🔥 Introduction: Passive Income in Crypto – Cloud Mining vs Staking

Listen up — in 2025, the crypto world is a jungle. Everyone’s looking for passive income, ways to make their money work while they sleep. Two beasts dominate the arena: cloud mining and staking. They sound similar, but trust me, they’re completely different games. One is about renting raw power, the other is about locking in your digital chips and letting the network pay you.

Today, I’m breaking down cloud mining vs staking — the key differences, the risks, the rewards — so you can decide where to put your hard-earned money and come out on top.

⚙️ How Cloud Mining Works in 2025

Here’s the deal: cloud mining lets you rent computing power from massive data centres. No noisy machines in your garage, no sky-high electricity bills. You pay for a contract, they do the mining, you collect the coins.

- Typical returns? 5%–10% APR on solid Bitcoin or Ethereum contracts.

- But wait, some shady operators dangle 800% APR “XRP mining” schemes. That’s not a deal — that’s a trap. If it sounds too good to be true, it usually is.

Why do beginners love it? Because it’s plug-and-play. No technical knowledge, no hassle, just a subscription. The problem? Once you sign a contract, you’re locked in. If Bitcoin tanks, you’re stuck bleeding cash.

💡 How Crypto Staking Works in 2025

Now let’s flip the script. Staking is the backbone of proof-of-stake (PoS) networks. You take your coins, lock them up, and secure the blockchain. In return, you earn yield.

- Ethereum (ETH): 3%–5% APY

- Solana (SOL): 6%–8% APY

- Cosmos (ATOM): up to 12% APY

But here’s where it gets sexy: liquid staking platforms like Lido and Marinade. They give you a token (stETH, mSOL) that represents your staked funds. That means you’re earning yield AND you can still move, trade, or lend your tokens. Pure liquidity, baby.

Institutions love staking because it ticks compliance boxes, is eco-friendly, and provides predictable returns.

📊 Profitability Showdown: ROI Matrix

Let’s talk numbers.

- Cloud Mining: 5%–10% APR, but fees, contracts, and market volatility eat into profits.

- Staking: 3%–12% APY, depending on the chain, with liquid staking pushing flexibility higher.

The Wolf’s rule? Staking is steady, mining is risky. Mining profits can collapse in a bear market, while staking usually holds up better — unless the coin itself nosedives.

🧑💼 Investor Profiles: Who Chooses What?

Not all investors are built the same. Here’s how the split looks in 2025:

- Beginners: They flock to cloud mining. It’s easy, it feels “passive,” and it doesn’t require deep knowledge.

- Risk Seekers: These maniacs chase staking plays on Cosmos, Polkadot, and smaller chains where yields hit 15%–20% APY. Big upside, big risk.

- Institutions: They choose staking — reliable, transparent, regulatory-friendly. Mining? Too messy for their balance sheets.

🌍 Environmental Impact: Green vs Greedy

Cloud mining comes with baggage. Massive energy consumption, centralised mining pools, and environmental critics breathing down its neck.

Staking? It’s eco-friendly, efficient, and politically correct. Ethereum’s shift from Proof-of-Work to Proof-of-Stake cut energy use by 99%. That’s why ESG investors are all-in on staking — it’s future-proof.

💰 Liquidity & Flexibility Factor

Liquidity makes or breaks your strategy:

- Cloud Mining: Once you buy a contract, you’re locked. No exit, no refunds.

- Staking: You can unstake, but there’s an “unbonding period” — usually 7 to 21 days.

- Liquid Staking: Game-changer. You stake, you earn, AND you stay liquid.

If flexibility is your priority, staking wins every time.

⚖️ Tax & Regulatory Game in 2025

You can make a fortune, but don’t forget the taxman.

- Rewards are taxed as ordinary income when received.

- When you sell those rewards? Capital gains tax applies.

- Jurisdictions vary, but compliance is getting tighter.

Regulators now demand platform transparency, audits, and KYC. Investors trust platforms that play by the rules. Anything less is a red flag.

🚨 Market Risks & Platform Trust

Here’s the brutal truth:

- Cloud Mining: Scam central. Some platforms disappear overnight. Others over-promise and under-deliver.

- Staking: Safer, but not bulletproof. Validator misbehaviour can lead to slashing — where you lose part of your stake.

The new gold standard is audited, transparent platforms. If they don’t publish audits? Walk away.

📉 Volatility: The Silent Killer

Don’t let glossy APRs fool you. Market volatility is the biggest risk in both strategies.

- If Bitcoin price crashes, cloud mining returns evaporate.

- If Solana drops 50%, your staking rewards won’t save you.

The Wolf’s warning: yields are meaningless if the coin tanks. Always factor in price risk.

🔑 Decision Framework: Mining or Staking?

So how do you decide? Simple checklist:

- Risk Appetite: High? Explore risky staking plays. Low? Stick to Ethereum staking.

- Liquidity Needs: Need flexibility? Liquid staking all day.

- Sustainability Goals: ESG-minded? Avoid mining, go staking.

- Time Horizon: Short-term gamble? Mining contracts. Long-term cashflow? Staking.

The Wolf’s Rule: Don’t chase shiny APR numbers. Choose based on your goals.

📚 Real-World Case Studies

- Beginner Miner: Signed a 2-year Bitcoin contract in 2022, enjoyed 7% APR during the bull run, but tanked in the bear. Net profit? Minimal.

- Solana Staker: Used Marinade’s liquid staking, earned 7% APY AND kept liquidity. Could pivot fast when the market moved.

- XRP Cloud Mining Victim: Believed the 800% APR scam, lost everything. Lesson? Greed kills.

🔗 Internal Resource Boosters

Want to go deeper? These guides are your next step:

- Beginners start with How to buy crypto guide

- Learn the ropes with RSI crypto trading strategies

- Build passive income with Earn crypto without selling passive income

🚀 The Wolf’s Final Verdict

Here’s my no-BS take:

- Cloud mining is beginner-friendly but risky, centralised, and environmentally messy.

- Staking is sustainable, predictable, and the smart institutional play.

- If you want true flexibility and yield, liquid staking is the weapon of choice.

Remember, you don’t have to pick just one. The sharpest investors diversify between mining, staking, and active trading.

❓ FAQs – Quickfire Answers

1. Which is safer in 2025: cloud mining or staking?

Staking, hands down. Mining is plagued with scams.

2. Can you lose money staking crypto?

Yes. Validators can get slashed, and token prices can drop.

3. Are staking rewards guaranteed?

No. They depend on network performance and validator reliability.

4. Is cloud mining profitable after fees?

Often not. Many contracts barely cover costs, especially in bear markets.

5. Which method suits ESG-conscious investors?

Staking. Proof-of-Stake is the green alternative.

📌 Conclusion: Play the Game Smart, Don’t Get Played

At the end of the day, both cloud mining and staking offer a shot at passive income. But they come with different risks, rewards, and suitability profiles.

- Cloud mining = risky contracts, centralisation, environmental impact.

- Staking = sustainable, flexible, and institution-approved.

The Wolf’s advice? Play smart, diversify, and never fall for outrageous promises. Passive income in crypto isn’t about luck — it’s about strategy, discipline, and picking the right partners.

And if you want tools, insights, and a network of over 100,000 traders ready to help you sharpen your edge — keep reading below.

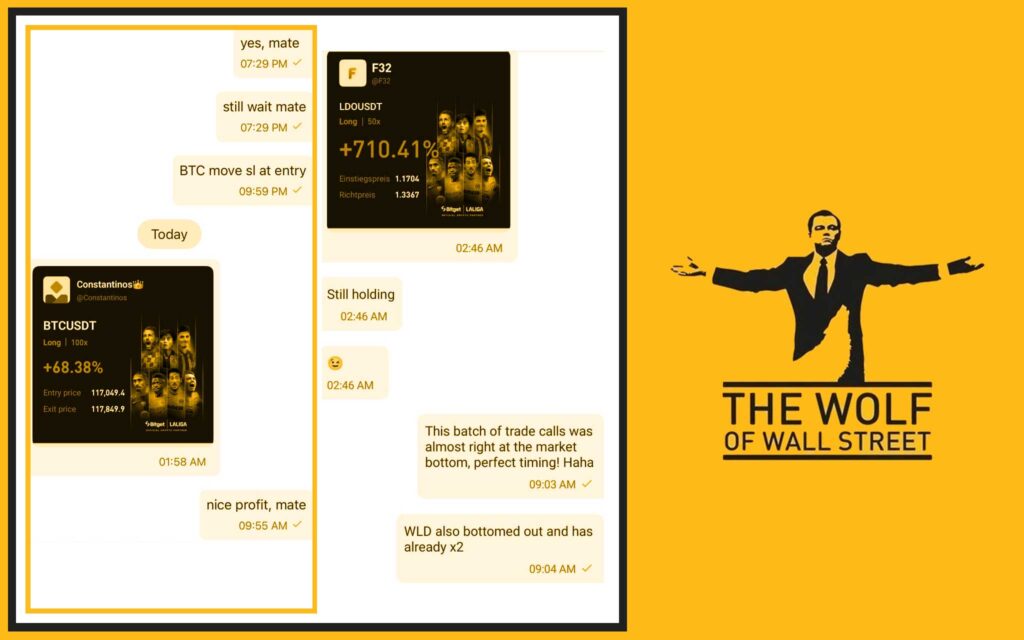

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street