🚀 Ethereum’s All-Time High and Sharp Pullback

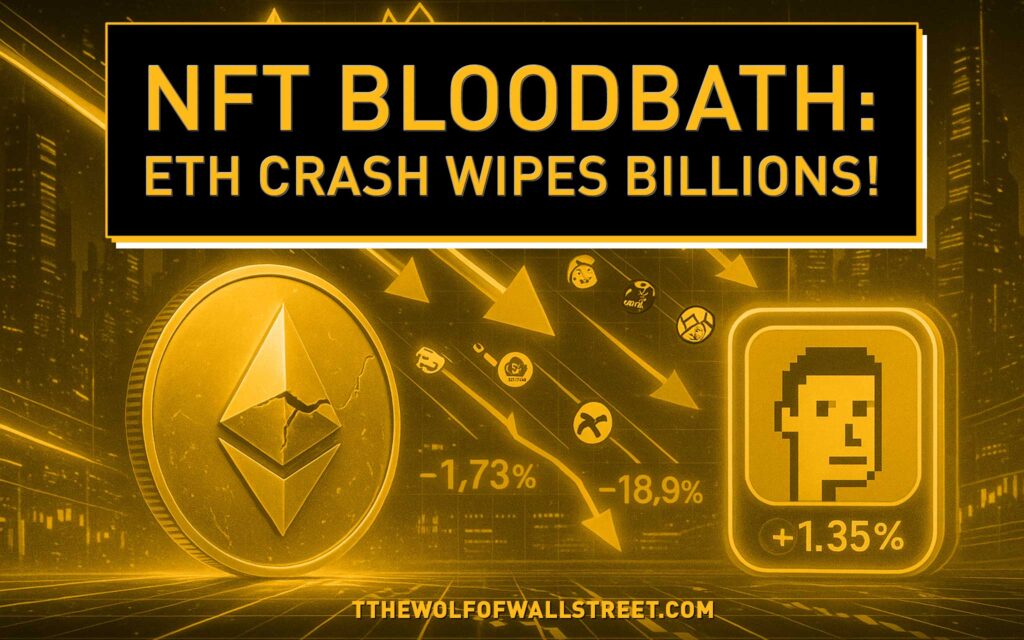

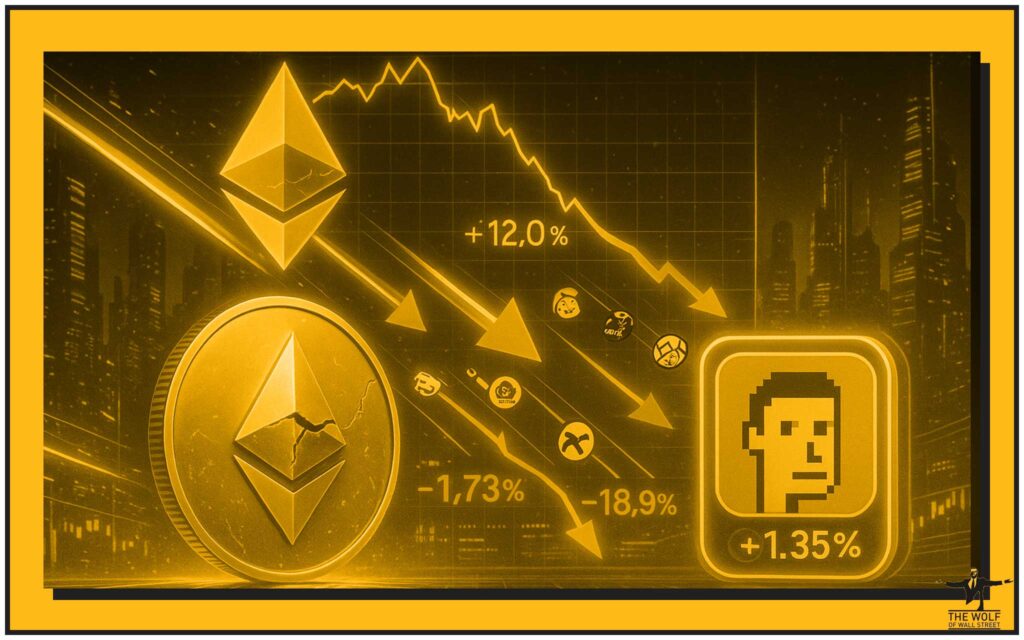

Ethereum just pulled one of the oldest tricks in the market playbook: hit a record high, then rip it away from traders before they can cash out. ETH soared to a staggering $4,946, sparking euphoria across crypto and NFTs. But like a rollercoaster that’s too good to be true, it plunged 12% within days, landing around $4,433. That correction? It lit the fuse on a chain reaction in the NFT market.

This is the reality: when ETH sneezes, NFTs catch pneumonia.

💸 How ETH’s Price Dictates the NFT Market

Let’s get something straight — NFTs don’t live in a vacuum. Their value is chained to ETH like a race car to nitrous. When ETH pumps, NFT floor prices skyrocket because traders feel rich and liquid. When ETH dumps, NFT floors collapse as liquidity evaporates. It’s not magic. It’s math + psychology.

Think of NFTs as a leveraged bet on ETH: higher upside in bull runs, harder downside in corrections.

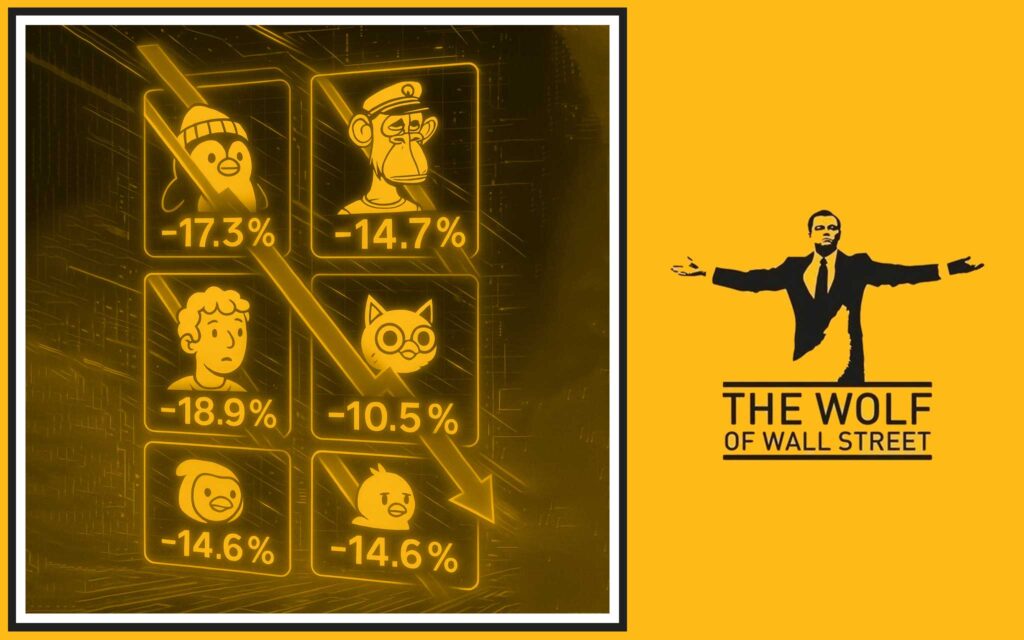

🐧 Pudgy Penguins: From Cute to Crushed (-17.3%)

The adorable Pudgy Penguins got slammed — floor prices dropped 17.3% to 10.32 ETH. But here’s the twist: trading volume hit 2,112 ETH (~$9.36M). Translation? Holders were dumping, but buyers with conviction were scooping them up. Weak hands out, strong hands in.

That’s not collapse. That’s redistribution.

🦍 BAYC: The Ape Empire Stumbles (-14.7%)

Bored Ape Yacht Club, the once untouchable status symbol of crypto culture, slid 14.7% down to 9.59 ETH. Harsh? Absolutely. But let’s not forget: BAYC isn’t just JPEGs, it’s a cultural brand with IRL influence. The dip could be temporary — or a sign the collection’s expansion (Mutant Apes, Otherside, merch drops) is stretching community loyalty too thin.

Apes are still apes. But are they still kings? The market is asking the same question.

🎨 Doodles and the Art of Decline (-18.9%)

Doodles took one of the steepest hits: -18.9%. Why? Community-driven projects without strong institutional backing suffer hardest in downturns. When ETH tanks, casual holders panic sell, crushing floors.

Lesson: pretty art doesn’t equal price resilience.

🦉 Moonbirds: Taking Flight, Then Freefall (-10.5%)

Moonbirds only dropped 10.5%, which looks like a win compared to Doodles. But dig deeper: they still logged a monster 1,979 ETH (~$8.77M) in trading volume. High turnover in a correction usually signals whales reshuffling positions.

Translation: volatility isn’t the enemy if you know how to play it.

🐧 Lil Pudgys: The Mini Penguins That Couldn’t (-14.6%)

Spinoffs like Lil Pudgys dropped 14.6%. Smaller collections tied to bigger brands often bleed harder in corrections. Why? Because the main collection hogs liquidity, leaving satellite projects exposed. Traders view them as speculative side bets — and side bets get cashed out first.

👑 CryptoPunks: The King Holds the Throne (-1.35%)

Amid the chaos, CryptoPunks barely budged — down just 1.35%. That’s not luck. That’s legacy. As the first true NFT collection with cultural prestige, CryptoPunks are seen as the Rolex of NFTs: they don’t lose value when markets shake, they gain respect.

CryptoPunks are the safe haven of the NFT world. If you wanted proof, you just got it.

📊 NFT Market Cap: From $9.3B to $7.7B

The big picture: NFT market cap fell nearly 5%, from $9.3B (Aug 13) to $7.7B (Aug 18). Painful? Yes. But this is part of the cycle. A $1.6B market cap haircut sounds brutal, but zoom out: NFTs are still commanding billions in liquidity. This isn’t a collapse — it’s a recalibration.

🔥 Trading Volumes Tell a Different Story

Here’s where it gets interesting. While floor prices fell, volumes spiked.

- Pudgy Penguins: 2,112 ETH (~$9.36M)

- Moonbirds: 1,979 ETH (~$8.77M)

- CryptoPunks: 1,879 ETH (~$8.33M)

- BAYC: 809 ETH (~$3.59M)

What does this tell us? People aren’t running away. They’re trading. They’re repositioning. Volatility isn’t death; it’s opportunity.

🧠 Why CryptoPunks Outperform in Bearish Pullbacks

Why did CryptoPunks shrug off the crash? Simple:

- Scarcity: Only 10,000 exist. Period.

- Cultural Weight: They’re the Mona Lisas of NFTs.

- Whale Support: Deep-pocketed holders don’t panic sell.

This is why institutions prefer CryptoPunks. It’s not about hype. It’s about credibility.

⚖️ Risk vs. Opportunity in NFT Trading During ETH Volatility

Volatility is where fortunes are made — and lost. Retail traders panic. Pros hunt deals. If you want to win, you need to:

- Manage risk with stop-loss levels.

- Track ETH–NFT correlations.

- Recognise when high volume = accumulation.

The smart money knows: chaos creates chances.

🔮 What Happens If ETH Rallies Again?

If ETH claws back toward $5K, NFTs could rip higher. Expect blue chips like CryptoPunks and Pudgy Penguins to rebound first. They’ve already proven resilience. Weak collections? They’ll stay buried.

Winners rebound harder. Losers disappear. Simple as that.

📉 What If ETH Falls Further?

Let’s flip the coin. If ETH breaks down below $4,000, NFT floors could see another 20–30% haircut. Smaller projects may vanish altogether. Traders without a plan? Toast. Traders with discipline? Buying opportunities.

Bear markets don’t kill wealth. They transfer it.

💼 What This Means for Investors and Traders Right Now

Here’s the straight talk:

- ETH drives NFT valuations. Never forget it.

- CryptoPunks are battle-tested. They’re the fortress in a storm.

- Volume spikes signal conviction. Watch them like a hawk.

If you’re trading NFTs, stop thinking like a collector. Start thinking like a strategist.

And above all — stop trading blind.

🔗 Internal Links for Deeper Insights

Want more strategies and breakdowns? Check out:

🏆 Conclusion – The Wolf’s Call to Action

Ethereum’s pullback just proved a truth the market keeps teaching: not all NFTs are created equal. The weak collections bled. The strong ones — CryptoPunks especially — stood tall. This is a lesson in resilience, liquidity, and psychology.

If you’re serious about trading, you can’t afford to just hope. You need real-time data, signals, and a network of killers who know how to play the game.

📌 The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a powerhouse platform for navigating this exact type of volatility. Here’s what you get:

- Exclusive VIP Signals → maximise your profits

- Expert Market Analysis → insights from seasoned traders

- Private Community → 100,000+ sharp traders sharing plays

- Essential Tools → volume calculators and pro-grade resources

- 24/7 Support → so you’re never left hanging

Empower your trading journey:

This is how you stop gambling and start trading like a wolf.