🚀 Introduction: The Wolf’s Eye on Crypto Spoofing

Picture this: You’re on the brink of making a killing in the crypto markets. The price is climbing, the order book looks stacked, and suddenly—bam! The rug’s pulled. What you just witnessed isn’t random chaos. It’s a deliberate play—cryptocurrency spoofing—a manipulation tactic straight out of the Wall Street playbook, but turbocharged for the digital age.

Crypto spoofing isn’t a game for amateurs. This is the Wild West of trading, where fortunes are made and lost in seconds, and the sharpest predator always wins. If you don’t know the rules, you’re lunch. But if you’re hungry for real money—and not some pipe dream—you need to know exactly how spoofing works, how it preys on your instincts, and, most importantly, how to turn this knowledge into your unfair advantage. Ready? Let’s break down the game.

🕵️♂️ What Is Cryptocurrency Spoofing?

Spoofing is the digital world’s ultimate bluff. It’s the art of faking intent—placing huge buy or sell orders you never plan to fill, all to fool the herd and move the market in your favour.

The Art of the Decoy Order

Imagine a whale dumps a mountain of buy orders just below the current price. Suddenly, the market thinks big money’s about to flood in. FOMO (fear of missing out) kicks in, retailers pile in behind, and the price surges. But before those orders ever get filled, the whale yanks them. The price spikes, then tumbles, and the only people holding the bag are the ones who fell for the trick.

Spoofing vs. Legitimate Market Activity

Legit traders place orders they actually want filled. Spoofers don’t. Their entire aim is psychological warfare—creating illusions of supply or demand, then vanishing before reality sets in. It’s not just dirty; it’s criminal. But in crypto, the lines blur, and the game’s even harder to police.

🧠 Psychology of the Game: How Spoofers Prey on Your Emotions

Let’s get real—money isn’t just numbers on a screen. It’s fear, greed, hope, regret. Spoofers know this, and they weaponise it.

FOMO, Fear, and Herd Mentality

Ever watched Bitcoin spike $2,000 in minutes, and felt that surge of adrenaline? That’s no accident. Spoofers place massive fake buy orders, sparking FOMO and a rush to buy. Conversely, a wall of sell orders can scare even seasoned pros into dumping fast, fearing a crash that may never come.

Emotional Triggers and Manipulation

Spoofers exploit these moments. They count on you to act on emotion, not logic. The more you’re swayed by the crowd, the easier you are to fleece. In the words of every Wolf: If you’re not playing the player, you are the player.

💹 Mechanics: How Cryptocurrency Spoofing Works

Let’s peel back the curtain and see how these pros pull it off.

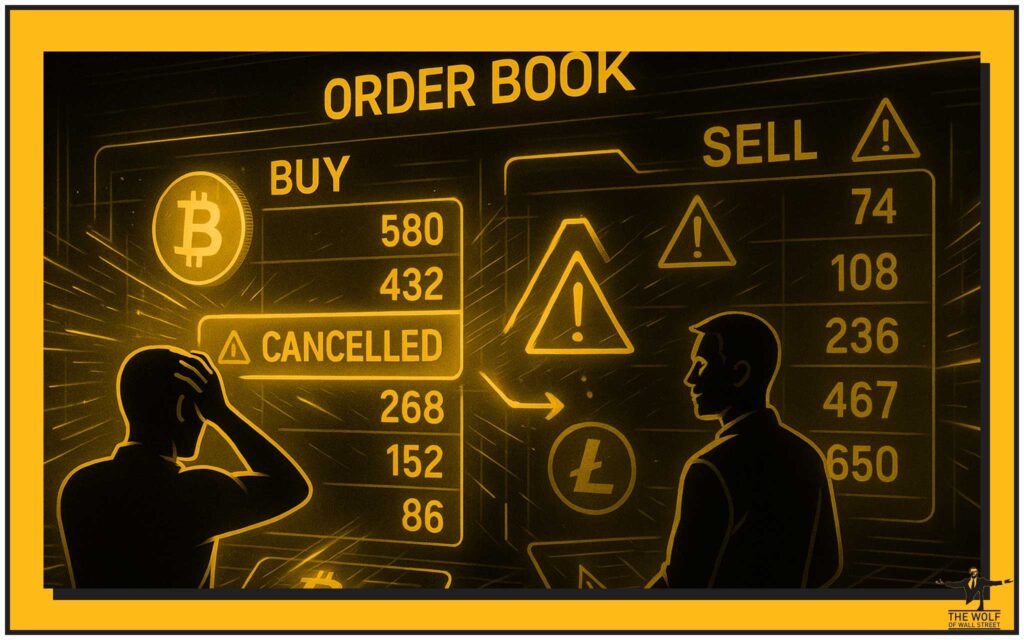

Step-by-Step Breakdown

- Place Large Orders: Spoofers enter huge buy or sell orders far above or below market price.

- Create Market Hype or Panic: Other traders see the “interest,” react emotionally, and follow suit.

- Cancel Before Execution: As price moves favourably, spoofers pull the fake orders, locking in their profits.

- Repeat: Rinse and repeat. The cycle continues, especially on exchanges with less oversight.

Spoofing vs. Wash Trading – The Dynamic Duo

Spoofing’s evil twin is wash trading—trading with yourself to pump up volume and lure in the unsuspecting. These tactics often work together, faking both demand and liquidity, sucking in retail investors who think they’re catching the next big wave.

💥 Volatility: Why Crypto Is the Ultimate Playground for Spoofers

The crypto market’s like the world’s biggest rollercoaster—wild swings, big rewards, and brutal losses. This volatility is a playground for manipulation.

Case Study: Bitcoin Flash Crashes

Bitcoin has seen drops of 10% or more in a matter of minutes. Sometimes these are triggered by real news. Other times, it’s a masterclass in spoofing—fake orders dump the price, panic sells ensue, and the whales scoop up cheap coins.

Altcoins and Thin Liquidity

It gets worse with altcoins—smaller coins with less volume. Here, a single whale can spoof the entire market. These coins are ripe targets: lower liquidity means fewer real buyers and sellers, so one manipulator can swing prices at will.

Want to learn how to navigate these wild swings? Check out our in-depth guide on Crypto Trading Insights for strategies the pros use every day.

🎯 Real-World Spoofing Cases

This isn’t just theory. Let’s talk real scams, real money, real consequences.

The Bitfinex Example

In 2021, Bitfinex was under fire for alleged spoofing activity that rattled the Bitcoin order books and triggered millions in forced liquidations. Fake buy and sell walls manipulated the price, while the real action happened elsewhere—leaving regular traders in the dust.

Spoofing on Major Exchanges

Binance, Huobi, and other big names have all faced scrutiny. While top-tier exchanges invest millions in security, spoofing persists, especially during high volatility events. Algorithms can catch some fakes, but in a market moving this fast, not everything is as it seems.

Historical Impact on Market Trust

Spoofing doesn’t just hit your wallet—it erodes trust. Retail traders burned by manipulation are less likely to invest again, draining liquidity and innovation from the market.

If you’re new and want a crash course on crypto risks, visit Newbie Essentials—because in this jungle, knowledge is survival.

🔍 How to Spot Spoofing: Red Flags & Tactics

Think you’re smart enough to spot the game? Here’s how you sniff out a spoof.

Order Book Patterns

Look for unusually large orders just outside the current price, often in round numbers. Real whales break orders into smaller chunks; spoofers want to be seen.

Sudden Order Cancellations

If massive orders vanish the moment the price nears them, that’s a dead giveaway. Spoofers act fast—if you blink, you’ll miss it.

Abnormal Volume Surges

Surges in trade volume, especially when paired with little actual price movement, often signal wash trading—a classic manipulation signal.

For more, see Mastering Crypto Order Types to understand how true pros manage their trades.

🛡️ Protecting Yourself Like a Pro

Survival in crypto isn’t just about profit—it’s about not getting played. Here’s the Wolf’s playbook.

Choose the Right Exchange

Stick with regulated exchanges that use advanced surveillance. Check if they’re registered with the FCA, SEC, or equivalent authorities. Shady platforms attract shady actors—don’t risk your bankroll on hype.

Leverage Tools (e.g., Volume Calculators, Order Tracking)

Platforms like The Wolf Of Wall Street offer essential tools: volume calculators, market analysis, and proprietary VIP signals. These aren’t toys—they’re weapons. Use them to cut through the noise and see the real market picture.

Community and Signal Groups

Don’t go it alone. Join private crypto communities where pros share insights, flag manipulation, and call out fake signals. The The Wolf Of Wall Street crypto trading community is one of the largest, with 100,000+ members and 24/7 support. Don’t just play the game—own it.

Dive deeper with Trading Insights and join the conversation on crypto fraud protection.

⚖️ Legal Status: Can You Go to Jail for Crypto Spoofing?

Let’s make this crystal clear: spoofing is illegal. It’s a federal crime in the US, with up to ten years in prison for every violation. And regulators are watching.

What the CFTC Says

The Commodity Futures Trading Commission (CFTC) treats spoofing as a serious market offence, with landmark prosecutions and multi-million dollar fines handed out over the past decade.

High-Profile Prosecutions

Big names have fallen—hedge fund managers, institutional traders, and even individual whales have been busted for spoofing. In 2018, one trader was sentenced to prison for manipulating the US futures market using crypto-related contracts.

Global Enforcement Gaps

While the US and EU crack down hard, many regions lack clear rules. This creates safe havens for manipulators. But make no mistake: the net is closing, and ignorance won’t save you.

Get up to speed on global crypto regulations with Cryptocurrency Policies and DeFi Compliance Guides.

📈 The Ripple Effect: Spoofing’s Impact on Retail Traders

Spoofing isn’t just a nuisance—it’s a wrecking ball for retail traders.

Losses, Missed Gains, and Emotional Burnout

Every spoof creates winners and losers. Spoofers bank easy profits; you get whipsawed by fake trends, take unnecessary losses, or—worse—miss out on legitimate opportunities.

Shattered Market Confidence

Too much manipulation, and retail traders bail. Liquidity dries up, prices get jumpier, and the market becomes a casino. Trust is the cornerstone of value—lose it, and even Bitcoin stumbles.

Read more about building your trading edge in Trading Insights and Crypto Profit Taking.

🧩 Exchange Security: How Platforms Are Fighting Back

The war on spoofing isn’t over. Here’s how exchanges are fighting dirty tactics.

Surveillance Algorithms

Top platforms deploy AI-driven surveillance, scanning for abnormal patterns and flagging suspicious activity. Some exchanges even publish transparency reports, tracking spoofing incidents and penalties.

Penalties for Bad Actors

From fines to permanent bans, exchanges aren’t messing around. Binance, for example, has delisted coins and booted users for market manipulation.

How Effective Are They, Really?

Progress is being made—but no system is foolproof. As long as profit is on the table, spoofers will keep trying. Stay sharp, use reputable platforms, and never get complacent.

🧭 The Wolf’s Playbook: Winning in a Rigged Arena

Here’s what separates the prey from the predators.

Mindset Over Hype

Stop chasing every green candle. Learn to read the market, not just react. The Wolf knows: cool heads make the biggest profits.

Diversification and Risk Management

Don’t bet the farm on a single coin. Diversify, use stop losses, and keep emotion out of the equation. The markets can stay irrational longer than you can stay solvent.

Never Trade Alone—The Power of Community

Solo traders get picked off first. Join communities like The Wolf Of Wall Street, where real traders share real insights and strategies. Success loves company—especially when that company is 100,000+ strong.

🔗 Further Learning and Internal Resources

Want to sharpen your edge even further? Here are some power links for deeper knowledge:

- Explore advanced strategies with Crypto Trading Insights.

- Learn to Master Crypto Order Types.

- Uncover hidden Crypto Fraud Risks and Protection.

- Dive into Bitcoin Trading Insights and Altcoin Market Guides.

❓ FAQs

Q: What makes spoofing so hard to detect in crypto?

A: Spoofers use rapid-fire orders and cancellations, making it hard for even top surveillance algorithms to keep up—especially in high-volatility markets.

Q: Are bots responsible for most spoofing activity?

A: Absolutely. Bots execute fake orders faster than any human could, scaling manipulation across dozens of coins at once.

Q: How can I verify if an exchange is truly regulated?

A: Look for FCA, SEC, or equivalent registrations. Reputable exchanges publish compliance data—don’t take their word for it, check public records.

Q: What’s the difference between spoofing and pump-and-dump?

A: Spoofing fakes order book interest; pump-and-dump hypes a coin, then dumps it. Both are scams, but spoofing is more technical and subtle.

Q: Can spoofing ever be stopped entirely?

A: Unlikely. Technology will keep evolving, but so will the scammers. Education, community, and vigilance are your best defence.

🏁 Conclusion: Your Next Move in the Crypto Game

If you’re still thinking crypto spoofing is just a minor annoyance, wake up. It’s a high-stakes, high-reward battlefield—only the smart, sceptical, and connected survive. The game isn’t fair, but the best games never are.

Stay sharp. Leverage the best communities—like the The Wolf Of Wall Street crypto trading community—for signals, analysis, and support. Never trade alone. And never let hype cloud your judgement. In the end, your greatest asset isn’t a hot tip or a lucky trade. It’s knowledge—and the discipline to use it.

📚 The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Want more high-value guides and strategy breakdowns? Explore our full crypto insights library and level up your trading game.