💥 The Future of Cash Has Already Left the Building

If you still think money lives in your wallet, you’re already behind.

The game has changed – and fast. Since the pandemic, we’ve watched cash go from king to casualty. Contactless payments, digital wallets, mobile banking – the whole financial ecosystem flipped to “tap and go” while paper notes started collecting dust.

Governments saw this shift and decided it was time to reclaim control. The result? Central Bank Digital Currencies, or CBDCs – the biggest shake-up in the history of money.

This isn’t just fintech hype. It’s a seismic shift in how nations issue, track, and control currency. Whether you’re trading crypto or working in finance, this revolution is coming straight for your balance sheet.

💡 What the Hell Are CBDCs, Really?

Let’s cut through the jargon.

A CBDC is digital money issued directly by a country’s central bank – not a private crypto project, not a stablecoin, but the digital twin of your national currency. One pound digital equals one pound sterling. One digital naira equals one physical naira.

CBDCs differ from cryptocurrencies in one crucial way – they’re centralised. They run under strict government oversight. There’s no mining, no volatility, no decentralisation. You’re dealing with state-issued cash coded into existence.

CBDCs fall into two camps:

- Retail CBDCs: for the public, used just like cash or debit cards.

- Wholesale CBDCs: used between banks and financial institutions.

If you want the full breakdown, check out our guide to retail vs wholesale CBDCs.

🚀 Why the World Is Going Digital – Fast

Cash is fading faster than a 90s trading pit. According to the Bank for International Settlements (2025), over 130 countries – representing 98% of global GDP – are exploring or piloting CBDCs.

In the UK, physical cash now represents less than 20% of all transactions, down from 60% just a decade ago.

Why? Because the world runs on three things central banks crave:

Convenience. Control. Continuity.

Digital payments slash costs, track every penny, and give central banks real-time insights into the economy. And in an era of data dominance, information is the new interest rate.

⚡ The Two Titans: Online vs Offline CBDCs Explained

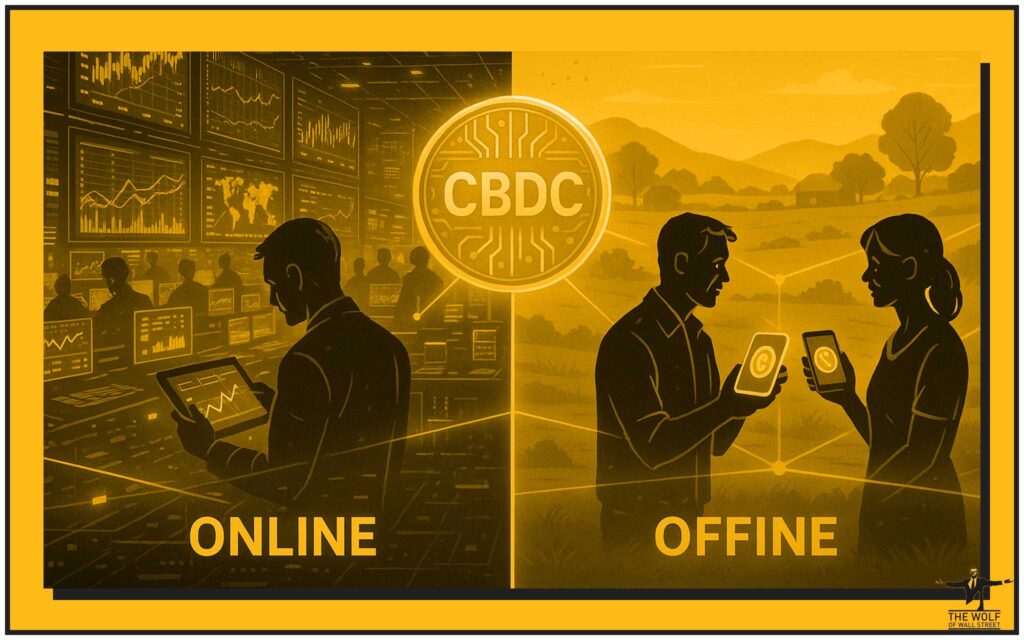

CBDCs aren’t one-size-fits-all. The next big divide? Online vs Offline functionality.

Online CBDCs

These are your high-speed, always-connected systems. Every transaction syncs instantly with the central ledger – frictionless, traceable, fast. Think China’s Digital Yuan (e-CNY) or the proposed Digital Pound in the UK.

They offer real-time clearing, programmable money features, and seamless integration with online banking and apps. For city economies and institutional payments, online CBDCs are a dream.

Offline CBDCs

Now, this is where things get wild.

Offline CBDCs operate without an internet connection – peer-to-peer, device-to-device, like passing a digital note hand-to-hand.

They’re the lifeline for rural regions, emergency zones, and economic resilience.

When a storm knocks out the network or a warzone loses power – your digital money keeps moving.

“When your 5G drops, your money shouldn’t.”

Offline functionality is what separates a resilient digital economy from a fragile one.

🔧 The Technology Under the Hood

CBDCs can be built on two main frameworks:

- Distributed Ledger Technology (DLT): a blockchain-like setup – decentralised, but still under the central bank’s command.

- Centralised Databases: faster, simpler, cheaper – but with less transparency.

Some countries, like Nigeria with its e-Naira, use a DLT-based approach. Others, like the Bank of England, are experimenting with hybrid architectures.

According to the ITU & DCGI Reference Architecture Report (2025), interoperability and scalability are the key design goals now.

In other words – every central bank wants control, but none want chaos.

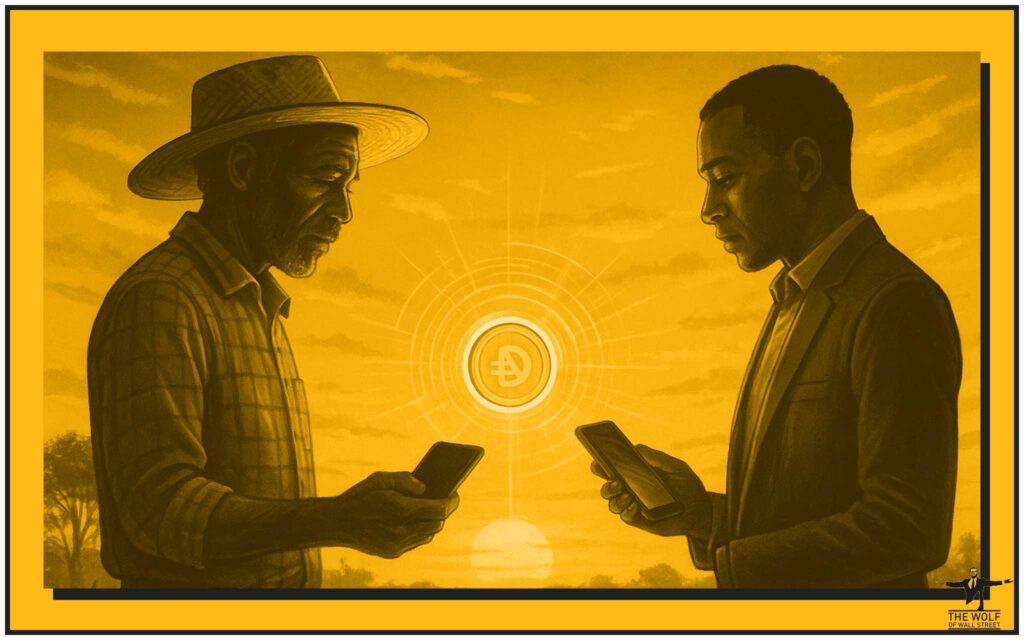

🌍 The Offline Advantage – Why It Matters More Than You Think

Imagine this: a farmer in rural Ghana sells maize to a trader – no Wi-Fi, no mobile signal. Yet, the payment clears. That’s offline CBDC in action.

Offline capabilities are about financial inclusion – making sure money flows even when the network doesn’t. It ensures no citizen is left out just because of weak connectivity.

But it’s not just inclusion. It’s about sovereignty and resilience.

Offline CBDCs protect against:

- Cyberattacks or grid failures

- Natural disasters

- Network outages

- Political instability

These systems can store value securely on local devices and sync later when connectivity returns.

For more on how this ties into digital ID verification, check out digital identity management in crypto.

“Offline money is not just a feature – it’s a safeguard.”

⚠️ The Dark Side: Double-Spending & Data Dangers

Now let’s talk about the flip side – because every revolution has risks.

The biggest challenge in offline CBDCs? Double-spending – using the same digital token twice before it syncs to the central ledger.

A 2024 MDPI study confirmed this is the top technical risk for offline systems.

Other issues:

- Tampering – if devices are compromised.

- Data reconciliation delays – transactions made offline need clean syncing once reconnected.

- Privacy trade-offs – how do you track fraud without tracking every user?

Some solutions involve secure hardware modules and zero-knowledge proofs for privacy. But balancing freedom vs oversight remains the trillion-dollar question.

🌐 Real-World Experiments in Action

Let’s put theory to the test.

- 🇳🇬 Nigeria’s e-Naira: The world’s first DLT-based retail CBDC, with limited offline transactions. Adoption has been slow – only around 1% of Nigerians actively use it – but it’s a start.

- 🇨🇳 China’s e-CNY: Already in live trials across major cities. The system can operate partially offline via NFC transfers.

- 🇧🇸 Bahamas’ Sand Dollar: The OG of retail CBDCs. Fully launched, fully integrated with payment apps.

According to the IMF (2024), these pilots are reshaping how citizens interact with centralised money.

And guess what? The race isn’t just national – it’s strategic. Whoever masters digital cash owns the rails of the global economy.

🧠 Policy Power Plays: Control vs Freedom

Here’s where things get spicy.

CBDCs are not just about convenience – they’re about control. Central banks can technically program how, where, and when you spend. That’s a powerful tool – or a terrifying one.

Privacy advocates warn that CBDCs could create a world of programmable compliance, where every transaction is traceable.

Governments, of course, call it “transparency.”

This is where decentralised money – crypto – stands its ground.

If you want to understand how CBDCs stack up against crypto ideals, read our beginner’s guide to CBDCs.

“CBDCs can either democratise finance – or digitise control.”

⚙️ The Future Hybrid: Merging Online Efficiency with Offline Resilience

The next phase isn’t a choice between online or offline. It’s a fusion.

Hybrid CBDCs will offer always-on connectivity, but still function independently during outages.

Think of it like Tesla’s autopilot: online when it can be, offline when it must.

That’s the sweet spot central banks are chasing – speed, control, and resilience.

The SUERF Review (2025) predicts the majority of advanced economies will adopt hybrid designs by 2030.

“Online gives you speed. Offline gives you survival. Together, they redefine money.”

📊 What This Means for You – The Trader, the Investor, the Visionary

Here’s where it hits your wallet.

CBDCs will rewrite how money moves – and that directly impacts traders, investors, and market strategists.

Expect changes in:

- Liquidity flow: instant settlement means faster markets.

- KYC/AML: CBDCs integrate compliance into every transaction – no escape routes.

- Trading environments: more transparent, less decentralised.

For those ahead of the curve, this means opportunity. Learn how to leverage these transitions in our open banking advantage guide and crypto travel rule compliance strategy.

The next decade belongs to the traders who adapt – not the ones who resist.

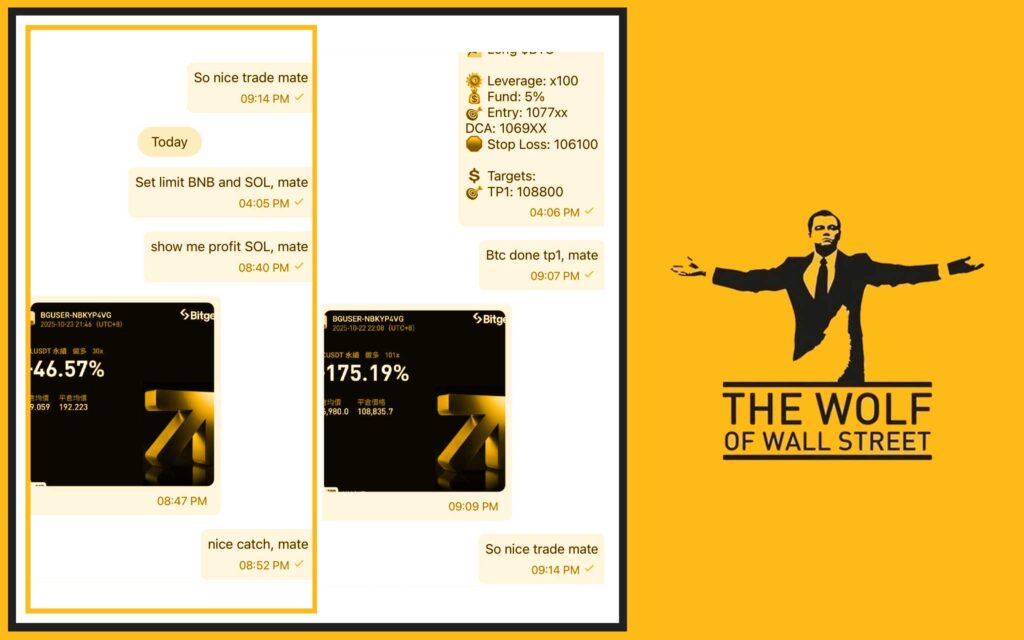

🐺 The Wolf’s Edge: Trade Smarter with The Wolf Of Wall Street

While central banks draft white papers, traders are already capitalising.

That’s where the The Wolf Of Wall Street crypto trading community steps in – a powerhouse for those who want to dominate the market, not just survive it.

Here’s what you gain when you join:

- Exclusive VIP Signals: proprietary insights that catch profit swings early.

- Expert Market Analysis: from seasoned traders who’ve seen every cycle.

- Private Community: over 150,000 members sharing strategies daily.

- Essential Trading Tools: volume calculators, analytics dashboards, and risk tools.

- 24/7 Support: your trading never sleeps, and neither does The Wolf Of Wall Street.

Empower your trading journey:

Trade smarter. Win bigger. Stay ahead of the CBDC curve.

🔮 The Wrap-Up: Money, Power, and Digital Sovereignty

We’re not just watching a new kind of money – we’re witnessing a new kind of control.

CBDCs are the bridge between cash and crypto, between privacy and policy.

And like every financial revolution in history, there will be winners and losers.

“The game’s changing – and the winners are the ones who see it first.”

So whether you’re a policymaker, investor, or crypto wolf – the time to understand CBDCs isn’t tomorrow. It’s now.

📚 Sources (Web-Style Citations)

- BIS – Advancing in Tandem: Results of the 2024 CBDC Survey (Aug 2025)

- IMF – Central Bank Digital Currency: Progress and Further Considerations (Nov 2024)

- ITU & DCGI – CBDC Reference Architecture Report (Jan 2025)

- SUERF – Retail Central Bank Digital Currency: A Review and Assessment (2025)

- MDPI – Offline Payment of Central Bank Digital Currency (2024)