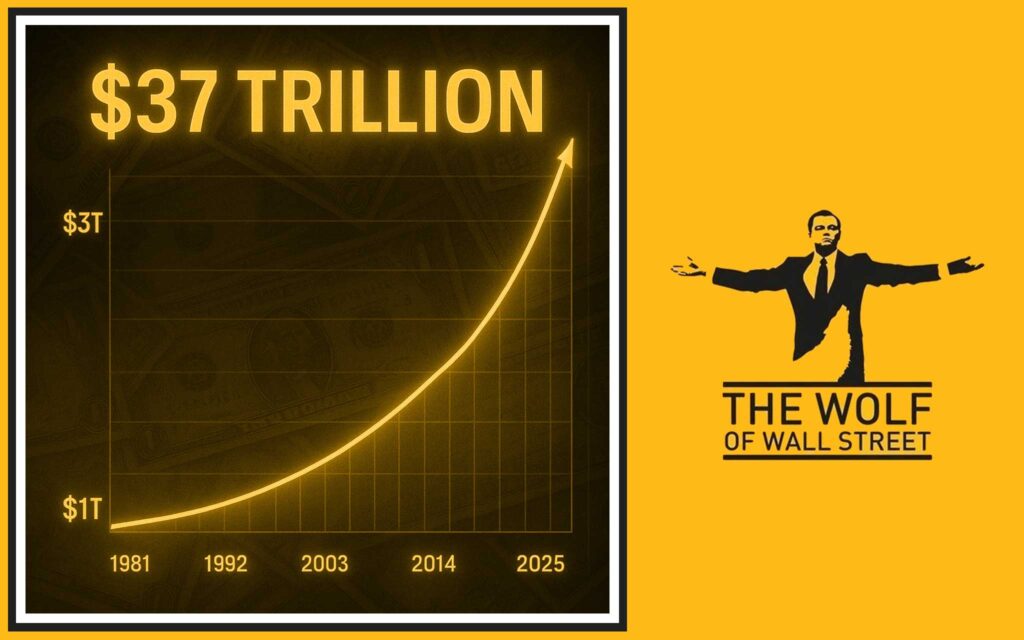

The United States is drowning in $37 trillion of national debt. That’s not a typo. Trillions, with a T. And while most governments kick the can down the road, Washington might just be planning the biggest financial reset in modern history — using stablecoins, gold, and even Bitcoin as weapons in its arsenal.

Recently, Anton Kobyakov, adviser to Russian President Vladimir Putin, threw a grenade into the conversation. He accused the US of “rewriting the rules” of global finance, leveraging stablecoins and gold to strategically devalue its mountain of debt. Whether you call it genius or desperation, one thing’s for sure: the financial world will never be the same.

⚡ The Shockwave: Putin’s Adviser Sounds the Alarm

Anton Kobyakov didn’t mince words. According to him, the US isn’t just dabbling in crypto — it’s weaponising it. His claim? The US could shift its debt into dollar-backed stablecoins, effectively pressing the reset button on $37 trillion worth of obligations.

Sounds wild? Maybe. But think about it: when the world’s reserve currency is tied to digital dollars, America sets the rules. Russia’s concern isn’t just paranoia — it’s recognition that the financial battlefield has gone digital.

💰 The Elephant in the Room: $37 Trillion US Debt

Let’s put this into perspective. Back in 1981, US debt was about $1 trillion. Today, it’s over 10x higher. Every second, it ticks higher like a time bomb strapped to the world economy.

Why does this matter? Because debt isn’t just numbers — it’s trust. And when creditors lose faith, currencies collapse. That’s why Washington is scrambling for tools like stablecoins to keep demand for US debt alive.

🏆 Historical Precedent: Gold Resets of the 1930s & 1970s

This isn’t the first time the US has changed the rules of the game:

- 1933: FDR took the US off the domestic gold standard. Citizens couldn’t redeem dollars for gold anymore.

- 1971: Nixon slammed the gold window shut internationally. Goodbye Bretton Woods, hello floating fiat.

Every time the debt trap tightened, America changed the system. Today’s version? A marriage of stablecoins and gold, blended with crypto influence.

👉 Related read: News, Policies

🔗 Stablecoins as the Dollar’s Secret Weapon

Stablecoins are simple on the surface — digital tokens pegged to the dollar. But here’s the kicker: they keep global demand for the dollar alive. Former House Speaker Paul Ryan said it best: stablecoins could turbocharge demand for US treasuries, lowering the risk of failed debt auctions.

In other words, stablecoins aren’t just crypto toys. They’re weapons of financial mass preservation, keeping the dollar’s grip on the world economy intact.

📜 The GENIUS Act: Trump’s Digital Finance Masterstroke

Enter the GENIUS Act, signed into law by President Trump in July 2025. This wasn’t about memes or hype — it was about power. The law essentially locked stablecoins into America’s playbook for dollar dominance.

Think about it: by controlling stablecoin rails, Washington can keep foreign trade, debt markets, and even rival nations tethered to its financial orbit.

₿ The Bitcoin Act: Cynthia Lummis’ Bold Proposal

While stablecoins guard the dollar, Bitcoin could secure America’s hedge. Senator Cynthia Lummis proposed the Bitcoin Act — the US government accumulating 1 million BTC over five years.

That’s a strategic reserve like no other. Call it “digital gold” on steroids. If this happens, it sends one message loud and clear: the US isn’t just trying to survive — it’s preparing to dominate the future of money.

🇷🇺 Russia’s Counterplay: The Ruble-Backed Stablecoin

Russia isn’t sitting on the sidelines. Moscow is cooking up a ruble-backed stablecoin to settle international trade without touching the dollar. Imagine Russia, China, and India bypassing the greenback entirely — that’s a direct hit to US dominance.

This isn’t just about innovation; it’s about financial survival in a world where the dollar has been the chokehold for decades.

📈 Russian Policy Shift: From Ban to Embrace

In 2022, Russia banned crypto payments. Fast-forward to 2025, and the script has flipped. Accredited investors and institutions are now allowed into crypto markets. Why? Because Moscow knows the future is digital, and ignoring it means falling behind.

This is a calculated pivot — control the rails, but open the gates.

🌍 Global Crypto Arms Race

Make no mistake: we’re in a crypto arms race. The US has the GENIUS Act and a Bitcoin plan. Russia is rolling out ruble-stablecoins. China is pushing its digital yuan.

This isn’t just finance anymore — it’s geopolitics played out in blockchain code. Whoever wins controls the future of global trade.

🧐 Can Stablecoins Really Devalue Debt?

Here’s the million-dollar question: can stablecoins actually shrink $37 trillion in debt? The theory is seductive. By pegging obligations to stablecoins, Washington could reshuffle liabilities, inflating away the real value.

But skeptics argue the mechanics aren’t there yet. Without transparency, it risks being smoke and mirrors — more PR play than policy.

🥇 Gold’s Role in the Reset Strategy

Gold isn’t going anywhere. Central banks, including Russia and China, are stockpiling it like doomsday preppers. For the US, pairing stablecoins with gold reserves could restore confidence. Call it a digital Bretton Woods.

In short: if crypto is the rocket fuel, gold is the anchor.

🗞️ Contrasting Narratives: Propaganda or Strategy?

So, what’s the truth? Russia says America is gaming the system. The US insists stablecoins are about innovation and dollar strength, not debt erasure.

Reality probably sits somewhere in between. But perception matters. And when rivals believe you’re rigging the system, geopolitical tensions escalate.

👉 Related: Cryptocurrencies, Trading Insights

📊 Market Reactions: Bitcoin, Stablecoins, and Beyond

Whenever governments meddle in crypto, markets react. Expect volatility across Bitcoin, stablecoins, and altcoins as traders digest the geopolitics. Institutional investors will circle, but retail will feel the whiplash.

Smart traders see chaos as opportunity.

👨💻 Implications for Retail Traders

This isn’t just a story for politicians and bankers. If the US pulls off a debt reset, expect:

- Bitcoin price shocks.

- Stablecoin adoption surging.

- Gold spiking as safe-haven demand explodes.

For retail traders, this is a minefield and a goldmine — depending on whether you’re prepared.

🦾 The The Wolf Of Wall Street Edge: Navigating Volatility Like a Pro

Here’s the brutal truth: the average trader isn’t ready for this storm. You need signals, tools, and a community that sees around corners. That’s where The Wolf Of Wall Street crypto trading community steps in:

- Exclusive VIP signals to maximise profits.

- Expert analysis from seasoned traders.

- A private community of 100,000+ members.

- Tools like volume calculators to sharpen decision-making.

- 24/7 support when markets go wild.

👉 Join now: The Wolf Of Wall Street Service or hop into the Telegram community.

🌐 The Bigger Picture: End of Dollar Dominance?

Could the US lose its throne as the world’s reserve currency? Stablecoins may extend dollar dominance, but at the same time, they open the door for rivals. If Russia, China, and others rally behind their own digital currencies, the multipolar era of money has arrived.

⚖️ The Verdict: Innovation or Manipulation?

So, is America’s plan genius or desperation? Maybe both. What’s undeniable is this: stablecoins, gold, and Bitcoin are no longer niche toys. They’re the weapons of financial geopolitics.

If you’re a trader, don’t just watch from the sidelines. Learn the rules, play the game, and ride the volatility to your advantage.

🔥 Conclusion

Anton Kobyakov’s claim is explosive, but it shines a light on something bigger: the financial system is shifting under our feet. Stablecoins, gold, and Bitcoin aren’t optional extras anymore — they’re the frontlines of global power.

And in a world where the US might reset $37 trillion of debt with digital tools, one thing is clear: adapt fast, or get left behind.

❓ FAQs

1. How could stablecoins impact US debt repayment?

By boosting global demand for US treasuries and potentially reshuffling how obligations are structured, stablecoins may ease repayment pressures.

2. What is the GENIUS Act and why does it matter?

It’s a 2025 law signed by Trump that institutionalises stablecoins as part of America’s financial strategy, ensuring the dollar’s dominance.

3. Will the Bitcoin Act actually pass?

Still in proposal stage, but if passed, it would give the US a massive crypto reserve of 1 million BTC.

4. How does Russia’s ruble stablecoin affect global trade?

It could reduce reliance on dollar-backed assets, creating an alternative settlement system for trade with allies like China and India.

5. Should retail traders invest in stablecoins or Bitcoin amid this drama?

Both have roles — Bitcoin as long-term hedge, stablecoins as liquidity tools. But always manage risk in volatile markets.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

👉 Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.