🌐 Introduction: The Dawn of Web 3.0

Web 3.0 is not just the next chapter of the internet – it’s a revolution. Imagine an internet where you own your data, your assets, and your financial future. No more middlemen. No more Big Tech dictating the rules. Just pure, uncut digital freedom.

If Web 2.0 made billionaires, Web 3.0 is going to mint empires. And the only question is: are you going to watch from the sidelines, or are you going to get in the game?

🚀 What Exactly Is Web 3.0?

Let’s cut the fluff: Web 3.0 is the decentralised internet powered by blockchain, artificial intelligence, and immersive tech like VR and AR. Unlike Web 2.0 – where Facebook, Google, and Amazon own your data – Web 3.0 puts power back in the hands of creators and users. Think decentralised apps, token economies, NFTs, DAOs, and unstoppable finance. For investors, it’s a once-in-a-lifetime chance to catch the early wave of a trillion-dollar disruption.

💰 Why You Should Invest in Web 3.0 Now

Timing is everything. Those who bet on Amazon in the 2000s or Bitcoin in 2013 didn’t just make money – they rewrote their family’s financial future. Web 3.0 is still early, and that’s where fortunes are forged. The market is projected to explode into the trillions. The window of opportunity is wide open – but it won’t stay that way forever. Miss this train, and you’ll be telling stories about the money you could have made.

📈 The Main Investment Vehicles in Web 3.0

Here’s how you can get in:

- Stocks – Safer exposure via companies driving Web3 innovation.

- Cryptocurrencies – Direct exposure to decentralised protocols.

- NFTs – Unique assets with ownership and utility.

- ICOs/IDOs – Early access to new tokens with moonshot potential.

- ETFs & Funds – Diversified baskets for the risk-conscious.

👉 For deeper analysis, check out our guide to researching crypto opportunities.

🏢 Web 3.0 Stocks: Safer Exposure with Big Tech Muscle

Not everyone has the stomach for crypto’s rollercoaster. Stocks offer a safer way in. Companies like Coinbase, Meta, Apple, and X (formerly Twitter) are all-in on Web3 infrastructure. Meta is betting billions on VR, Apple is rolling out AR hardware, and Coinbase is the on-ramp to the crypto economy. Stocks won’t give you the 100x gains of a meme coin – but they offer stability, liquidity, and exposure to the next internet wave.

👉 Stay sharp on the latest trending crypto news to track Web3 stocks in real time.

🎨 NFTs: The New Digital Assets

NFTs aren’t just overpriced JPEGs. They’re digital property rights. From gaming skins to metaverse land, VIP access passes to music royalties – NFTs are evolving into real utility assets. Yes, the hype cycle burned some investors, but the underlying tech is here to stay. Winners in the NFT space are building ecosystems, not just pictures.

👉 See how NFTs are disrupting gaming in our NFTs and gaming insights.

🪙 Cryptocurrencies: Direct Web3 Exposure

If you want pure exposure, you go crypto. Ethereum, Solana, Polkadot, Avalanche – these blockchains power decentralised apps, finance, and digital identities. Then you’ve got governance tokens, utility tokens, and stablecoins to diversify your play. But let’s be real: crypto is volatile. Gains can be astronomical, but losses can be devastating. You need discipline.

👉 If you’re new, start with our how to buy crypto guide.

📊 ICOs & IDOs: The High-Risk, High-Reward Plays

Want to feel the adrenaline? Early token offerings (ICOs/IDOs) are where fortunes are made – and lost. Ethereum itself started as an ICO. But for every Ethereum, there are dozens of scams, rug pulls, and dead projects. If you dive in here, do your research, check the team, and never risk what you can’t afford to lose.

⚠️ The Risks of Web3 Investing

Here’s the truth: Web3 is the Wild West.

- Volatility: Crypto swings 20% in a day like it’s nothing.

- Security risks: Hacks, phishing, rug pulls.

- Regulation: Governments are still figuring out how to deal with this space.

- Psychology: The biggest risk is you – greed, fear, and FOMO are killers.

👉 Stay informed with updates in crypto regulations.

🔒 How to Invest Safely in Web 3.0

Risk management is the name of the game. Here’s how to play it smart:

- Use hardware wallets for serious holdings.

- Diversify across cryptos, stocks, and NFTs.

- Only invest what you can afford to lose.

- Research projects, join communities, and check roadmaps.

👉 Learn how to protect your assets with our private key vs seed phrase guide.

📚 Factors to Consider Before Investing

Before you throw money at Web3, ask yourself:

- What’s my risk tolerance?

- Am I in this for short-term flips or long-term growth?

- Do I understand the team and roadmap behind this project?

- What’s the tax and regulatory impact in my country?

👉 For compliance, see our crypto tax strategy guide.

🎯 Who Should Invest in Web 3.0?

Web3 investing isn’t for everyone. It’s for:

- Investors with high risk tolerance.

- People with capital to play with.

- Tech-savvy individuals who understand decentralisation.

- Visionaries who see the internet not as it is, but as it’s becoming.

🏆 Reasons to Believe in Web 3.0 Long-Term

Forget the hype. Here’s why Web3 is the real deal:

- Decentralisation = user control and ownership.

- AI, VR, AR integration will transform industries.

- Institutional adoption is already happening.

- It’s not just an internet upgrade – it’s a new digital economy.

🧠 FAQs on Web 3.0 Investing

1. Is Web3 investing safe?

Not risk-free. It’s high risk, high reward. Manage risk with diversification and secure wallets.

2. What’s the difference between Web 2.0 and Web 3.0?

Web 2.0 is centralised, controlled by tech giants. Web 3.0 is decentralised, user-owned, and blockchain-powered.

3. Can beginners invest in Web 3.0?

Yes, but start small. Stick to safer plays like Web3 stocks or ETFs before diving into altcoins and NFTs.

4. What are the safest ways to invest?

Stocks, ETFs, and top-tier cryptos like Ethereum. Avoid hype-driven coins and unverified projects.

5. Will regulation kill or legitimise Web 3.0?

Regulation will slow scams but legitimise real projects. Long-term, it’s a positive.

🔑 Final Word: The Wolf’s Verdict on Web 3.0

Listen up: Web 3.0 is not a question of if – it’s a question of when. The decentralised internet is coming, and those who position themselves now will ride the biggest wealth transfer of our generation. The cautious will watch. The bold will win. Don’t be the guy saying, “I almost bought Ethereum at $100.” Be the one who acted. The time is now.

👉 For more, dive into our trading insights.

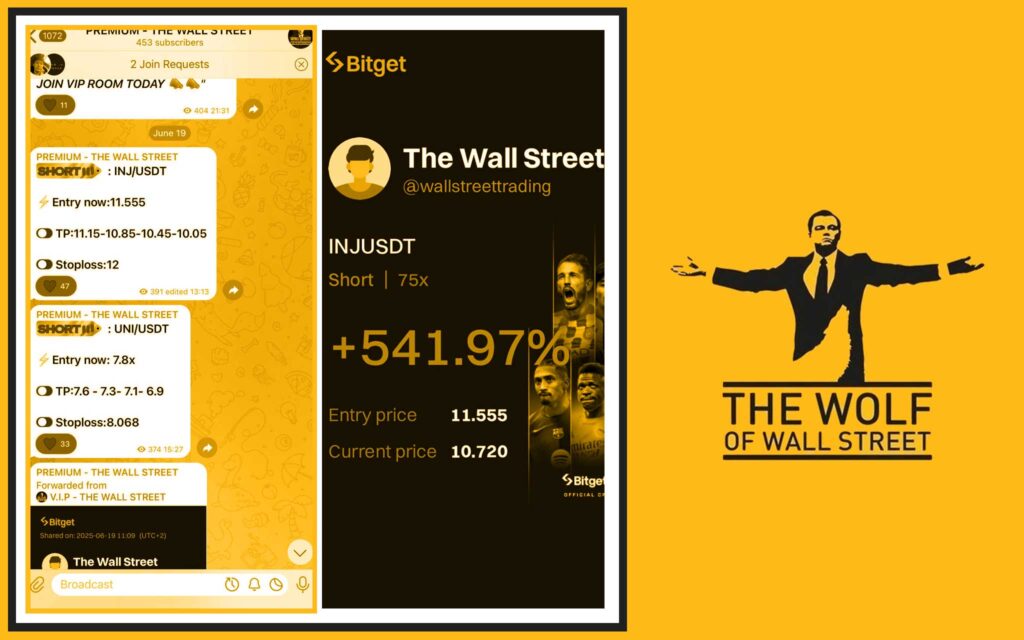

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals.

- Essential Trading Tools: From volume calculators to advanced resources.

- 24/7 Support: Continuous assistance, whenever you need it.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our Telegram: The Wolf Of Wall Street Community