🔥 The Wolf Meets the Blockchain

Let’s cut through the noise. Everyone loves to talk about “decentralisation” like it’s a holy grail – free, fair, and uncorrupted. But here’s the truth: decentralisation costs money, and money comes from somewhere.

Joseph Lubin, Ethereum co-founder and ConsenSys chief, just dropped a bomb that split the crypto world in two. In a statement this October, he defended venture capital (VC) firms like Paradigm as “necessary for the long-term health of Ethereum.”

You can call that controversial, but it’s brutally honest. Because without capital, innovation stalls. And as Lubin himself put it – “We need VCs for now because they bridge global capital to Web3.” (CoinTelegraph)

⚡ Ethereum’s Core Conflict: Decentralisation vs. Capital

Ethereum was built on the dream of financial freedom – no middlemen, no gatekeepers. Yet as the network grew, so did its complexity. Building global-scale infrastructure isn’t a garage project anymore; it’s a multi-billion-pound operation.

So the conflict arises: how do you stay decentralised when you need the deep pockets of institutions? That’s the paradox – and Lubin’s trying to sell the uncomfortable truth: decentralisation needs capitalism to survive its infancy.

🦾 Joseph Lubin Enters the Arena

In 2025, Lubin isn’t just a blockchain pioneer – he’s Ethereum’s voice of reason in a sea of idealism. He doesn’t flinch from critics. He knows that shouting “code is law” won’t fund layer-2 scaling solutions or mainstream integration.

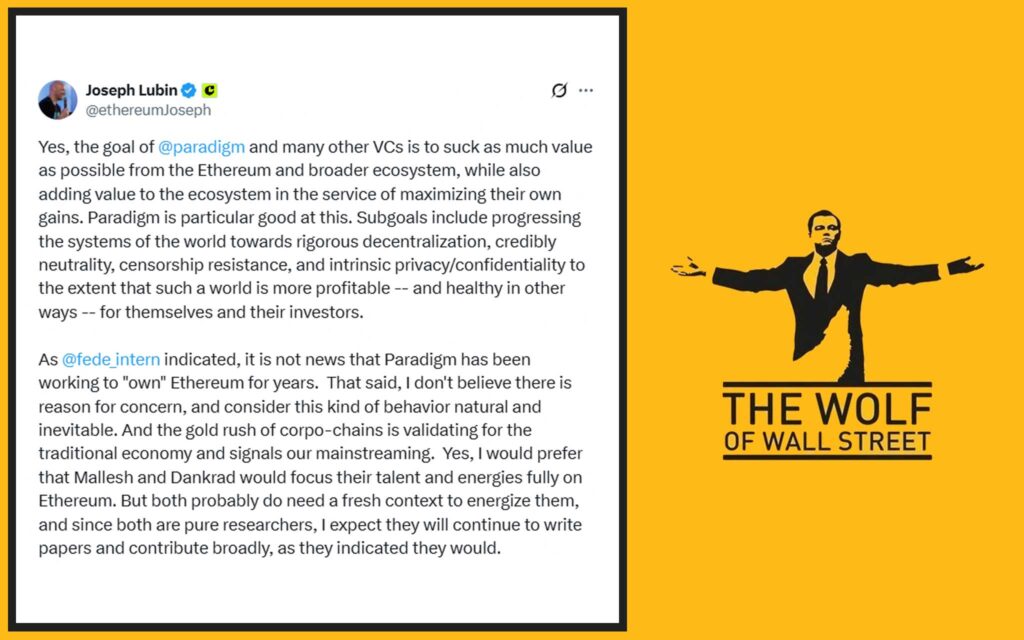

When the media accused VC firms of “extracting value” from decentralised ecosystems, Lubin didn’t backpedal. Instead, he flipped the script. His logic? They extract value because they create it first.

That’s not a cop-out – that’s capitalism 101.

💼 Paradigm, Tempo, and Stripe – The Billion-Dollar Trio

Here’s where it gets juicy. VC giant Paradigm partnered with Stripe to launch Tempo, a next-gen blockchain focused on global payment infrastructure.

The rumour mill called it “Stripe’s blockchain,” but that’s a stretch. According to Paradigm’s Tempo whitepaper, validators are curated, not controlled. Stripe has oversight – not ownership.

And yet, this partnership has sent decentralisation purists into meltdown. Why? Because they see it as corporate infiltration. Lubin sees it differently: “Institutions entering blockchain means validation – not violation – of what we built.”

He’s not wrong. When Stripe drops half a billion into Web3, the world pays attention. (Ledger Insights)

💣 “Necessary Value Extraction” – Lubin’s Words, Not Mine

Lubin doesn’t sugarcoat it. He admits that VCs do extract value – but argues that it’s the price of progress.

Think of it like early Wall Street IPOs: investors put in big money, take their slice, and fuel innovation. Ethereum’s no different. Without liquidity from venture firms, projects like layer-2 scaling, smart contract audits, and decentralised identity frameworks would never reach market.

It’s not greed – it’s gas money for the decentralisation machine.

🧱 Why the Ethereum Foundation Isn’t Panicking

Critics expected the Ethereum Foundation to slam Lubin’s comments. They didn’t. Why? Because decentralisation isn’t binary – it’s a continuum.

Ethereum’s roadmap (see Ethereum 2 Reborn: Merge & Surge 2025) embraces scalability through multiple players, both public and private. The Foundation knows that VC involvement doesn’t kill decentralisation – it funds the research to make it stronger.

💰 VCs as the New On-Ramp to Web3 Capital

Lubin’s message is simple: venture capital isn’t the villain; it’s the vehicle.

Traditional investors bring liquidity, compliance expertise, and global reach. Without them, DeFi remains a niche playground. With them, Ethereum becomes the financial backbone of the 21st century.

Look at it this way – the venture capital–crypto funding ecosystem isn’t just about profit. It’s about acceleration. The faster capital flows, the faster innovation compounds.

🧠 The Paradigm Power Play

Paradigm isn’t new to controversy, but its long game is clear. It’s not trying to own Ethereum – it’s trying to future-proof it.

Through Tempo and similar initiatives, Paradigm is securing Ethereum’s relevance in a world where corporate blockchain infrastructure is becoming the norm.

You can call that strategic capitalism – or, as the Wolf would say, “smart money doing smart things.”

🏦 The Stripe Factor – Innovation or Infiltration?

Let’s be honest – Stripe doesn’t enter markets to play small. Its Tempo collaboration signals a seismic shift: corporate fintech is merging with decentralised finance (DeFi).

Some cry foul, claiming Stripe’s validator oversight threatens decentralisation. But that’s missing the forest for the trees. Stripe’s entry signals confidence in the blockchain model. And when multi-billion-dollar enterprises bet on Ethereum-linked ecosystems, the network’s legitimacy skyrockets.

🌍 Tempo’s Role in the Institutional Blockchain Era

Tempo’s mission? Build a scalable payment rail that bridges fiat and crypto without sacrificing transparency.

It’s not about killing Ethereum – it’s about extending its DNA into enterprise-grade systems. That’s how blockchain wins: by infiltrating the incumbents, not isolating from them.

This hybrid model is the essence of Layer-1 and Layer-2 evolution – performance meets participation.

💥 What the Critics Get Wrong

Here’s where the purists lose the plot. They see any form of VC control as betrayal. But decentralisation isn’t anarchy; it’s structured evolution.

Without capital influx, innovation dies in the lab. Without liquidity, protocols stagnate.

The real betrayal is pretending ideology pays the bills.

As Lubin puts it: “We’re not selling out – we’re scaling up.” That’s not corporate spin. That’s the voice of a man who’s been building this since day one.

🚀 The Bigger Picture – Ethereum’s Evolutionary Phase

Ethereum isn’t in crisis – it’s in transformation. Every technology that scales goes through its “VC phase.” Web2 had Silicon Valley; Web3 has Paradigm.

Eventually, decentralised DAOs and community treasuries will take over funding. But for now? Venture capital keeps the lights on.

And let’s be honest – even DeFi investors love liquidity.

📈 Follow the Money – Institutional Confidence Rising

Between 2023 and 2025, institutional capital inflows into blockchain projects grew over 200% (Reuters, 2025). VCs aren’t pulling value out of the system – they’re injecting lifeblood into it.

Ethereum remains the #1 Layer-1 ecosystem for institutional integration and smart contract deployment. And that’s no accident. Lubin’s pragmatism is paying off.

🐺 The Wolf’s Verdict: Adapt or Get Left Behind

Let’s call it what it is: evolution.

The market doesn’t reward ideology – it rewards execution. Ethereum’s ability to attract institutional backing while keeping open governance is proof it can scale without surrendering its soul.

So, you can either cry about “VC corruption,” or you can position yourself to profit from the next leg up.

And if you’re serious about that – you don’t go it alone.

💼 Where Traders Gain the Edge

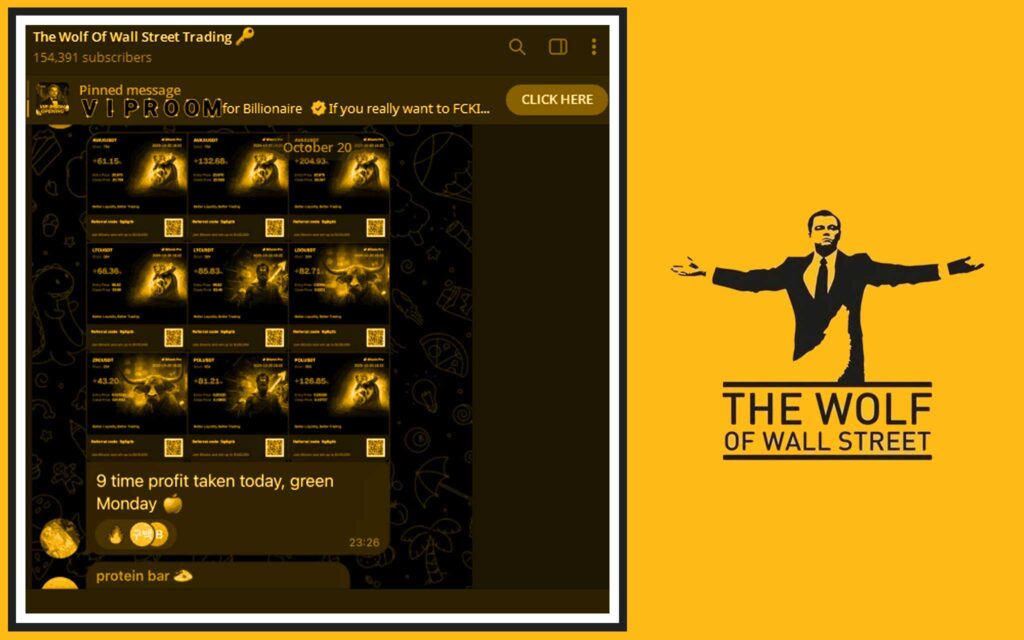

Enter The Wolf Of Wall Street, the crypto trading community built for wolves – not sheep.

This isn’t your average Telegram signal group. The Wolf Of Wall Street gives you exclusive VIP signals, pro trader insights, and 24/7 support from a global network of over 150,000 traders.

It’s a powerhouse platform for those who want to trade smarter, faster, and harder – exactly how Lubin thinks.

Join their Telegram community and get real-time updates, analysis, and tools that turn insights into income.

Because in this market, you don’t just watch the wolves. You run with them.

🚨 Join the Pack – Final CTA

Lubin’s message isn’t just about Ethereum. It’s about survival. The smart money adapts – and so should you.

So if you’re ready to navigate volatility, seize opportunity, and trade like a wolf on the blockchain frontier, join The Wolf Of Wall Street today.

👉 Visit The Wolf Of Wall Street Service | Join Telegram

Because in crypto – hesitation kills. Action builds empires.

Sources

- CoinTelegraph Report

- Paradigm Tempo Blockchain Whitepaper

- Ledger Insights Coverage

- Ethereum Foundation

- Reuters (2025) – Institutional Capital Report