🔥 The Market Never Waits

Listen — in crypto, hesitation kills faster than a rug pull. The old Ethereum is dead. The new Ethereum — the post-Merge, proof-of-stake, green-machine beast — is rewriting the playbook for how smart money is made in 2025.

This isn’t about tech for tech’s sake. It’s about control, scalability, and profit. What we witnessed in September 2022 wasn’t a routine update — it was surgical reinvention. Ethereum shed the waste, cut the power bill by 99.95%, and built a system that now powers billions in DeFi, NFTs, and staking rewards every single day.

The wolves didn’t wait. They adapted. The question is — are you catching the next wave or watching from the sidelines?

⚙️ From Gas Guzzler to Green Machine

Ethereum’s old Proof-of-Work system was a heavy, inefficient dinosaur — powerful, yes, but choking on its own success. Gas fees were outrageous, transactions lagged, and the environmental backlash was mounting.

Then came The Merge in 2022 — the single biggest upgrade in blockchain history. PoW was gone, replaced by Proof-of-Stake (PoS), merging Ethereum’s execution layer with its consensus layer.

“Ethereum 2.0” was what we called it back then. But make no mistake — the brand may be gone, yet the revolution lives on.

Fast forward to 2025, and we’re deep in The Surge — powered by EIP-4844 (Proto-Danksharding). This upgrade is slashing fees and cranking throughput, paving the road to 100,000 transactions per second.

👉 Fast Fact: Ethereum’s combined throughput across Layer-2s (Arbitrum, Optimism, Base) now hits 200+ TPS, up from just 14 in 2022.

This is why Ethereum remains the alpha in Web3. The Merge made it efficient. The Surge makes it unstoppable.

🧩 Staking, Validators, and Passive Power Plays

Here’s where the game flips. In Proof-of-Stake, your ETH isn’t just sitting idle — it’s working for you. Staking turned holding into earning.

Want to run a solo validator? You’ll need 32 ETH, a bit of tech setup, and some serious conviction. But for everyone else, pooled staking and liquid staking tokens (like stETH and rETH) make it simple to earn yield while staying flexible.

Staking rewards in 2025 hover between 3% and 6% APY, depending on market activity. Not bad for an asset that also deflates over time — thanks to EIP-1559 burning excess gas fees.

Still, every profit has its risks. Centralisation is creeping in — giants like Lido dominate validator pools. Some whisper Ethereum’s turning into Wall Street 2.0. But the reality? Opportunity never stays decentralised for long.

For those chasing passive income, read our guide on earning crypto without selling. And if you’re trading this volatility, master your entries with crypto order types and market maker strategies.

The edge belongs to the informed.

🚀 The Surge — Ethereum’s Scalability Explosion

The Merge was the warm-up. The Surge is the main event.

Through EIP-4844, Ethereum now handles blobs of data — temporary storage packets that supercharge rollups like Arbitrum and Optimism. This slashes transaction fees, letting traders move assets faster than ever.

Layer-2s are the new battlefield. They take the load off Layer-1, giving Ethereum the wings it needs to scale without sacrificing security.

“Ethereum + L2 = the decentralised internet’s new infrastructure stack.”

With gas costs plummeting, DeFi protocols, NFT marketplaces, and even institutional players are onboarding at record pace. The future isn’t “Ethereum vs Layer-2.” It’s Ethereum with Layer-2.

Curious how this competition stacks up? Explore our Layer-1 and Layer-2 analysis or check the Ethereum Fusaka upgrade that’s redefining efficiency.

💰 Winners, Losers, and the New ETH Game Plan

Let’s get one thing straight: ETH isn’t just a token — it’s an economy.

The Merge flipped Ethereum into a deflationary asset. Every transaction now burns a slice of supply, making scarcity part of the protocol. In plain English: fewer coins, higher potential value.

Institutions noticed. In 2025, staking isn’t a niche — it’s a trillion-dollar business. ETFs, custodians, and validators-for-hire are the new Wall Street brokers.

But not everyone wins. Small validators fight against centralisation. Liquid staking derivatives (LSDs) like stETH dominate liquidity, sparking decentralisation debates.

Can Solana or Avalanche dethrone Ethereum? Doubtful. They’re fast, yes — but Ethereum is battle-tested. The Merge didn’t break it; it fortified it.

If you want to ride these cycles like a pro, don’t miss our trading insights and crypto profit-taking guide.

🧠 The Wolf Smells Weakness — Critics & Controversies

Every empire has critics. Ethereum’s no different.

They point fingers at validator centralisation, claiming the network bends to OFAC compliance and censorship. Others cry that Lido’s dominance makes Ethereum too centralised for true decentralisation.

But here’s the raw truth: innovation moves faster than fear. The Ethereum Foundation keeps shipping. Rollup teams keep building. DeFi protocols keep innovating.

And regulators? They’re still figuring out what a wallet is.

“If you’re waiting for government clarity to make your move, you’re already a year behind the profit curve.”

That’s the Wolf way — smell the opportunity, not the fear.

📈 Smart Money Moves — How Traders Win the Merge Era

Here’s the playbook for traders who want more than headlines.

1️⃣ Stake and Hold

Turn ETH into a yield engine. Compound rewards, reinvest, and play the long-game wealth curve.

2️⃣ Ride the Rollups

Use rollups like Arbitrum, Optimism, and Base to execute trades cheaper and faster. Fees are pennies — speed is unmatched.

3️⃣ Watch the EIP-4844 Ecosystem

Projects building around sharding and data availability layers are this cycle’s Layer-2 gold rush.

For research tactics, read our crypto opportunities guide.

Remember — strategy beats hype. Always has. Always will.

🦍 The Verdict — Adapt or Get Left Behind

Ethereum didn’t just evolve. It weaponised efficiency.

The Merge was phase one. The Surge, Verge, and Purge complete the empire.

Every cycle, the weak wait, and the Wolves act. The traders who saw Bitcoin at $1,000 aren’t geniuses — they’re opportunists with conviction.

Now, that conviction belongs to Ethereum.

ETH has proven it can pivot, scale, and sustain under pressure. This isn’t speculative tech anymore — it’s infrastructure. The rails for DeFi, NFTs, AI tokens, and beyond.

If you’re still doubting it, fine. The Wolves will take your share.

🏆 Join the Smart Money Pack

If you’re done watching from the sidelines, it’s time to move like a professional.

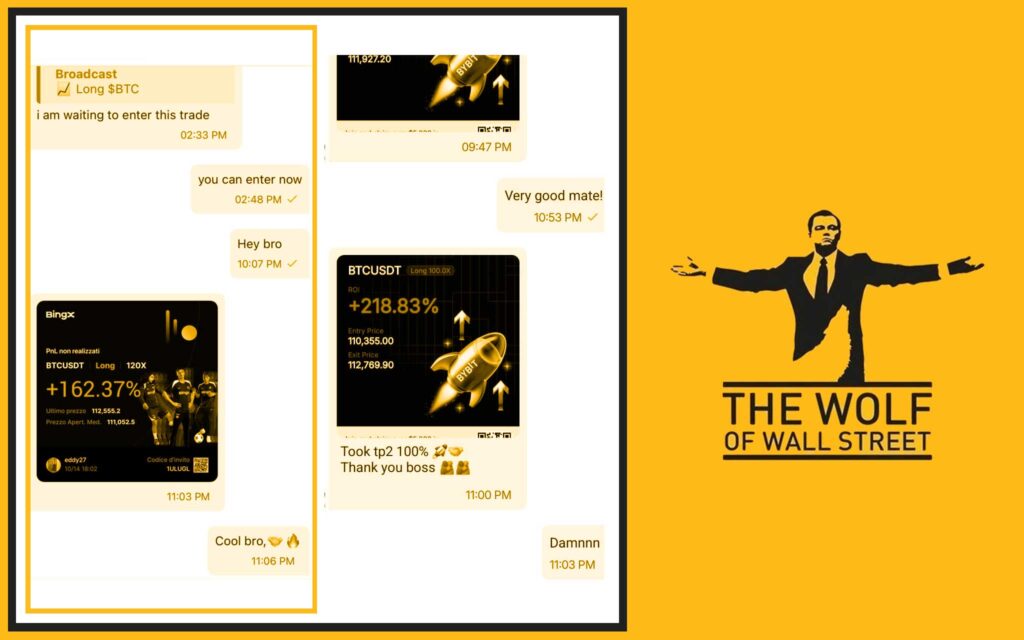

The The Wolf Of Wall Street crypto trading community isn’t a Telegram pump group — it’s an elite platform built for traders who want results.

Here’s what you get:

- Exclusive VIP signals from proven analysts.

- Market analysis from seasoned crypto pros.

- A private network of over 100,000 traders sharing insights daily.

- Trading tools — volume calculators, bots, metrics — all in one place.

- 24/7 support so you never trade blind.

Join the movement:

👉 Visit the service for details.

💬 Join the Telegram group for live market insights.

Stop surviving the market. Start dominating it.

📚 Ethereum FAQs 2025

Q: What replaced Ethereum 2.0?

A: The term “Ethereum 2.0” is obsolete. It’s now known as the execution layer and consensus layer — unified under the post-Merge architecture.

Q: How does staking work after The Merge?

A: Validators stake ETH to secure the network. Rewards are distributed based on uptime, honesty, and active participation. You can stake solo (32 ETH) or join pools via exchanges or DeFi platforms.

Q: What is EIP-4844?

A: Also called Proto-Danksharding, EIP-4844 introduces “blobs” — temporary data storage that drastically reduces Layer-2 transaction fees.

Q: Is Ethereum deflationary in 2025?

A: Yes, depending on network activity. Gas burns often exceed ETH issuance, creating a net-deflationary supply.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Proprietary signals built to maximise trading profits.

- Expert Market Analysis: Deep dives from seasoned crypto traders.

- Private Community: Over 100,000 like-minded professionals exchanging alpha.

- Essential Trading Tools: Volume calculators and market resources for smart execution.

- 24/7 Support: Round-the-clock assistance to sharpen your edge.

Empower your crypto trading journey:

👉 Visit tthewolfofwallstreet.com/service for details.

💬 Join t.me/tthewolfofwallstreet for real-time updates.

Unlock your potential. Trade like a Wolf.