🔥 Introduction – The New Gold Rush in Crypto ETFs

The financial world is buzzing, and make no mistake — this isn’t just noise. It’s a seismic shift. We’re talking about the birth of a brand-new asset class that bridges Wall Street with the raw power of blockchain. And right now? The spotlight is blazing on SEI, a young but mighty blockchain, as 21Shares files with the SEC to launch the first SEI ETF.

But they’re not alone. Canary Capital has already staked their claim, filing earlier this year. What’s happening here is nothing short of a land grab in the ETF space — a high-stakes race where the winner earns not just first-mover advantage but possibly billions in inflows.

So buckle up. We’re diving into why the SEI ETF battle could reshape crypto investing forever.

🚀 What’s Going Down: 21Shares SEI ETF Filing

Here’s the straight shot: 21Shares filed with the US SEC to launch an exchange-traded fund that tracks SEI, the native token of the Sei network. This is Wall Street packaging crypto in a way even your grandmother’s broker understands.

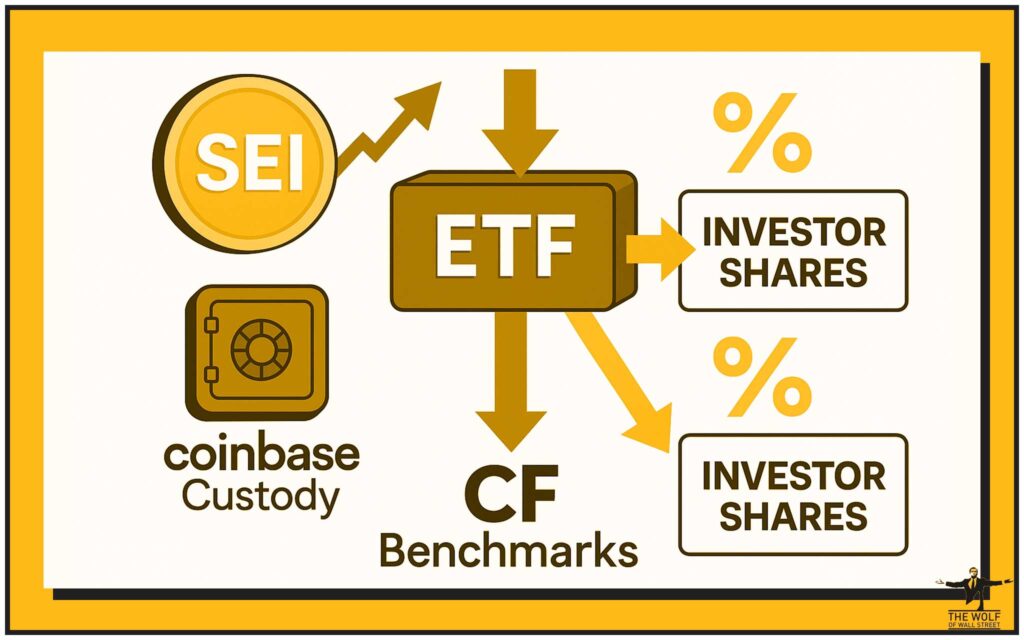

The ETF will use CF Benchmarks — a regulated, rock-solid index provider — to track SEI prices across multiple exchanges. That means reliable pricing and transparency for institutional investors who demand nothing less.

And then comes the clincher: Coinbase Custody Trust Company will act as custodian. That’s like saying your gold bars are guarded by Fort Knox. It’s a credibility stamp, critical when courting hedge funds, pension managers, and retail investors who don’t want to touch messy private keys.

💰 The Staking Bombshell – Passive Income Meets Wall Street

Here’s where the game gets wild. 21Shares isn’t just stopping at tracking SEI price. They’re considering adding staking rewards to the ETF. Imagine this: you hold ETF shares, and on top of exposure to SEI price action, you collect yield from staking. That’s passive income delivered through a Wall Street-friendly wrapper.

But hold on — nothing is simple in finance. The legal and tax landscape for staking in ETFs is a minefield. The SEC could see it as a security feature, or tax authorities could complicate yield distribution. Still, the fact 21Shares is even exploring this shows they know one truth: yield sells.

If they pull it off? Expect a tidal wave of capital from investors desperate for returns beyond bonds and equities.

⚔️ Canary Capital vs. 21Shares – The Race for First Mover Advantage

Canary Capital filed their own SEI ETF application in April, and their strategy? Focus heavily on staking integration. They want to be the pioneers of yield-bearing ETFs in the altcoin sector.

This sets the stage for a cutthroat competition: two firms, one asset, one goal — first mover advantage. In the ETF world, being first isn’t just bragging rights. It’s everything. Look at Bitcoin ETFs — the early movers raked in billions while latecomers are still scrambling for scraps.

If Canary gets there first, they plant the flag. If 21Shares beats them, their brand dominates SEI ETF exposure for years. Investors? They win either way — better products, faster innovation, lower costs.

📊 SEI Network – The Blockchain Built for Trading

Let’s not forget the star of the show: SEI itself. This isn’t some random meme coin with a fancy ticker. SEI is a Layer 1 blockchain launched in August 2023, built specifically for trading infrastructure. Think high-speed order books, optimised liquidity, and architecture that supports decentralised exchanges and marketplaces.

At the time of writing, SEI trades at $0.30, showing a 4.2% gain in 24 hours, and holds the 74th spot on CoinGecko rankings. Not massive yet, but it’s got momentum — and ETFs pour jet fuel on momentum.

🌍 The Bigger Picture – Beyond Bitcoin and Ethereum ETFs

For years, the SEC has been conservative, approving ETFs only for Bitcoin and recently Ethereum. But now? The dam is breaking. Filings are flooding in for SUI, XRP, Solana, and more.

This matters because investors crave diversification. Bitcoin and Ethereum ETFs are the door openers, but altcoin ETFs like SEI are the growth engine. They offer exposure to innovative chains before they hit mass adoption.

Mark my words: once one altcoin ETF gets the green light, the floodgates swing wide open.

📜 The SEC Wildcard – 75-Day Fast Track Approval

Here’s where it gets spicy. The SEC is reportedly considering a simplified approval process. Translation: if no formal objection lands within 75 days, the ETF is automatically approved.

That’s lightning speed in regulatory time. For context, Bitcoin ETF battles dragged on for over a decade. If this streamlined process becomes reality, we could see SEI ETFs on the market in record time.

Of course, the risks are real. The SEC can still object, stall, or impose harsh restrictions. But if they don’t? Say hello to a new era of crypto ETFs.

🔑 Why ETFs Are the Gateway Drug to Crypto

Why does Wall Street love ETFs? Simple: ease, safety, familiarity.

With an ETF, investors don’t need wallets, private keys, or shady offshore exchanges. They just buy it through their broker, same as stocks. That’s why ETFs are the gateway drug to crypto adoption.

For SEI, this means an instant credibility boost. ETFs turn tokens into mainstream, regulated financial instruments. And with Wall Street’s stamp of approval, sceptics start turning into believers.

📈 Market Sentiment & Investor Psychology

Investors are wired for simplicity. ETFs package complexity into a neat ticker symbol. That’s why demand is insane whenever new ETFs launch.

For SEI, this psychology is gold. Retail investors see legitimacy, institutions see opportunity, and both dive in. Add the possibility of staking rewards, and you’ve got a formula that triggers fear of missing out (FOMO) on steroids.

⚡ Opportunities & Risks for Investors

Let’s cut through the noise. Here’s what investors stand to gain — and risk:

Opportunities:

- Mainstream adoption: ETFs legitimize SEI.

- Liquidity boost: Inflows drive volume and price stability.

- Staking yield: Potential passive income inside a regulated product.

Risks:

- Regulatory hurdles: The SEC could reject or neuter staking features.

- Volatility: ETFs don’t eliminate the ups and downs of crypto.

- Competition: Multiple SEI ETFs could dilute capital inflows.

Smart investors? They play early, hedge risk, and ride momentum.

🛠️ Tools of the Trade – Making Smarter Moves

In crypto, speed and intelligence win. You need the right tools to make moves before the herd catches up.

That means real-time analysis, volume calculators, and communities that share signals before the mainstream media picks it up. This is where serious traders sharpen their edge.

👉 For advanced strategies and insights, check out Trading Insights or explore the latest Layer 1 and Layer 2 Solutions.

🌐 The Wolf Of Wall Street Advantage – Trade Smarter, Not Harder

If you’re serious about riding the SEI ETF wave, you need more than luck. You need a network and a strategy. That’s exactly what the The Wolf Of Wall Street crypto trading community delivers.

Here’s what you get when you join:

- Exclusive VIP Signals designed to maximise profits.

- Expert Market Analysis from seasoned traders.

- Private community of 100,000+ members sharing real-time insights.

- Essential trading tools like volume calculators.

- 24/7 support for when the markets get rough.

👉 Power your trading journey today:

📊 The Numbers Game – SEI in Context

Let’s put SEI side by side with the competition. While Bitcoin ETFs dominate headlines and Ethereum ETFs follow closely, SEI represents a new breed: tokens built for specific use cases like trading infrastructure.

That’s a different value proposition entirely. If ETFs unlock institutional capital, SEI could evolve from a mid-cap altcoin into a powerhouse. With a $0.30 price point and growing adoption, the upside potential is enormous.

🔥 The Ripple Effect – How This Shapes Crypto’s Future

This isn’t just about SEI. It’s about the future of crypto ETFs. If SEI gets approval, other altcoin ETFs will rush the gate. XRP, Solana, SUI — all will follow.

2025 could be remembered as the year multi-asset crypto ETFs went mainstream, pulling crypto deeper into the global financial system.

🧠 FAQs – Investor Quickfire

1. What is an SEI ETF and how does it work?

It’s an exchange-traded fund that tracks the price of SEI tokens, making them accessible via traditional brokers.

2. Can ETFs really include staking rewards?

Potentially. 21Shares is exploring it, but regulatory and tax approval remain hurdles.

3. What makes SEI different from other blockchains?

SEI is a Layer 1 built for trading — fast, liquid, and optimised for decentralised exchanges.

4. How likely is SEC approval for SEI ETF?

If the SEC streamlines processes, odds increase significantly. But regulatory unpredictability is always a risk.

5. Should retail investors jump in early or wait?

Depends on risk appetite. Early movers catch upside, but they also face uncertainty.

🏆 Conclusion – SEI ETF: The Next Big Wave

The battle is on. 21Shares and Canary Capital are racing to launch the first SEI ETF, with billions in potential inflows and investor psychology on the line.

ETFs are the Trojan horse bringing crypto onto Wall Street’s doorstep. And SEI? It might just be the breakout star of 2025.

So don’t just watch history unfold — position yourself to ride the wave.