🔥 Introduction: The Crypto Power Play

Listen up—because what’s happening right now in the world of crypto is not just another headline, it’s the kind of move that shifts markets, redirects capital, and rewrites the future of money. The UK and the US—the heavyweight champs of global finance—are tightening their grip on the crypto industry with a landmark agreement.

We’re talking stablecoins, digital assets, and a full-scale play to align their regulatory strategies. Translation? This is the green light institutional investors have been begging for, and the rocket fuel entrepreneurs and traders need to scale to the stratosphere.

🌍 The Global Stage is Set

Let’s set the scene: crypto is now a multi-trillion-dollar market, not a fringe experiment. Governments can’t ignore it anymore. Stablecoins alone are reshaping how money flows across borders, threatening to sideline traditional banks.

Advocacy groups in the UK have been hammering regulators with one message: “Move faster, or get left behind.” That urgency pushed London and Washington to the table, and they’re not here for small talk—they’re here to set the rules of the next financial revolution.

🇬🇧 UK’s Past Missteps & Missed Opportunities

Here’s the truth: the UK has been dragging its feet. Overly cautious regulations strangled innovation, pushing some of the brightest fintech talent across the Atlantic. The Bank of England even floated caps on stablecoin holdings—moves that screamed “we don’t get it” to global investors.

Result? Startups bled out, top talent walked, and the UK’s shot at being a crypto hub started slipping. That’s why this new pact matters—it’s about clawing back lost ground.

👉 For ongoing updates on policy shifts, check out our UK crypto news updates.

🇺🇸 America’s Pro-Innovation Model

Contrast that with the US. While far from perfect, the States have consistently positioned themselves as the centre of gravity for crypto capital. The GENIUS Act, new compliance frameworks, and a pro-growth stance turned the US into the place where money meets innovation.

UK companies, hungry for that same energy, have been lobbying hard for regulators at home to borrow a few pages from Washington’s playbook. Guess what? It’s finally happening.

👉 Learn more about shifting crypto policies shaping markets.

🤝 The Landmark UK–US Crypto Pact

At the centre of this breakthrough: high-level meetings between major banks (Barclays, Bank of America, Citi) and crypto giants like Coinbase, Circle, and Ripple. When you’ve got this calibre of players in the same room, you know serious money is on the line.

The pact’s core?

- Align stablecoin rules

- Tighten anti-money laundering (AML) standards

- Lock in custody protections

- Set unified consumer safeguards

And here’s the kicker—they’re building joint digital securities sandboxes. Think of them as billion-dollar playgrounds where blockchain meets financial innovation, with governments watching, learning, and clearing paths for scale.

💸 The Capital Market Opportunity

This is the part that should make every investor sit up. Regulatory alignment means UK firms can tap US capital markets with less friction. More liquidity, more access, more growth.

For Britain, this is about pulling fresh investment into London. For the US, it’s about expanding dominance in digital finance. And for everyone else? Pressure. Frankfurt, Singapore, and Hong Kong won’t sit still—they’ll be forced to adapt or lose out.

👉 Gain insights on trading opportunities with our crypto trading insights.

📊 Consumer Adoption: The Silent Force

While regulators and banks strategize, everyday consumers are already in motion:

- 27% of UK adults say they’d consider crypto in retirement portfolios.

- Over 11.6 million Brits already hold digital assets.

- But 40% of investors have been blocked or delayed by banks when moving into crypto.

That’s a tidal wave of demand crashing against old walls. Tear down those walls with aligned policies, and adoption will skyrocket.

🚨 Industry Concerns & Risks

But let’s not kid ourselves—it’s not all smooth sailing. Industry insiders warn of a real danger: regulators tightening the noose so much that innovation suffocates.

Payment bottlenecks remain a massive frustration. And let’s not forget the UK’s recent brain drain—the best and brightest moving where the rules are friendlier. If the UK fails to balance security with innovation, this whole pact could fizzle into another bureaucratic nightmare.

🚀 Why This Agreement Changes the Game

Done right, though, this pact is a game-changer. Here’s why:

- Unified rules mean institutional investors finally feel safe.

- More safety equals massive liquidity inflows.

- With the UK and US aligned, the EU and Asia face pressure to catch up.

This isn’t just a treaty—it’s a signal to the market: crypto is moving mainstream, fast.

💡 The Sandbox Effect

Here’s where things get exciting. The digital securities sandbox is not some academic exercise—it’s a launchpad.

- Tokenized stocks? Test them.

- Decentralised finance products? Build them.

- Cross-border payments with stablecoins? Scale them.

Startups will be able to stress-test products inside this sandbox with regulators looking over their shoulders. If they pass, they go live. That’s innovation at speed, without years of red tape.

📈 The Ripple Effect Across the Ecosystem

Let’s talk winners. This pact ripples through every layer of the crypto stack:

- Layer-1 blockchains (Ethereum, Solana) → more institutional validation.

- Layer-2 solutions → scaling retail adoption.

- DeFi protocols → cleaner compliance path.

- NFTs & gaming ecosystems → mainstream credibility.

Stablecoins are the backbone. They don’t just grease the system—they are the system. This deal cements them as infrastructure for the Web3 economy.

👉 Stay ahead with insights on Layer 1 and Layer 2 innovations.

🎯 What This Means for Retail Traders

Let’s bring it back to the ground level—retail traders. What do you get out of this?

- Safer exchanges, fewer rug pulls.

- Stronger custody protections.

- Faster bank-to-crypto pipelines.

- And most importantly: more liquidity = tighter spreads = better profits.

The big boys aligning on rules doesn’t just benefit institutions—it creates safer, more profitable playgrounds for you.

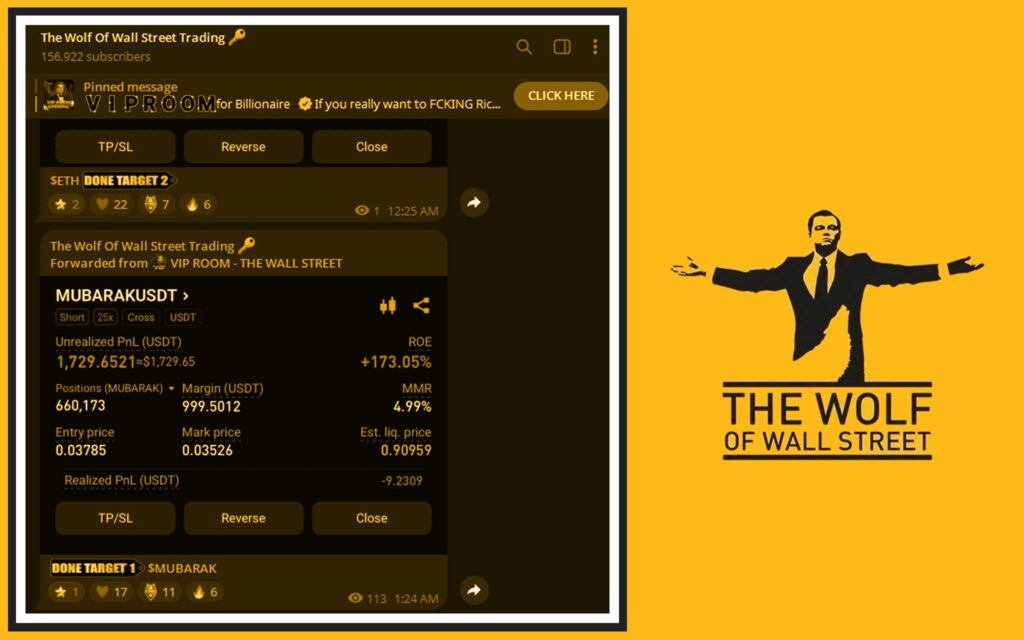

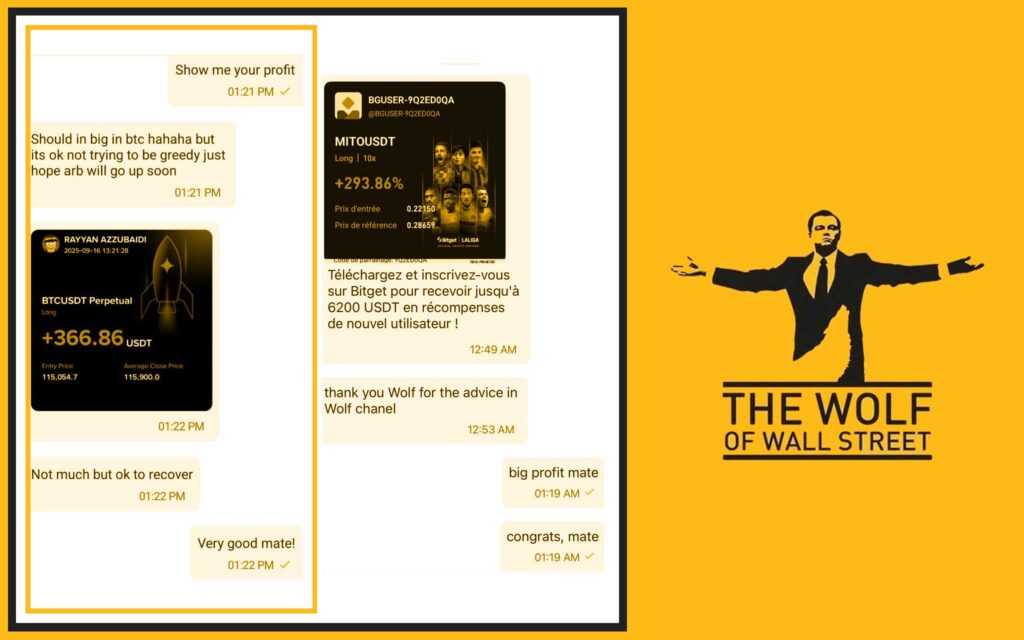

🔑 The The Wolf Of Wall Street Advantage in the New Era

Now, if you’re a trader, this is where you separate winners from wannabes. A market with more liquidity and less chaos means timing is everything. That’s where the The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals: Tap into insider-grade alerts designed to maximise profits.

- Expert Market Analysis: Learn from seasoned traders who break down complex moves into clear plays.

- Private Community: Over 100,000 traders backing each other up.

- Essential Tools: From volume calculators to risk management resources.

- 24/7 Support: Because markets never sleep, and neither should your strategy.

👉 Empower your trading journey today: The Wolf Of Wall Street Service | Join the The Wolf Of Wall Street Telegram

📚 FAQs

1. What are digital securities sandboxes?

They’re testing environments where new blockchain products can run under regulator supervision, reducing risks while speeding up innovation.

2. How will UK traders benefit from this agreement?

They’ll gain smoother access to US markets, stronger investor protections, and faster adoption of mainstream crypto services.

3. Why are stablecoins so central to regulation?

Stablecoins bridge fiat and crypto, making them essential for payments, DeFi, and cross-border transfers—regulators want them secure and reliable.

4. Will this affect Bitcoin and altcoin adoption?

Indirectly, yes. Clearer rules boost institutional trust, which increases liquidity across the board—including Bitcoin and altcoins.

5. How does The Wolf Of Wall Street fit into this evolving landscape?

The Wolf Of Wall Street equips traders with signals, tools, and community support to capitalise on opportunities created by regulatory clarity and market growth.

✅ Conclusion: The Turning Point

Here’s the bottom line: this UK–US crypto pact isn’t just paperwork—it’s a turning point. It’s about two financial superpowers planting their flags in the digital frontier and saying, “We run this show.”

For institutions, it means confidence. For startups, it means growth. For retail traders, it means safer, more liquid markets.

The message is clear: this isn’t regulation slowing crypto down. This is the green light. And if you’re paying attention, it’s the opportunity of a lifetime.