💥 The Shockwave That Rattled Crypto

Two guys, a flashy pitch, a mountain of investor cash, and a scam so big it could have its own zip code. That’s the short version of the HashFlare saga — a $577 million Ponzi scheme dressed up as a crypto mining empire.

Sergei Potapenko and Ivan Turõgin didn’t just play the game; they rewrote the rules. They built dashboards, cranked out fake mining stats, and had hundreds of thousands of investors convinced they were printing Bitcoin like it was going out of style.

But here’s the kicker — while prosecutors screamed for 10 years behind bars, the judge gave them “time served.” Sixteen months in custody and they’re walking. And if you think that’s just a quirky court story, you’re missing the lesson: this is the perfect crash course in how not to get played in the crypto market — and how to spot the wolves before they circle.

📈📉 The Rise and Fall of HashFlare

The Pitch That Pulled In 440,000 People

HashFlare sold itself as the crypto mining solution for the everyday investor. You didn’t need your own rig, warehouse, or electric bill from hell. You just “rented” their mining power and watched the returns roll in.

It was clean, it was digital, it was seductive — and it looked legitimate enough to convince over 440,000 customers to jump in. The dashboards were slick. The mining data seemed real. And the marketing? It hit all the emotional hot buttons of the gold rush mentality.

The Mechanics of a $577M Ponzi Scheme

Behind the curtain, it was the same tired formula as every Ponzi scam since Charles Ponzi himself — new investor money was used to pay the old investors.

From 2015 to 2019, those shiny dashboards inflated mining capacity and ROI figures like a bodybuilder on steroids. And here’s the plot twist — $2.3 billion was withdrawn by investors over the years, which the defence used to argue that “most people didn’t lose much.”

Sure, if you were in early, you may have gotten out ahead. But if you came in late? You were the exit liquidity for someone else’s Lambo.

The Lifestyle of the ‘Crypto Rich’

Private jets. Luxury real estate. Cars that cost more than a house. Jewellery that could blind a camera lens. Potapenko and Turõgin weren’t shy about enjoying the spoils.

The optics were clear: they weren’t just running a business, they were living a fantasy on the backs of their investors.

🔗 Related Internal Links:

- Learn more about the crypto market and its opportunities.

- Understand how Bitcoin mining actually works before investing.

⚖️ The Legal Firestorm

The Arrest and Extradition Drama

In November 2022, the Estonian authorities made their move. Potapenko and Turõgin were taken into custody, starting a 16-month wait in detention before their extradition to the U.S. in May 2024.

They landed in a courtroom facing one of the largest fraud cases in Seattle’s history. The Department of Justice was ready to make an example out of them.

Courtroom Chess: Prosecution vs. Defense

The prosecution came in swinging: “10 years, minimum,” citing the size, scope, and sheer audacity of the fraud.

The defence counterpunched hard:

- $400 million in assets forfeited.

- 390,000 customers reportedly withdrawing their funds over time.

- “Net losses” claimed to be less severe than the headlines suggested.

Judge Robert Lasnik shocked the room — no extra prison time, just time served, $25K fines each, and 360 hours of community service.

The DHS Self-Deportation Confusion

Here’s where it gets weird. Despite a court order to stay in the U.S. for sentencing, Homeland Security told them to “self-deport” before the hearing. Legal observers scratched their heads, the press had a field day, and the defendants… walked right into one of the most lenient sentencing outcomes for a fraud case this size.

🌍 The Aftermath and Bigger Picture

Sentencing Disparities in Crypto Fraud

Just weeks earlier, another crypto scammer was hit with 12 years behind bars for a smaller scheme. That’s like stealing a candy bar and getting the electric chair while the bank robber gets probation.

This disparity raises questions: Are we looking at a new trend of leniency in complex crypto cases? Or was this just a fluke in the system?

DOJ’s Next Move

The DOJ isn’t thrilled. They’re weighing an appeal to challenge the sentence, and if they move forward, it could set a precedent for harsher penalties in future crypto fraud trials.

What It Means for the Crypto Industry

This case is a PR nightmare for the legitimate side of crypto. Public trust is already fragile, and every high-profile scam shakes it further.

But here’s the flip side — for savvy investors, this is an opportunity. The more noise there is in the market, the more you can profit if you know where to look and who to trust.

🧠 Lessons for the Smart Investor

Spotting the Red Flags Before You Lose

- Guaranteed returns in crypto = 🚩.

- Opaque operations with “proprietary” secrets = 🚩.

- Aggressive marketing that overpromises without proof = 🚩.

Why Due Diligence is Your Best Friend

Research the founders, the business model, and the actual mechanics of how the platform works. If you can’t explain how it makes money without new investor deposits, it’s not an investment — it’s a time bomb.

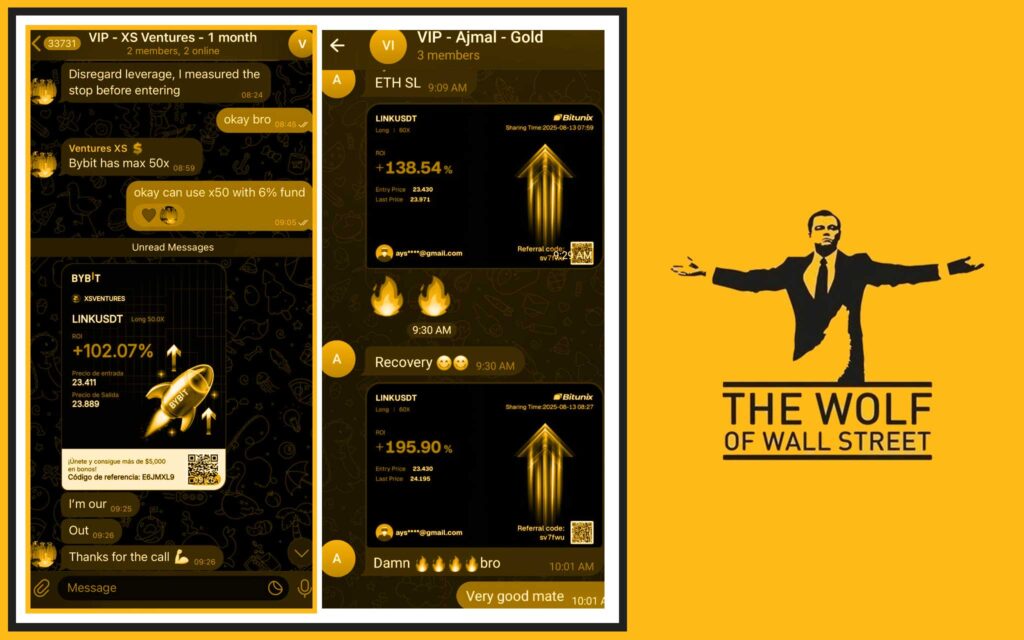

The Power of Community in Trading

One of the smartest moves you can make is to surround yourself with people who’ve been around the block. You want real traders, not hype merchants. A solid trading community can alert you to red flags before they blow up your portfolio.

💰 Turning Lessons into Profits

From Scammed to Savvy: Your Roadmap

- Only invest in platforms with transparent operations.

- Diversify — no single trade should be able to sink you.

- Use data-driven entry and exit points, not gut feelings.

- Keep a percentage of your portfolio in cold storage for security.

Why Platforms Like The Wolf Of Wall Street Keep You Ahead of the Game

If HashFlare was the warning, The Wolf Of Wall Street is the solution.

Here’s why:

- Exclusive VIP Signals help you hit the market at the right time.

- Expert Market Analysis keeps you out of hype traps and fake opportunities.

- Private Network of 100,000+ traders means you get real-time, battle-tested insights.

- Essential Tools like volume calculators keep your decisions sharp.

- 24/7 Support means you’re never trading blind.

🔗 Related Internal Links:

- Get sharper trading insights from the pros.

- Stay ahead with trending market analysis.

🏆 Don’t Just Play the Game, Win It

The HashFlare saga is a masterclass in greed, illusion, and misplaced trust. But it’s also a reminder that in crypto, you’ve got two choices: be the wolf or be the sheep.

Armed with the right knowledge, the right tools, and the right network, you’re not just avoiding scams — you’re positioning yourself to take advantage of the volatility that takes others out.

The wolves are out there. The question is… are you running with them, or running from them?

❓ FAQs

- Was HashFlare ever a legitimate operation?

In its early marketing, it appeared so, but evidence shows the core model relied on Ponzi-style payouts. - What happens to the $400M in forfeited assets?

They’re intended for victim compensation, though the exact distribution process can take years. - How can I check if a crypto project is a scam?

Look for transparency in leadership, clear revenue sources, and third-party audits. - What’s the difference between mining and staking?

Mining secures proof-of-work networks via computing power; staking secures proof-of-stake networks via locked tokens. - How can The Wolf Of Wall Street help me avoid scams?

Through VIP signals, verified analysis, and a community of experienced traders who share real-time insights.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.