🚀 Introduction

Crypto is a jungle. Back in 2017, it was the Wild West — Bitcoin was booming, fortunes were made overnight, and every hustler with a laptop thought they could launch “the next big thing.” Enter Initial Fork Offerings (IFOs), where Bitcoin’s blockchain was cloned, tweaked, and sold to investors like hotcakes.

The problem? Most were garbage. Scams. Empty promises.

Fast-forward to today, and we’ve got a new beast in the arena: Initial Farm Offerings — also called IFOs — a DeFi-native fundraising model built on decentralised exchanges (DEXs). These are transparent, automated, and way more aligned with the principles of decentralisation.

If you’re serious about playing this game, you need to understand why forks failed and why farms are the new gold standard. Because in crypto, ignorance isn’t bliss — it’s bankruptcy.

🍴 The Era of Forks

What the Hell Was an Initial Fork Offering?

An Initial Fork Offering (IFO) was the crypto world’s equivalent of spinning up a knockoff product and convincing people it was revolutionary. Developers cloned Bitcoin’s blockchain via a hard fork or soft fork, created a shiny new token, and sold it as the next gold rush.

Classic examples:

- Bitcoin Cash – branded as “the real Bitcoin.”

- Bitcoin Gold – pitched as a GPU-friendly alternative.

- Countless other forks that nobody remembers because they tanked.

The Problem with Forks – Scams, Hype, and Empty Promises

Here’s the ugly truth: most of these fork offerings were smoke and mirrors. Take Bitcoin Platinum — a total scam cooked up by a South Korean teenager. Or Super Bitcoin, hyped by entrepreneur Li Xiaolai, which fizzled out almost instantly.

Fork IFOs suffered from:

- Zero transparency.

- No real innovation.

- Pump-and-dump manipulation.

Investors got burned. Hard.

Why Forks Died Out – Investors Wised Up

The fork model collapsed under its own weight. Too many projects. Too little credibility. The market got smarter, moved on to ICOs (Initial Coin Offerings) and later IEOs (Initial Exchange Offerings).

👉 Want to know how tokens actually launch today? Check the crypto token listing process guide. And if you want to avoid falling for scams, dig into the research crypto opportunities guide.

🌾 Enter the Farms

What is an Initial Farm Offering (IFO)?

Forget forks — farms are where the action is now. An Initial Farm Offering is a DeFi-native fundraising model run on DEX platforms like PancakeSwap, BasketDAO, or StreetSwap.

Instead of shady forks, IFOs integrate directly into the DeFi ecosystem:

- Investors lock liquidity in the DEX’s native tokens (BNB, CAKE, etc.).

- Smart contracts handle all the accounting.

- Investors receive new project tokens once the sale ends.

It’s transparent, automated, and damn hard for founders to manipulate.

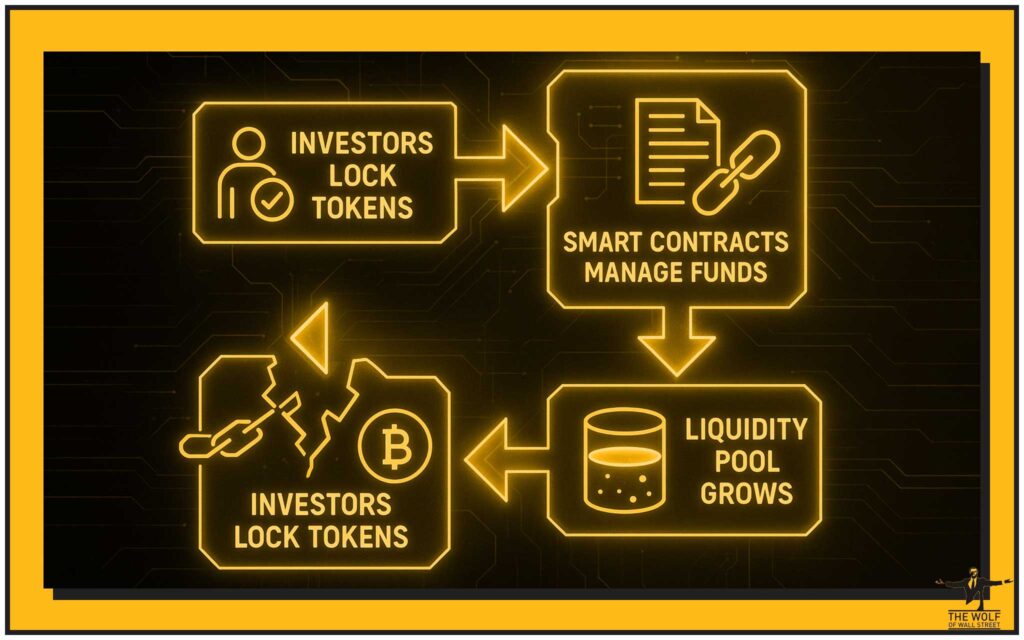

How IFOs Actually Work

Step-by-step:

- Project partners with a DEX.

- Investors prepare liquidity tokens (e.g., BNB/CAKE LP).

- During the IFO, liquidity is locked.

- Smart contracts distribute project tokens automatically.

- Liquidity flows directly into the project pool, fuelling sustainability.

Why Farms Beat Forks – Transparency & Trust

Here’s why farms crush forks:

- Smart contracts = no shady middlemen.

- DEX vetting = more security upfront.

- Liquidity-first model = tokens actually have use and demand.

Compare that with forks, where developers disappeared overnight with investor cash. No contest.

👉 Curious about generating income on-chain? Read how to earn crypto without selling through passive income strategies. And if decentralisation excites you, the DYDX decentralised crypto trading revolution is essential reading.

⚡ Forks vs Farms – The Showdown

Side-by-Side Comparison

| Feature | Initial Fork Offering (Fork) | Initial Farm Offering (Farm) |

|---|---|---|

| Launch Model | Blockchain clone | DEX-integrated fundraising |

| Transparency | Low | High (smart contracts) |

| Investor Protection | Weak | Stronger, community-based |

| Liquidity | Weak, post-launch scramble | Built-in from day one |

| Trust Factor | Low (scams rampant) | Higher (DEX vetting) |

Benefits of Initial Farm Offerings

- Early Token Access – Get in before the herd.

- Liquidity Pool Access – Immediate utility for your tokens.

- Yield Farming Opportunities – Earn while you hold.

- Governance Rights – Shape project decisions.

Risks Still Lurking

Look, nothing in crypto is bulletproof. Risks include:

- Rug pulls – still possible if DEX vetting fails.

- Overhyped projects – not every IFO will moon.

- Investor complacency – failing to research is suicide.

👉 Protect yourself by staying on top of crypto AML compliance and security strategies. And to really understand market trends, study the crypto macro indicators.

🏦 How to Participate in an IFO

Step-by-Step Wolf-Style Guide

- Pick a trusted DEX – PancakeSwap is the classic example.

- Get the native tokens – BNB and CAKE are standard.

- Join the IFO pool – lock liquidity during the event.

- Wait for allocation – smart contracts distribute tokens.

- Stake, farm, or flip – your strategy, your call.

Pro Tips for Maximising Gains

- DYOR: Always read the project white paper.

- Community strength: Look for active Telegrams and Discords.

- Liquidity health: Use trading strategies like the master crypto dominance guide to identify strong plays.

🔮 The Future of Fundraising

Why IFOs Represent the Evolution of Crypto Capital

Crypto fundraising has evolved like this:

- ICOs → chaos and scams.

- IEOs → centralised gatekeepers.

- Forks → messy, untrustworthy.

- Farms → decentralised, transparent, scalable.

Institutional & Retail Investor Impact

- Retail: More accessibility, less middlemen.

- Institutions: Slowly warming up — especially with DeFi risk management improving.

Where We’re Headed in 2025+

- DEX-led vetting will be standard.

- Cross-chain IFOs will dominate.

- Regulators will step in, but decentralisation will keep innovation alive.

🎯 Conclusion

Here’s the truth, straight up:

- Forks? Dead. Outdated. Scam-filled relics.

- Farms? Transparent, community-driven, the future of DeFi fundraising.

If you want to survive — and thrive — in this market, you need to back models that align with transparency, decentralisation, and liquidity-first principles. That’s what IFOs deliver.

And if you’re serious about levelling up, don’t do it alone. Join a network, sharpen your edge, and trade smarter.

👉 Check out the The Wolf Of Wall Street crypto trading community. With VIP signals, expert analysis, essential trading tools, and a private community of 100,000+ members, The Wolf Of Wall Street is your backstage pass to crypto dominance. Or jump straight into the action with the The Wolf Of Wall Street Telegram.

❓ FAQs

1. What’s the biggest difference between an initial fork offering and an initial farm offering?

Forks clone blockchains and sell new tokens — often scams. Farms raise capital via DEX liquidity pools with transparency and community trust.

2. Are IFOs safer than ICOs?

Yes. ICOs relied on centralised promises; IFOs rely on smart contracts and DEX vetting. Still risky, but safer.

3. Can you lose money in an IFO?

Absolutely. Market risk, rug pulls, and bad projects exist. DYOR always.

4. How do DEXs vet projects for IFOs?

They review team credibility, tokenomics, and project utility. But vetting isn’t foolproof.

5. What are the future trends in DeFi fundraising?

Cross-chain IFOs, stricter regulatory oversight, and even more investor empowerment through governance tokens.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals to maximise profits.

- Expert Market Analysis from seasoned traders.

- Private Community of 100,000+ members.

- Essential Trading Tools like volume calculators.

- 24/7 Support from a dedicated team.

Empower your journey: