🔥 Introduction – The Big Breakthrough

Listen up. Bitwise just dropped a bomb on Wall Street and the crypto world: an S-1 filing with the SEC to launch the first-ever US spot Chainlink ETF. That’s right—Chainlink, the altcoin powering decentralised oracles, is moving out of the crypto jungle and into the regulated financial spotlight.

This isn’t just news. It’s the moment altcoins stop being “high-risk casino tokens” and start earning the respect of institutional capital. Bitcoin and Ethereum opened the door. Chainlink is barging in next.

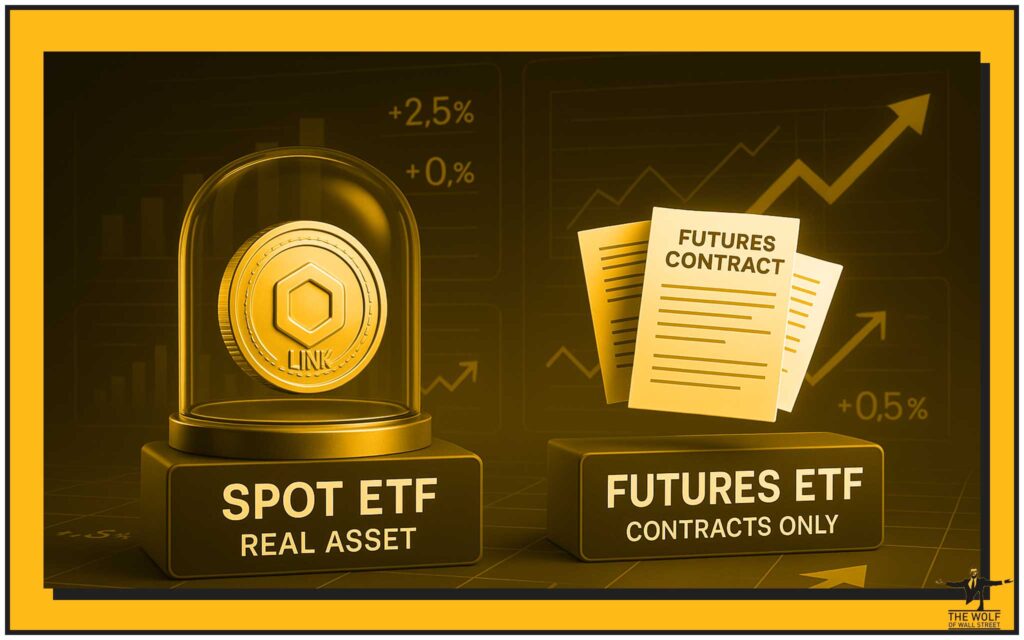

🚀 What is a Spot Crypto ETF?

Let’s cut through the noise. A spot ETF tracks the real underlying asset. No futures contracts, no leverage gimmicks. You want Chainlink exposure? A spot ETF gives you LINK, plain and simple—wrapped in a regulated package that Wall Street loves.

The difference is huge:

- Futures ETF: You’re betting on contracts, not the asset itself. Prone to price slippage.

- Spot ETF: You’re tied directly to LINK’s real-time market value. Transparent. Tangible. Solid.

This is why investors are salivating. Spot ETFs are the bridge between crypto chaos and regulated finance.

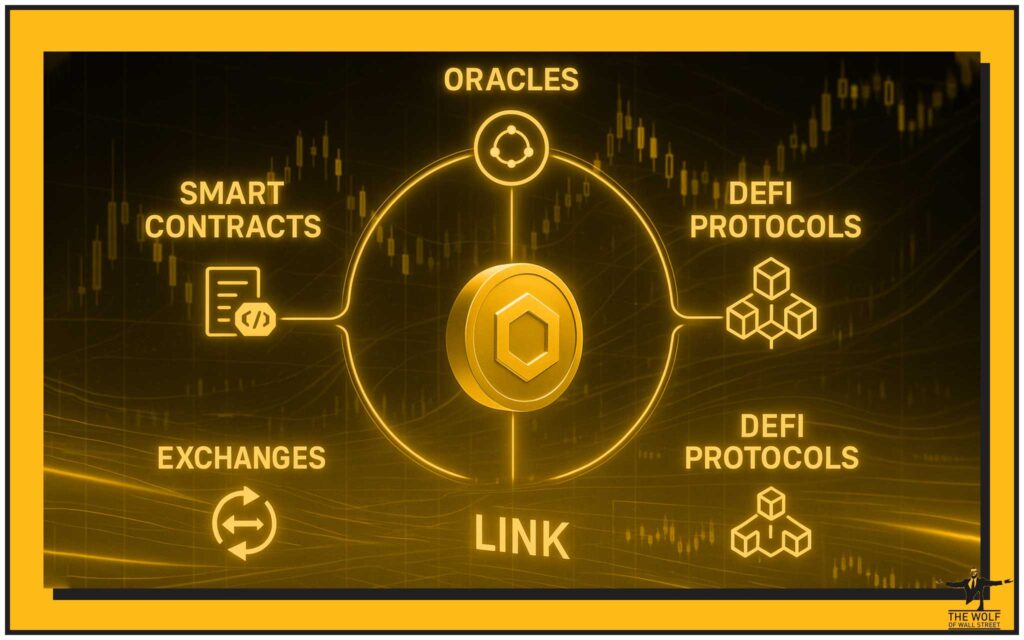

📈 Why Chainlink? The Altcoin Powerhouse

Chainlink isn’t just another altcoin. It’s the plumbing of decentralised finance. Its oracles connect smart contracts with real-world data. DeFi platforms, exchanges, and protocols rely on it to function.

The LINK token fuels the network. Without LINK, decentralised finance would collapse like a house of cards. That’s why this filing matters: it signals Wall Street has finally recognised Chainlink’s indispensable role.

🏦 The Filing: Bitwise’s Strategic Move

On August 26, 2025, Bitwise Asset Management submitted the S-1 registration with the SEC. This isn’t their first rodeo. Bitwise already has Bitcoin and Ethereum ETFs live, with billions under management.

Now they’re playing the altcoin card, and they want to be first. Why? Because in ETFs, being first means owning the market. Investors don’t chase second place.

👉 Want more breaking news? Check out our News hub or dive into our Cryptocurrencies section. For deeper coverage of non-BTC assets, explore Altcoins.

🔒 Custody & Security – The Coinbase Trust Factor

Here’s where the institutional money gets comfortable. Bitwise appointed Coinbase Custody Trust Company as the official custodian. That means LINK tokens for the ETF are stored in a regulated, secure vault.

This isn’t some shady offshore wallet. It’s Wall Street-grade security. And institutions need that reassurance before they write seven-figure cheques.

💰 NAV & Pricing – How the ETF Gets Its Value

The ETF’s net asset value will track the CME CF Chainlink–Dollar Reference Rate. Translation? Investors get pricing that’s transparent, audited, and benchmarked against a recognised standard.

When you’re playing in regulated markets, transparency isn’t optional—it’s mandatory. This is how Bitwise builds trust with both regulators and investors.

📊 Creation & Redemption – The 10,000 Share Block Mechanism

Like other crypto ETFs, shares are minted and redeemed in blocks of 10,000. Investors can transact in LINK directly or in USD.

That dual flexibility is massive. Institutions can move in USD. Crypto-native traders can deliver LINK. Everybody wins.

📉 The Market Reaction – LINK Price Surge

Chainlink didn’t just smile at the news—it spiked 4.2% immediately after the filing. Trading volumes shot up as investors scrambled to front-run the institutional wave.

Remember this: ETFs don’t just provide access. They ignite demand. And if demand surges while LINK supply remains capped, you already know what happens next.

🏛️ The Delaware Trust Structure – Institutional Playbook

Bitwise is running the ETF through a Delaware statutory trust. Why Delaware? Because it’s the gold standard for fund structures in the US.

This move signals to the SEC: “We’re playing by the book.” It’s exactly the play institutional investors expect.

🌍 The Bigger Picture – Altcoin ETFs Going Mainstream

This isn’t just about Chainlink. It’s about the altcoin ETF revolution. Bitcoin ETFs opened the floodgates. Ethereum followed. Now altcoins are storming in.

Recent filings include:

- Avalanche ETF (Grayscale)

- JitoSOL ETF (VanEck)

- Even a TRUMP token ETF (Canary Capital)

The trend is crystal clear: regulated access to altcoins is the new frontier.

👉 For more on decentralised finance, see our DeFi coverage, or learn about evolving Layer 1 & Layer 2 Solutions. Traders, head over to Trading Insights for deeper strategies.

🥊 The Competition – Race for First-Mover Advantage

ETF issuers aren’t playing nice. They’re racing. Whoever lands the first Chainlink ETF dominates inflows. The first Bitcoin ETF in Canada? It’s still leading the pack years later.

First-mover advantage in ETFs isn’t marketing hype. It’s financial gravity.

⚖️ Risks & Challenges – The SEC Hurdle

Now, let’s not kid ourselves. This isn’t a done deal. The SEC remains cautious on altcoins. Approval delays, rejections, or additional compliance hurdles are still on the table.

Investors need to remember: ETFs don’t guarantee profits. They simply provide access.

🧠 What This Means for Retail Investors

Here’s the money shot: a Chainlink ETF means average investors—the ones with retirement accounts and IRAs—can finally get exposure to LINK.

No need for crypto wallets, private keys, or decentralised exchanges. Just buy shares in your brokerage account. Accessibility like this unlocks massive capital inflows.

🏦 Institutional Adoption – The Whale Factor

Institutions have been eyeing LINK for years but lacked a regulated entry point. This ETF provides it. Pension funds, endowments, and hedge funds now have a green light to pile in.

When whales move, the tide rises for everyone.

🛠️ How to Position Yourself Now

So, how do you play it? Smart traders aren’t waiting for SEC approval. They’re front-running the move, building LINK positions before ETFs funnel billions into the market.

Stay diversified, watch the timeline, and remember: being early in crypto is where the money is made.

👉 If you’re new to crypto, check out our Newbie Guide. For the latest hot picks, see Hot and Trending.

🔑 Key Takeaway – The Shift Has Begun

Bitwise’s filing is more than paperwork. It’s a signal that the era of altcoin ETFs has arrived. Chainlink is the spearhead, and institutional money is circling like sharks.

If you think crypto adoption is slowing down, think again. It’s just getting started.

❓ FAQs Section

1. What is the difference between a spot and futures ETF?

A spot ETF holds the underlying asset (LINK tokens), while a futures ETF tracks contracts tied to its future price. Spot = real asset exposure.

2. Why was Chainlink chosen for an ETF before other tokens?

Because Chainlink powers the DeFi ecosystem through oracles, making it system-critical compared to many speculative tokens.

3. How safe is Coinbase Custody?

It’s fully regulated and already trusted for billions in institutional assets. One of the safest custody solutions in the industry.

4. Will ETF approval guarantee LINK’s price rise?

No guarantees. But historically, ETF approvals for Bitcoin and Ethereum sparked massive inflows and price appreciation.

5. How can retail investors prepare for this development?

Research LINK, consider portfolio allocation, and stay updated on SEC decisions. Being early often makes the difference.

🎯 Conclusion – The Wolf’s Call to Action

Here’s the bottom line: Bitwise’s Chainlink ETF filing isn’t just another crypto headline. It’s a market-defining event. Altcoins are crossing into regulated finance, and Chainlink is leading the charge.

The institutions are coming. The liquidity is coming. The legitimacy is coming. The only question is: are you positioned to profit when it all hits?

Because in this game, hesitation kills.

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our Telegram: The Wolf Of Wall Street Community

Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.