🔥 Introduction – The Big Reset is Here

We’re not in a “normal” market cycle anymore — we’re staring straight down the barrel of the biggest societal and financial reset in modern history. Economists call it the Fourth Turning. I call it a once-in-a-lifetime opportunity. And guess what? Bitcoin is the lifeboat. The hard money, the uncensorable asset, the rocket fuel that’s going to take us out of the wreckage of broken banks and worthless paper money.

This isn’t hype — it’s survival. And if you’re not paying attention, you’ll be left behind.

🔄 The Fourth Turning Explained

The Fourth Turning comes from historians Strauss & Howe — a generational theory that says society runs on cycles. Every 80–100 years, everything breaks. Institutions collapse, governments fall, currencies implode, and a new order rises. The last one? World War II. The current one? It’s happening right now.

Debt crises. Inflation. Geopolitical chaos. Distrust in leaders. This is the reset phase, and it’s why people are scrambling for something solid, something incorruptible. That’s where Bitcoin enters the stage.

🏦 The Crisis of Trust

Jordi Visser nailed it: nobody trusts banks, governments, or even their own employers anymore. People are watching their savings get inflated away, their jobs automated, their pensions threatened, and they’ve had enough.

Let’s be clear: when trust disappears, money follows. And it’s flowing straight into decentralised, borderless, permissionless Bitcoin. Because unlike fiat? Bitcoin doesn’t lie. Bitcoin doesn’t need Jerome Powell’s approval. Bitcoin doesn’t care about politics.

💎 Bitcoin: Hard Money for a Soft World

Gold had a good run, but Bitcoin is digital gold on steroids. Immutable. Scarce. Transparent. While central banks are printing trillions, Bitcoin laughs — capped at 21 million forever.

When governments play games with interest rates, Bitcoin doesn’t flinch. It’s the purest form of hard money humanity has ever created. The ultimate antidote to weak currencies and failed policies.

📉📈 The K-Shaped Economy

We’re living in a K-shaped recovery — where the rich get richer and the rest get crushed. Asset holders? They’re riding the wave of stocks, property, and yes — Bitcoin. Wage earners? They’re drowning in inflation.

This divide isn’t closing. It’s widening. And Bitcoin isn’t just an investment anymore. It’s the ticket out of a system rigged against the average person.

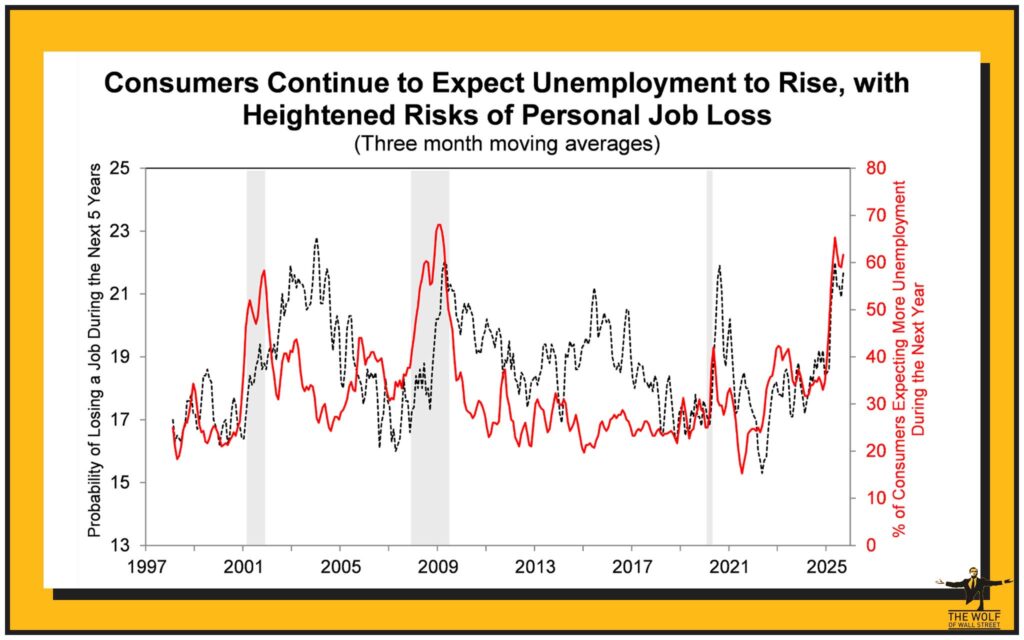

📊 Consumer Confidence at Rock Bottom

Check the University of Michigan survey: only 24% of people expect to maintain stable spending power, and over 60% think unemployment will rise by 2026. Translation? Fear is sky-high. Confidence is dead.

When fear dominates, smart money runs to safety. But this time, safety isn’t the dollar, or bonds, or even gold. It’s Bitcoin — the one asset outside government control.

🌎 Bitcoin in Emerging Markets

Want proof? Look at Argentina. Inflation’s so bad people can’t save in pesos without going broke. What do they do? They stack Bitcoin. Not for speculation — but to survive.

Emerging markets are ground zero for Bitcoin adoption. These nations don’t need to be convinced — they’re living the pain, and Bitcoin is their shield.

🏛️ Institutional Adoption: The Next Domino

Retail investors lit the match, but institutions will fuel the fire. ETFs are here. Pension funds are circling. Hedge funds are allocating. And when Wall Street goes all-in? That’s when Bitcoin rockets to the stratosphere.

Regulatory clarity is the last domino. Once governments set the rules, the floodgates open.

🌍 The Geopolitical Wildcard

The dollar’s dominance is under siege. BRICS nations are building alternatives. Countries are dumping US treasuries. What’s the neutral middle ground? Bitcoin.

A currency no single nation controls. A settlement layer for a multipolar world. Don’t underestimate the power of that shift.

⚠️ Counterarguments & Risks

Let’s not sugar-coat it. Bitcoin isn’t risk-free. Volatility can shake weak hands. Governments could launch crackdowns. Scalability is still evolving.

But here’s the thing — every risk you see in Bitcoin? It’s nothing compared to the risk of holding fiat in a collapsing system.

🎯 Why the Fourth Turning is Bitcoin’s Sweet Spot

This isn’t just a macro play — it’s a generational play. Young people don’t trust banks. They don’t believe in pensions. They don’t want to play the same rigged game. Bitcoin is their default option.

The Fourth Turning is the moment when old institutions die, and new ones rise. Bitcoin isn’t just participating — it’s leading the revolution.

💼 Actionable Strategies for Investors

Here’s the play:

- Buy and Hold: Don’t overthink. Stack sats and hold.

- DCA (Dollar-Cost Average): Smooth out volatility by buying consistently.

- Risk Management: Don’t over-leverage. Protect your downside.

- Use Tools & Signals: Ride with expert insights instead of guessing.

Want the edge? That’s where The Wolf Of Wall Street comes in.

🚀 The Wolf Of Wall Street Crypto Advantage

The Wolf Of Wall Street crypto trading community gives you the ammo to win:

- Exclusive VIP Signals: Proprietary calls to maximise profits.

- Expert Market Analysis: Insights from seasoned traders.

- Private Community: 100,000+ traders sharing strategies.

- Essential Trading Tools: Volume calculators, risk tools.

- 24/7 Support: Real people, always on call.

👉 Check the full service here

👉 Join the Telegram community

This is your edge in a brutal market.

🔗 Internal Linking Opportunity

For readers looking to go deeper:

- Latest News on Bitcoin adoption.

- Broader Cryptocurrencies market insights.

- Advanced Trading Insights for serious players.

🔮 Future Outlook: Bitcoin Beyond the Fourth Turning

Fast forward 10 years. Bitcoin isn’t fringe anymore. It’s mainstream. Reserve banks hold it. Nations settle trade with it. Corporations use it as treasury collateral. Retail investors? They just call it “money.”

The Bitcoin Standard isn’t a dream. It’s a scenario within reach. And the Fourth Turning is the ignition switch.

🌊 Conclusion – Don’t Miss the Wave

History doesn’t wait. The Fourth Turning is already here. Institutions are crumbling. Inflation is eating savings alive. Trust is gone. And in that chaos, Bitcoin shines like a lighthouse in the storm.

This is the moment. The lifeboat is leaving. You can either climb aboard, or get swallowed by the old system. The choice is yours.

❓ FAQs

1. What is the Fourth Turning and why does it matter for Bitcoin?

It’s a generational crisis cycle. Every 80–100 years, institutions collapse. This time, Bitcoin is the asset rising from the rubble.

2. Why is distrust in banks fuelling Bitcoin adoption?

Because people see fiat failing. Bitcoin offers a decentralised, incorruptible alternative.

3. How does Bitcoin protect against inflation?

Supply is fixed at 21 million. No central bank can print more.

4. Can emerging markets really lead global adoption?

Yes. Countries like Argentina prove Bitcoin works as a survival tool against hyperinflation.

5. What risks should I watch out for before investing?

Volatility, regulatory risks, and scalability. But the systemic risks of fiat are far greater.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street