🚀 Introduction: The Billion-Dollar Question

Here’s the deal: cryptocurrencies are wild. Bitcoin surges one week, crashes the next, and leaves retail traders crying into their keyboards. Enter stablecoins—pitched as the silver bullet, the anchor in a storm, the safe house of digital finance. But the real question is this: are they the cure to crypto’s volatility, or just another glossy illusion ready to collapse when the music stops? Let’s strip away the fluff and get to the raw truth.

💰 What Exactly Is a Stablecoin?

Stablecoins are cryptocurrencies engineered to hold their value steady. They’re pegged to real-world assets like the US dollar, gold, or in some cases, maintained by algorithms. The goal? Eliminate the insane volatility that makes Bitcoin and Ethereum thrilling but unreliable as day-to-day money.

Think of them as digital dollars on steroids—fast, borderless, and programmable.

🎯 Why Stablecoins Exist: Solving the Volatility Nightmare

Why do we even need stablecoins? Simple: volatility is a nightmare. Bitcoin can tank 20% overnight. Imagine paying rent in BTC—you’d either overpay by thousands or stiff your landlord.

Stablecoins step in as the bridge:

- A store of value in a volatile market.

- A medium of exchange for everyday transactions.

- The backbone of DeFi, enabling lending, borrowing, and staking.

Without stablecoins, decentralised finance would look like Vegas—exciting, but disastrous long-term.

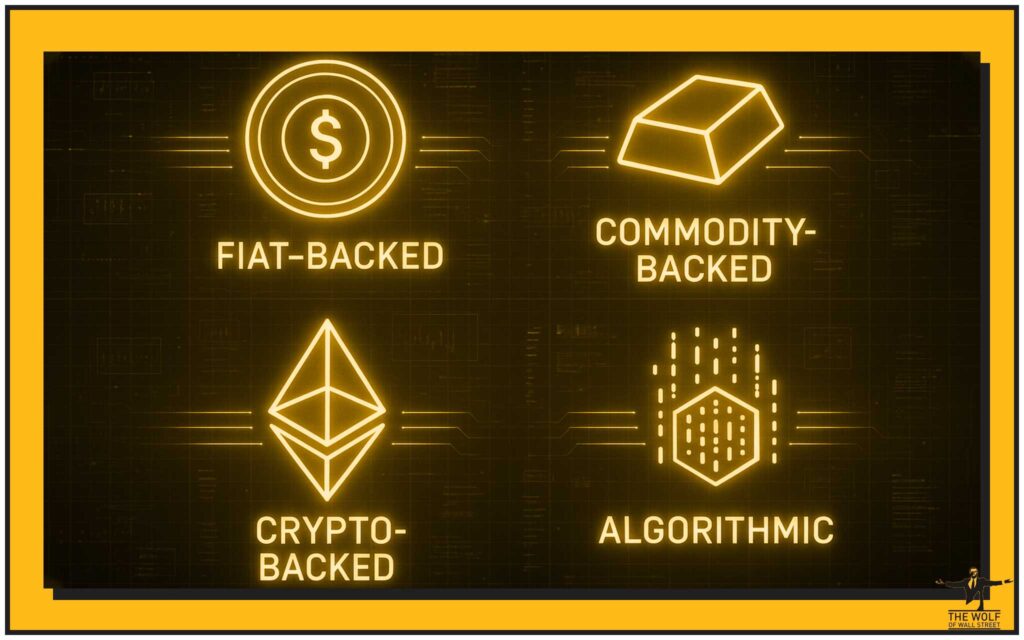

🛡️ How Stablecoins Keep Their Value (The Four Playbooks)

Let’s break it down street-smart style. There are four main categories, each with its own playbook.

1. Fiat-Collateralised: The Cash-Backed Kings

These are the OGs. They’re backed 1:1 with fiat currency. Think Tether (USDT) and USD Coin (USDC). When you buy one, the issuer supposedly locks a dollar in the vault.

The problem? Trust. You need rock-solid audits to prove the reserves exist. Without transparency, you’re just taking their word for it—and that’s a gamble.

2. Commodity-Collateralised: Gold-Backed Glory

Enter Paxos Gold (PAXG) and Digix Gold Token (DGX). These tokens are pegged to shiny commodities like gold.

Pros: Tangible, time-tested value.

Cons: Auditing the actual gold is tricky. Without transparent proof, investors can get sceptical fast.

3. Crypto-Collateralised: Backed by Volatility Itself

These guys use crypto as collateral—ironically using volatility to fight volatility. Example: MakerDAO’s DAI.

To protect against market swings, they’re over-collateralised. That means if you mint $100 of DAI, you might need $150 of ETH locked up.

Smart? Yes. Efficient? Not always.

4. Algorithmic Stablecoins: The Dangerous Game

This is where things get spicy. Instead of backing with assets, algorithms manage supply and demand to keep prices stable. In theory, it’s genius. In practice? Well, see TerraUSD below.

🔥 The TerraUSD Meltdown: A Hard-Learned Lesson

Let’s cut to the chase: TerraUSD (UST) promised stability with pure code. No collateral, just algorithms. It was marketed as the holy grail.

Then it collapsed. Billions evaporated. Investors lost life savings. The so-called stablecoin went from $1 to mere cents almost overnight.

Lesson? You can’t outsmart market psychology with math alone. TerraUSD is the poster child for why blind faith in code is dangerous.

📈 Stablecoins in Action: Real-World Applications

Despite disasters like UST, stablecoins are powerful tools:

- Payments & Remittances: Cheap, fast, cross-border transfers.

- DeFi: Fuel for lending platforms, staking, and liquidity pools.

- Trading: Quick escape hatch when markets crash—flip volatile coins into stablecoins instantly.

- Retail adoption: Merchants can price goods without fearing volatility.

They’re the grease in the crypto machine.

⚖️ Regulation: The Wolves Are at the Door

Governments are circling like sharks. Why? Stablecoins mimic money. That’s a direct threat to central banks.

- United States: SEC and CFTC cracking down, demanding audits.

- Europe: MiCA regulations setting rules for collateral and transparency.

- Asia: Mixed approach—some countries embrace, others ban.

Regulation will make or break stablecoins. Too much, and innovation dies. Too little, and another TerraUSD disaster is inevitable.

💡 The Potential: Stablecoins as the Glue of Crypto

Picture this: every DeFi app, every NFT marketplace, every P2P transaction—greased by stablecoins. They’re the financial glue holding the decentralised economy together.

- Mass adoption? Possible.

- Banking disruption? Already happening.

- The future of money? Stablecoins could be the bridge.

But they’re walking a tightrope between decentralisation and centralised control.

🚩 The Red Flags You Can’t Ignore

Before you go all-in, know the dangers:

- Transparency issues: Some issuers don’t show proof of reserves.

- Centralisation risks: A handful of companies control billions in circulation.

- Algorithmic traps: Code can’t always predict human panic.

Ignore these red flags, and you’re gambling, not investing.

🏆 How to Choose a Trustworthy Stablecoin

Here’s the trader’s checklist:

- Demand regular audit reports.

- Check collateral reserves (fiat, commodity, or crypto-backed).

- Look for regulatory compliance.

- Avoid sketchy, overhyped projects promising magic.

Play smart, and stablecoins become your safety net—not your downfall.

⚡ The Future of Stablecoins: Evolution or Extinction?

Where are we headed?

- Institutional adoption: PayPal launched its own stablecoin (PYUSD).

- CBDCs: Central banks are coming—digital dollars, digital euros. Competitors, not partners.

- Survival game: Only the most transparent, regulated, and collateral-backed will thrive.

Will stablecoins be the backbone of Web3—or relics crushed by government-issued digital currencies? Time will tell.

🔗 Internal Linking Opportunities

Want to sharpen your trading edge?

- Master Trading Insights

- Dive deeper into Decentralised Finance (DeFi)

- Learn strategies like Bollinger Bands Trading

🐺 The Wolf’s Take: Stablecoins as a Trader’s Weapon

Listen, stablecoins aren’t perfect. They won’t make you rich overnight. But they’re a weapon. Used right, they let you lock in profits, dodge volatility, and stay liquid.

The smart play isn’t blind trust—it’s using them strategically. That’s how wolves play the game.

🎤 FAQs (Punchy, No-Fluff)

1. Can stablecoins really protect my portfolio from crashes?

Yes. They’re your lifeboat in a storm. When Bitcoin tanks, stablecoins keep your value steady.

2. What’s the safest stablecoin in 2025?

USDC is generally seen as the most transparent. But always verify audits.

3. Will CBDCs kill private stablecoins?

Not kill—but they’ll compete hard. Expect only the strongest private coins to survive.

4. How do stablecoins make money for traders?

By letting you lock in profits, avoid volatility, and use them in DeFi for passive income.

5. Are algorithmic stablecoins dead forever?

Not dead, but on life support. After TerraUSD, trust is shattered.

📝 Conclusion: Stablecoin – The Fix or the Illusion?

Stablecoins promise to solve crypto’s biggest headache: volatility. But they bring their own risks—transparency gaps, centralisation, algorithmic collapses. The truth? They’re not magic. They’re a tool. Used wisely, stablecoins can bridge chaos and control in cryptocurrency. Used recklessly, they’re just another gamble.

The key isn’t the coin—it’s your strategy.

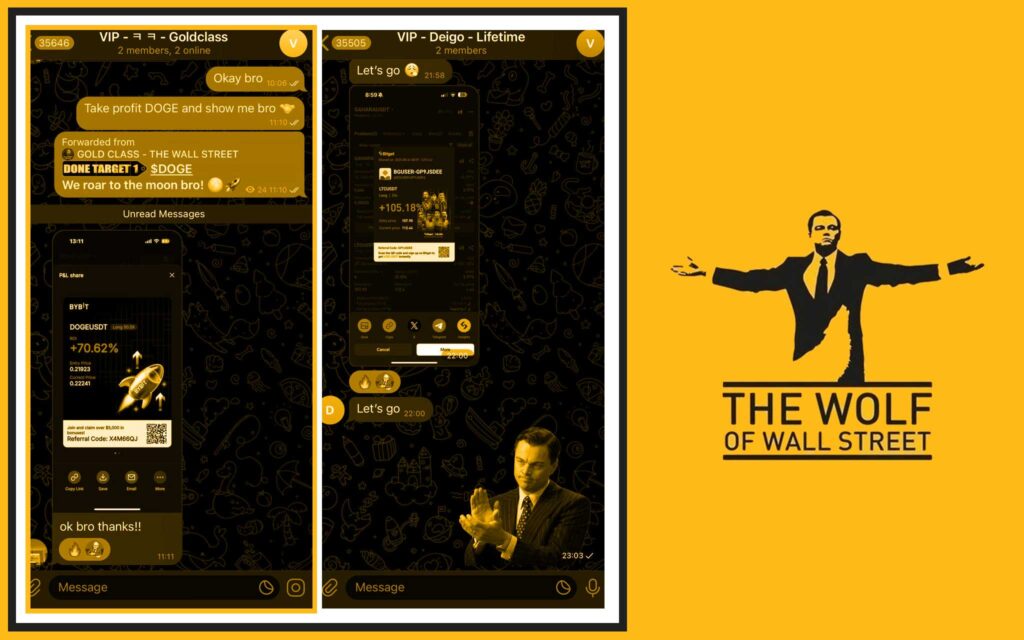

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community: The Wolf Of Wall Street Telegram for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.