🚀 Introduction – What the Hell is Hodling?

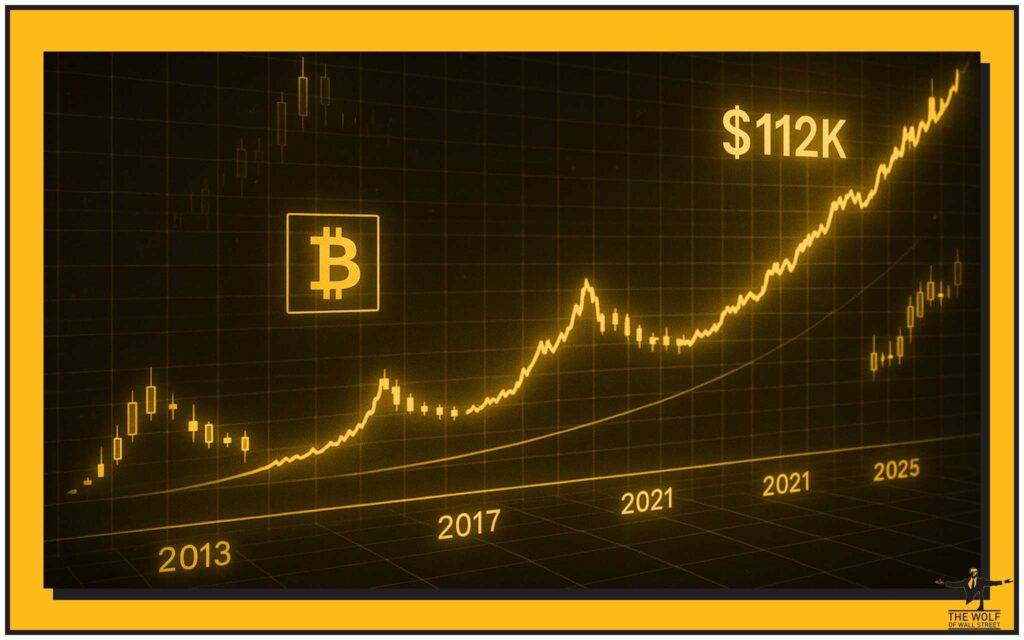

Bitcoin didn’t just stumble its way to $112,000 in 2025. It was dragged there by one of the most powerful, misunderstood, and wildly effective strategies in the game: Hodling.

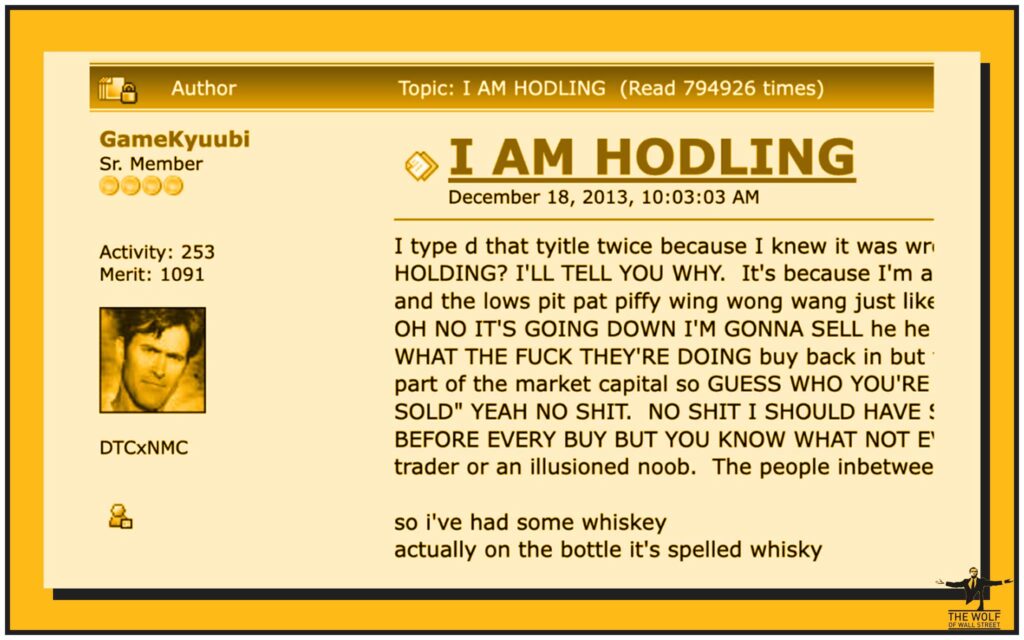

If you’re new, here’s the deal: hodling means you hold your Bitcoin long-term — no panic selling, no chasing pumps, no puking your portfolio at the bottom. The word itself came from a drunken 2013 forum post on Bitcointalk when someone mistyped “I AM HOLDING.” The crypto world loved it, turned it into a battle cry, and now here we are, a decade later, with hodling shaping the entire market.

It’s more than a meme. It’s the lifeblood of crypto conviction. Let’s break it down Wolf-style — direct, no BS, and dripping with value.

🔥 The Birth of Hodling

2013: Bitcoin crashes from $1,000 to $300. Traders panic. One guy slams his keyboard and writes, “I AM HODLING.” That single typo became gospel.

Why? Because in crypto, memes become movements. Hodling went from internet joke to financial philosophy. Those early hodlers who refused to sell? They weren’t just stubborn — they became millionaires.

This is where it all began: the anti-trading strategy that beats 90% of traders at their own game.

🧠 The Psychology of Hodling

Hodling isn’t just about wallets and blockchains — it’s about the mind. It’s built on loss aversion: the pain of losing is stronger than the joy of winning.

But true hodlers flip that psychology. They embrace volatility. They wear 20% daily swings like a badge of honour. That’s what “diamond hands” means — not flinching when your net worth gets cut in half overnight.

You can’t hodl without emotional discipline. The weak hands panic-sell at the bottom. The hodlers scoop the profits when the cycle flips.

👉 Want more on psychology in trading? Check out crypto trading insights.

🏦 Institutions Are Hodling Too

Here’s the kicker: it’s not just retail diehards anymore. Wall Street is in the game.

- Fidelity, BlackRock, ARK Invest — they’re all treating Bitcoin as “digital gold.”

- Over 70% of Bitcoin’s supply is now held long-term.

- Spot Bitcoin ETFs in the U.S. alone hold $94 billion in assets.

This is institutional conviction. This is hodling at scale.

👉 Dive deeper with our ETPs vs ETFs Investment Guide.

💹 2025 Market Context

Let’s not sugarcoat it: Bitcoin’s path wasn’t clean. FTX imploded, regulators circled like sharks, inflation spiked worldwide. Yet by mid-2025, Bitcoin smashed through $112,000.

Why? Hodlers.

- Scarcity: 93% of all Bitcoin is already mined.

- Demand: Institutional inflows haven’t slowed.

- Conviction: Hodlers didn’t sell when the headlines screamed “Bitcoin is dead.”

This is why hodling crushed active trading in 2025.

⚖️ The Risks: Regulators & Rivals

Regulation is heating up. The SEC, EU, and Asia have all tightened rules on exchanges, custody, and taxation.

At the same time, CBDCs (Central Bank Digital Currencies) and tokenized US treasuries are entering the market. They’re shinier, they’re compliant, but here’s the truth:

They don’t kill Bitcoin. They just highlight how much people want non-government, non-corporate, decentralised money.

👉 Learn more about crypto regulations in 2025.

🔐 Storage Solutions for Hodlers

If you’re hodling, your #1 job: protect your coins.

- Cold Wallets (Ledger, Trezor): Offline, secure, immune to hacks.

- Hot Wallets: Now with multisig setups and decentralised ID for safer access.

- Hybrid Approach: Long-term storage cold, active funds hot.

👉 Protect yourself by reading our Private Key vs Seed Phrase Guide.

📊 Institutional Custody & Yield

Institutions don’t just hodl — they do it with style:

- Coinbase Custody, Fidelity Digital Assets, Anchorage offer regulated, insured vaults.

- Yield products are booming: Bitcoin-backed stablecoins, BTC staking derivatives.

- Institutions want to hodl and earn at the same time.

For big players, hodling isn’t passive anymore — it’s profit-engineered.

🤖 Automation Tools for Hodlers

Smart hodlers don’t just hold — they automate.

- Dollar-Cost Averaging (DCA): Buy Bitcoin weekly/monthly, ignore noise.

- Auto Cold-Storage Withdrawals: Zero exchange exposure.

- Inheritance Planning: Multi-signature wallets ensuring wealth passes on.

- Portfolio Trackers: Real-time data, no private keys needed.

👉 Curious about automation? Read about Trading Bots vs AI Agents.

🏆 Why Hodling Works Long-Term

The math is brutal and clear:

- Traders pay fees, make emotional mistakes, get chopped up by volatility.

- Hodlers? They ride the cycle, avoid FOMO, and accumulate wealth.

- Bitcoin’s long-term chart doesn’t lie: up and to the right.

That’s why hodling wins. Period.

⚠️ The Dark Side of Hodling

But let’s get real — hodling isn’t all sunshine and Lambos.

- Opportunity Cost: You miss staking or trading gains.

- Regulation: Governments can make life difficult.

- Mental Strain: Watching your net worth drop 80% isn’t for the faint-hearted.

Hodling takes guts. It’s simple, but not easy.

⚔️ Comparing Hodling to Other Strategies

Hodling vs Trading: traders get wrecked. Hodlers win cycles.

Hodling vs Staking/DeFi: staking earns yield, but with smart contract risk.

Hodling vs Passive Income Tools: depends on your time horizon.

👉 Want alternatives? Check how to earn crypto without selling.

🌍 The Cultural Power of Hodling

Hodling isn’t just financial — it’s cultural.

- Memes like “diamond hands” and “to the moon” created a global tribe.

- Hodling became a badge of honour, proving you’re in it for the long haul.

- That culture made Bitcoin unstoppable — because belief drives adoption.

🔮 The 2030 Outlook

Next halving is coming. Supply tightens. Institutions keep stacking. Models predict $1M Bitcoin by the decade’s end.

Will it happen? No guarantees. But if history repeats, hodlers will be the winners again.

👉 Don’t miss our Bitcoin $1 Million Impact Analysis.

📝 Practical Tips for New Hodlers

Want to hodl like a pro? Follow the rules:

- Secure Storage: Cold wallet is king.

- Set Rules: Decide when (or if) you’ll ever sell.

- Automate Buys: Dollar-cost average and forget the noise.

- Ignore Headlines: Media screams “Bitcoin dead” every cycle.

Play it smart. Stay patient. That’s how hodlers win.

🐺 Conclusion – The Wolf’s Verdict

Listen — hodling isn’t passive, it’s powerful. It’s the strategy that turned memes into millionaires, amateurs into legends, and Bitcoin into a $2 trillion beast in 2025.

Institutions, retail investors, hedge funds — they’re all doing it now. Hodling works because it’s backed by scarcity, psychology, and conviction.

If you’re serious about playing this game long-term, remember this: Hodling is not just holding. It’s winning.

❓ FAQs

1. Is hodling Bitcoin still profitable in 2025?

Yes — Bitcoin’s price growth, ETF inflows, and scarcity validate hodling as the most effective long-term play.

2. What’s safer: cold storage or custody?

Cold wallets are best for individuals. Institutions use insured custodians.

3. How do ETFs affect hodling?

ETFs soak up supply, making hodling even more powerful as scarcity grows.

4. Is hodling better than staking?

Depends on your risk appetite. Hodling is safer; staking offers extra yield but with risk.

5. What’s the biggest risk of hodling?

Regulatory crackdowns and personal security (losing access to your wallet).

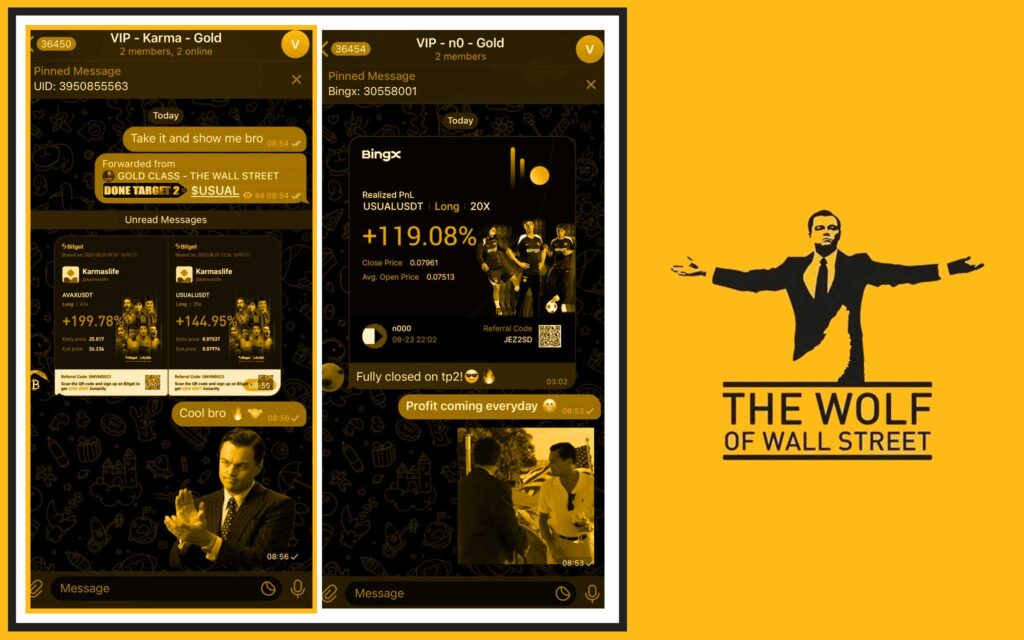

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street