🚀 The Fed’s Power Move Into Crypto: Game On

Listen up — when a top dog at the Federal Reserve steps up and says, “DeFi and crypto payments are nothing to be afraid of,” it’s not just a soundbite. It’s a shot fired across the bow of traditional finance. Christopher Waller, one of the most influential voices in U.S. monetary policy, just gave a masterclass at the Wyoming Blockchain Symposium. His message? Crypto isn’t a threat. It’s evolution.

Let that sink in — because if you’re sitting on the sidelines, it’s time to get off the bench. The real players are already gearing up. You’re either early… or irrelevant.

📉 From Caution to Confidence: The Fed’s Crypto Pivot

Remember back in 2022 when regulators were breathing down crypto’s neck? The Fed’s infamous “novel activities supervision program” practically slammed the door shut on banks dabbling in blockchain. But today? That door just swung wide open.

Waller confirmed what smart money already suspected — that program is dead. The outdated guidance discouraging bank involvement in crypto? Scrapped. We’re entering a new phase where blockchain tech isn’t feared — it’s respected.

Why? Because Waller knows what we all know: smart contracts, tokenization, distributed ledgers — they’re not buzzwords. They’re scalable tools for moving value faster, cheaper, and more securely. Period.

👉 Check out our breakdown of the Fed’s evolving crypto policy to see what’s really happening behind closed doors.

🍏 Waller’s Apple Analogy: DeFi for the Masses

Waller nailed it with a dead-simple analogy. Buying crypto with a stablecoin? It’s like buying an apple with your debit card. No fear. No complexity. Just another way to pay.

That comparison strips the drama from DeFi and frames it as what it really is — a streamlined, digitized payment rail. And that, my friends, is the kind of narrative that gets Main Street, Wall Street, and Capitol Hill aligned.

Let’s break it down:

- Smart Contracts: Automated rules. No middlemen. Just code doing its job.

- Tokenization: Real-world assets, digitized for frictionless trading.

- Distributed Ledgers: Transparent, secure records. No banker handshakes required.

This isn’t science fiction. It’s the infrastructure for a 21st-century financial system.

💵 GENIUS Move: Stablecoins Fueling Dollar Domination

Waller threw major weight behind the GENIUS Stablecoin Act — and for good reason. This legislation isn’t fluff. It’s the scaffolding for a digital dollar empire.

Stablecoins, especially U.S. dollar-pegged ones like USDT and USDC, are already filling gaps in economies riddled with inflation or poor banking access. Waller sees them not just as financial tools, but strategic weapons. They’re how America exports monetary stability.

Why this matters:

- In high-inflation countries, stablecoins are a lifeline.

- Cross-border payments become instant and nearly free.

- The U.S. dollar stays dominant — but digitally.

👉 Dive deeper into the world of altcoins and stablecoins — and discover which projects are worth your time.

📈 Numbers Don’t Lie: Stablecoin Market on Fire

Let’s talk growth. The stablecoin market today is valued at $280 billion. But by 2028? Try $2 trillion — a jaw-dropping 615% surge, per U.S. Treasury forecasts. That’s not speculation. That’s trajectory.

And who’s leading the pack?

- Tether (USDT): $167B market cap

- USDC: $67.5B and climbing

CoinGecko backs the data. And if you’re smart, you back the trend.

Want more stats and strategies? Tap into our real-time trading insights — built for traders who don’t sleep.

🏦 What This Means for You (Yes, YOU)

Here’s the kicker: Christopher Waller isn’t just any Fed governor. He’s the frontrunner to take over as Fed Chair in 2026. That means his pro-crypto stance isn’t just talk — it’s a preview of U.S. monetary policy.

What’s coming?

- Banks entering the DeFi arena

- Startups getting regulatory green lights

- Traders making moves while the mainstream catches up

You don’t want to be the person explaining to your future self why you missed this shift.

👉 Arm yourself with the crypto tools and services that matter and be part of the next financial frontier.

⚠️ Risk Isn’t Going Anywhere — But Neither Is Opportunity

Let’s not sugarcoat it. DeFi has risks. Hacks, scams, volatility — you name it. But so does every frontier worth exploring. The difference? You don’t go in blind.

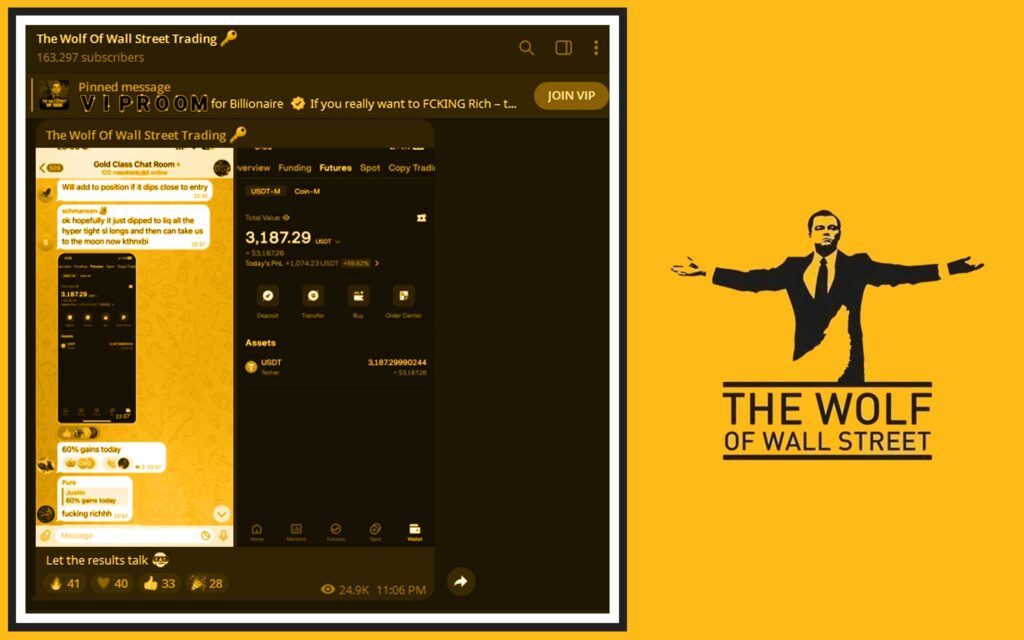

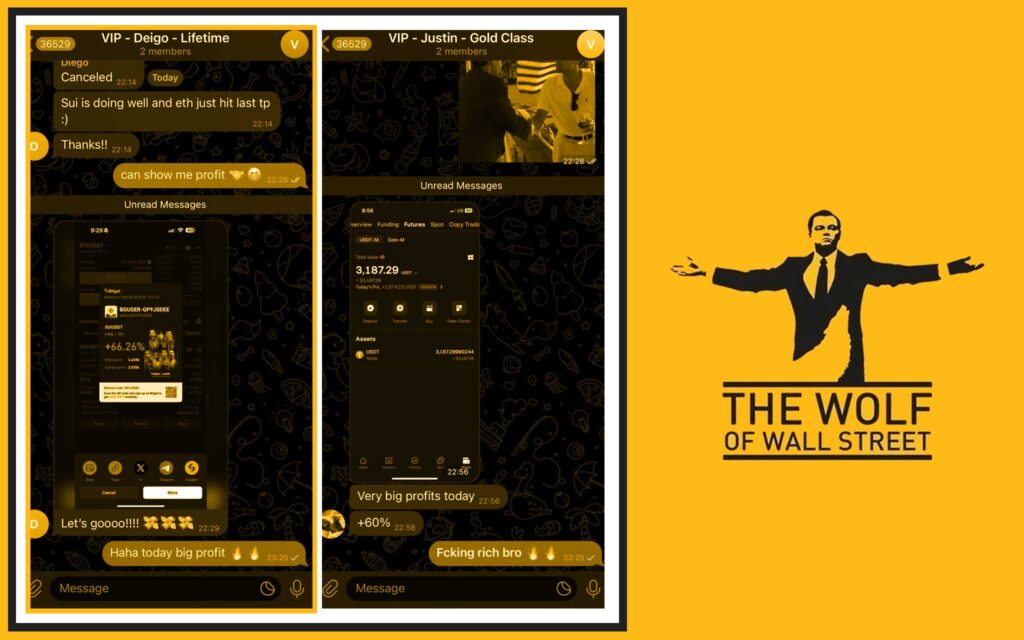

That’s why The Wolf Of Wall Street exists. We’re not here to hype. We’re here to equip:

- 📊 VIP Trading Signals — proprietary strategies that hit where it counts

- 📚 Market Analysis — from crypto veterans who’ve seen every market cycle

- 🧠 Private Community — 100,000+ minds stronger than one

- 🛠️ Tools & Calculators — built for precision

- 🎧 24/7 Support — because crypto doesn’t sleep

👉 Don’t miss our DeFi deep dives if you’re serious about strategy.

🔥 Final Word: Get In or Get Out of the Way

The Fed’s not afraid of crypto anymore. And neither should you be. When the people who set monetary policy start sounding like early adopters, the game changes.

So here’s your play:

- Be informed.

- Be prepared.

- Be in.

Start with our beginner guides, track the hottest market trends, and don’t just watch the future happen — trade it.

🧩 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street