🔥 Introduction – Why You Can’t Ignore ISPOs

Listen up. Traditional fundraising in crypto is broken. You’ve seen it — ICOs, IDOs, IEOs, STOs — all smoke and mirrors, making investors cough up cash and hope the project doesn’t vanish. But there’s a new kid on the block, and it’s flipping the script: the Initial Stake Pool Offering (ISPO).

Born on Cardano, ISPOs let investors stake their tokens, earn project rewards, and — here’s the kicker — never lose custody of their money. That’s right. You keep your ADA, you keep control, and you still bag the upside. By the time you finish this guide, you’ll understand exactly how ISPOs work, why they’re making waves, and how to position yourself to win big.

💰 Traditional Crypto Fundraising Models (And Why They Suck)

Before ISPOs, crypto projects leaned on old-school models:

- ICOs (Initial Coin Offerings): Send your funds, cross your fingers, pray you don’t get rugged.

- IEOs (Initial Exchange Offerings): Centralised exchanges take control. Sure, there’s vetting, but you’re still handing over money.

- IDOs (Initial DEX Offerings): Same deal, but on decentralised platforms — slightly freer, just as risky.

- STOs (Security Token Offerings): More regulated, but locked behind compliance walls. Retail investors often left out.

The problem? Every single model demands custody of your funds. You give up liquidity and control. If the project tanks, good luck getting your money back.

If you want to dig deeper into how tokens traditionally get listed, check out this crypto token listing process guide.

🏦 Enter ISPO – The Wall Street of Cardano

Here’s where the game changes. An ISPO lets you delegate your ADA to a project’s stake pool. Instead of pocketing the staking rewards yourself, you get rewarded with the project’s native tokens. Your ADA never leaves your wallet — you retain full custody.

In plain English: you’re betting on upside without burning your capital. It’s democratic, liquid, and safe. Exactly the kind of fundraising model crypto needed.

⚙️ How Staking Pools Actually Work

Let’s cut through the noise. ISPOs function on Proof-of-Stake (PoS). Here’s the breakdown:

- Delegators (investors) stake ADA into pools.

- Pools with larger stakes have higher odds of validating new blocks.

- Each five-day epoch, Cardano’s Ouroboros protocol distributes ADA rewards.

- Normally, delegators receive ADA rewards. In an ISPO, those rewards fund project development.

So, instead of “donating” ADA, you’re redirecting your staking yield to back projects. Your capital stays intact.

🪙 ADA’s Role in the ISPO Engine

Think of ADA as the fuel. You delegate it, and the pool starts running. Developers set “margins” in their pool — usually 100%. That means all staking rewards are funnelled to the project.

- Public pools: Anyone can jump in.

- Private pools: Invite-only, exclusive.

This design creates a win-win dynamic: developers fund their project, and you, the investor, stack their tokens risk-free.

🚀 Famous ISPO Case Studies

- MELD – the trailblazer. MELD’s ISPO was a monster success, raising billions in delegated ADA. Investors could choose:

- Pool A: 100% MELD token rewards.

- Pool B: 50% MELD + 50% ADA.

A revolutionary DeFi banking protocol born without a single ICO. - MinSwap – introduced the FISO (Fair Initial Stake Pool Offering). Instead of one mega-pool, rewards were spread across smaller community pools, avoiding whale domination.

These projects proved ISPOs weren’t just theory — they work.

🥊 ISPO vs ICO – The Real Showdown

Let’s put it head-to-head:

- ICO: You send funds. You lose liquidity. You cross your fingers.

- ISPO: You delegate ADA. You keep custody. You can unstake anytime.

The difference? Control. And in crypto, control is everything.

If you’re learning the ropes of crypto investment strategies, you’ll want to check out The Wolf’s guide to asset classes in crypto.

🌍 Beyond Cardano – Cross-Chain ISPO Adoption

Cardano may have pioneered the ISPO, but others smelled the money and followed:

- Tron

- Polkadot

- Terra

- Solana

These ecosystems are adapting ISPO-style fundraising because the logic is bulletproof: investor safety + project capital = unstoppable growth. Expect even more Proof-of-Stake blockchains to roll out ISPOs in 2025 and beyond.

🏦 MELD’s ISPO in Detail – A Masterclass in Fundraising

MELD didn’t just experiment — it dominated. By attracting billions in ADA delegation, MELD showed the world how to launch without extracting a single cent from investors’ pockets.

Its model:

- 100% MELD token reward pools – investors bet fully on MELD’s success.

- 50/50 split pools – perfect for hedgers who wanted ADA yield too.

The result? A fully funded DeFi banking protocol with global recognition.

🔑 Flexibility and Control – Why Investors Love ISPOs

Investors aren’t dumb. They’re tired of scams, rug pulls, and vanishing projects. ISPOs solve that.

- Unstake anytime – no lock-ins.

- Redelegate anytime – liquidity always preserved.

- Tokens as rewards – upside potential, downside limited.

Compare that to ICOs, where funds vanish into thin air. It’s not even close.

⚡ Risks & Limitations of ISPOs

Let’s be real. Nothing in crypto is risk-free. Here’s what you need to watch:

- Dilution: If a pool is overcrowded, your share of tokens drops.

- Project risk: If the project fails, your tokens may be worthless.

- Regulation: Governments haven’t fully addressed ISPOs yet. Rules could change.

Still, compared to ICOs, ISPOs are a safer, smarter bet.

📈 Why ISPOs Could Be the Future of Crypto Fundraising

The stars align for ISPOs:

- Investor protection – keep funds, gain tokens.

- Developer empowerment – projects get steady funding.

- Inclusivity – anyone with ADA can join.

This is crypto’s fundraising evolution, and it’s not going away. In fact, ISPOs could set the new global standard.

🧭 How to Get Started with ISPO Participation

Ready to roll? Here’s how to get in the game:

- Pick your project – research ISPO pools.

- Set up a wallet – Daedalus or Yoroi are Cardano-friendly.

- Delegate your ADA – choose the pool, delegate.

- Monitor rewards – check project token allocations.

- Unstake anytime – your ADA is liquid, always.

Want more passive income strategies? Read this guide on earning crypto without selling.

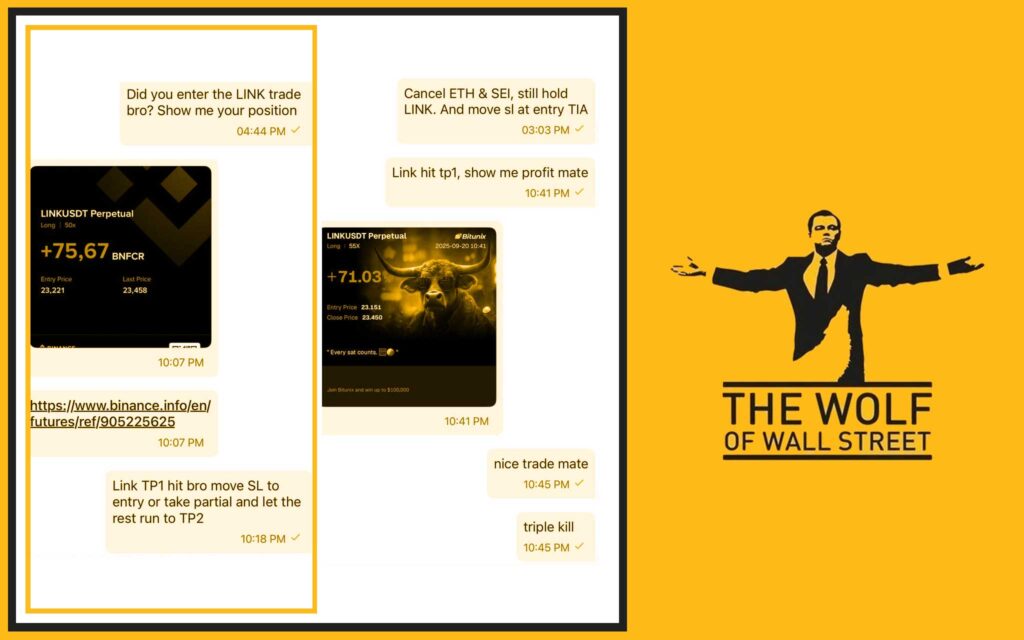

🤝 The Wolf Of Wall Street – Your Trading Edge

While ISPOs are shaking up fundraising, you’ll also want tools to sharpen your trading edge. That’s where The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals – maximise profits with insider-grade calls.

- Expert Market Analysis – seasoned traders break it down.

- Private Community – 100,000+ members sharing insights.

- Essential Trading Tools – calculators, charts, everything you need.

- 24/7 Support – always on, always there.

👉 Visit The Wolf Of Wall Street Service for full details.

👉 Join the The Wolf Of Wall Street Telegram community for real-time discussions.

📌 FAQs on ISPOs

1. Can you lose ADA in an ISPO?

No. Your ADA never leaves your wallet. Only your staking rewards are redirected.

2. What wallets support ISPO delegation?

Popular options include Daedalus and Yoroi.

3. Are ISPOs regulated?

Not yet. Regulatory clarity may come as adoption grows.

4. Do ISPOs guarantee project success?

No. Token rewards are tied to project outcomes. DYOR (Do Your Own Research).

5. Can ISPOs work outside Cardano?

Yes. They’re already being trialled on Tron, Polkadot, Solana, and Terra.

🎯 Conclusion – The Wolf’s Take on ISPOs

Here’s the bottom line. ISPOs are a revolution. They flip fundraising on its head, giving investors control and developers the capital they need without the risks of traditional models.

If you’re ignoring ISPOs, you’re leaving serious money on the table. It’s democratic, liquid, and damn effective. And in this game, control is the name of the game — and ISPOs hand it back to you.