🐺 Introduction: The $100M Power Play

Listen up. Archetype just closed a $100 million+ crypto venture fund. That’s not pocket change. That’s serious institutional firepower being aimed straight at blockchain startups in 2025. And here’s the kicker—this isn’t some hype-driven play. This is real money with real conviction.

In a market where most retail investors are chasing memecoins, Archetype is playing a different game. They’re building the rails for the next economy. And if you’re a founder or trader, this matters to you more than you think.

💰 The Big Win: Archetype III Fund Launch

Archetype just launched its third fund—Archetype III—and it’s locked in over $100 million in capital commitments. Who’s backing this thing? Not your typical crypto bros. We’re talking pensions, sovereign wealth funds, academic endowments, and funds of funds. Heavy hitters.

Why does that matter? Because when these guys show up, it means crypto isn’t fringe anymore. It’s institutional. It’s mainstream. And that money? It’s sticky. It doesn’t just flow in and out based on Twitter sentiment.

📈 Market Timing: Why Now?

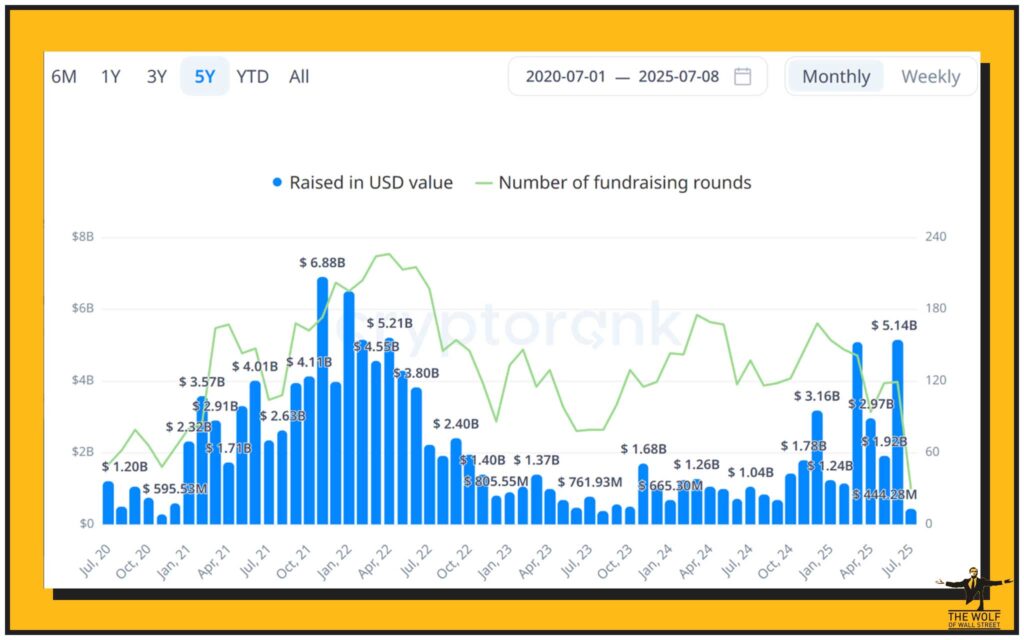

Let’s talk timing. Q2 2025 saw crypto VC investments skyrocket to $10.03 billion, the highest since 2022. That’s not luck—that’s strategy. The market is shifting from speculative bets to projects with sustainable revenue models.

Add to that the GENIUS Act, a regulatory framework for stablecoins that’s given institutional investors the green light. Regulation isn’t a roadblock anymore—it’s a tailwind.

🚀 Archetype’s Playbook: Where the Money’s Going

This isn’t a scattershot play. Archetype is laser-focused. Here’s where the cash is flowing:

- Onchain Infrastructure: The backbone of blockchain. Think scaling solutions, interoperability, and security.

- Decentralized Finance (DeFi): Building the new Wall Street onchain. If you’re trading, you should already be studying DeFi strategies.

- Stablecoins: With the GENIUS Act in place, the stablecoin market is primed for explosive growth.

- Tokenization & Mobile Apps: From real-world assets to crypto-native social platforms.

This aligns perfectly with broader blockchain ecosystems. Archetype isn’t chasing hype—they’re backing the future.

🏆 Track Record: Archetype’s Winning Bets

This isn’t their first rodeo. Archetype has already chalked up some serious wins:

- Privy – acquired by Stripe.

- US Bitcoin Corp – merged with Hut 8.

- Early bets on Monad, Farcaster, Relay, and Ritual.

That’s not luck. That’s execution. And in venture capital, execution is everything. When founders see that track record, they know Archetype is more than a cheque—they’re a launchpad.

It’s the same strategic thinking you see in the crypto hedge funds market shift. Play smart, play long-term.

🎯 Strategic Shift: Fewer, Bigger, Smarter Bets

Here’s where Archetype separates from the pack. They’re not doing the shotgun approach anymore. Instead, they’re concentrating capital into fewer, bigger, and higher-conviction bets. Only one new limited partner joined this fund. That means more alignment, more trust, more control.

In other words, they’re not just backing startups. They’re betting their reputation—and big money—on the right ones.

🌍 Archetype’s Vision: The Commerce Backbone of Web3

The long game? Archetype wants to be the commerce backbone of the blockchain internet. Forget speculation—this is about utility.

They’re supporting:

- Real-world payments and integrations.

- Tokenized assets.

- Decentralized social networks.

Think about it: if the internet built in the ’90s was about information, Web3 is about commerce and value transfer. And Archetype is laying those rails. If you’re a founder aiming for mainstream adoption, learn the ropes of the crypto token listing process.

📊 Institutional Confidence: The Shift to Professional Capital

You know what separates this fund from the last bull run? Institutions. Pensions and endowments don’t invest lightly. They do their due diligence, and they’re in it for decades, not days.

Archetype manages $350 million in assets and maintains liquid positions in Ethereum and Solana. That’s not speculation—that’s a portfolio strategy. And it ties into the major upgrade narratives like the Ethereum Fusaka upgrade and Solana’s rise.

⚖️ Regulation & the GENIUS Act: Fueling VC Momentum

The GENIUS Act gave stablecoins a regulatory framework that’s clear, enforceable, and institutionally acceptable. That’s why VCs are pouring money back into the space. Regulation isn’t a headwind anymore—it’s fuel.

For a deep dive, check out the Stable Act vs Genius Act comparison. Spoiler: the GENIUS Act is making crypto safer for big money.

🕹️ Sector Expansion: Beyond Finance

Archetype isn’t just playing in finance anymore. Their portfolio is expanding into:

- Decentralized social networks – giving users ownership and freedom.

- AI-powered gaming – merging Web3 with interactive entertainment.

- Tokenized real-world assets – from property to commodities.

This diversification ensures that even if one vertical slows, the overall portfolio keeps moving.

🔥 The Bigger Picture: Archetype vs. Other Crypto VC Giants

The VC space is crowded. But Archetype’s edge is clear: focus. While others spread thin, Archetype doubles down on scalable infrastructure and consumer-facing apps.

This focus keeps them ahead of the curve, aligned with crypto macro indicators, and positioned for outsized returns.

📉 Risks & Realities: What Could Go Wrong?

Let’s be real. There are always risks:

- Regulatory whiplash – rules can change fast.

- Market liquidity risks – downturns cut deep.

- Execution risk – founders don’t always deliver.

But Archetype’s concentrated, conviction-driven model reduces the noise. They’re not betting on everything. They’re betting on the best.

🐂 The Bullish Case: Why Founders Should Care

If you’re building in crypto right now, Archetype should be on your radar. Here’s why:

- You don’t just get funding—you get strategic backing.

- Archetype has a proven track record of scaling winners.

- Their network opens doors you can’t buy.

In short: If you’ve got a big vision, this is the partner you want in your corner.

🧩 The Wolf Of Wall Street Edge: How to Ride the Same Wave

Here’s the reality: most people reading this don’t have $100M to deploy. But you don’t need it. You need access to tools, signals, and a community that helps you trade smart. That’s where The Wolf Of Wall Street crypto trading community comes in.

What you get with The Wolf Of Wall Street:

- Exclusive VIP Signals – proprietary calls to maximise your profits.

- Expert Market Analysis – from seasoned traders who know the game.

- Private Community – over 100,000 strong, sharing strategies.

- Essential Tools – calculators, trackers, and insights.

- 24/7 Support – never trade alone.

👉 Empower your journey: Visit The Wolf Of Wall Street services or join the Telegram community.

❓ FAQs: The Investor’s Burning Questions

1. What types of startups does Archetype fund in 2025?

Early-stage blockchain startups in infrastructure, DeFi, stablecoins, tokenization, and Web3 applications.

2. How does the GENIUS Act impact VC funding in stablecoins?

It provides clarity and legitimacy, encouraging institutional adoption and long-term VC backing.

3. Why are institutional investors piling into crypto now?

Because regulation is clearer, infrastructure is stronger, and the returns are unmatched compared to traditional markets.

4. How can smaller investors position themselves alongside VC giants?

By leveraging communities like The Wolf Of Wall Street for signals, tools, and strategies that mirror institutional approaches.

🏁 Conclusion: The Archetype Blueprint

Here’s the bottom line. Archetype’s $100M fund isn’t just capital—it’s a blueprint for the future of crypto venture investing. Institutions are here, regulation is paving the way, and the focus is shifting to utility-driven projects.

As Jordan Belfort would say: this is about conviction, not hesitation. If you’re a founder, get Archetype’s attention. If you’re a trader, ride the same wave with The Wolf Of Wall Street. The game is changing—and the question is whether you’ll play to win.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.