🔥 Introduction – The Wolf Sniffs Blood

Michael Saylor doesn’t whisper; he roars. One tweet from him, one cryptic orange dot on a Bitcoin chart, and suddenly the market wakes up like it’s had a shot of espresso laced with adrenaline. When the CEO of Strategy Inc. (formerly MicroStrategy) hints at a new Bitcoin purchase, it’s not noise-it’s a message to the world’s biggest traders: the game isn’t over, it’s just getting louder.

While other corporate treasuries crumble under their NAV collapses, Saylor’s out here plotting the next billion-dollar buy. That’s not insanity-it’s conviction on steroids.

💰 The Signal: “The Next Orange Dot”

When Saylor dropped his chart showing cumulative Bitcoin purchases-tagged with the line “the most important orange dot is always the next”-the crypto world immediately translated that into one thing: he’s buying again.

This is classic Saylor strategy. Every “orange dot” post precedes an acquisition. His company Strategy Inc. now owns roughly 640,250 BTC, worth about $69 billion-a 45 percent jump over the average $74,000 cost per coin (CoinDesk, 2025).

That’s not just a flex. It’s an open challenge to every corporate treasury still trembling in this market.

Check out Michael Saylor’s full profile for his Bitcoin playbook and philosophy.

📊 The Numbers Behind the Noise

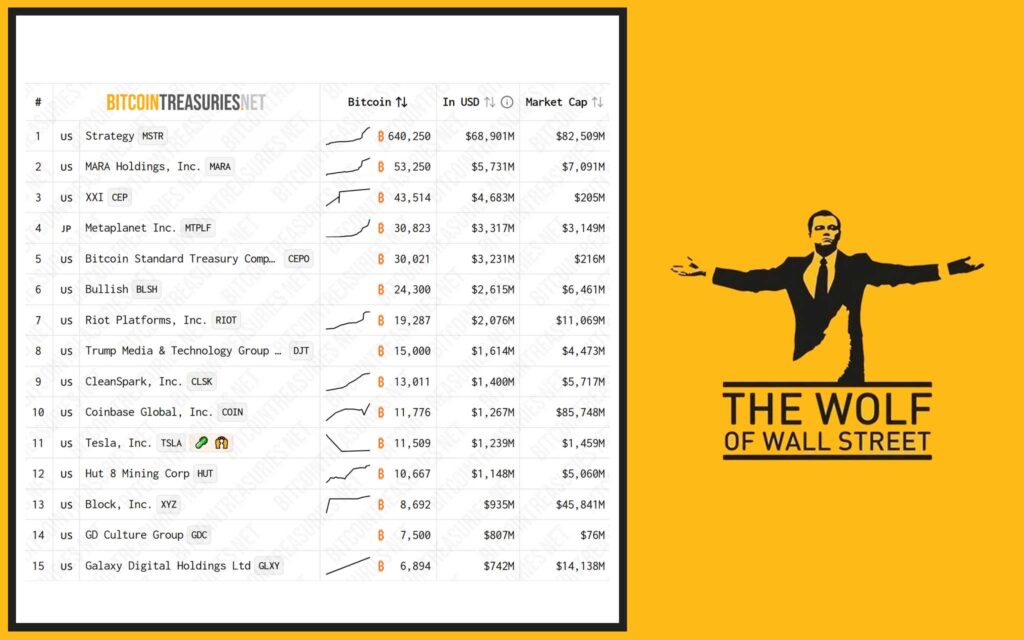

Let’s break it down.

- Total BTC holdings: ~640,250 coins

- Current market value: ~$69 billion

- Total supply share: 2.5 percent of all Bitcoin in circulation

At today’s price near $107,000, that’s a 45 percent unrealised gain on a multibillion-dollar treasury. While competitors like Marathon Digital, Metaplanet, and XXI Corp play catch-up, Strategy sits on a stack bigger than the next fifteen corporate holders combined.

And yet, corporate Bitcoin NAVs are imploding. Companies that mimicked Saylor’s strategy without his balance-sheet discipline are now trading below the value of their own BTC reserves. Metaplanet’s NAV ratio, for instance, plunged to 0.99 in October 2025 (10x Research, 2025).

For more insights on the state of Bitcoin corporations, explore our coverage of the crypto ecosystem.

⚖️ The Collapse: Corporate Bitcoin NAV Meltdown

Here’s the brutal truth: corporate Bitcoin treasuries are bleeding. After a two-year rally, NAV collapses have wiped out billions in paper value. The same investors who chased Bitcoin’s glory in 2024 are now watching their equity evaporate faster than market confidence.

Reports from Bloomberg (2025) confirm that treasury firms are now trading near or below the value of their Bitcoin assets. The “premium” that once rewarded bold accumulation has round-tripped to zero.

But not Saylor. While the world panics, he doubles down. His thesis is simple: short-term pain, long-term dominance. When everyone else sells at a loss, he’s accumulating. That’s not recklessness-it’s calculated aggression.

For a deep dive into how hedge funds are reacting, read Crypto Hedge Funds and Market Shift.

🚀 The Psychology of Power Plays

Saylor isn’t just moving markets; he’s manipulating narrative. The moment he posts, traders scramble. Shorts cover. Retail piles in. Liquidity spikes. And he buys cheaper.

That’s not luck-that’s mastery of market psychology. He’s turned social media into an institutional weapon. Every time he drops a phrase like “deploying more capital-steady lads,” it’s the equivalent of a rallying cry to the Bitcoin faithful.

While competitors chase charts, Saylor commands sentiment. It’s the difference between following price and setting it.

If you want to understand this mindset, check our article The Treasury Model: Why Corporations and Nations Hold Crypto.

🧠 Strategic Takeaway: What Traders Should Learn

Stop idolising Saylor and start studying him. The man treats Bitcoin like a leveraged asset with asymmetric upside. He uses conviction and capital discipline, not emotion.

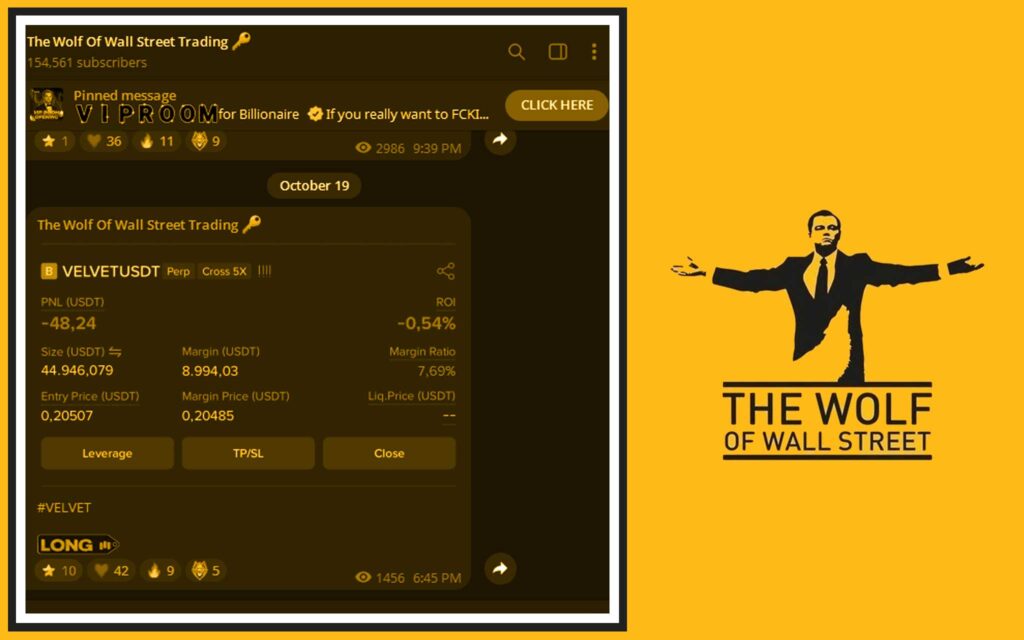

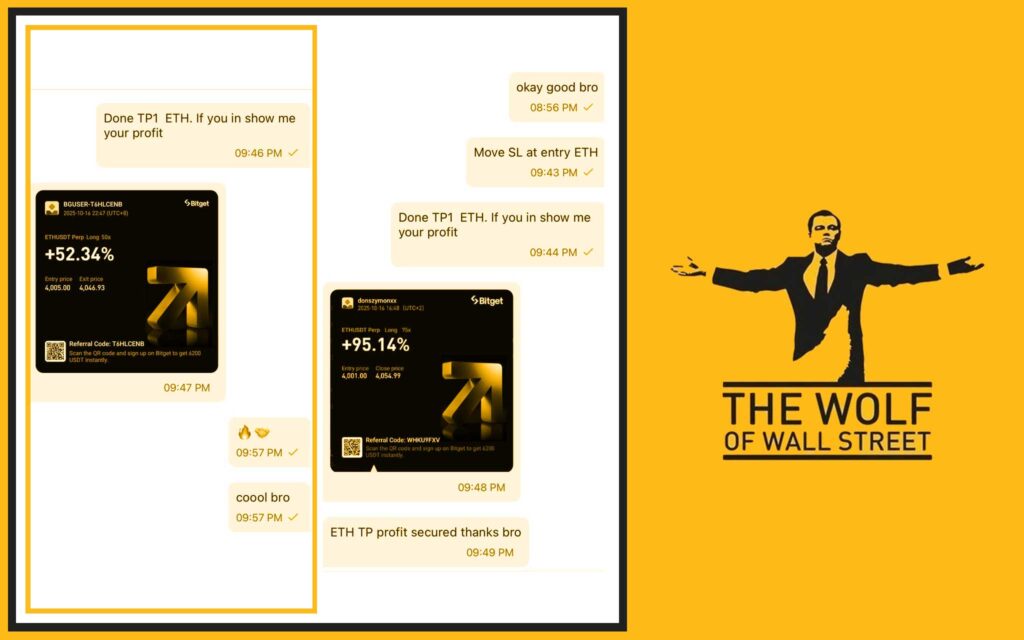

Retail traders can play the same field-just without the billion-dollar budget. The secret? Surround yourself with information that cuts through noise. That’s where the The Wolf Of Wall Street crypto trading community comes in.

They deliver:

- Exclusive VIP Signals that mirror institutional setups

- Expert Market Analysis from professional traders

- Essential Trading Tools like volume calculators

- A private network of 150,000+ members

- 24/7 support that keeps you sharp when the market turns

Join their Telegram group for real-time updates, or visit The Wolf Of Wall Street Service for the full suite of trading tools.

💡 Conclusion – The Wolf’s Lesson

Michael Saylor isn’t hinting at a Bitcoin buy; he’s signalling a mindset. When the herd flees, the wolves move in. Corporate NAVs can collapse, stocks can sink, but conviction backed by liquidity? That wins.

So whether you’re trading with a few hundred quid or managing institutional size, remember this: fear creates opportunity, and the bold get there first.

If you want to trade like a wolf, plug into The Wolf Of Wall Street-the one community that doesn’t just talk profit, it teaches you how to hunt it.

The Wolf Of Wall Street Crypto Trading Community

A complete platform for mastering the volatility of crypto markets.

- Exclusive VIP Signals designed to maximise profits

- Expert Analysis from seasoned traders

- Private Community of 150,000+ members

- Essential Trading Tools including calculators and dashboards

- 24/7 Support from dedicated pros

Empower your trading journey:

Visit https://tthewolfofwallstreet.com/service

Join https://t.me/tthewolfofwallstreet