💣 Intro – The Big Lie

You think Wall Street just strolled into crypto last year? Wake up. They’ve been swimming in this ocean long before you even knew what “HODL” meant. While you were stacking sats, they were stacking influence. And now? They’re not just dipping their toes — they’re re-engineering the entire game.

The danger isn’t just regulation or SEC press releases. The real threat? Wall Street’s ability to wrap crypto in traditional finance machinery, to make it look safe while quietly draining the very volatility that gave early adopters insane profits.

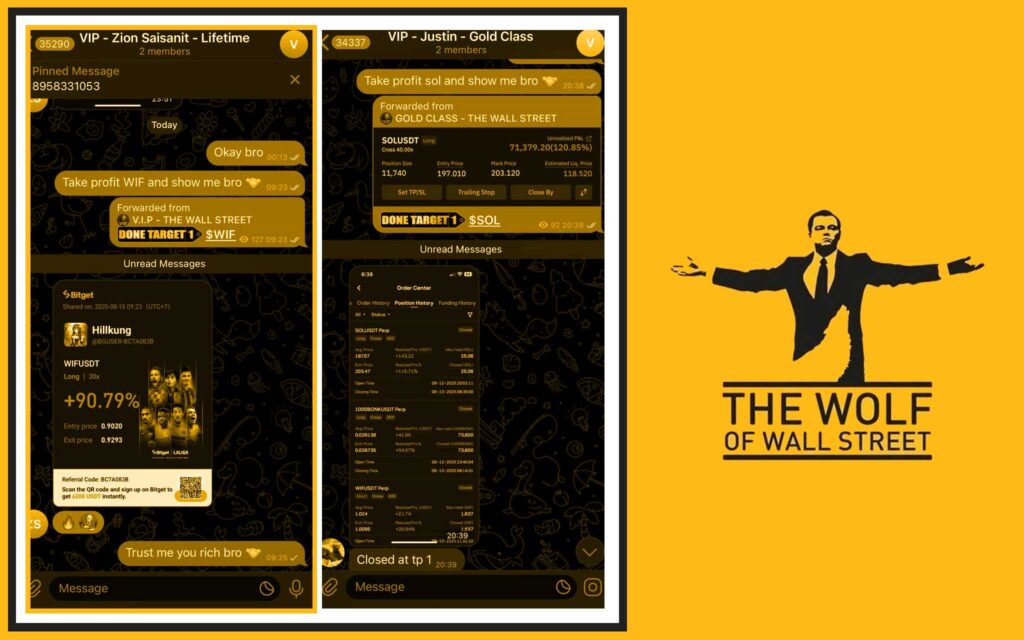

But here’s the thing: markets don’t reward the clueless. If you want to win in this new Wall Street–infested crypto world, you either learn the rules they play by or you get eaten alive. And if you want the tools to play at their level, the The Wolf Of Wall Street crypto trading community is the smart money’s pit crew — delivering exclusive VIP signals, deep market analysis, and a network of over 100,000 traders who live and breathe profit.

🐺 The Wolf’s Eye View on Wall Street in Crypto

Wall Street didn’t send out a press release announcing their arrival. They slipped in quietly — via OTC desks, private funds, and even early mining operations.

They didn’t need fanfare; they needed control. And while retail traders were battling each other in Telegram groups, institutional desks were loading up positions through prime brokers and custodians.

This is exactly how they’ve always operated: enter quietly, absorb liquidity, set the terms. And now, those terms are in their favour.

🔄 Hypothecation & Rehypothecation: The Double-Edged Sword

Let’s strip the jargon.

- Hypothecation: You pledge your asset (Bitcoin, ETH, whatever) as collateral for a loan.

- Rehypothecation: That same asset gets pledged again… by someone else… for another loan.

In traditional finance, this is perfectly legal. But in crypto? It’s a ticking time bomb.

Imagine the same Bitcoin appearing on five different balance sheets. You think you own it, your broker thinks they own it, and their lender thinks they own it. Guess what happens when the music stops?

Pull-quote: “Not your keys, not your coins… and if they’re rehypothecated, not even your claim.”

🏦 The Custody Crisis Waiting to Happen

Here’s the nightmare scenario: an exchange or broker holding rehypothecated BTC collapses. Suddenly, there are multiple claims on the same asset. Who gets paid first? Spoiler: it won’t be you.

We’ve already had previews of this chaos: the FTX collapse, the Celsius bankruptcy. The messy reality is that custody rules designed for stocks and bonds don’t cleanly apply to crypto.

If you don’t control your private keys, you are playing the riskiest game in finance without knowing the rules.

🌐 The Illusion of Decentralization

Crypto was built on decentralization, but here’s the truth — most trading happens on centralized exchanges. And with that comes counterparty risk.

Even if your balance shows 5 BTC, unless you’ve pulled it into self-custody, it’s a database entry, not a guarantee. True decentralization — P2P trades, self-hosted wallets — is still a niche play.

If you want a deeper breakdown of how these models differ in risk and profit potential, read the P2P vs Centralized Crypto Exchanges Profit Guide.

📉📈 From Chaos to Control: Volatility Then vs. Now

Back in the early days, volatility was king. You could see Bitcoin swing 20% in a single day — insanity for traditional markets, paradise for aggressive traders.

That was retail-driven chaos: FOMO pumps, panic dumps. But now? Wall Street’s algorithms and high-frequency bots have smoothed those waves. Less drama. Less opportunity for the little guy to score life-changing gains.

🏛️ The ETF Invasion: Wall Street’s Trojan Horse

First came the Bitcoin futures ETFs in 2021 — a way to get exposure without touching the actual coins. Then, in 2024, the spot Bitcoin ETFs arrived. Suddenly, retirement funds and conservative investors could “own Bitcoin” without ever downloading a wallet.

Sounds like a win for adoption, right? Sure — but it also hands Wall Street control over huge pools of crypto liquidity. They can move the market without touching the blockchain.

Want the full playbook? See the Bitcoin & Ethereum ETFs Guide.

🦄 Ethereum Joins the Club

May 2024: the SEC greenlights Ether spot ETFs. Game changer. Now, institutions aren’t just in Bitcoin; they’re deep in Ethereum too.

That means bigger players in DeFi, Layer-1 ecosystems, and staking infrastructure. It’s a huge vote of confidence… and a massive shift in control.

More on ETH’s Layer-1 role here: Layer-1 Foundational Coins Crypto.

⚖️ The Stability vs. Profitability Trade-Off

Institutions hate volatility. Retail traders live for it. Less volatility means fewer jackpot trades — but that’s exactly what Wall Street wants.

In a stable market, they can leverage size, speed, and insider access to extract profit while retail settles for crumbs. If you want to stay competitive, you need tools that exploit micro-volatility, not just big swings. That’s where The Wolf Of Wall Street’s exclusive VIP signals turn small moves into consistent wins.

🧩 The Domino Effect: Systemic Risk in Crypto

Long collateral chains work… until they don’t. If one major counterparty defaults, the whole chain can snap, triggering a cascade of liquidations.

We saw this in 2008 with mortgage-backed securities. Now imagine it with Bitcoin and ETH — assets that can move 10% in a day.

🎯 How to Play Offense, Not Defense

Want to survive and thrive? Here’s the Wolf’s checklist:

- Self-custody is non-negotiable — get your coins off exchanges. Learn the difference in the Private Key vs Seed Phrase Guide.

- Avoid centralized lending platforms unless you fully understand the rehypothecation risk.

- Use institutional-grade analysis and trading signals — the kind The Wolf Of Wall Street delivers daily.

📜 The Wolf’s Rules for Thriving in a Wall Street-Run Crypto Jungle

- Rule #1: If you don’t hold the keys, you don’t hold the asset.

- Rule #2: Volatility is your friend — if you know how to ride it.

- Rule #3: Follow the smart money, but don’t become their exit liquidity.

📚 Case Studies: When Custody Confusion Crushed Investors

- FTX: Billions in customer funds tied up in bankruptcy court.

- Celsius: Investors forced into creditor status, fighting for scraps.

Lesson: If your asset’s on someone else’s balance sheet, you’re a creditor, not an owner.

🔄 Adapting Your Trading Strategy in the Institutional Era

You can still win — but you have to adjust:

- Use ETFs tactically — hedge spot positions or capture arbitrage.

- Trade smaller, sharper moves in a less volatile market.

- Diversify into under-the-radar plays — see the Research Crypto Opportunities Guide.

🚀 The Future: Wall Street’s Endgame for Crypto

Two possible futures:

- The Corporate Blockchain Era — fully regulated, low-volatility, institution-dominated.

- The Hybrid Future — institutions coexist with a thriving, decentralized, high-volatility underground.

The Wolf’s bet? Retail survives — but only those who adapt their mindset and tools.

🐑 Conclusion – Don’t Be the Sheep

Wall Street isn’t coming for crypto — they’re already inside the gates. They’ll stabilise it, monetise it, and bend it to their rules. Your job? Stay ahead.

Don’t just watch the game change — play it better than the big boys. Start with the tools that give you an edge:

If you’re serious about making it in the next phase of crypto, you need more than hope — you need strategy.

❓ FAQs

- What is rehypothecation and why is it risky in crypto?

It’s when the same asset is pledged as collateral multiple times, creating ownership confusion. In a default, you may lose your claim. - How can I protect my assets from custody disputes?

Use self-custody wallets and avoid platforms with unclear rehypothecation policies. - Are Bitcoin and Ether ETFs good for retail investors?

They provide exposure without custody risk, but you lose decentralization benefits. - How does Wall Street affect crypto volatility?

Institutional trading strategies often reduce volatility, limiting high-profit swing trades for retail. - What’s the safest way to trade crypto in a Wall Street-dominated market?

Combine self-custody with reliable market analysis and risk-managed trade execution.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet