🔥 Introduction: Breaking the Mold

SoFi Technologies just made history. It’s not another boring banking update—it’s a paradigm shift. SoFi is now the first U.S. bank to integrate the Bitcoin Lightning Network and Universal Money Address (UMA) into its ecosystem. Translation? Cheaper, faster, borderless money transfers for its 11.7 million members.

Later this year, the rollout begins in Mexico—ground zero for remittances. If you’re sending money abroad, this isn’t a small step forward—it’s a full-blown leap into the future of finance.

⚡ The Big Move: SoFi’s Integration of Bitcoin Lightning

SoFi isn’t dabbling in crypto anymore—it’s going all in. By adopting UMA and Lightning, the company is rewriting the rules of international remittances.

- Launch Target: Mexico, later this year.

- User Base: 11.7 million SoFi members.

- Service: Directly inside the SoFi app, no third-party hacks.

This isn’t a “crypto experiment”—it’s a bank-backed revolution.

🔑 How It Works: UMA + Lightning Demystified

Let’s break it down in plain English:

- You send dollars inside SoFi.

- UMA tech instantly converts USD → Bitcoin.

- The payment is shot across the Bitcoin Lightning Network at lightning speed.

- Recipient gets local currency in their bank account.

No middlemen, no SWIFT delays, no Western Union mark-ups. Just instant, low-cost money.

🎤 CEO Anthony Noto’s Pitch

SoFi CEO Anthony Noto isn’t mincing words: this is a “meaningful improvement” for families who send money abroad.

Translation? He knows remittances aren’t just transactions—they’re lifelines. Parents feeding kids, workers supporting families back home, students covering tuition. Faster, cheaper remittances = more money where it matters most.

💰 The Cost Advantage: Speed + Transparency

Here’s the kicker: SoFi’s fees will undercut U.S. averages for remittances. Every user sees:

- Exchange rate before sending.

- Fees upfront and transparent.

- No hidden charges waiting to bite.

Compare that to Western Union (average fee ~6%), MoneyGram, or even newer fintech players like Wise and Remitly. SoFi is bringing Wall Street firepower to a Main Street problem.

💎 The Remittance Goldmine: $740 Billion Market

Global remittances hit $740.5 billion in 2024.

And guess what? The U.S. → Mexico corridor is the world’s largest. Billions move every year from workers in the States sending funds to family in Mexico.

SoFi isn’t just entering a market—it’s stepping into a goldmine. And it’s doing it with lower costs, higher speed, and massive scale.

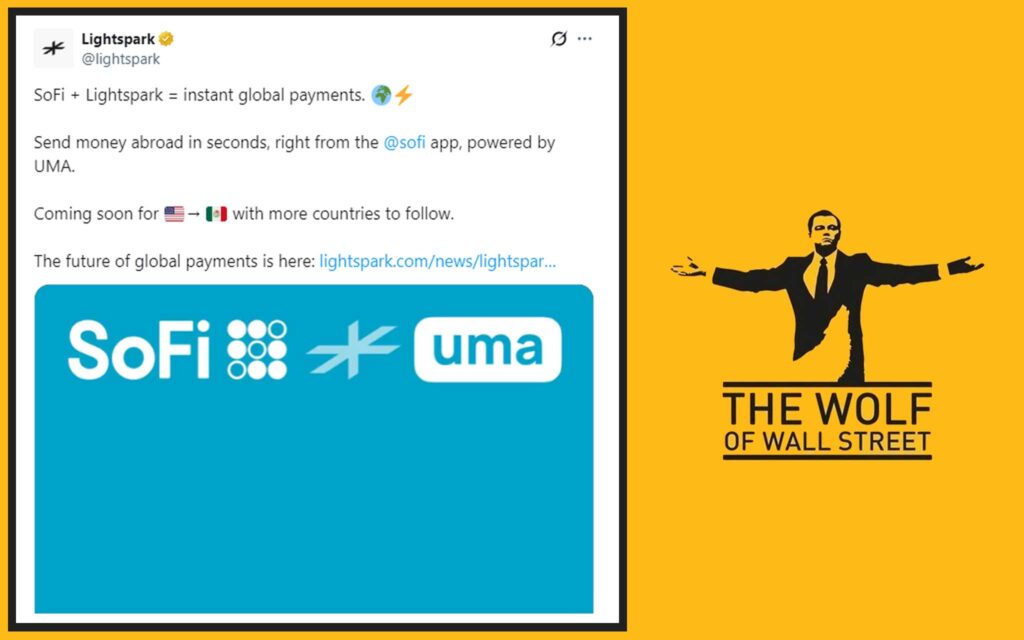

⚡ Technology Behind the Curtain: Lightspark

Behind SoFi’s move is Lightspark, founded by David Marcus (ex-PayPal president). His pitch? UMA makes sending money as easy as sending an email.

Think of it as the Gmail of payments. Type in someone’s UMA address, hit send, and boom—the money’s there. No IBANs, no routing codes, no friction. Just seamless transfers.

🥊 Competitive Landscape: Coinbase, Nubank & Beyond

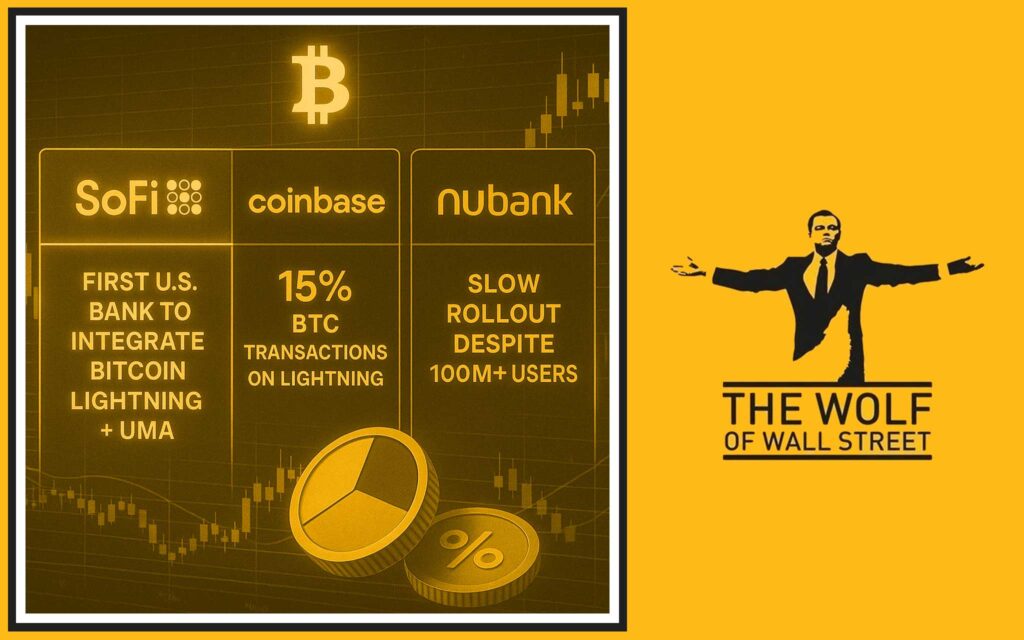

SoFi isn’t the only one sniffing this opportunity. But here’s where it dominates:

- Coinbase integrated Lightning in 2024. Result? 15% of BTC transactions now run on Lightning.

- Nubank (Brazil) partnered with Lightspark but is crawling at rollout speed despite 100M+ users.

- SoFi: First U.S. bank to integrate. That’s the difference—it’s not an exchange or a fintech app. It’s a regulated bank with millions of members.

This isn’t “crypto-native adoption.” This is mainstream banking flipping the switch.

⚖️ The Regulatory Lens: Friend or Foe?

Banking innovation doesn’t happen in a vacuum. Questions linger:

- How will U.S. regulators react to Bitcoin-powered transfers inside a bank?

- What about Mexican remittance rules?

- Can SoFi walk the line between innovation and compliance?

Answer: it has to. And the fact they’re going live means regulators are at least not slamming the brakes.

👪 Consumer Impact: What This Means for Everyday Users

Let’s cut through the tech talk. For the everyday user:

- Money lands faster—minutes, not days.

- Costs are lower—more pesos in a family’s pocket.

- Service is always-on—24/7 access, no banking hours.

It’s not just a fintech innovation—it’s a life upgrade.

📈 Investor Takeaway: Why This Is a Big Bet

For investors, here’s the play: SoFi isn’t just riding the crypto wave—it’s steering it.

- First-mover advantage in the largest remittance corridor.

- A sticky feature that keeps users glued to the app.

- Expansion potential: LATAM, Asia, Africa.

If SoFi executes, it’s not just disrupting—it’s dominating.

🌊 The Risks: Not All Smooth Sailing

Let’s be real. Risks exist:

- Bitcoin volatility: Currencies shift. But UMA conversions happen instantly, reducing exposure.

- Tech bottlenecks: Lightning is fast, but scale is still evolving.

- User trust: Convincing the average customer that “crypto rails” are safe will take work.

But every disruption carries risk. Winners don’t avoid it—they manage it.

🏦 SoFi’s Playbook vs. Traditional Giants

Traditional remittance players—Western Union, MoneyGram, Wise, Remitly—charge higher fees, take longer, and rely on old-school rails.

SoFi’s edge:

- Bank-grade trust.

- Crypto-native infrastructure.

- Transparent, cheap, instant.

That’s not just competition—it’s obliteration.

🧩 Crypto Adoption in Banking: The Domino Effect

SoFi is the first domino. But others will fall.

- Lightning adoption by banks = legitimising Bitcoin in finance.

- UMA addresses becoming standard could replace outdated account numbers.

- The line between banks, fintech, and DeFi? It’s blurring by the day.

SoFi isn’t following the future—it’s building it.

🔮 Strategic Outlook: Where This Goes Next

- Short-term: Dominate U.S. → Mexico transfers.

- Mid-term: Expand to other remittance-heavy corridors.

- Long-term: A world where banking rails are blockchain-native.

And when that world arrives, SoFi will be the OG mover.

🏆 Final Word: A Defining Moment for Crypto Banking

Let’s call it like it is: SoFi just redefined what it means to be a bank in 2025. By becoming the first U.S. bank to integrate Lightning + UMA, it’s not just innovating—it’s leading.

For remittances, this means faster, cheaper, smarter transfers. For crypto, it’s the validation it’s been waiting for. And for banking? The writing’s on the wall: adapt or get left behind.

🔥 The Wolf Of Wall Street Crypto Trading Community: Your Next Step

Want to ride the crypto wave beyond SoFi? Step into the The Wolf Of Wall Street crypto trading community.

Here’s what you get:

- Exclusive VIP Signals: Maximise trading profits with proprietary insights.

- Expert Market Analysis: Learn from seasoned crypto traders.

- Private Community: Join 100,000+ like-minded traders.

- Essential Tools: Volume calculators, real-time updates, and more.

- 24/7 Support: Always-on help when you need it.

👉 Check our service here

👉 Join our Telegram community

Empower your journey. Trade smarter. Profit bigger. Unlock your potential with The Wolf Of Wall Street.

❓ FAQs

1. What makes SoFi different from Coinbase or Nubank in Lightning adoption?

SoFi is the first U.S. bank to integrate Lightning + UMA, while Coinbase is an exchange and Nubank is still in slow rollout mode.

2. How much cheaper are SoFi’s fees compared to traditional remittance services?

SoFi’s fees will be below U.S. national averages (~6%), making it significantly cheaper than Western Union or MoneyGram.

3. Is Bitcoin volatility a risk in SoFi’s new system?

Not really. UMA instantly converts USD to BTC and back, reducing exposure to price swings.

4. Will this service expand beyond Mexico?

Yes. Mexico is the launchpad, but SoFi has a roadmap for other high-volume remittance markets.

5. How does UMA technology simplify the process for users?

It turns money transfers into an email-like experience. Easy addresses, instant confirmation, zero complexity.