge.

📚 Further Reading & Resources

- The Wolf Of Wall Street Service – Your crypto strategy HQ

- News – Stay ahead with market analysis

- Trading Insights – Level up your trading IQ

- DeFi – Explore the future of decentralised finance

- Bitcoin – Deep dives on BTC trends

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.