🔥 Introduction

Listen up. The SEC just pulled the trigger on a regulatory shift that’s going to send shockwaves through Wall Street and the crypto markets. Forget the slow, case-by-case approval process — those days are gone. With generic listing standards, crypto ETFs can hit the exchanges faster than ever, unleashing a tidal wave of institutional capital into the market.

If you’ve been waiting for the moment crypto goes fully mainstream, this is it. And in the next 10 minutes, I’m going to break down exactly what this means, who stands to profit, and how you can ride the wave before everyone else wakes up.

📈 The Big Move by the SEC

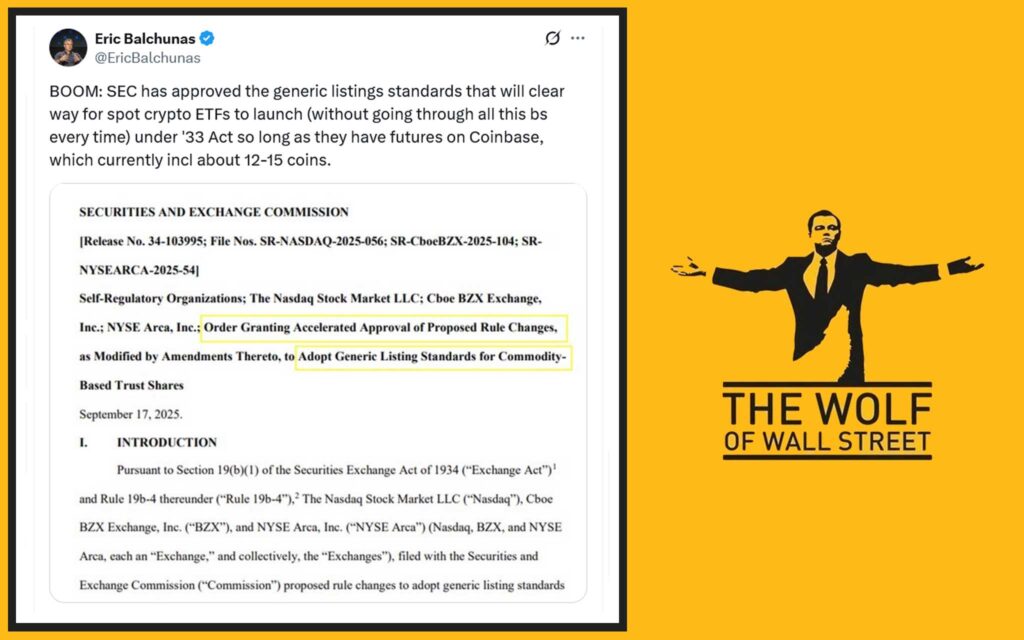

Here’s the play: the SEC just approved generic listing standards. That means Nasdaq, NYSE Arca, and Cboe BZX no longer have to beg for approval each time they want to list a new spot crypto ETF.

Instead, if a product checks the boxes laid out under Rule 6c-11, boom — it goes live. No more waiting months. No more endless regulatory purgatory. This is efficiency injected straight into the financial bloodstream.

⚖️ Breaking Down the New ETF Requirements

The SEC isn’t throwing the gates wide open without a lock. These ETFs still need to meet some serious conditions. To qualify, an ETF must be commodity-backed (not securities) and fit one of three categories:

- ✅ Traded on Intermarket Surveillance Group (ISG) markets with surveillance agreements.

- ✅ Underlying futures contract must have been listed for at least six months.

- ✅ Another ETF with 40%+ exposure must already be listed on a national exchange.

This structure guarantees oversight while still accelerating growth. Translation? They’ve balanced speed with safety — just enough to make institutions comfortable.

🏛️ The Power Players: Exchanges in the Spotlight

The big boys — Nasdaq, NYSE Arca, and Cboe BZX — are the ones benefiting first. With this ruling, they can automatically list ETFs that meet the criteria.

But here’s the kicker: if a product doesn’t fit these standards, exchanges still need to file with the SEC for special review. That’s the “safety valve” regulators are keeping to maintain control.

So while the faucet is flowing, it’s not fully open — but it’s open wide enough for billions to pour in.

🚀 Which Altcoins Are About to Explode?

Let’s talk tokens. Applications are already lined up for:

- Solana (SOL)

- XRP (Ripple)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Avalanche (AVAX)

- Chainlink (LINK)

- Polkadot (DOT)

- BNB (Binance Coin)

Deadlines are coming in hot, with many final decisions expected by October 2025. You don’t need to be a Wall Street analyst to see where this is headed — ETFs for these assets will ignite massive demand.

For deeper insights into upcoming altcoin opportunities, check out our Altcoins category and even explore wildcards in the Memecoins section.

💸 Institutional Money Is Coming – Big Time

Here’s the money shot. Analysts expect 100+ new spot crypto ETFs by the end of 2025 and $5–8 billion in fresh inflows.

ETFs are the bridge. They let hedge funds, pensions, and retirement accounts get exposure without touching wallets, private keys, or shady exchanges. This is about making crypto safe for Wall Street.

We’ve seen this before. When Bitcoin ETFs hit in 2024, they raked in billions practically overnight. Ethereum ETFs followed, and the pattern repeated. Institutions love regulated exposure. And now? They’re getting it for altcoins.

Want to prepare your strategy? Our Trading Insights hub is loaded with tactics for navigating ETF-driven markets.

🧠 Expert Takes: Bulls vs. Bears

- Paul Atkins (SEC Chair): He’s calling this a move to maximise investor choice and keep the U.S. ahead in innovation. Translation? He’s throwing gasoline on the fire.

- Caroline Crenshaw (SEC Commissioner): She’s not buying the hype. Crenshaw warns this could flood the market with poorly vetted products, leaving retail investors holding the bag.

- Eric Balchunas (Bloomberg Analyst): Straight up: “game-changer.” He sees a tsunami of ETFs flooding the market and dragging crypto into the mainstream.

This split shows the reality: opportunity and risk, both on steroids.

📊 Historical Lessons from Bitcoin & Ethereum ETFs

When Bitcoin ETFs launched, they accumulated billions in assets within weeks. Prices surged, liquidity spiked, and institutional adoption went vertical.

Same story with Ethereum ETFs. Investors didn’t hesitate — they dove in headfirst.

Now, imagine that same pent-up demand hitting Solana, XRP, or DOGE. We’re talking fresh liquidity, market caps exploding, and retail investors jumping in to avoid missing the train.

🌍 Global Competitive Edge

This isn’t just about Wall Street — it’s about global dominance. While Europe and Asia have been moving faster with digital asset frameworks, the U.S. is making its play.

Crypto ETFs put America back in the driver’s seat of financial innovation. They send a clear message: the U.S. isn’t just tolerating crypto, it’s institutionalising it.

The ripple effect? Other countries scramble to match or risk losing investor capital.

⚡ Risks That Investors Can’t Ignore

Hold on. Don’t pop the champagne just yet. There are risks:

- 🚨 Too many ETFs could dilute quality.

- 🚨 Retail investors could get trapped in hype cycles.

- 🚨 Volatility will spike as liquidity floods in.

- 🚨 Oversight gaps may create regulatory backlash later.

That’s why Crenshaw’s warning matters. The SEC will refine these standards as problems surface — and you don’t want to be caught blindsided.

💼 Institutional Strategy Playbook

Here’s what’s coming next:

- BlackRock, Fidelity, Ark, Vanguard — the asset giants — will line up altcoin ETFs.

- Portfolios will diversify beyond Bitcoin and Ethereum.

- Institutions will finally offer crypto exposure in retirement funds, index portfolios, and hedge fund strategies.

This isn’t a trend. It’s a paradigm shift.

🛠️ Tools for Retail Traders to Ride the ETF Wave

So how do you, the retail investor, play this game?

- 🔑 Stay educated: don’t get blindsided by institutional flows.

- 📊 Use signals and analysis: don’t trade blind.

- 📈 Manage risk: volatility is opportunity, but it can also wreck you.

- 👥 Leverage communities: insights compound when shared.

If you’re new to this, start with our Newbie guides and dig into Bitcoin fundamentals before chasing the next big altcoin ETF.

🔑 Actionable Investor Takeaways

Here’s the raw truth:

- ETFs bring legitimacy and accessibility.

- Solana, XRP, and BNB are primed to benefit.

- October 2025 is the real inflection point.

- Get positioned before the crowd, not after.

You don’t want to be the guy buying at the top while institutions quietly unload into your FOMO.

📚 FAQs

1. What are generic ETF listing standards?

A fast-track system allowing exchanges to list spot crypto ETFs without case-by-case approval if they meet SEC criteria.

2. Which crypto assets will likely get ETFs first?

Solana, XRP, Litecoin, Dogecoin, Avalanche, Chainlink, Polkadot, and BNB are in line.

3. How do ETFs impact retail investors differently from institutions?

Institutions get regulated, scalable exposure. Retail investors get easier access but also higher risk of hype-driven volatility.

4. What risks should investors watch out for?

Market oversaturation, poorly structured ETFs, volatility, and regulatory changes.

5. How can traders prepare for the ETF boom?

Follow market analysis, use tools, and join active communities that provide real-time insights.

🏆 Conclusion

The SEC just rewrote the rules of the game. By fast-tracking crypto ETFs, they’ve opened the doors to trillions in institutional capital.

This isn’t hype — it’s history in motion. If you’re serious about making money in crypto, you can’t sit on the sidelines. Position yourself now, or watch everyone else get rich while you’re still “waiting for confirmation.”

📌 The Wolf Of Wall Street Promo

The The Wolf Of Wall Street crypto trading community gives you the edge in a market that’s moving faster than ever:

- Exclusive VIP Signals designed to maximise profits

- Expert Market Analysis from seasoned traders

- Private Community of 100,000+ members

- Essential Tools like volume calculators

- 24/7 Support to keep you sharp

🚀 Empower your trading journey:

Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.