⚡ Introduction

Listen up — the game’s changed. In 2025, at least one cryptocurrency holder gets kidnapped, tortured, or extorted every single week. This isn’t a movie. This isn’t a Twitter rumor. Alena Vranova, founder of SatoshiLabs, laid it out on stage at the Baltic Honeybadger 2025 conference, and the numbers are brutal.

And before you start thinking, “That’s only for the Bitcoin whales,” let me smash that myth right now — you are just as likely to be targeted if you’re holding as little as $6,000 worth of crypto. Criminals don’t care about your portfolio size — they care about how easy it is to break you.

This article is your blueprint — not just to survive, but to stay ten steps ahead of the wolves hunting you. By the end, you’ll know the threats, the tactics, and the exact moves to secure your digital and physical wealth. Let’s go.

🥷 The New Face of Crypto Crime

We call them wrench attacks — not because the attackers literally use a wrench (though some do), but because they’ll beat the private keys out of you if that’s what it takes.

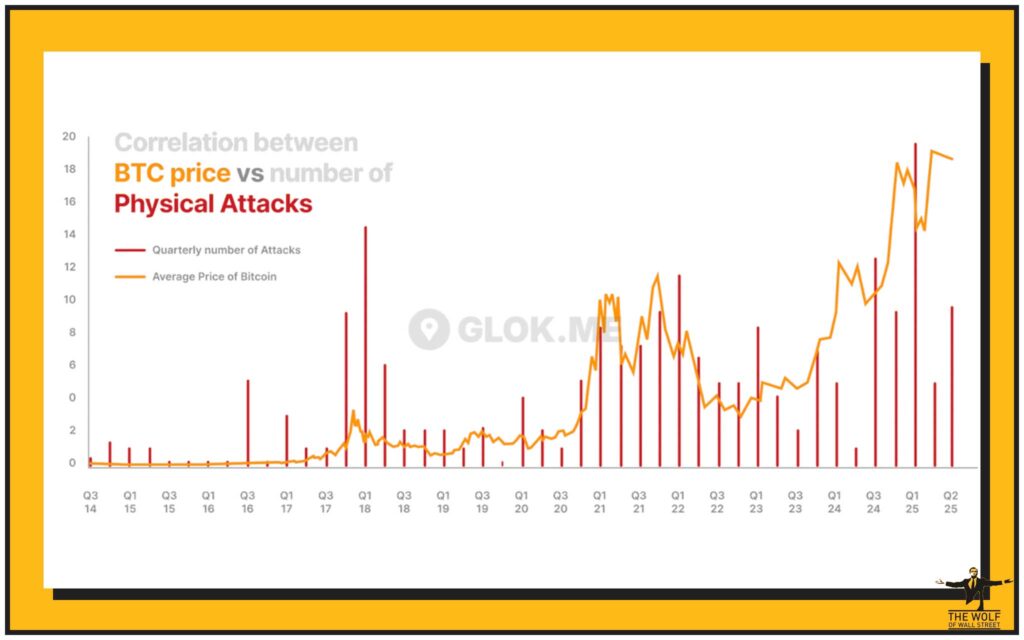

Here’s the scary part: 2025 is on track to double the worst previous year for these violent crypto-related crimes. The old rule was that thieves hid behind keyboards. Now, they’re standing at your front door.

We’re talking:

- Home invasions.

- Kidnappings in broad daylight.

- Victims killed over $50,000 in Bitcoin.

The line between digital and physical crime is gone. And anyone with an address, a wallet, and bad luck is in play.

🎯 Why Even Small Investors Are Targets

Forget the myth that only millionaires are worth the trouble. In reality, criminals are increasingly going after small fish. Why?

- Lower risk — You’re less likely to have sophisticated security.

- Faster payout — No need to negotiate; they get in, get out.

- Less heat — Small thefts don’t make headlines, meaning they can keep operating.

I’ve seen cases where a guy holding $6K in altcoins gets the same treatment as someone with a hundred Bitcoin. To the attacker, you’re not a person — you’re a walking withdrawal button.

🗺️ Data Breaches: The Criminal’s Treasure Map

Your risk level has nothing to do with your blockchain address and everything to do with your real-world footprint. Over 80 million crypto user identities are floating around on the dark web. Worse, 2.2 million of those include home addresses.

The Coinbase breach in May 2025? It didn’t just expose account data — it leaked some users’ actual residential details. That’s like giving a burglar your floor plan.

Then came the Cybernews June 2025 bombshell — 16 billion leaked credentials from giants like Apple, Facebook, and Google. Combine those with blockchain intelligence, and it’s open season.

You need to understand — a criminal doesn’t just guess your name. They pull your leaked email, tie it to your Telegram username, then cross-reference with your LinkedIn profile. Boom. Target locked.

Related reading: News, Cryptocurrencies

📈 The Bitcoin Bull Run Effect

When Bitcoin pumps, crime spikes. It’s not superstition — it’s economics. In bull markets:

- Everyone talks more about their gains.

- Portfolio values jump overnight.

- Criminal motivation skyrockets.

It’s the same in every cycle: 2017, 2021, and now 2025. Every time BTC rips upward, physical attacks follow like clockwork.

🛡️ More Than Just Wrench Attacks

The physical threat is bad enough, but it’s part of a bigger picture. Cyber and physical attacks are blending:

- Phishing: You click a fake link, give away credentials, and days later someone’s at your door.

- Social engineering: Criminals trick delivery drivers or service workers into revealing where you live.

- SIM swaps: Your phone gets hijacked, leading to stolen accounts and leaked info.

One recent case started with a leaked email, escalated into phishing, and ended in an in-person threat. That’s the new reality.

🏦 The Custodial Dilemma

Faced with rising physical threats, some investors are moving funds to centralised custodians. But is it safer?

Pros:

- Assets stored in guarded facilities.

- No home storage = reduced personal targeting.

Cons:

- You trust a third party with your private keys.

- You’re exposed to institutional hacks.

For some, it’s worth the trade-off. For others, self-custody remains king — but only if you lock it down.

Read more: Trading Insights, Bitcoin

🧠 The Psychology of Target Selection

Criminals use OSINT — Open Source Intelligence — to pick victims. That means:

- Your tweets about “buying the dip.”

- Your Instagram photo with a Lambo.

- Even your Discord banter about stacking sats.

Every public brag is a breadcrumb. Every breadcrumb is a map to your door.

📂 Case Files: Real Incidents from 2025

Case 1: A mid-level trader in Eastern Europe posts about hitting a 2x on Solana. Two weeks later, masked men force entry, demanding seed phrases.

Case 2: An Australian investor gets SIM-swapped after using the same email for Coinbase and Facebook. Days later, attackers show up in person.

Pattern? Loose digital hygiene → exposure → real-world confrontation.

🔒 Locking Down Your Digital Footprint

Here’s your 3-step purge plan:

- Scrub personal info from data brokers and public records.

- Compartmentalise — different emails, usernames, and numbers for different accounts.

- Harden access — hardware wallets, multi-factor authentication, and no cloud backups of seed phrases.

If you’re new, start with our Newbie guide.

🏠 Physical Security for Crypto Holders

Some basics that could save your life:

- Use a hidden safe bolted into the structure.

- Install motion-activated cameras with cloud storage.

- Never conduct large in-person transactions alone.

- Keep a low profile — no “crypto rich” image in public.

🤝 Leveraging Communities for Safety

Lone wolves get eaten first. The smart move? Plug into communities where you can share and receive real-time intel.

The The Wolf Of Wall Street crypto trading community is a prime example. Members don’t just get market insights — they get early warnings about active scams, phishing campaigns, and suspicious wallet activity.

With over 100,000 members, VIP trading signals, volume calculators, and 24/7 support, The Wolf Of Wall Street is more than a profit engine — it’s a shield.

Check the The Wolf Of Wall Street service or join their Telegram group to see the alerts in action.

🚀 The Wolf Of Wall Street as a Risk Mitigation Tool

Here’s how The Wolf Of Wall Street directly reduces your risk:

- Exclusive alerts on active threats before they hit mainstream news.

- Expert market analysis to avoid FOMO-driven exposure.

- Community watch — members flag suspicious actors instantly.

I’ve seen traders avoid five-figure losses simply because someone in the chat spotted a fake airdrop link in time.

📋 Action Plan: Your First 24 Hours of Security

Today, do this:

- Change passwords & enable 2FA on all crypto accounts.

- Move assets to a hardware wallet — no cloud backups.

- Join a vetted trading community for intel.

- Lock down your social media — stop broadcasting your wins.

⚠️ The Harsh Truth About Complacency

Thinking “It won’t happen to me”? That’s exactly what every victim thought. Complacency is your most expensive mistake. Criminals are opportunists — the moment you look like an easy mark, you’re done.

🐺 Final Word: The Wolf’s Take

I’m going to be straight with you — the crypto market isn’t just about charts and moonshots anymore. It’s a jungle. And in the jungle, the loudest, slowest, and least-prepared animals get eaten first.

You can either play blind and pray you’re not next, or you can stack the odds in your favour. Use the tools. Join the right circles. Harden your life like your future depends on it — because it does.

The wolves are out there. Don’t be their next meal.

❓ FAQs

1. What’s the safest way to store large amounts of crypto in 2025?

A combination of hardware wallets, multi-sig setups, and secure physical storage.

2. How can I check if my data has been leaked?

Use services like HaveIBeenPwned and remove your info from data broker sites.

3. Is it safer to use a custodial exchange or self-custody?

Depends on your ability to maintain security — custodians reduce home-targeting risk but introduce third-party trust.

4. How can a trading community like The Wolf Of Wall Street improve my safety?

By providing real-time alerts, fraud detection tips, and a network of eyes scanning the market 24/7.