🔥 Introduction: When Crypto Meets Prediction Power

The MetaMask–Polymarket integration isn’t just another partnership — it’s a full-blown revolution in decentralised finance. For years, MetaMask has been the gateway for crypto traders, investors, and Web3 pioneers. But now, it’s flipping the script. By joining forces with Polymarket, MetaMask is transforming itself from a digital wallet into a financial prediction engine — where traders don’t just hold coins, they bet on the future.

You’re not gambling; you’re forecasting. You’re using market intelligence, not luck. In a world driven by data, this integration gives traders a new dimension of opportunity — trading probabilities, not just tokens.

This move cements MetaMask’s mission to evolve into the all-in-one DeFi powerhouse — a platform for swapping, staking, perps trading, and now, event-based market speculation. The crypto market just got a new playing field — and only the sharpest minds will dominate it.

💥 MetaMask’s Power Move: Betting Meets Blockchain

This isn’t about rolling dice. It’s about turning information into profit.

MetaMask’s partnership with Polymarket introduces the next logical step in Web3’s evolution — transforming belief into tradeable assets. Imagine being able to buy shares on whether Bitcoin will cross $100K, or if the next US election will swing blue or red — all within your MetaMask wallet.

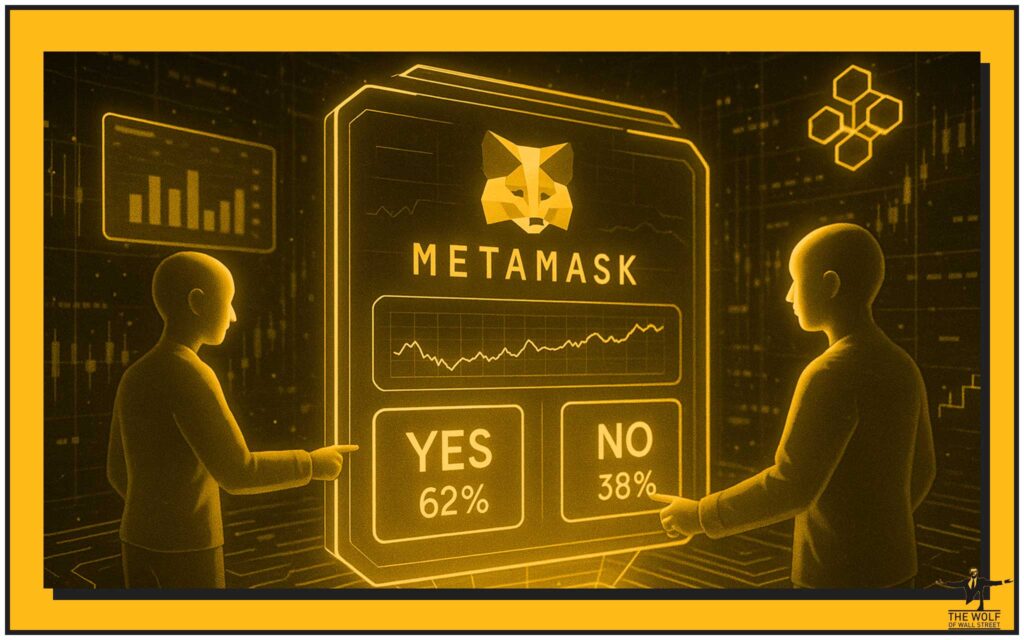

Polymarket has already become the Wall Street of decentralised predictions, with over $1.4 billion in recent monthly volume. MetaMask recognised this surge and seized the opportunity to embed it right into the user experience. With this move, MetaMask users can now speculate, hedge, and monetise knowledge — all under the secure umbrella of self-custody.

Prediction markets are not about guessing; they’re about reading collective intelligence. Traders are effectively pricing the truth — and when you’re early to that truth, you profit.

⚙️ Inside the Integration: How It Works

Here’s how the MetaMask–Polymarket engine runs.

Users can browse prediction markets directly within MetaMask, buying or selling “shares” tied to real-world outcomes — elections, sports results, crypto milestones, or macroeconomic events. Each share’s price reflects the probability of an outcome, moving dynamically as traders place bets.

The system relies on decentralised oracles to feed verified event data into smart contracts, ensuring transparency and immutability. No shady middlemen, no central authority. Just pure, verifiable data powering the market.

Polymarket operates on Ethereum and Polygon, and MetaMask’s built-in connectivity makes it seamless to participate. Within seconds, users can shift from wallet management to event speculation — no new accounts, no third-party custodians.

That’s not evolution. That’s domination.

Related Reads:

Learn how prediction mechanics work with our Tokenomics Investing Guide, or master trading execution through Order Types Explained.

📈 The Rise of Prediction Markets in DeFi

Prediction markets are becoming the hottest vertical in decentralised finance, overtaking NFTs and even meme coins in user engagement. Platforms like Polymarket and Kalshi are clocking billions in monthly trading volume, proving that people crave data-backed speculation more than passive holding.

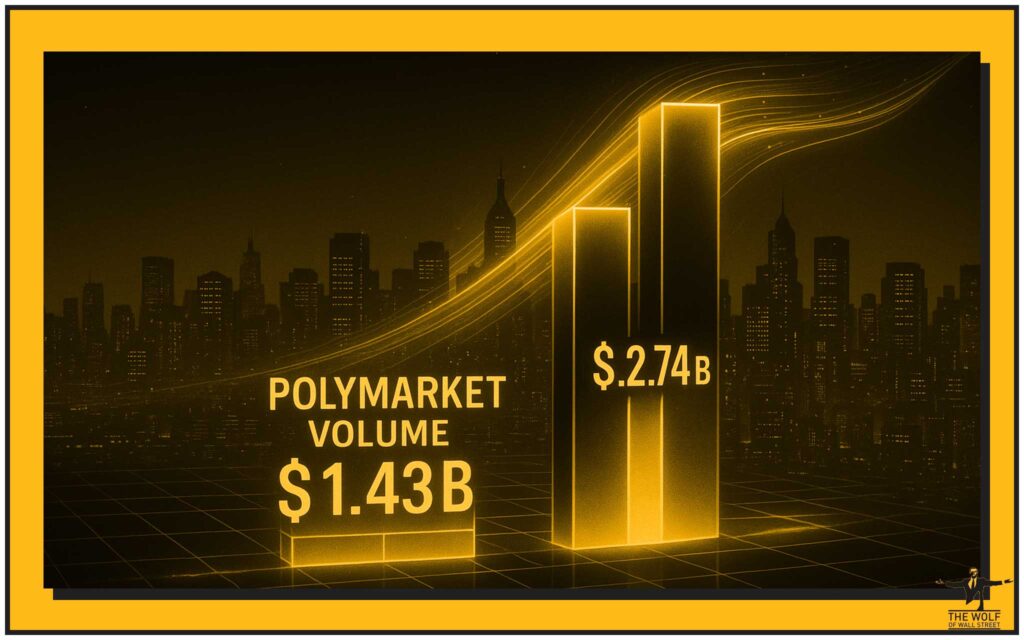

According to DeFiLlama data, Polymarket recorded approximately $1.43 billion in trading volume in September 2025, while Kalshi surged to $2.74 billion. The message is clear: traders are done waiting for volatility — they’re creating it.

What makes this movement explosive is the psychological element. Prediction markets convert information flow — news, rumours, public sentiment — into immediate financial opportunity. That’s why MetaMask integrating Polymarket isn’t just functional — it’s strategic. It puts the power of global sentiment trading into the hands of over 30 million MetaMask users.

🏦 Institutional Money Joins the Game

Now let’s talk big money. The moment Intercontinental Exchange (ICE) — the parent company of the New York Stock Exchange — invested $2 billion in Polymarket, the game changed. Wall Street didn’t just notice; it joined the table.

This institutional injection valued Polymarket between $8 and $9 billion, effectively legitimising prediction markets as serious financial instruments. For years, traditional finance laughed at crypto as speculative. Now, it’s crypto turning speculation into data assets — and traditional finance wants in.

Prediction markets are evolving into the real-time pulse of global sentiment — indicators faster than polls, more honest than headlines. And with MetaMask’s integration, this pulse is now directly tradable.

Related Insight:

Check out Crypto Hedge Funds Market Shift and Bitcoin–Ethereum ETFs Guide for deeper dives into institutional adoption.

🚫 Restricted Regions: The Regulatory Wall

Here’s the kicker — not everyone gets to play.

MetaMask’s Polymarket integration will exclude several jurisdictions, including the US, UK, France, Singapore, Thailand, Australia, and Canada’s Ontario province. Why? Because regulators still can’t decide if prediction markets are financial forecasting tools or glorified gambling platforms.

These restrictions reflect outdated frameworks that struggle to distinguish speculation from informed prediction. Yet, the DeFi ethos — borderless, permissionless, transparent — will continue to evolve around these walls. Decentralised architecture has a way of finding the cracks in legacy systems.

The integration also sets the stage for a future showdown between innovation and regulation — a battle that could define the next decade of Web3.

🧠 The Psychology of Prediction Markets

Let’s be clear: this isn’t betting — it’s behavioural economics in action.

Prediction markets aggregate the intelligence of thousands of participants, turning collective belief into quantifiable odds. When people put money behind an opinion, they reveal what they truly think, not what they claim to think.

This creates a marketplace of truth, powered by incentives.

Smart traders don’t guess — they read probability flows, sentiment shifts, and macro narratives. That’s why savvy investors see these markets not as gambling, but as alpha generation tools.

In the words of every top trader ever: follow the money, not the noise.

🔥 MetaMask’s Broader Evolution: From Wallet to Powerhouse

MetaMask isn’t sitting still. This isn’t its first expansion into active trading. Earlier this year, it integrated Hyperliquid to enable perpetual futures (perps) trading directly within the wallet. No central exchange, no KYC, no downtime.

From swaps to staking, perps, and now predictions — MetaMask is building what can only be described as the first decentralised finance super-app. A one-stop cockpit for self-custody traders.

As DeFi becomes more modular, MetaMask positions itself as the ultimate front-end layer — where all DeFi roads converge.

See Also:

Explore DYDX’s Decentralised Trading Revolution and learn how Layer 1 and Layer 2 solutions are transforming transaction efficiency.

💼 Risk vs Reward: The New DeFi Frontier

Every opportunity in DeFi carries risk — that’s the price of freedom.

Prediction markets face volatility, liquidity risks, and jurisdictional hurdles. But here’s the truth Jordan Belfort would shout from the trading floor: risk is the admission ticket to opportunity.

In this world, the bold get paid.

If you understand information flow — if you can anticipate trends before headlines hit — prediction markets let you monetise foresight. That’s not speculation. That’s data arbitrage.

And when paired with MetaMask’s self-custody architecture, the risks are transparent, not hidden behind corporate curtains.

📊 Numbers Don’t Lie: Market Momentum and Data Trends

The statistics back the hype.

DeFi analytics confirm that 2025 has been the strongest year yet for prediction market volume. Combined with MetaMask’s growing user base, this partnership could push adoption to levels unseen since the NFT boom.

In September 2025 alone, Polymarket processed more transactions than any decentralised exchange except Uniswap and dYdX. Volume doesn’t lie — conviction drives capital.

The convergence of prediction data, user psychology, and decentralised execution signals one thing: DeFi is maturing into a data-driven ecosystem.

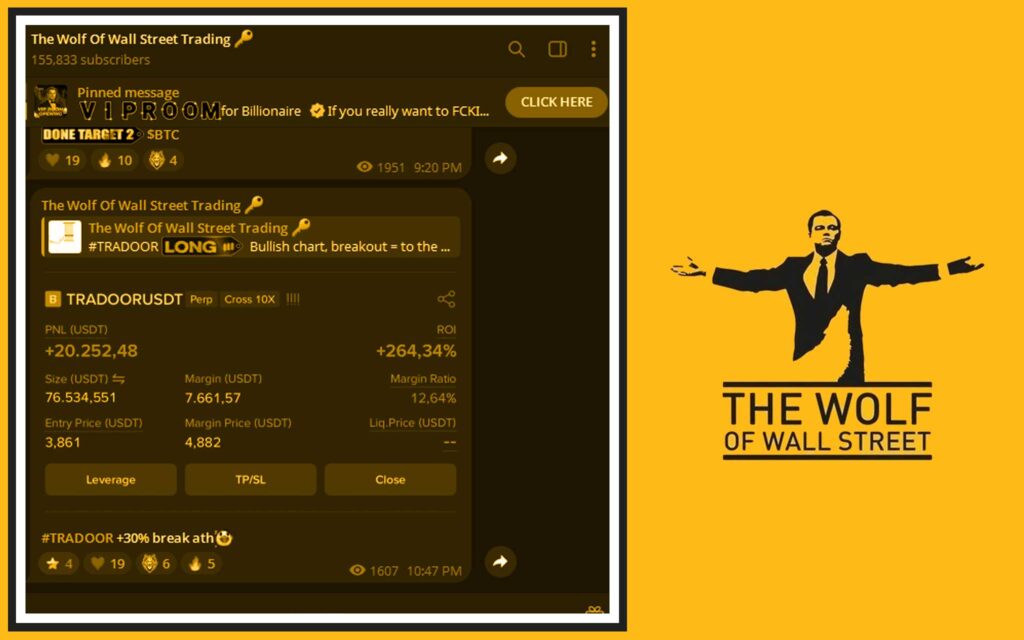

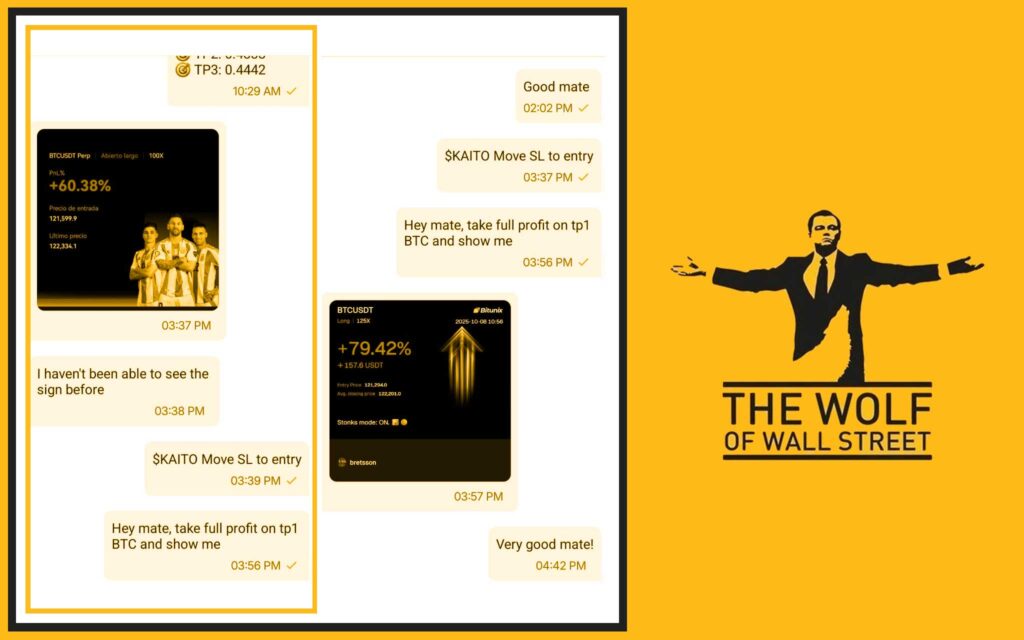

🧩 The Wolf Of Wall Street: The Ultimate Edge for Crypto Traders

Want to get ahead of the curve? Join the wolves who already are.

The The Wolf Of Wall Street crypto trading community gives traders a complete toolkit for navigating volatile markets — whether you’re predicting election outcomes or timing Bitcoin reversals.

Members gain:

- Exclusive VIP Signals for maximising profit.

- Expert Market Analysis from professional crypto strategists.

- Private Community Access — 100,000+ traders sharing insights.

- Essential Tools like volume calculators and trade monitors.

- 24/7 Support that never sleeps, because crypto never does.

The Wolf Of Wall Street isn’t just a community — it’s a trading ecosystem built for conviction-driven investors who play the long game.

Join the The Wolf Of Wall Street Telegram Group and start turning data into dollars.

💬 Industry Reactions: Hype, Hope, and Hesitation

Crypto analysts are calling this integration a defining moment for DeFi.

Institutions see it as a bridge between real-world forecasting and blockchain efficiency. Regulators, of course, are less enthusiastic — calling it “borderline gambling.” Traders? They’re ecstatic. Finally, the ability to trade real-world events with crypto precision.

Even sceptics admit: MetaMask is redefining what a wallet can be.

🌍 The Future: When Prediction Meets Decentralisation

Fast-forward two years, and the financial world will look unrecognisable.

Prediction markets could become a key indicator for everything from election outcomes to macroeconomic policy. MetaMask’s integration marks the dawn of real-time, crowd-powered forecasting.

Combine this with AI analytics, DeFi automation, and smart contracts — and you’ve got the financial ecosystem of the future.

Decentralised, data-driven, and damn exciting.

🧠 FAQs

1. What is MetaMask’s Polymarket integration?

It’s a feature that allows MetaMask users to participate directly in prediction markets powered by Polymarket, trading on outcomes of real-world events.

2. How do prediction markets differ from gambling?

Unlike gambling, prediction markets are data-driven and reflect collective intelligence, turning informed probabilities into tradable value.

3. Is Polymarket available globally?

No — it’s restricted in regions such as the US, UK, France, Singapore, and Australia due to local regulations on financial betting.

4. What are the main risks?

Liquidity and volatility are the primary risks, but decentralised architecture ensures transparency and fairness.

5. How can traders gain an edge using The Wolf Of Wall Street?

By leveraging VIP trading signals, expert analysis, and market tools available through The Wolf Of Wall Street, traders can make smarter, faster, and more profitable decisions.

🏁 Conclusion

The MetaMask–Polymarket integration isn’t just a technical upgrade — it’s a turning point for decentralised finance. It merges the predictive power of data with the autonomy of Web3. Traders who understand this shift won’t just ride the next wave — they’ll own it.

So gear up, stay sharp, and start reading the markets before they read you.

Because in the new world of DeFi, information isn’t just power — it’s profit.