⚡ Introduction: Wall Street Meets Blockchain

The stock market has been locked behind gates for decades — 9:30 a.m. to 4 p.m., Monday to Friday. That’s not a market. That’s a daycare schedule. But Alpaca just ripped those gates down with the Instant Tokenization Network (ITN), and suddenly the world’s biggest asset class — US stocks — is available 24/7, tokenized, and tradable on-chain.

We’re talking about minting and redeeming tokenized equities instantly, with no waiting, no middlemen, no clunky cash settlements. This is the future of Wall Street, and if you’re not paying attention, you’ll be steamrolled by those who are.

🚀 The Big Play: What Alpaca Just Unleashed

Here’s the deal: Alpaca’s ITN lets institutions instantly mint and redeem US stocks as tokens. No settlement delays, no wire transfers stuck in limbo, no friction.

The killer feature? In-kind redemptions. That means token holders can swap tokens directly for the underlying stock. No cash shuffle, no artificial price distortions. Just pure liquidity — clean, efficient, unstoppable.

🏦 Breaking the Shackles of Wall Street Hours

Wall Street’s 9-to-5 model is dead. Tokenized equities are now a 24/7 market.

Why does this matter? Because money doesn’t sleep, opportunity doesn’t wait, and the smartest traders want to move capital at the speed of thought — not wait for a bell to ring.

Crypto traders already live in this world. Now equities are joining the round-the-clock game. Imagine being able to arbitrage Tesla tokens on a Sunday morning, or hedge an Apple position in the middle of the night. That’s the world ITN unlocks.

🔑 The Core Mechanics of ITN

Let’s break it down like I’d sell it in the boardroom:

- One API call. Tokenize or redeem entire stock portfolios with a single command.

- Direct settlement. No third-party clearinghouse delays.

- Frictionless execution. Smooth flow of liquidity from TradFi to DeFi.

Picture this: A hedge fund decides to tokenize $500M worth of Tesla and Apple stock. With ITN, it’s a single API call, instant settlement, and those tokens are live on Solana, tradable worldwide.

📜 Regulatory Green Light: The SEC’s Game-Changer

Here’s why this is even possible: The SEC recently approved in-kind settlement for crypto ETFs.

That precedent cracked the door wide open. Now, Alpaca’s ITN is kicking that door off its hinges. For institutions, that means one thing: safety in numbers. If the regulators are backing in-kind settlements for ETFs, tokenized equities suddenly look a lot less risky.

🤝 The Players at the Table: Partners & Backers

This isn’t a scrappy startup experiment. Alpaca’s ITN launched with serious institutional partners:

- Backed and xStocks using Alpaca’s infrastructure.

- Kraken and DRW as early adopters.

- Ondo Finance integrating for tokenized equities.

That’s the caliber of players you want when you’re rolling out a new market structure.

🌍 Global Ambitions: TradFi Meets DeFi

This is bigger than Wall Street. ITN is built to be global liquidity infrastructure.

- Today: Settlement runs on Solana.

- Tomorrow: Cross-chain compatibility with Ethereum, Polygon, and beyond.

- Long-term: A seamless TradFi + DeFi liquidity highway, where capital moves across borders without friction.

This isn’t just about equities. It’s about the integration of global markets.

💸 Liquidity Without the Friction

Traditional settlement introduces delays, distortions, and inefficiencies. ITN fixes that:

- In-kind redemptions eliminate artificial slippage.

- Tighter spreads keep token prices aligned with the underlying stock.

- Institutions can push and pull liquidity instantly across markets.

That’s what efficient markets look like.

📊 Tokenization Trend: The $31 Billion Proof

If you think tokenization is a fad, let me wake you up. As of 2025, over $31 billion in real-world assets (RWAs) are already tokenized on-chain.

And we’re not talking about small experiments. Bonds, treasuries, and credit have already exploded. Equities are simply the next domino to fall — and it’s a trillion-dollar domino.

By 2030, analysts project tokenized markets could top $10 trillion. And Alpaca’s ITN is the infrastructure to get us there.

🕹️ Efficiency = Power

When you strip away clearinghouses, wire transfers, and middlemen, you get raw efficiency:

- Faster settlement = quicker reinvestment.

- Lower costs = fatter margins.

- Cleaner execution = more opportunities.

Institutions live and die by efficiency. ITN isn’t a convenience — it’s a competitive advantage.

🔒 Security & Transparency

One of the biggest objections to tokenization? Trust.

Here’s how ITN neutralises that fear:

- Blockchain validation ensures verifiable, tamper-proof records.

- Auditability satisfies regulators.

- Institutional privacy ensures big players can still operate discreetly.

It’s the perfect balance: transparency where you need it, privacy where you demand it.

📈 Why This Is the Perfect Storm for Institutions

Let’s line this up like a closing pitch:

- Regulatory approval ✅

- Exploding tokenization trend ✅

- Institutional partners on board ✅

- Infrastructure already running ✅

When all the stars align like this, there’s only one question left: are you in, or are you out?

🔥 The Jordan Belfort Angle: Why You Can’t Ignore This

Let me put it bluntly: if you’re not tokenizing, you’re bleeding alpha.

Your competitors are moving faster, settling quicker, and capturing spreads you can’t even touch. The old way of trading looks like using dial-up in the age of fibre internet.

This isn’t optional. It’s survival.

💥 Real-World Scenarios

Here’s how ITN plays out in the real world:

- Hedge Funds: Tokenize portfolios to tap instant liquidity for new plays.

- Brokers: Offer clients 24/7 stock trading with tokenized equities.

- Market Makers: Arbitrage between tokenized and traditional equity markets for pure profit.

The opportunities aren’t coming “someday.” They’re here.

📚 Lessons from Crypto ETFs & RWAs

We’ve seen this before:

- Bitcoin and Ethereum ETFs gave institutions a safe way into crypto.

- Tokenized bonds and treasuries passed the $31B mark.

- Now, equities are about to experience the same hockey-stick growth curve.

History doesn’t just rhyme — it repeats.

⚖️ Risks & Roadblocks

No innovation comes without hurdles:

- Regulation outside the US is still murky.

- Cross-chain interoperability must be solved.

- Institutional adoption depends on privacy and governance standards.

But these aren’t deal-breakers. They’re speed bumps on a highway that’s already being built.

📌 Strategic Takeaways for Traders

Why should retail traders care about ITN? Because this isn’t just for institutions.

- New arbitrage plays will open between tokenized and traditional equities.

- Tokenized stocks will bring DeFi-level liquidity to blue-chip assets.

- Communities like the The Wolf Of Wall Street crypto trading community will become key hubs for navigating these opportunities.

Want to stay ahead? Equip yourself with technical strategies like Bollinger Bands, RSI trading signals, or MACD momentum indicators. Tokenized equities will make these strategies even more powerful.

🏁 Conclusion: The Wolf’s Verdict

Here’s the truth: Alpaca’s ITN is a market revolution in disguise.

The 9-to-5 equity market is obsolete. The new world is tokenized, global, liquid, and always open. Institutions that adopt early will dominate. Those that don’t? They’ll become dinosaurs.

You’ve got a choice. Sit on the sidelines while the next trillion-dollar market explodes — or jump in and ride the wave. Because once this train leaves the station, it’s not coming back.

❓ FAQs

1. What exactly is Alpaca’s ITN?

A network that lets institutions instantly mint and redeem tokenized US stocks with in-kind settlement.

2. How does in-kind redemption differ from traditional settlement?

Instead of cash-based settlements, tokens can be redeemed directly for the underlying shares. Faster, cleaner, and less distortion.

3. Why are institutions embracing tokenized equities now?

Regulatory approval, exploding tokenization trends, and Alpaca’s infrastructure made this the perfect time.

4. Will tokenized US stocks be available to retail traders?

Retail access depends on regulation, but brokers may use ITN to roll out 24/7 tokenized equity trading.

5. How does this tie into DeFi liquidity pools?

Tokenized equities can be plugged into DeFi protocols, unlocking new yield and arbitrage opportunities.

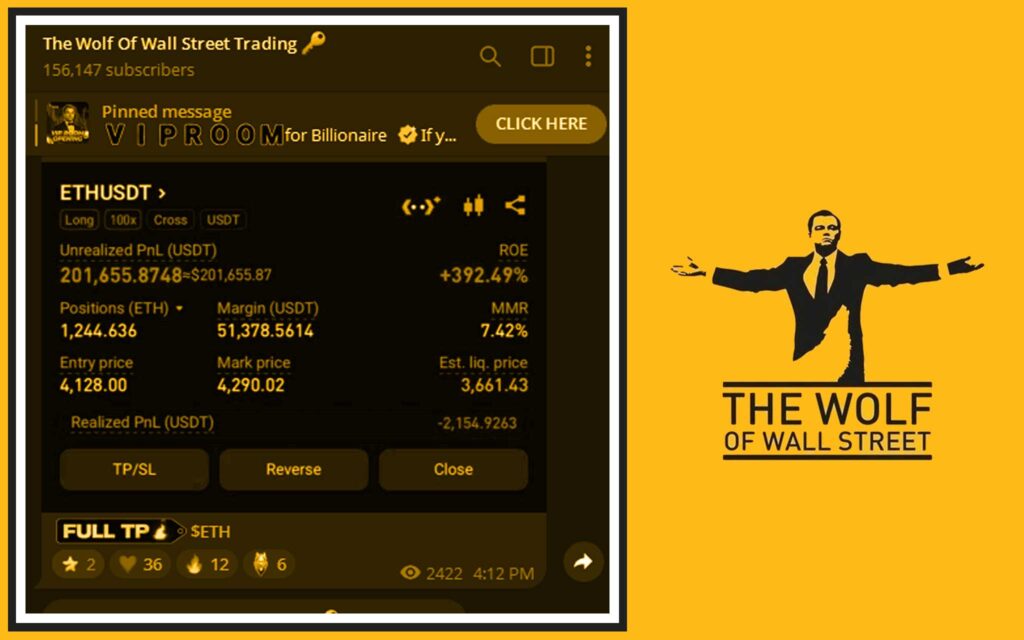

📌 The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a powerful ecosystem for traders diving into volatile markets. Here’s what you gain:

- Exclusive VIP Signals: Proprietary alerts to maximise profits.

- Expert Market Analysis: Insights from seasoned crypto pros.

- Private Community: 100,000+ like-minded traders.

- Essential Tools: Volume calculators and resources.

- 24/7 Support: Non-stop assistance for every trading move.

👉 Empower your trading journey:

- Visit The Wolf Of Wall Street Service for full details.

- Join the The Wolf Of Wall Street Telegram Community for real-time updates.

- Unlock your full potential with The Wolf Of Wall Street.