Listen up. The guide to understanding the Initial DEX Offering (IDO) that you’re about to read will change the way you see crypto investing forever. Forget everything you thought you knew about crypto fundraising. ICOs? That’s yesterday’s news, a relic from a bygone era for slow-moving dinosaurs. The real money, the smart money, is moving faster, smarter, and with more precision than ever before.

It’s playing a different game, and if you’re not in on the secret, you’re not just losing—you’re being left for dead. The old world was built on slow, centralized, and often rigged games of Initial Coin Offerings (ICOs), where insiders got rich and you got the scraps. This world is different. This is about taking back control. This article is your masterclass, your no-fluff playbook to understanding, spotting, and profiting from the leaner, meaner, and more democratic revolution in fundraising: the IDO.

📉 The Old Guard: Why ICOs Are a Sinking Ship

To understand where we’re going, you have to understand where we’ve been. The Initial Coin Offering (ICO) was the first real attempt at crowdfunded crypto projects. Back in the day, it was the Wild West—a chaotic frenzy of opportunity, but one that was riddled with landmines for the average investor. A project would mint a boatload of tokens, sell them directly to the public, and raise millions. It sounded great on paper, but the reality was a disaster waiting to happen.

The entire model was fundamentally broken, a playground for scammers and a paradise for gatekeepers who controlled the flow of capital. These weren’t just small issues; they were fatal flaws baked into the very DNA of the system. First, the absolute lack of regulation meant that anyone could promise the moon, take your money, and disappear into the night with zero consequences. It was a market flooded with vapourware and outright fraud.

Second, the centralisation was suffocating. Projects were completely at the mercy of massive, centralized exchanges. To get listed, they had to beg, plead, and pay exorbitant fees, all while the exchange held the power to make or break them. This created a system where only the well-connected or the incredibly well-funded could even get a seat at the table. And for investors? Your money was often tied up for months in lockup periods, held hostage while you prayed for a listing on a reputable exchange. By the time you could finally trade, the hype was often dead and your investment with it. It was a rigged game from the start.

🚀 Enter the IDO: The New Apex Predator of Crypto Fundraising

Out of the ashes of the ICO dumpster fire rose a new apex predator: the Initial DEX Offering (IDO). Let me break it down for you in simple, powerful terms. An IDO is a fundraising event that happens on a Decentralized Exchange (DEX). It’s instant. It’s fair. And most importantly, there are no middlemen, no gatekeepers, and no corporate suits telling you what you can and can’t invest in. This is the financial revolution in its purest form.

The concept is brilliantly simple. Instead of selling tokens behind closed doors, a project launches its token directly into a liquidity pool on a DEX like Uniswap or PancakeSwap. The second it goes live, it’s tradable. There’s no waiting period, no lockup, no praying for a listing. The token is born with immediate liquidity, available to anyone, anywhere in the world.

This single shift changes everything. It rips power away from the centralized exchanges and puts it back into the hands of the project and the community. The benefits are undeniable: radical fairness, instant access to liquidity, and drastically lower costs. An IDO isn’t about asking for permission from the old guard; it’s about taking decisive action in a new, decentralized world. It’s faster, more efficient, and built for the speed of modern markets.

⚙️ How the IDO Machine Actually Works

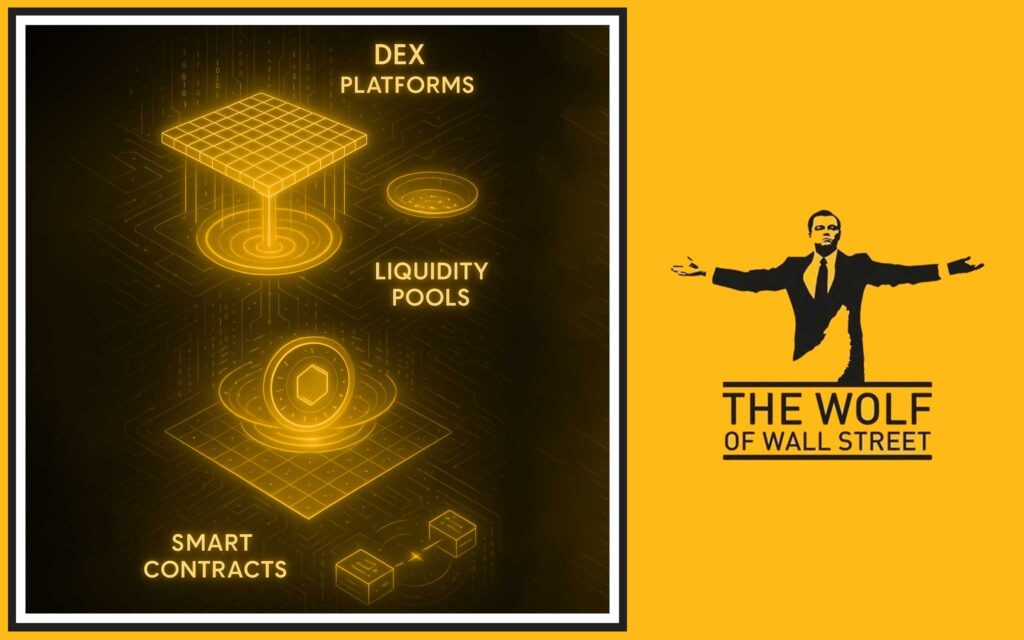

Alright, so how does this beast actually operate? It’s not magic; it’s a finely tuned machine built on three powerful pillars of decentralized finance. You need to understand the engine if you want to drive the car.

The Power of Decentralized Exchanges (DEXs)

First, you have the battlefield itself: the Decentralized Exchange, or DEX. These aren’t like your typical exchanges. There’s no central company, no CEO, and no single point of failure. They are open-source financial protocols that run on the blockchain, allowing anyone to trade directly from their own wallet. Think of them as open, automated marketplaces that never close. Mastering these platforms is crucial, as they represent a complete paradigm shift in trading. For those looking to get a deeper understanding, The DyDx Revolution: Your Guide to Decentralised Crypto Trading is an essential read on one of the leading platforms.

Liquidity Pools: The Engine Room

The second piece of the puzzle is the liquidity pool. This is the absolute genius of the DEX model. Instead of matching buyers and sellers, a DEX uses a “pool” of two tokens locked in a smart contract. For an IDO, this would be the new project token and a stablecoin like USDT. Anyone can contribute to this pool, becoming a “liquidity provider.” Why would they do that? Because they earn a cut of the trading fees from every single transaction that happens in that pool. It’s like a public pot of gold where anyone can trade, and the people who fill the pot get paid handsomely for it. This is what creates instant, deep liquidity from day one.

Smart Contracts: The Unbreakable Vow

Finally, the entire operation is managed by smart contracts. Think of a smart contract as an unbreakable digital vow, a self-executing agreement with the terms written directly into code. It’s the automated banker, the incorruptible escrow agent who executes the deal flawlessly every single time, exactly as programmed. When you participate in an IDO, you’re not trusting a person or a company; you’re trusting mathematics and code. This removes the need for intermediaries and creates a trustless system where the rules are transparent and enforced by the network itself.

🐺 The Wolf’s Playbook: How to Launch a Killer IDO

So, you want to be on the other side of the table? You want to launch the next big thing? Don’t just show up with an idea; show up with a battle plan. This is the insider’s playbook, the step-by-step process for winners who execute with ruthless efficiency.

Step 1: Craft an Unbeatable Strategy

Before you write a single line of code, you need a rock-solid strategy. This isn’t just about a cool idea; it’s about a viable business. You need to define your tokenomics—the economic model of your token. What is its utility? How many will exist? How will they be distributed? You need a clear vision, a detailed roadmap, and a compelling reason for your project to exist. Fail to plan, and you plan to fail. It’s that simple.

Step 2: Build Your Arsenal (Marketing)

In the decentralized world, your reputation is your currency. You need two key weapons in your arsenal. The first is your website—your digital storefront. It needs to be sharp, professional, and instantly convey value. The second, and more important, is your white paper. This isn’t some flimsy marketing brochure; it’s your bible. It’s the document that sells the dream with cold, hard facts, outlining the problem, your solution, the technology, the team, and the tokenomics. If you don’t know how to craft one, learn. A powerful document like this is non-negotiable, and understanding What is a White Paper? The Ultimate Guide for Crypto Projects is the first step.

Step 3: Choose Your Battlefield (The Launchpad)

While you can launch an IDO directly on a DEX, most successful projects use an IDO launchpad. These are platforms that specialize in vetting and launching new projects. Getting accepted onto a reputable launchpad gives your project instant credibility and exposure to a dedicated community of investors. They perform due diligence, which helps filter out scams and gives investors confidence. Choosing the right launchpad is a critical strategic decision that can amplify your launch exponentially.

Step 4: Forge Your Weapon (The Token)

This is where the idea becomes a reality. You need to create the cryptocurrency token itself. This is done by deploying a smart contract on a blockchain like Ethereum or Binance Smart Chain. In the past, this was a highly technical task reserved for elite developers. Today, there are tools and platforms that simplify the process, but it still requires meticulous attention to detail. A single flaw in your token’s contract can be catastrophic. For those serious about this step, diving into a resource like How to Create Your Own Crypto Token: The Wolf’s Guide can provide the necessary framework.

Step 5: Unleash the Beast (The Token Sale)

This is showtime. The token sale is typically managed through the launchpad. Investors who want to participate often need to be “whitelisted,” a process that might require them to hold the launchpad’s native token or complete certain tasks. This prevents a free-for-all and ensures a more orderly sale. Once the sale is complete, the token is immediately listed on the DEX, the liquidity pool is created, and trading begins instantly. The beast is unleashed, and the market takes over.

🥊 Head-to-Head: IDO vs. ICO – A No-Contest Fight

When you put these two models in the ring together, it’s not even a fair fight. The IDO delivers a technical knockout in every single round.

- Control: Decentralised vs. Centralised. With an IDO, the project team is in control. They don’t need permission from a centralized exchange. With an ICO, you’re on your knees, begging for a listing from a gatekeeper who charges a fortune for the privilege.

- Speed & Liquidity: Instant vs. Delayed. An IDO provides immediate trading and liquidity the second the sale ends. With an ICO, investors and the team are stuck waiting and praying for a listing, which can take weeks or months, killing all momentum.

- Cost: Lean & Mean vs. Bloated & Expensive. Launching an IDO is incredibly cost-effective. The main expense is creating the liquidity pool. An ICO requires astronomical listing fees for major exchanges, sometimes running into the hundreds of thousands or even millions of dollars.

- Fairness: Open Access vs. Private Deals. IDOs, especially through launchpads, offer a more level playing field for the average investor. ICOs were notorious for massive private pre-sales to venture capitalists and insiders at huge discounts, who would then dump their tokens on retail investors the moment it hit an exchange.

🚧 Navigating the Minefield: The Risks of IDOs

Now, let’s be crystal clear. This world is not without risk. The jungle has predators, but the wolf knows the terrain. Amateurs wander in blindly and get eaten alive. Professionals understand the risks and navigate them with intelligence and strategy.

First, you have smart contract vulnerabilities. The code that powers an IDO is complex, and a single bug or exploit can be used by hackers to drain funds. This is why due diligence and third-party security audits are non-negotiable. Second, there’s the bot problem. Sophisticated trading bots can manipulate the price in the first few seconds of a token listing, front-running retail investors and creating massive volatility.

Furthermore, the DeFi learning curve is incredibly steep. Using DEXs, managing your own crypto wallet, and understanding gas fees can be overwhelming for newcomers. This complexity is a barrier to entry and a field where mistakes are costly. Finally, the dark side of decentralisation is the prevalence of “rug pulls”—scams where developers list a token, attract investment, and then drain the liquidity pool, disappearing with everyone’s money. Spotting the red flags—like anonymous teams and unlocked liquidity—is a survival skill.

🗣️ The Power of the Pack: Community is Everything

In the IDO world, traditional advertising is dead. Projects don’t succeed by buying billboards; they succeed by building fanatical, engaged communities. A project’s success lives or dies on the strength of its pack. Social media platforms like Telegram and Twitter aren’t just for idle chatter; they are the primary arenas for marketing, communication, and, most importantly, community-led due diligence. A strong, active community is one of the biggest green flags a project can have.

But navigating this chaotic landscape alone is a fool’s game. This is where the amateurs get wiped out, throwing money at hype without any real intelligence. But not you. Not when you can have a wolfpack of over 100,000 traders and expert analysis in your corner. That’s the ultimate edge. This is precisely why the The Wolf Of Wall Street crypto trading community exists. Being part of a private community that provides Expert Market Analysis and Exclusive VIP Signals isn’t a luxury—it’s essential ammunition in this high-stakes game. You get the insights you need to separate the winners from the losers. Don’t go into battle alone.

❓ Your Next Move: Are You In or Are You Out?

So, here’s the bottom line. The IDO model has fundamentally revolutionised crypto fundraising. It has torn down the walls erected by centralized gatekeepers and has created a more democratic, transparent, and efficient system for funding innovation. It empowers small teams with big ideas and gives the average investor a chance to get in on the ground floor, right alongside the big players. It’s the great equaliser.

The choice is yours. You can stand on the sidelines and watch as the world changes without you, clinging to outdated models and missed opportunities. Or, you can arm yourself with knowledge, understand the new rules of the game, and step into the arena. The world of the Initial DEX Offering (IDO) is waiting for those bold enough to seize the opportunity.

Frequently Asked Questions (FAQs)

- What’s the main difference between an IDO and an IEO (Initial Exchange Offering)?

An IDO is launched on a Decentralized Exchange (DEX) and is managed by the project team and smart contracts. An IEO is managed and hosted by a Centralized Exchange (CEX), which acts as a middleman, vetting the project and conducting the sale on its platform. - Is investing in IDOs safe?

No investment is ever 100% safe. IDOs carry significant risks, including smart contract bugs, market volatility, and potential scams (“rug pulls”). However, investing in projects launched on reputable launchpads that conduct thorough vetting can help mitigate some of these risks. Always do your own research. - How do I find new IDOs to invest in?

The best places to find upcoming IDOs are on dedicated IDO launchpad platforms (like Polkastarter, DAO Maker, or Seedify), crypto-focused news sites, and by following reputable project aggregators and influencers on platforms like Twitter and Telegram. - Do I need a lot of money to participate in an IDO?

Not necessarily. One of the main advantages of IDOs is their accessibility. While some launchpads may require you to hold a certain amount of their native token to participate, the actual investment allocation sizes can be quite small, allowing investors with less capital to get involved.