Forget meme coins for a second – the real sharks are circling. Central banks. Governments. The same players who control the printing presses are gearing up to control the code of money.

Welcome to the age of CBDCs – Central Bank Digital Currencies, where the future of finance isn’t about paper or coins; it’s about data, dominance, and digital power.

By the time you finish reading this, you’ll know exactly what a CBDC is, why central banks are obsessed with launching them, and – most importantly – how you can position yourself to profit from the biggest monetary shift since the gold standard collapsed.

👉 Want to stay ahead of this revolution? Join the The Wolf Of Wall Street crypto trading community – over 150,000+ traders mastering volatility, signals, and opportunity together.

⚡ What Exactly Is a CBDC?

A CBDC (Central Bank Digital Currency) is the official digital version of a nation’s money, issued directly by the central bank, not a private company or commercial bank.

It’s not a cryptocurrency, not a stablecoin – it’s sovereign digital cash, a digital liability of the central bank.

In plain English:

- Crypto = decentralised, permissionless, market-driven.

- CBDC = centralised, government-issued, and tightly controlled.

CBDCs can run on blockchain, hybrid distributed ledgers, or traditional systems, depending on what each central bank wants. According to the Bank for International Settlements, most pilots today are technology-agnostic – they want speed, not ideology.

But here’s the split that really matters:

- Retail CBDC: For you and me – citizens, consumers, taxpayers. Think of it as digital cash in a government wallet.

- Wholesale CBDC: For banks and financial institutions – used for interbank settlements and liquidity transfers.

In short, CBDC is fiat gone digital, a merger of central control with the speed and programmability of blockchain-inspired tech.

💰 Retail vs Wholesale: The Twin Engines of Digital Money

Here’s how the two species of CBDC stack up:

| Type | Users | Use Case | Example Pilot |

|---|---|---|---|

| Retail CBDC | General public | Everyday digital payments | EU Digital Euro (2025) |

| Wholesale CBDC | Banks & institutions | Interbank settlements | Banque de France (2024) |

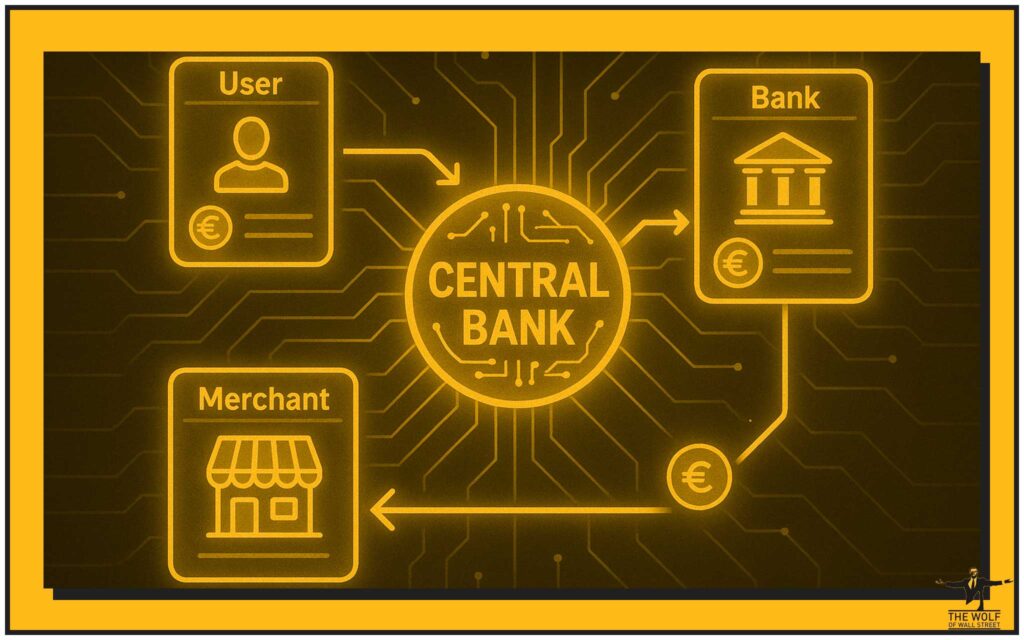

According to the European Central Bank, their Digital Euro will be an intermediated model: citizens get wallets through banks or fintechs, not directly from the ECB.

Why? Because going “direct” could drain banks of deposits – a dangerous game.

To prevent panic and misuse, central banks are introducing holding limits (caps on how much you can store) and privacy layers for small-value offline transactions. The ECB promises that “a digital euro will complement, not replace cash.”

Translation: they’re not killing cash – they’re slowly upgrading it.

🧠 How CBDCs Actually Work

Let’s cut through the jargon and see how the money flows.

- Central Bank Issues the CBDC – They mint digital money, backed 1:1 by the central authority.

- Intermediaries Distribute It – Commercial banks or payment providers offer wallets.

- Users Transact – Peer-to-peer, merchant payments, or even direct government-to-citizen transfers.

- Ledger Settles in Real Time – Either centralised or distributed, but fully auditable.

Simple? Yes.

Powerful? Absolutely.

CBDCs also come with programmable features – the ability to automate payments, enforce spending limits, or trigger instant stimulus. That’s the same innovation DeFi traders love – but in the hands of policymakers.

The IMF calls this the “programmable layer of monetary policy.”

But here’s the Wolf’s take: programmable money equals programmable power.

CBDCs aren’t here to kill crypto – they’re here to learn from it, copy it, and control it.

🚀 Why Central Banks Are Rushing In

Let’s be honest – governments hate being late to the money party.

Here’s what’s pushing them in:

- Cash is dying: UK Finance reports a 35% drop in cash payments in 2020, with only 17% of transactions made in cash.

- E-commerce explosion: Global online retail hit $6.3 trillion in 2024 according to eMarketer.

- Stablecoins are stealing attention: USDT, USDC, and others show how efficient digital value transfer can be – but they’re private.

- Monetary sovereignty: Governments want to ensure their currencies don’t get displaced by corporate or crypto alternatives.

The Bank for International Settlements notes that over 130 countries are exploring CBDCs in 2025.

This isn’t an experiment – it’s a race for financial control.

And here’s the money quote:

“When money moves digital, control follows the coder – and central banks want their hands on the code.”

🌍 The Global Race: Who’s Winning the CBDC Game?

Every major player’s now got skin in the game.

- 🇨🇳 China (e-CNY): Rolling out nationwide. The People’s Bank of China says the e-CNY is meant to complement cash, not replace it.

- 🇷🇺 Russia: Preparing mass rollout by July 2025, according to Global Government Fintech.

- 🇪🇺 European Union: ECB tests privacy-by-design, offline payments, and holding caps.

- 🇸🇬 Singapore (Project Orchid): The Monetary Authority of Singapore sees “no urgent case” for retail CBDC but continues R&D on purpose-bound money.

- 🇺🇸 United States: Federal Reserve continues research; no decision to issue.

Quick Stat: According to the Atlantic Council CBDC Tracker (2025):

- 11 countries launched CBDCs

- 40+ in pilots

- 70+ in research

Everyone’s building their version of digital cash. But only a few will make it global.

🔥 The Pros: Why CBDCs Could Be a Game Changer

CBDCs aren’t all control and doom – there’s serious upside.

- 💡 Inclusion: People without bank accounts can get direct access to digital cash.

- ⚡ Speed: Payments settle instantly, 24/7, no clearinghouse needed.

- 🛡️ Security: Central bank backing means near-zero credit risk.

- 🪙 Programmability: Automate welfare, tax rebates, or stimulus payments.

- 🌐 Global Efficiency: Enable cheaper, faster cross-border transfers.

As the IMF explains, CBDCs could reshape how governments execute fiscal policy in real time.

⚠️ The Cons: The Double-Edged Sword of Digital Money

Now, let’s flip the coin. Every innovation has a catch – and this one has a few big ones.

- 🕵️ Privacy: Unless anonymised, every transaction can be tracked.

- 🏦 Bank Funding Risk: People could withdraw deposits into CBDC wallets – draining liquidity from banks.

- ⚠️ Cybersecurity: If hacked, a CBDC system could cripple a nation’s economy.

- 🧱 Control Overreach: Programmable money could limit how, when, or where you spend.

The BIS warns that CBDCs must “balance innovation with public trust.”

Or as I’d say – don’t let the fox code the henhouse.

💎 CBDCs vs Crypto: Collaboration or Collision?

So, are CBDCs and crypto allies or enemies?

The truth is – both.

- CBDCs = government-backed, centralised, stable.

- Crypto = decentralised, transparent, free-market.

But the overlap is growing. Some CBDCs use blockchain-inspired architectures, others adopt token-based wallets – just like Bitcoin.

And while CBDCs give governments programmable money, crypto gives individuals programmable freedom.

The smartest move? Understand both.

That’s exactly what we teach inside The Wolf Of Wall Street – how to anticipate these macro shifts and trade volatility before the headlines hit.

Remember:

“Smart traders don’t pick sides – they read the system, adapt early, and profit from both.”

For deeper synergy insights, check out stablecoin answer to crypto problems and wholesale vs retail CBDC guide.

🦾 The Future Outlook: The Digital Monetary Revolution

By 2030, expect to live in a financial world where:

- Cash, CBDCs, and crypto coexist.

- Banks evolve into digital wallet providers.

- Privacy tech (zero-knowledge proofs, offline wallets) becomes a national policy tool.

The European Central Bank predicts the digital euro could go live as early as 2026.

So, what’s the takeaway?

CBDCs are inevitable – but how they’re implemented will define your freedom, your finances, and your future.

“The game isn’t who prints the money anymore – it’s who programs it.

CBDCs are coming, and the wolves who understand them first will own the future of finance.”

🔗 The Wolf Of Wall Street – The Wolf’s Edge in Crypto

The Wolf Of Wall Street crypto trading community gives traders an unfair advantage in the volatile crypto market:

- 🧭 Exclusive VIP Signals – proprietary alerts to maximise profits.

- 📊 Expert Market Analysis – insights from seasoned traders.

- 🤝 Private Community – 150,000+ active members.

- ⚙️ Essential Tools & 24/7 Support – because the market never sleeps.

Empower your crypto journey: