🏁 Introduction: Crypto Shakes the Auto World

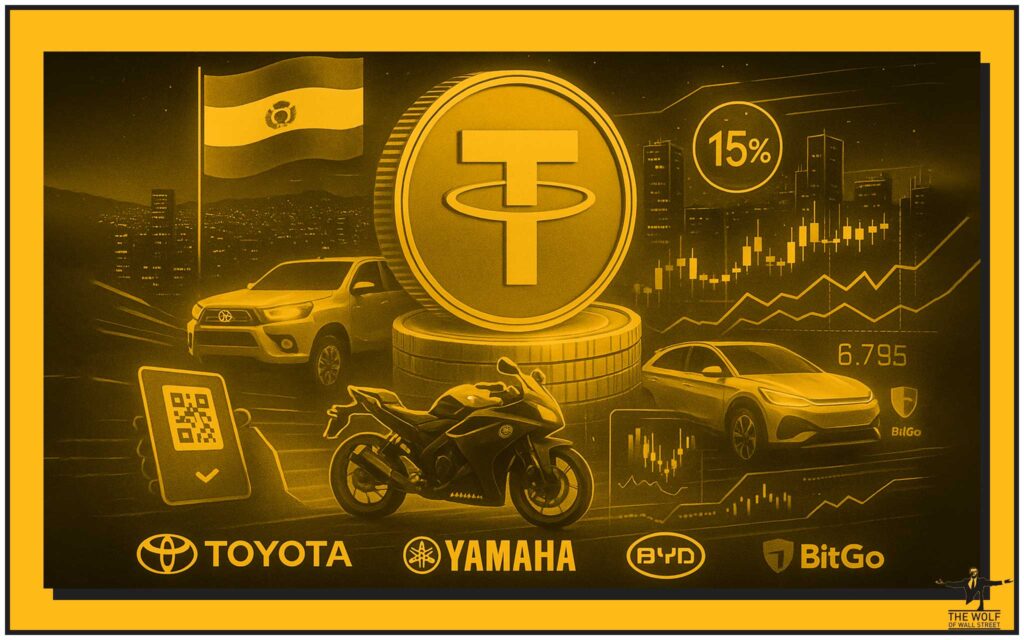

Forget Wall Street – the real fireworks are going off in Bolivia. Toyota, Yamaha, and BYD – three giants in the global automotive arena – just flipped the script on how cars get sold. They’re not waiting on fragile banks or hyperinflated local currencies. Instead, they’re cashing in on Tether (USDT). That’s right: Bolivians can now walk into a dealership and drive away in a Toyota using stablecoins.

This isn’t hype. This is financial revolution in motion – and it’s happening because the old system collapsed. The Bolivian economy is burning, the dollar is scarce, and stablecoins are the oxygen tank.

🌍 The Big Shift: Automakers Embrace Tether

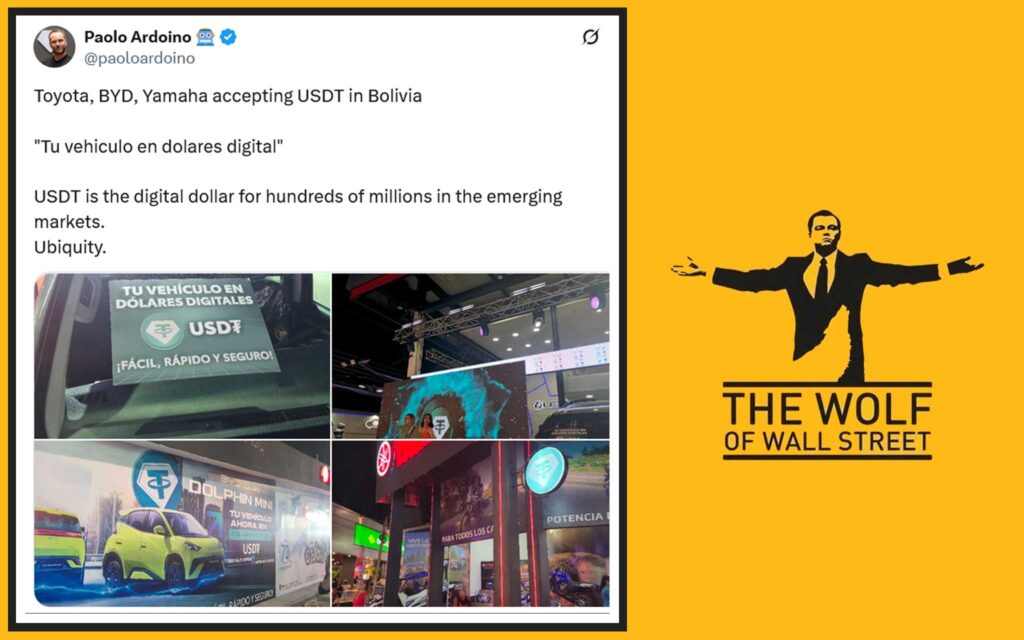

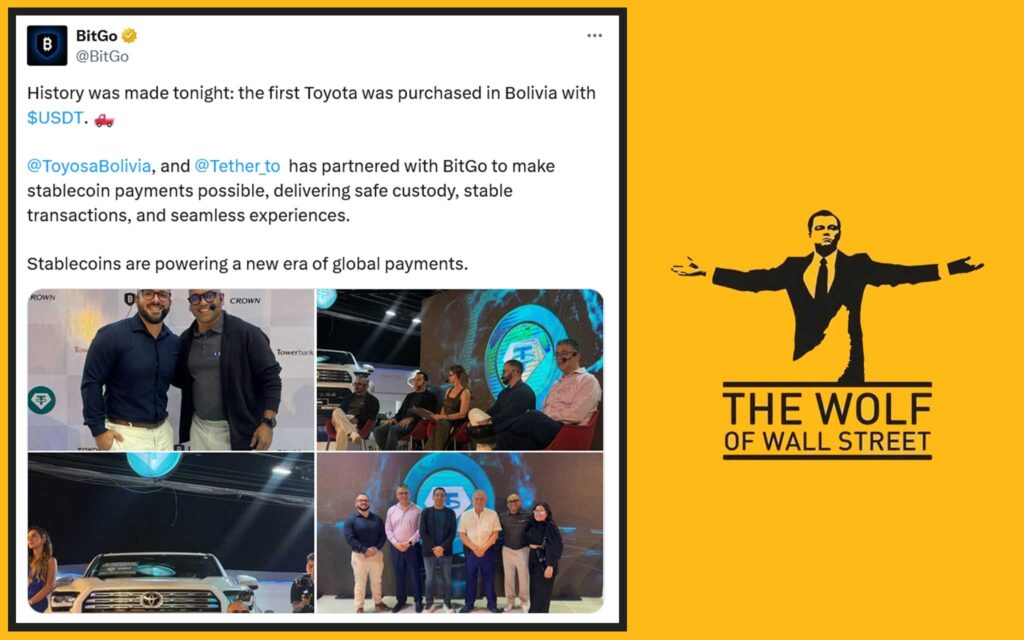

Here’s the headline move: Toyota, Yamaha, and BYD now officially accept USDT in Bolivia. This isn’t some pilot programme. It’s mainstream, top-tier adoption. Tether CEO Paolo Ardoino confirmed transactions already went through. And to lock down security, BitGo is handling custody for those big-ticket deals.

Think about it: cars – one of the most universally desired consumer assets – now being bought and sold in stablecoins. If that doesn’t scream “crypto’s gone mainstream,” nothing does.

📉 Bolivia’s Dollar Crisis: The Catalyst Nobody Saw Coming

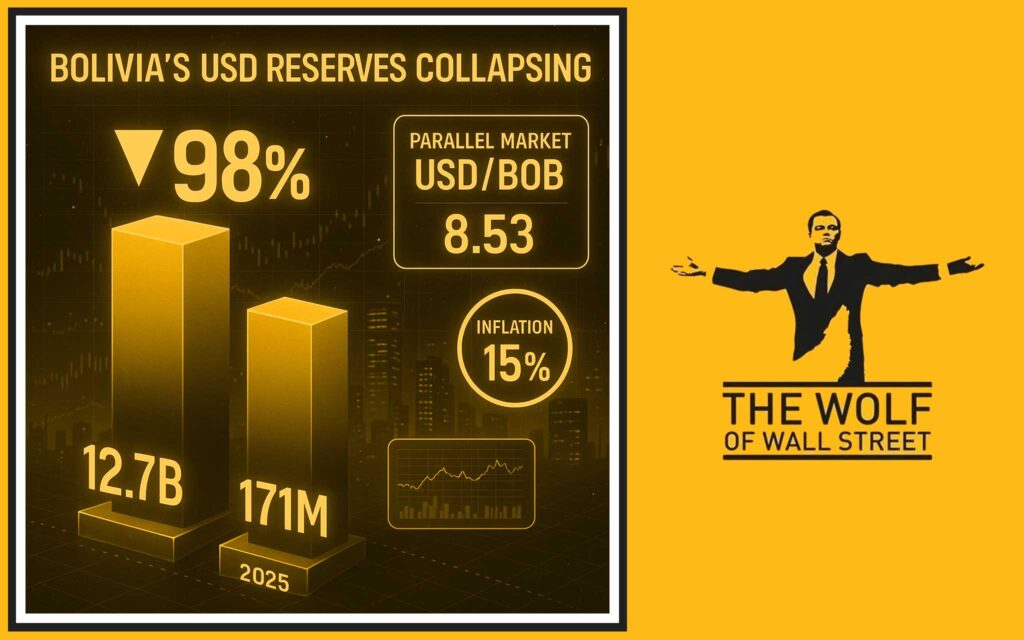

Let’s talk economics. Bolivia’s foreign reserves were once $12.7 billion in 2014. By August 2025? $171 million. A 98% collapse. Dollars are harder to find than diamonds in a coal mine.

The black-market dollar exchange rate has exploded, doubling the official rate. Inflation? Over 15%. Businesses can’t import, families can’t plan, and the average Bolivian is priced out of stability.

Enter USDT – a lifeline. Stablecoins aren’t speculation here. They’re survival.

💰 Stablecoins as Life Support for Bolivia’s Economy

Bolivia didn’t just adopt crypto for fun. Businesses had no choice. Importers now use USDT to pay overseas suppliers. Retailers price daily goods in Tether. At airports, you’ll see prices tagged in USDT. At dealerships? A brand-new Toyota Hilux tagged in stablecoin.

Stablecoins have become Bolivia’s unofficial parallel currency. They’re not replacing the boliviano yet, but they’re propping up what little remains of stability.

⚖️ From Ban to Boom: Bolivia’s Crypto Legalisation Story

Rewind a year: Bolivia was a hostile environment for crypto. A total ban was in place. Fast-forward to June 2024: the government reversed course. Banks were authorised to process Bitcoin and stablecoin transactions.

That policy flip turned the nation into one of the fastest adopters of crypto in Latin America. Within months, state firms and global corporations jumped in. Now? Automakers are leading the way.

🏦 Banks Flip the Script: From Opposition to Endorsement

Bolivia’s top bank made it official: crypto is “a viable and reliable alternative.” This is monumental. When institutions back stablecoins, the scepticism dies. State-owned companies followed, using USDT for cross-border trade in oil, gas, and more.

Institutional support was the domino that allowed retail adoption to go full throttle.

🚗 Dealerships on the Blockchain: Case Study in Cars

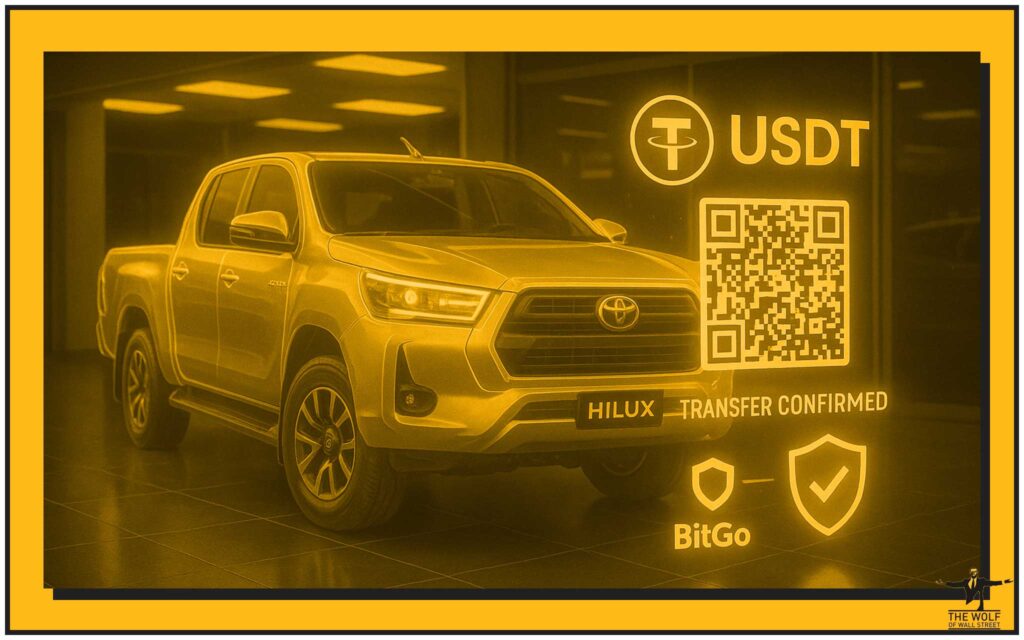

Here’s how it works: a Bolivian buyer transfers USDT from their wallet to the dealership’s wallet. BitGo provides secure custody for large sums, ensuring transactions can’t be tampered with. The buyer drives away with a car, the dealership settles accounts in crypto or converts to USD abroad.

It’s frictionless, secure, and faster than any traditional banking channel. Welcome to blockchain in real commerce.

🔗 Why Stablecoins, Not Bitcoin?

Why not Bitcoin? Simple: volatility. You can’t peg a car to a currency that can swing 10% in a day. USDT offers predictability – it’s tied to the US dollar. That stability makes it usable for daily commerce.

Businesses don’t want rollercoasters. They want certainty. And stablecoins deliver.

📈 Macro Impact: Bolivia as Latin America’s Crypto Test Lab

Bolivia’s experiment is now a regional case study. Argentina and Venezuela have toyed with crypto adoption, but Bolivia is setting the pace by necessity, not ideology. Automakers adopting USDT is a signal the corporate world takes crypto seriously.

If this works, expect copycats across Latin America.

🎭 Politics, Power, and the Blockchain Election

October 2025 brings a runoff election. One candidate is pushing blockchain integration, the other wants the old guard. Crypto adoption isn’t just economic now – it’s political.

The question: will blockchain become a national policy or remain a desperate survival tool? The outcome of the election could cement Bolivia as Latin America’s first true crypto economy.

🛠️ The Infrastructure Backbone: Security & Custody

No revolution survives without infrastructure. BitGo is the backbone here, offering secure custody for high-value transactions. Buyers and sellers alike trust the system because funds are locked into custody wallets, reducing risk.

This infrastructure race is only heating up. Expect more players – wallets, exchanges, payment processors – to flood Bolivia with solutions.

🛒 Retail Everywhere: USDT for Coffee, Cars, and More

Crypto in Bolivia isn’t just for big-ticket items like cars. You can now grab a coffee or fill up your tank in USDT. Shops, supermarkets, and even airport kiosks price items directly in stablecoins.

This isn’t the future. This is right now. And the cultural shift is seismic.

🧠 Consumer Psychology: Trust in Crypto Over Government

The boliviano is weak. The government is weaker. Citizens have lost faith in the state’s ability to manage money. Stablecoins offer trust without politicians.

For the average Bolivian, it’s not about speculation or trading charts. It’s about buying groceries without worrying tomorrow’s price will double. Crypto has become common sense.

⚡ The Global Ripple Effect: Auto & Finance Industries Take Notes

Toyota, Yamaha, and BYD adopting USDT isn’t just about Bolivia. Global automakers are watching. If crypto works in a collapsing economy, why not integrate it everywhere? Finance, insurance, and even property markets are now taking notes.

This could trigger a domino effect where stablecoin payments become standard for industries far beyond cars.

🚨 The Dark Side: Risks & Remaining Gaps

Not everything is smooth. Gaps remain:

- No concrete data on consumer adoption rates.

- Over-reliance on stablecoins could backfire if USDT faces global regulation issues.

- Political instability could undo progress overnight.

Bolivia is running on momentum – but the long-term impact is still uncertain.

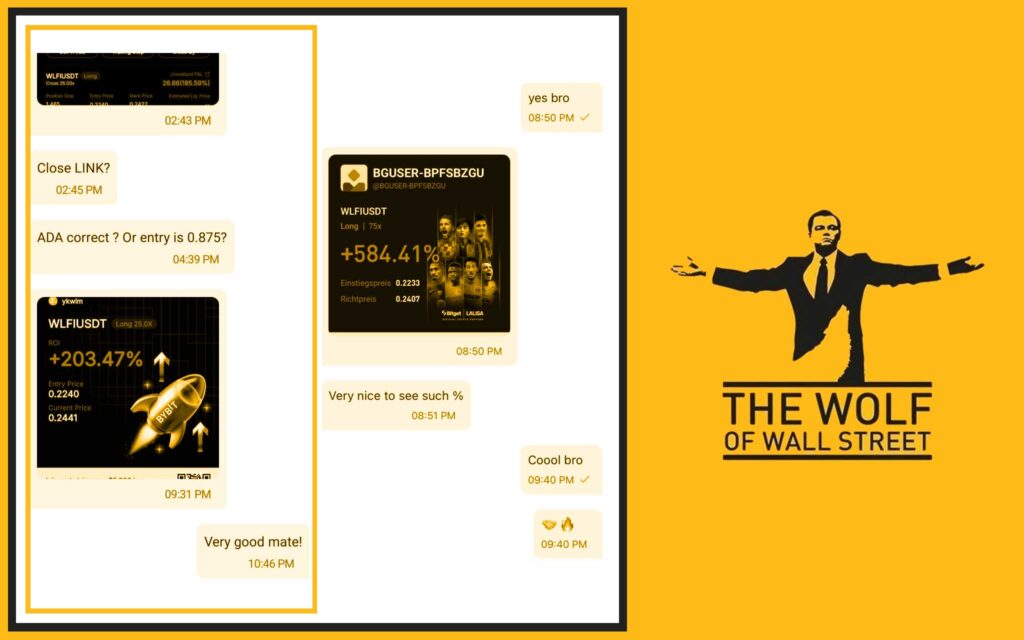

🐺 The Wolf’s Playbook: Profit From the Crypto Revolution

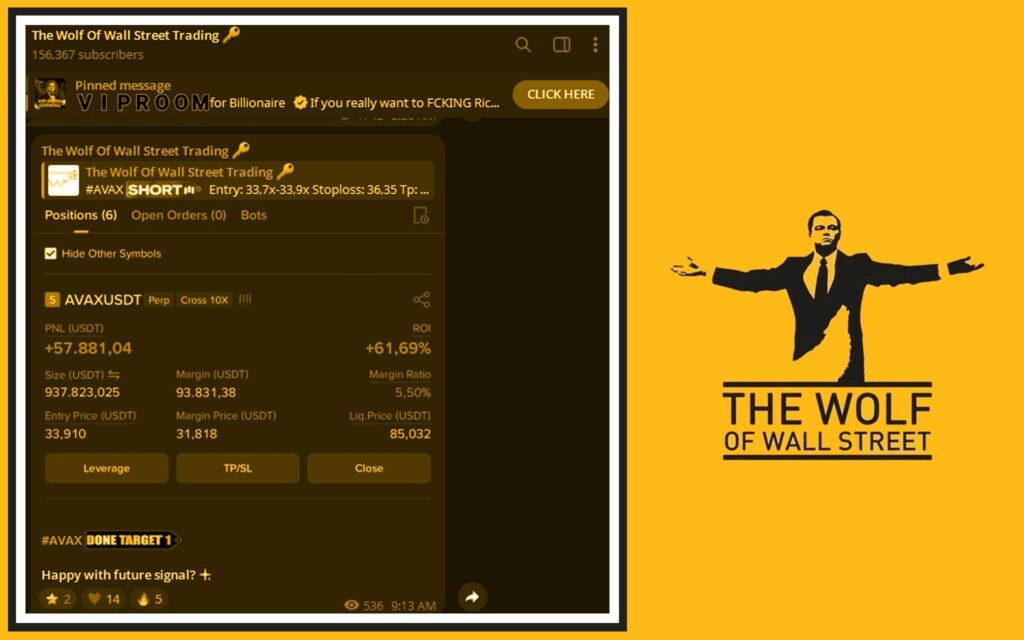

Here’s the bottom line: when money shifts, fortunes are made. Bolivia is showing the world that crypto is no longer a niche – it’s mainstream. The smart players aren’t sitting on the sidelines. They’re moving.

That’s why communities like the The Wolf Of Wall Street crypto trading network are mission critical. You want signals, analysis, private community insights, and trading tools? You want an edge in chaos? The Wolf Of Wall Street delivers. Don’t just watch adoption. Profit from it.

📚 FAQs: Cutting Through the Noise

1. Can anyone in Bolivia buy a car with Tether?

Yes. Dealerships for Toyota, Yamaha, and BYD now accept USDT.

2. Is Bolivia’s crypto adoption permanent or political?

It’s driven by necessity. The upcoming election could make adoption permanent policy.

3. Why did Toyota, Yamaha, and BYD jump first?

Because car sales are high-ticket items where secure transactions matter. Crypto solves their currency risk instantly.

4. How safe is paying with stablecoins?

With custodial partners like BitGo, transactions are secured at institutional levels.

5. What’s next for Latin America’s crypto future?

Expect wider adoption. Bolivia could be the playbook other struggling economies copy.

🏆 Conclusion: The Wolf’s Final Word

Toyota, Yamaha, and BYD accepting Tether in Bolivia is more than a headline – it’s a warning shot at the old financial system. Stablecoins aren’t the future. They are the now.

When the world’s biggest automakers embrace crypto in a country fighting inflation and currency collapse, you know the tide has turned. The Wolf’s advice? Don’t just read about it – act. The greatest transfer of wealth is happening in plain sight.

🔗 Internal Link Opportunities

- For traders seeking deeper analysis, explore crypto trading insights.

- Learn more about stablecoin adoption strategies.

- Stay updated on Latin America’s crypto regulations.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community: The Wolf Of Wall Street Telegram for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.