🔥 The 0.2% That Could Change the Game

Listen up, because this is the kind of thing that can either make you or break you in the markets. New York is about to slap a 0.2% excise tax on every single crypto and NFT transaction you make — and if you’re not paying attention, you’re going to watch your profits bleed out drip by drip.

Assembly Bill 8966 is the weapon. September 1 is the date. And your wallet? That’s the battlefield.

You think 0.2% is nothing? That’s what the slow movers say… right before they get blindsided by the compounding effect over hundreds of trades.

Let’s break down why this matters, how it’s going to hit your bottom line, and — most importantly — how you can stay two steps ahead.

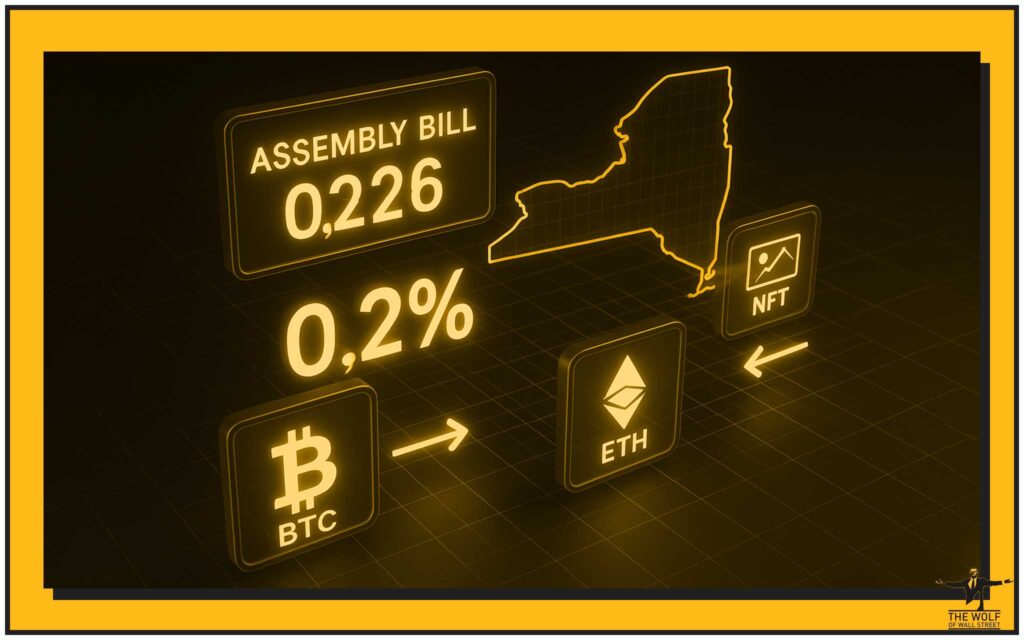

📜 The Bill at a Glance: Assembly Bill 8966

Here’s the straight talk:

- Rate: 0.2% excise tax.

- Scope: Every sale, transfer, and exchange of digital assets — we’re talking Bitcoin, Ethereum, Solana, meme coins, and NFTs alike.

- Start Date: September 1 (if it passes the gauntlet).

- Purpose: Funding substance abuse prevention and intervention programs in upstate New York schools.

It’s not just about paying the tax — it’s about understanding what the state is doing here. This is precedent-setting stuff. The first small crack in the dam before more states rush in with their own versions.

🏛 The Bigger Picture: How NY Got Here

New York’s been eyeing the crypto space for years like a hawk. Back in 2015, they rolled out the BitLicense, the first big regulatory framework for digital assets in the U.S. Everyone laughed, complained, or packed up and left — but it set the tone for the entire industry.

Now? They see the market maturing, billions moving through their financial hub every day, and they want a cut.

This bill isn’t about killing crypto in New York — it’s about taming it. And when the financial capital of the world decides to set a rule, other states listen.

💰 Who Pays & How Much It’ll Hurt (or Not)

Let’s put this into numbers.

- You sell $10,000 in BTC → You owe $20.

- You flip $250,000 in NFTs over a year → $500 gone.

- If you’re a high-frequency trader moving $5 million annually → That’s a cool $10,000 straight to Albany.

For long-term HODLers? The sting is small — one or two trades a year, and you barely feel it. But for NFT degens, day traders, and arbitrage chasers… this is a constant tap on the shoulder.

🏙 New York – Crypto’s Wall Street

You can’t underestimate how big this market is in NYC. This isn’t some sleepy suburb — it’s the beating heart of U.S. finance.

You’ve got Circle (the USDC giant), Paxos (stablecoins, settlement tech), Gemini (the Winklevoss twins’ exchange), and Chainalysis (blockchain analytics) all right here. Billions in transactions flow through servers and offices in this city every day.

New York’s not just taxing your crypto — they’re taxing the nerve center of the global digital economy.

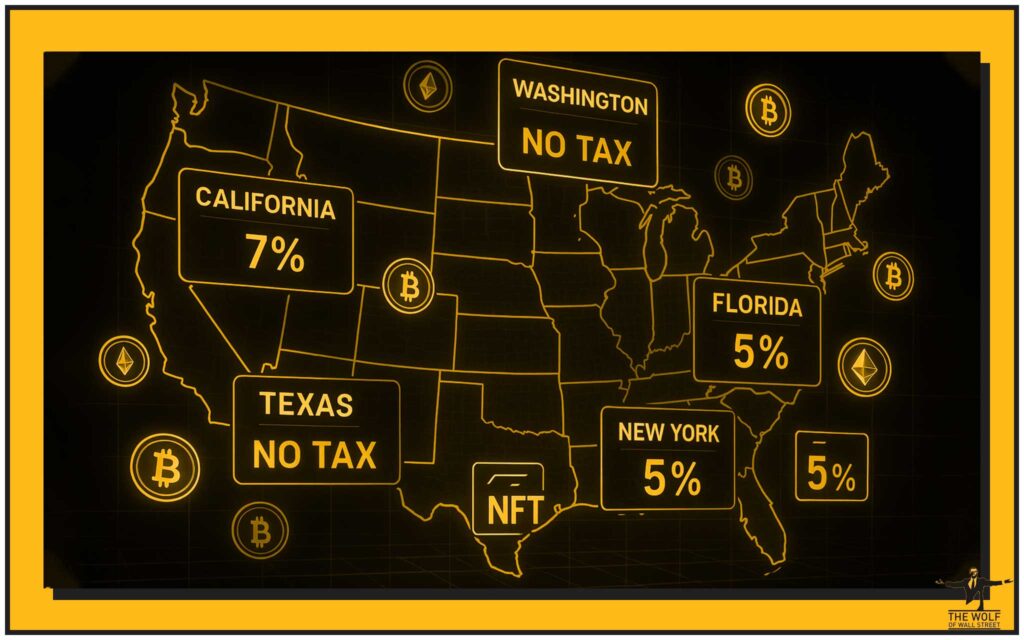

🆚 State-by-State Showdown: Crypto Tax Approaches

Every state’s playing a different game:

- California: Taxes crypto like cash — every transaction counts.

- Washington: Hands-off for certain types of trades.

- Florida & Texas: Rolling out the red carpet for crypto businesses.

New York’s move could tilt the balance. Friendly states may scoop up traders fleeing the Empire State… but they’ll also be watching the revenue numbers closely. If New York pulls in millions without tanking the market? Expect copycats.

⚖️ The Legislative Hurdles Ahead

This bill isn’t law yet. It’s got to survive:

- Committee review.

- Assembly vote.

- Senate vote.

- Governor’s signature.

That’s a political gauntlet — but don’t get too comfortable. The climate is right for passage, and lawmakers love bills that generate revenue for “good causes.”

📈 Industry Impact – The Good, The Bad, and The Ugly

Good: Stable, predictable regulation can attract serious institutional players.

Bad: Smaller traders and startups could get squeezed.

Ugly: If liquidity starts leaving NY-based exchanges, spreads widen, and the cost of trading rises even more.

The biggest risk? Death by a thousand cuts — not one massive regulation, but dozens of small ones piling up.

🎯 Winners & Losers

- Winners: State-funded school programs, regulators who want bragging rights.

- Losers: High-volume traders, NFT flippers, small exchanges.

- Neutral: Low-frequency investors and miners.

💡 How to Stay Ahead of This Tax

- Time your trades: Big moves before September 1 could save you cash.

- Track every transaction: Even that $50 NFT flip.

- Optimise your strategy: Fewer, larger trades instead of constant micro-moves.

📚 Lessons from History – Taxes that Changed Industries

Look at Wall Street’s reaction to the original securities transaction taxes — markets adapted. Same with tobacco and alcohol excise taxes. The market adjusts, traders find efficiency, and life goes on.

The winners aren’t the ones who complain. They’re the ones who pivot.

🚀 Action Plan for NY Crypto Traders

- Audit your portfolio — know your exposure.

- Evaluate exchange options — maybe NY-based isn’t optimal anymore.

- Leverage analytics tools to calculate tax impact in real-time.

- Stay plugged into communities for rapid updates.

🤝 The Role of Communities in Navigating Change

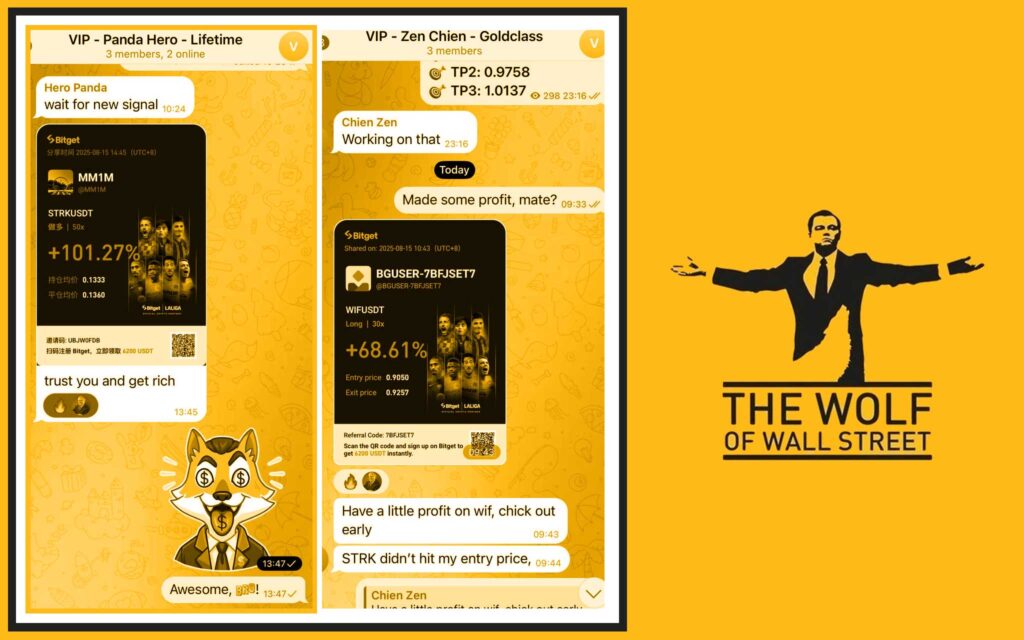

This is where trader networks earn their keep. Inside groups like The Wolf Of Wall Street, you get:

- Exclusive VIP signals tuned for maximising post-tax profits.

- Expert market analysis to outmaneuver new costs.

- Volume calculators to forecast exact tax impact.

- 100K+ traders swapping strategies 24/7.

When the rules change, the informed win.

💎 The The Wolf Of Wall Street Edge

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit The Wolf Of Wall Street service for detailed information.

- Join our active The Wolf Of Wall Street Telegram for real-time updates and discussions.

❓ FAQs

1. When will the NY crypto tax take effect?

If passed, September 1 is the launch date.

2. Does the tax apply to crypto-to-crypto trades?

Yes — it’s any digital asset sale or transfer.

3. Are NFTs taxed differently?

No — they fall under the same 0.2% rule.

4. Can individuals avoid the tax legally?

Only by reducing taxable transactions or relocating outside NY.

5. Will this encourage other states to follow suit?

Almost certainly if it proves profitable without harming markets.

Key Takeaway:

New York’s proposed 0.2% crypto tax is more than just another fee — it’s a signal. Adapt now, or watch opportunity pass you by. With the right tools and community, you can turn even this tax into a stepping stone.