No time for fluff.

This is the regulatory move set to flip the US crypto market on its head—and if you’re not paying attention, you’re about to get left behind. The CFTC’s push to allow spot crypto trading on federally registered exchanges isn’t just another policy memo. It’s the Wall Street-style shakeup every trader, investor, and DeFi junkie needs to understand, fast.

Let’s break down exactly what’s happening, why it matters, and how you can profit—before the rest of the herd catches up.

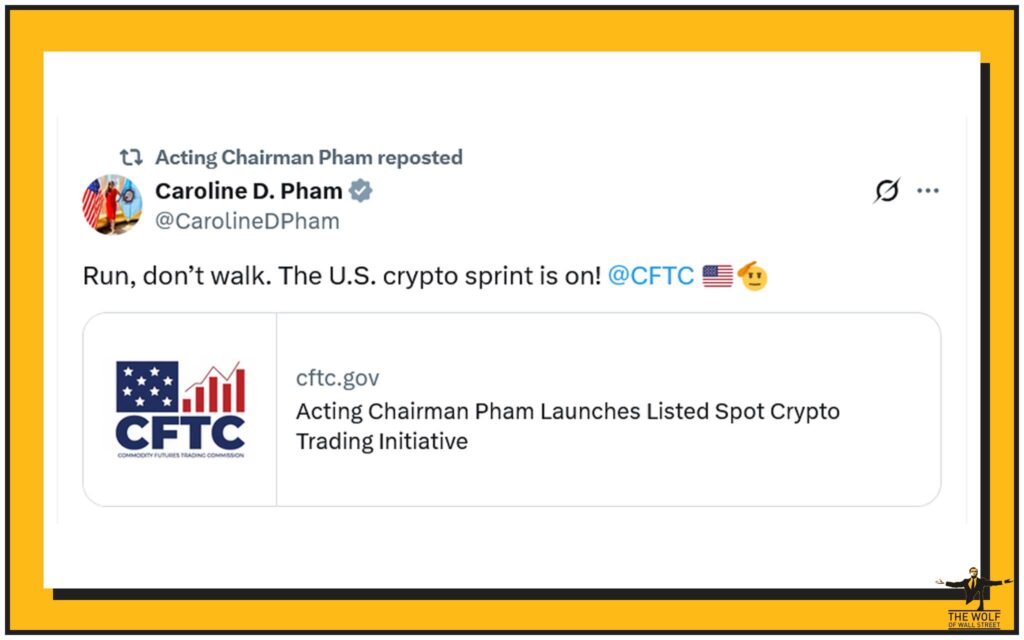

🚀 The CFTC’s Power Play

When the US Commodity Futures Trading Commission (CFTC) speaks, the smart money listens. This agency is the bouncer at the club, deciding who gets in and who gets bounced from the trading floor. And right now, they’re on a “crypto sprint”—racing to regulate the next multi-trillion dollar asset class before the chaos takes over.

Forget slow government bureaucracy. This is a fast-track effort to bring order (and massive new trading opportunities) to crypto markets. If you trade, you should care—a lot.

🇺🇸 Presidential Push – The Trump Era’s Digital Asset Revolution

Why now? Because the Trump administration’s Working Group on Digital Asset Markets dropped 18 recommendations designed to rocket the US to the top of the global crypto game.

This isn’t just another government whitepaper—it’s a playbook for domination.

Key players like the SEC and the CFTC are suddenly dancing together, sometimes in-step, sometimes stepping on toes. But make no mistake: the goal is clear. Federal-level spot crypto trading is coming, and it’s going to separate the pros from the amateurs.

💥 Spot Contracts Unleashed

Here’s where it gets interesting. Right now, most US crypto trading is on futures—bets on where Bitcoin and Ethereum might go. Spot contracts change the game. You’re not betting on a future price; you’re buying and selling at the price right now, in real-time.

That means:

- Faster execution.

- Direct market exposure.

- Potentially tighter spreads and better liquidity.

The CFTC wants these contracts available on registered, regulated exchanges—not the Wild West offshore casinos. That means more trust, more volume, and less risk of getting burned.

📜 Legal Framework – Cutting Through the Red Tape

Let’s get technical for just a second.

The CFTC’s plan leans on:

- Section 2(c)(2)(D) of the Commodity Exchange Act: The core rulebook for derivatives and spot commodity trading.

- Part 40 regulations: The fine print that makes an exchange a “Designated Contract Market” (DCM).

Translation? If you want to offer leveraged or margined spot crypto contracts, you’d better be CFTC-approved. No approval? No business. That’s how they’re cleaning up the market.

Want the nitty-gritty? Check out our detailed trading insights or the full breakdown in our crypto policies section.

📢 Public Comment – Your Voice, Your Money

Deadline: August 18, 2025.

This isn’t a backroom deal. The CFTC is opening the floor to you, the traders, the projects, the funds. Want your opinion to shape the rules? Speak up before the window slams shut.

Because once these rules are live, they’ll decide who gets rich—and who gets rekt—in the new regulated landscape.

⚠️ Power Vacuum – CFTC’s Leadership Crisis

Here’s a curveball. Right now, the CFTC is down to just two commissioners after a string of resignations and political gridlock.

What does that mean for you?

- Slower approvals

- Possible regulatory delays

- More uncertainty (for now)

But don’t get complacent. When the dam breaks, the flood of new rules will hit fast. Stay ready, not reactive.

⚔️ Leveraged and Margined Contracts – The Double-Edged Sword

Leveraged trading is where fortunes are made—and lost.

With these new CFTC rules, leveraged and margined spot contracts (think: trading with borrowed money) will be locked down on registered, supervised exchanges.

- For pro traders: Expect new products, higher liquidity, and tighter spreads.

- For retail: It’s a wakeup call—more compliance, more checks, fewer cowboy operators.

Want to know how to play this new edge? See our trading insights and the newbie guide for staying safe while scaling up.

🔗 DeFi, DAOs & the Future of Decentralised Finance

This isn’t just about centralised exchanges. The CFTC’s move will ripple through DeFi, DAOs, and the entire blockchain ecosystem.

Questions you should be asking:

- Will your favourite DeFi protocol get blacklisted or become the new gold standard?

- How will DAOs comply when regulators come knocking?

DeFi is about to grow up—and the stakes have never been higher.

Stay ahead with our DeFi insights and ecosystems coverage.

📉 Industry Impact – Winners, Losers & Big Movers

Let’s talk money.

Who wins?

- Platforms ready to comply with CFTC rules (think Coinbase, Kraken, The Wolf Of Wall Street-backed projects)

- Traders who prepare early

Who loses?

- Unregulated offshore exchanges

- Cowboy projects that can’t (or won’t) adapt

For real-world case studies and instant updates, our news and cryptocurrencies hubs have your back.

🌍 The International Angle

The world is watching.

Will the US set the standard—or play catch-up to Europe and Asia?

- The EU’s MiCA regulations are already shaking things up

- Singapore and Hong Kong are moving fast

Global traders: this isn’t just a US story. What happens here will ripple everywhere.

See how it connects with layer-1 and layer-2 solutions worldwide.

🤑 Real-World Impact for Retail Traders

Here’s where it hits your pocket.

- Will your profits shrink or soar?

- Will KYC (Know Your Customer) slow you down or protect you?

- Are your favourite altcoins about to get delisted—or moon?

Compliance is the cost of entry. Smart traders will use the new rules as a moat, not a wall.

If you’re new, don’t panic—start with our newbie section and keep your finger on the pulse in our trending updates.

🛠️ Navigating the New Rules – Practical Steps for Traders

Don’t just sit there—take action. Here’s your three-point cheat sheet:

- Audit Your Exchange: Are you trading on a CFTC-registered platform? If not, move fast.

- Brush Up on Compliance: Get familiar with new KYC/AML processes and margin rules.

- Level Up Your Tools: Use calculators, market data, and VIP signals to outsmart the crowd.

For a one-stop toolkit, check out The Wolf Of Wall Street’s service platform and supercharge your edge.

👑 Community is King – Why You Need a Trading Community

You don’t get rich alone—ask any Wolf.

The most successful traders are plugged into the sharpest communities.

- Real-time VIP signals

- Unfiltered market analysis

- 100,000+ members for instant support and crowd-sourced insights

- 24/7 help desk—never miss an opportunity

That’s the kind of edge you get inside the The Wolf Of Wall Street crypto trading community. Don’t trade blind.

Join the Telegram group for live updates, trading banter, and real-time alpha.

🛣️ The Road Ahead – What’s Next for Spot Crypto in the US?

Mark your calendar:

- Public comment deadline: August 18, 2025

- Final rules drop: Watch for late 2025

Expect waves of:

- New exchange listings and delistings

- Major project pivots

- Retail traders flocking to registered platforms

Stay glued to our news, cryptocurrencies, and policies sections for every twist and turn.

❓ FAQs – Everything You’re Too Busy (or Smart) to Ask

1. Will these new CFTC rules kill off unregulated crypto exchanges?

Short answer: Many will disappear or relocate offshore. The US market will get leaner but safer.

2. How can traders prepare for the transition?

Start using CFTC-registered exchanges, learn the new compliance requirements, and join communities like The Wolf Of Wall Street for real-time updates.

3. What happens if my favourite coin isn’t listed on a regulated exchange?

High risk of delisting—diversify your portfolio and stay informed through our altcoin category.

4. Will DeFi projects face new barriers?

Yes, especially those offering leveraged or margined spot contracts. Keep an eye on our DeFi and ecosystems pages for project updates.

5. How can beginners get a head start?

Check out our newbie guide, follow trading insights, and connect with The Wolf Of Wall Street’s community for mentorship and resources.

🐺 Conclusion – The Wolf’s Take

Bottom line?

The CFTC’s push for spot crypto trading on registered exchanges is the market’s next big shakeup. Winners will be the ones who see the opportunity, get educated, and move before the rules go live.

Want to play like a Wolf? Plug into the right community, use every tool, and never stop learning.

Stay hungry. Stay compliant. Stay in the money.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Ready to own the new era of spot crypto trading? This is your shot. Make it count.