🔥 Introduction: The Wolf’s Take on Aave V4

Listen up. Aave isn’t just dropping an update — it’s about to rewrite the DeFi playbook with V4. We’re talking a hub-and-spoke architecture, smarter risk management, liquidation that saves your ass instead of nuking your portfolio, and automation tools that’ll make even the most casual trader feel like a Wall Street pro.

By the end of this piece, you’ll know why Aave V4 isn’t just an upgrade, it’s a revolution, and how you can position yourself to squeeze every last drop of profit out of it.

🚀 The Big Picture: Why Aave Still Dominates DeFi

DeFi is sitting on a mountain of money again. The total value locked (TVL) is brushing up against $156 billion — almost at 2021 bull market highs. And guess who’s sitting on the throne? Aave.

Since launch, Aave has been the go-to protocol for decentralised lending, a place where whales, traders, and institutions alike have trusted their liquidity. But in crypto, if you’re not evolving, you’re dying. That’s why Aave’s V4 is so important.

If you don’t understand how TVL impacts liquidity and adoption, you need to check out this breakdown on total value locked (TVL) in crypto.

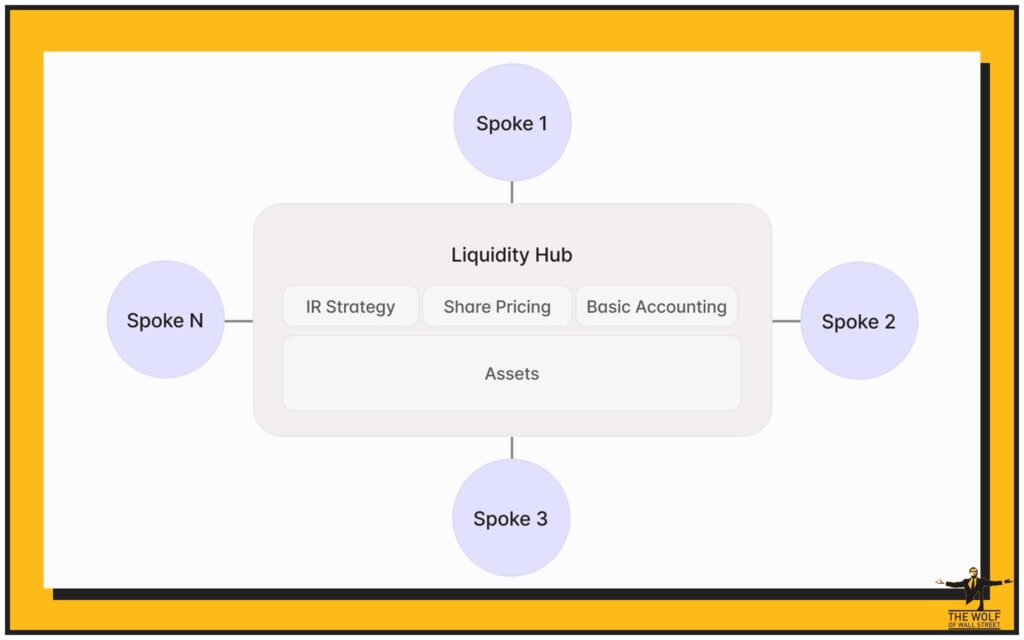

🏛️ The Hub-and-Spoke Revolution

Here’s the deal: V4 is dropping the old one-size-fits-all lending model and introducing something smarter. The hub-and-spoke design.

- Liquidity Hub = the central pool.

- Spokes = separate lending markets, each with unique risk profiles and interest rates.

This means instead of being tied down to uniform conditions, each market can flex based on risk and collateral composition. It’s modular, it’s efficient, and it’s built for growth.

Think of it like moving from one giant casino table where everyone plays the same game… to a whole casino floor where each table has its own rules and rewards.

💸 Liquidity Efficiency on Steroids

The liquidity hub isn’t just a pretty structure. It’s engineered to make capital work harder. Imagine routing your trade seamlessly across spokes for maximum yield. That’s what V4 delivers.

Liquidity efficiency is the heartbeat of DeFi profits. More efficiency = more lending opportunities, tighter spreads, and fatter returns.

When you’ve got money in motion, the system wins — and more importantly, you win.

⚡ Risk Management 2.0: The Smart Safety Net

Forget static, uniform risk rates. In V4, we’re getting asset-specific risk premiums tailored to the actual collateral you’re holding. That’s huge.

Why? Because in the old system, global changes could nuke multiple positions. Now, risk adjustments are dynamic and market-specific, keeping you safe even when volatility rips through the charts.

Picture this: ETH tanks 20% overnight. In V3, you might be staring at mass liquidations. In V4, dynamic risk configuration kicks in, absorbing shocks more intelligently.

For traders who care about surviving the storm, it’s the closest thing to an insurance policy built into the protocol. For a broader perspective, explore crypto risk management strategies.

🛡️ Liquidation Without Annihilation

Here’s where V4 really flexes: the health-targeted liquidation engine.

Instead of liquidating your entire position like a greedy loan shark, it only liquidates the precise amount needed to bring your collateral health back above water.

That means your portfolio stays intact, your game isn’t over, and you live to trade another day. This is a massive psychological edge too — it keeps confidence high in the system.

📊 The User Interface Overhaul

Say goodbye to clunky dashboards. V4 is serving up a unified, wallet-level interface.

- Full portfolio visibility across spokes.

- Trade routing made simple.

- All markets, one screen, maximum control.

That’s not just convenience. It’s power. The kind of control that keeps retail traders in the game and gives pros a crystal-clear overview.

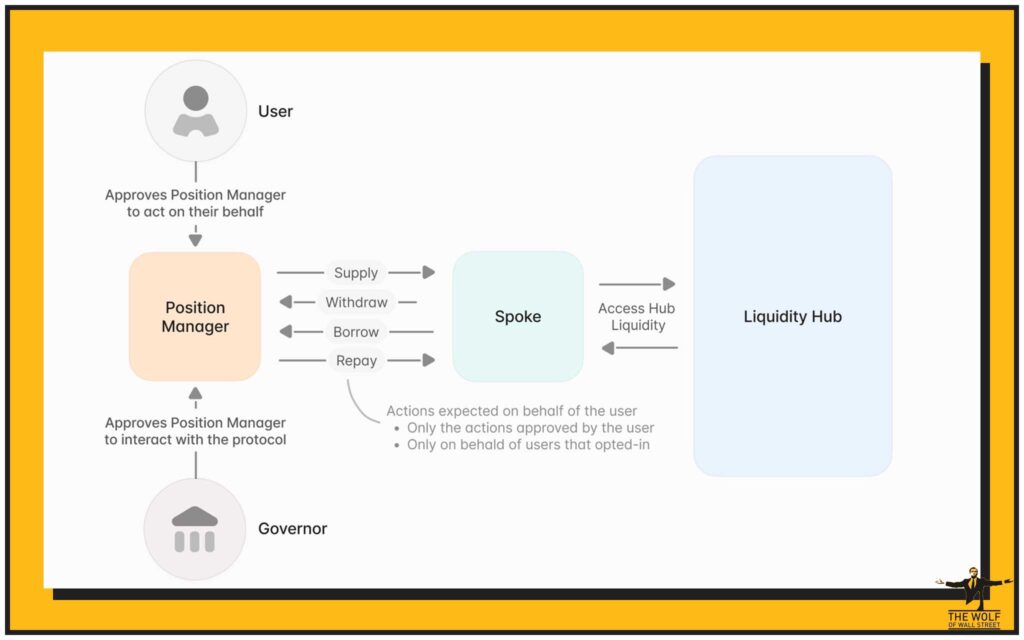

🤖 Automation: The New Power Tools

Automation is the secret sauce of wealth builders. And Aave V4 brings two killer tools to the table:

- Position Manager – handles withdrawals, borrowing, repayments automatically.

- Multi-call batching – combine transactions into a single, cost-effective action.

This isn’t just an upgrade — it’s a time and fee killer. And in DeFi, every second and every dollar counts.

🌐 The Bigger DeFi Context

We’re at a critical point: $156B in DeFi TVL, surging adoption, and institutional money circling the waters.

Aave’s timing couldn’t be sharper. V4 hits right as liquidity is roaring back into the ecosystem, meaning the impact won’t just be technical — it’ll be cultural.

We’re talking confidence restored in decentralised finance right when the market needs it most.

📅 Timeline: When V4 Hits the Market

Here’s the rollout playbook:

- Whitepaper release – full details for devs and analysts.

- Public codebase – open for the world to inspect.

- Testnet launch – chance to kick the tires before mainnet.

- Q4 2025 – the big one. Mainnet launch.

Early movers will win. Period.

🧩 What It Means for Traders and Investors

Let’s break it down Wolf-style:

- Borrowers – enjoy safer, more flexible loans without fear of getting wiped out.

- Lenders – benefit from higher, risk-adjusted yields.

- Developers – build new DeFi products on top of modular architecture.

If you’re new to the game, get your basics sorted with this guide on how to buy crypto. Because when V4 drops, you’ll want to be in.

💥 Comparison: Aave V3 vs Aave V4

- V3 Strengths: Cross-chain liquidity, efficiency mode, isolation mode.

- V3 Weaknesses: Uniform risk rates, liquidation risks, clunky UI.

- V4 Fixes It All: Modular markets, dynamic risks, liquidation safety net, automation, slick interface.

This isn’t just an upgrade. It’s a reinvention.

🐺 Wolf-Style Lessons: How to Profit from Aave V4

Here’s the straight talk:

- Don’t just HODL. Play the lending markets. Put assets to work.

- Leverage automation. Use Position Manager and batching to save fees and time.

- Stay connected. Be in communities that move faster than the market.

If you’re serious about trading, join sharp communities that share strategies in real time. That’s where the edge lives.

🔗 DeFi Ecosystem Impacts

Mark my words: when Aave V4 launches, it’ll force competitors to adapt. Expect new liquidation models, better UI, and smarter automation across DeFi.

This isn’t just Aave levelling up — it’s DeFi levelling up. A rising tide lifts all boats, but Aave is steering the ship.

📢 The Community Factor: Why Collaboration Wins

No one wins alone. Aave V4 will be decoded, dissected, and mastered in private trading communities.

Networks like The Wolf Of Wall Street, with over 100,000 traders, are where strategies are born, signals are shared, and profits are multiplied. Collaboration isn’t just helpful — it’s essential.

📝 FAQs

1. What makes Aave V4 different from V3?

Modular markets, dynamic risk, safer liquidations, automation, and a cleaner UI.

2. How do modular markets affect everyday traders?

They allow for custom risk and rate environments per asset, meaning better opportunities and protection.

3. What’s the benefit of health-targeted liquidation?

It only sells what’s needed to save your position, not the whole portfolio.

4. Is V4 safer for new DeFi users?

Yes. Dynamic risk + modular design = a more protective system.

5. When can I start testing Aave V4?

Testnet launch before Q4 2025.

🎯 Conclusion: The Future of DeFi Belongs to Builders

Aave V4 is not just another update. It’s the blueprint for DeFi 2.0.

If you’re a borrower, lender, or builder, you’ll feel the impact. This is about smarter risk, smoother liquidations, more efficiency, and total control.

Don’t sit on the sidelines. Educate yourself, connect with the right communities, and get ready to ride the wave.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals to maximise profits.

- Expert Market Analysis from seasoned traders.

- Private Community of 100,000+ members.

- Essential Trading Tools like volume calculators.

- 24/7 Support for your trading journey.

👉 Visit The Wolf Of Wall Street service

👉 Join The Wolf Of Wall Street Telegram